Survey Reveals Loss of Trust but High Expectations for US-German Partnership

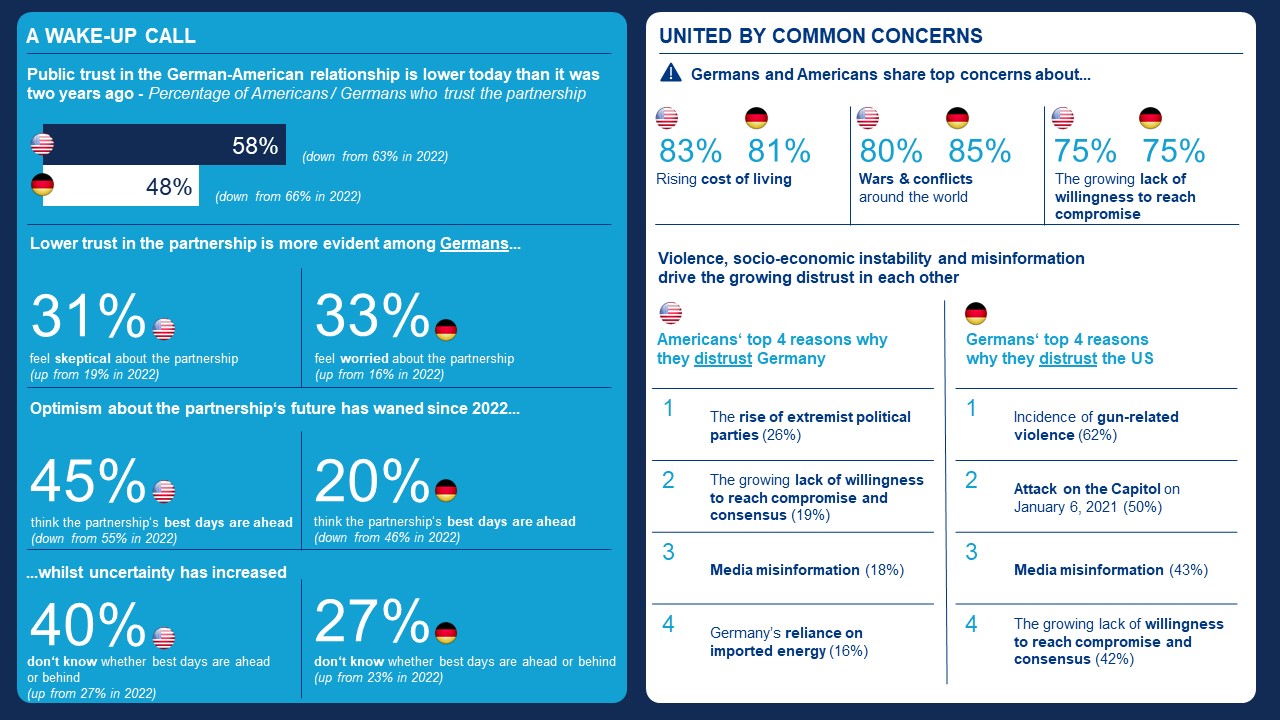

A Wake-up Call

- Lower trust in the partnership is more evident in Germany, with people feeling skeptical (31%, +12 points increase since 2022) and worried (33%, +17 points increase since 2022) about the partnership.

- Overall, the optimism observed in 2022 has waned across all generations, with fewer now believing that the partnership’s best days are ahead. Younger generations in both countries, however, remain slightly more hopeful for the partnership’s future.

- Uncertainty is rising in both counties. A larger proportion of each country’s participants, particularly from the US, responded that they “didn’t know” whether the best days of the partnership were ahead or behind us – 27% of Germans (+4 points vs. 2022) and 40% of Americans (+13 points vs. 2022).

United by Common Concerns, Especially Rise of Extremism and Violence

Underlying the emerging pessimism and ambivalence, however, is evidence that Americans and Germans actually share a wide range of common concerns, including cost of living and war and conflicts around the world. Germans and American participants agree that media misinformation and a growing lack of willingness to reach common ground and consensus are top reasons driving distrust in the other country.

