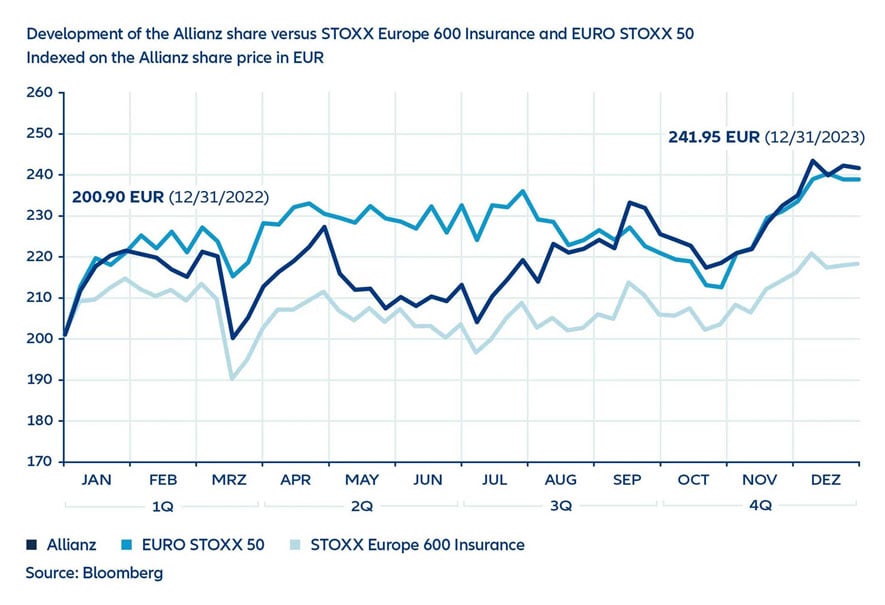

The upward trend in European stock markets continued into 2025. In particular, stocks from the banking, insurance, and commodities sectors showed strong performance. Similar to the previous year, a sustained expansionary monetary policy by central banks, increased capital inflows, and robust corporate profits were relevant drivers. Overall, the EURO STOXX 50 recorded a price increase of approximately 18%.

Insurance stocks performed significantly better once again, as reflected in the STOXX Europe 600 Insurance, which achieved a yearly gain of 25%. Allianz shares stood out in particular, closing with a price increase of around 32% at 390.50 euros. Including the dividend of 15.40 euros (for the 2024 financial year), this results in a total performance of over 37%. Allianz shares were also an attractive investment in the longer term. Over the last ten years, the average annual increase in value (including dividends) was approximately 14%.