From hedging against unforeseen, unfortunate circumstances to securing our collective future, the role of insurance has evolved over the past decades.

In fact, the insurance industry has become something of a business-side frontrunner in the movement to ensure a sustainable future for the planet: economic, social and environmental.

It’s hardly a surprising role for insurers. After all, who knows future risks better than insurance companies?

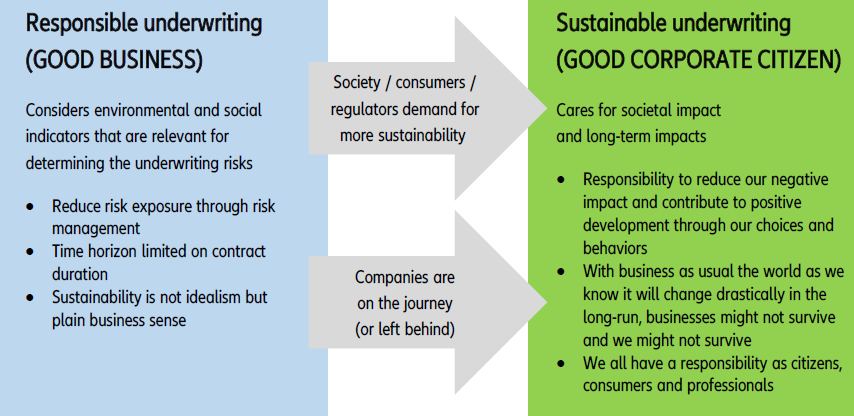

Other than predicting risks and helping customers manage them, insurers can accelerate the global economy’s sustainable transformation by encouraging a shift away from non-sustainable behavior and processes, according to Allianz economists.

‘Impact underwriting’ is not just good for society, it’s also good for business, they write in the 'Impact Underwriting: Sustainable Insurance as an Opportunity for Society and Business’ report.

Allianz Research highlights nine fields of sustainable action for the insurance industry.