Compared to the optimism found in the 2022 study, this year’s survey reflects a somber mood, driven by mutual concerns about the rise of extremism and issues that threaten socio-economic stability. For Americans, the #1 event driving distrust in Germany is the rise of extremist political parties, while Germans cite incidents of gun violence and the attack on the U.S. Capitol on January 6, 2021 as most concerning. Extreme opinion in the political debate is perceived as fomenting division in both countries.

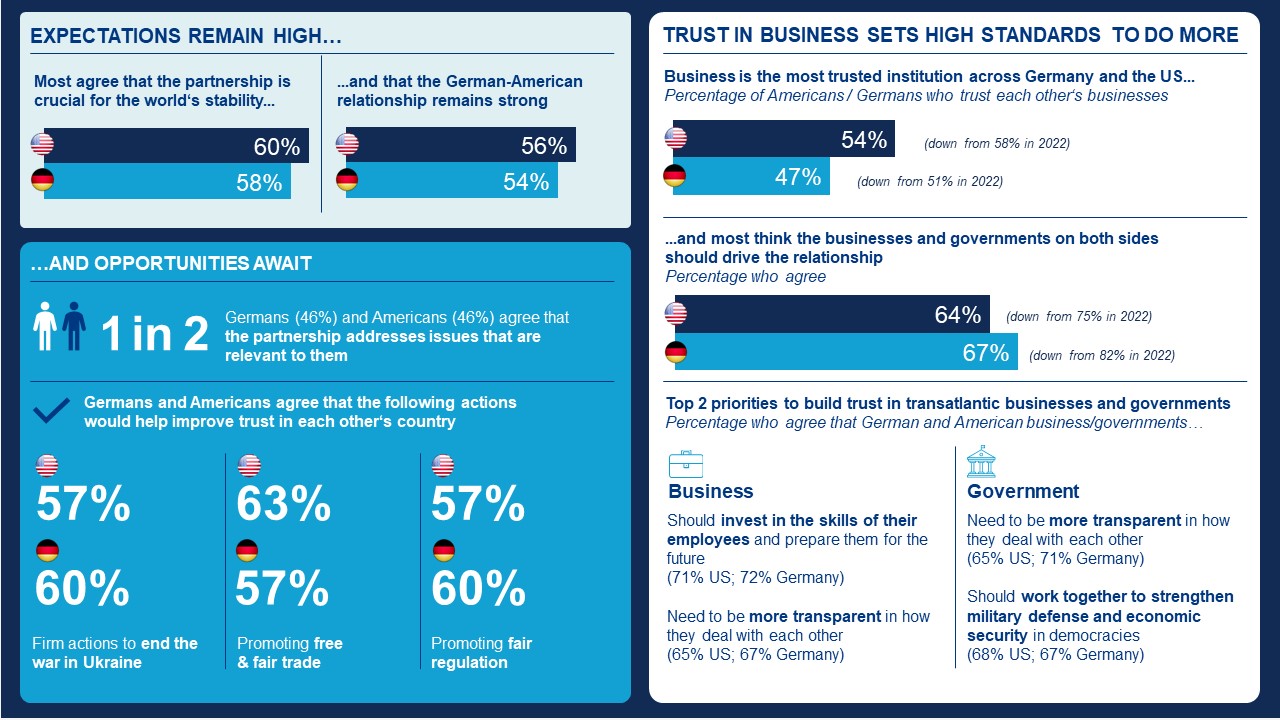

Expectations Remain High and Opportunities Await

Declining optimism since 2022 may reflect a sense of disappointment rather than entrenched pessimism, as expectations in the partnership remain very high. Over half of German and American participants expect the relationship to do good for both countries and also globally. A majority of participants believe that a strong German-US partnership is crucial for the world’s stability (60% of Americans and 58% of Germans) and describe the partnership as “strong” (56% of Americans and 54% of Germans). “Common values,” “shared interests and challenges,” and “common views of democracy” are reasons for trust in each other’s government.

Opportunities await the partnership to leverage this trust and build further relevance for citizens of both countries. Asked whether the partnership addresses issues that are relevant to them personally, nearly 1 in 2 agreed (46% for both Germans and Americans). Americans and Germans expressed common priorities and expectations for the partnership to take further action on climate change, Russian aggression, strengthening democracies around the world, and human rights. Both recognize that the current top priority of the partnership is containing Russian aggression.

Taking firm actions to end the war in Ukraine and promoting free trade and fair regulation are common priorities that would drive further trust in both countries. Americans would like to see economic growth and job creation in both countries as the partnership’s highest priority, whereas Germans prioritize addressing climate change. The findings indicate that leveraging opportunities found at the intersection of these top priorities would build relevance and restore trust in the partnership.

Trust in Business Raises Standard to Do More

As in 2022, participants in both countries report positive perceptions of each other’s business competence and reliability, citing quality of products and services and innovation. Business is the most trusted institution across both countries.

With this trust comes responsibility and high expectations for businesses to partner with governments to bolster transatlantic bonds. A majority of German and American participants would like to see businesses invest in employee skill development (71%), be more transparent (66%) and prioritize diversity, equity, and inclusion (57%). Aligning on common business practices and regulation would strengthen bonds, as 46% of Germans and 36% of Americans find these differences weaken trust.

Germans and Americans expect their governments to lean on business. Leadership of the transatlantic partnership is viewed as a common endeavor between business and government, with 67% of Germans and 64% of Americans agreeing. There is also a common understanding on the purpose of partnership – 51% of German and American participants believe that there should be equal focus on achieving both domestic and global improvements.

In the face of rising uncertainty about the future, people want more transparency and collaboration on defense and economic security (68%), but they realize that governments can’t achieve these objectives alone. Today the expectation for the German-American partnership is that government and business work together to better prepare their citizens and stakeholders for the future. Restoring hope that the best days of the German-American relationship are ahead will require going beyond traditional diplomatic channels and the government capitals of Berlin and DC, and into regional towns and cities, to demonstrate public/private collaboration that reinforces social and economic security for all generations.

“The survey shows that transatlantic trust has declined recently. But this is by no means a reason to panic. German-American relations have fluctuated widely since 1945 – and this has mostly been in response to international crises. The political climate has become rougher on both sides of the Atlantic – and two wars are threatening the peace and security of the Western world. Citizens have a right to question how their governments are handling multiple simultaneous crises at once. Even if political relations appear to be shaky, economic relations between the two countries remain strong. Germans and Americans need each other – and that will remain the case in the future,” says Julia Friedlander, CEO of Atlantik-Brücke.

“Although the survey indicates that confidence in the bilateral partnership has eroded somewhat, I take solace in two things. First, more than 80 percent of those polled believe that Germany and the United States have common interests and shared challenges. This is grounded in history but recognizes the uncertain environment we face today. Second, nearly two-thirds of respondents believe that the bilateral relationship is crucial for global stability. Looking ahead, this is an indispensable partnership if we are going to contain Russia, work toward peaceful resolutions in Ukraine and the Middle East, and address issues like climate change and workforce preparedness,“ says Dr. Steven E. Sokol, President and CEO of the American Council on Germany.

About the Study

The study surveyed a total of 4,000 Americans and Germans – nationally representative of their respective general populations – to understand their confidence in the stability of the US-German partnership and views on the global challenges facing both countries. This research continues work initiated in May 2022, just after Ukraine’s counter-offensive against Russia, which was widely supported by western democracies, including the US and Germany.

Allianz SE, the American Council on Germany and Atlantik-Brücke share a keen interest in understanding the ongoing development of German-US relations. This survey aids understanding of the perceptions and expectations of Americans and Germans and provides insight for developing meaningful cooperation between all partners. Previous questions and the longitudinal view from the May 2022 survey were included, along with new updates to gauge perceptions of polarization and unity within Germany and the US, and in US-German relations.

For further information please contact:

About Allianz

** As of December 31, 2023.