The remuneration system of the Board of Management of Allianz SE is designed to be appropriate compared to peers, given the Allianz Group’s range of business activities, operating environment, and business results achieved. It was last amended in 2021 taking into account the Act implementing the Second Shareholder Rights Directive (ARUG II) and the German Corporate Governance Code and was approved by the Annual General Meeting. The remuneration is published on an individualized basis in the Annual Report.

Remuneration of the Board of Management

Remuneration Structure

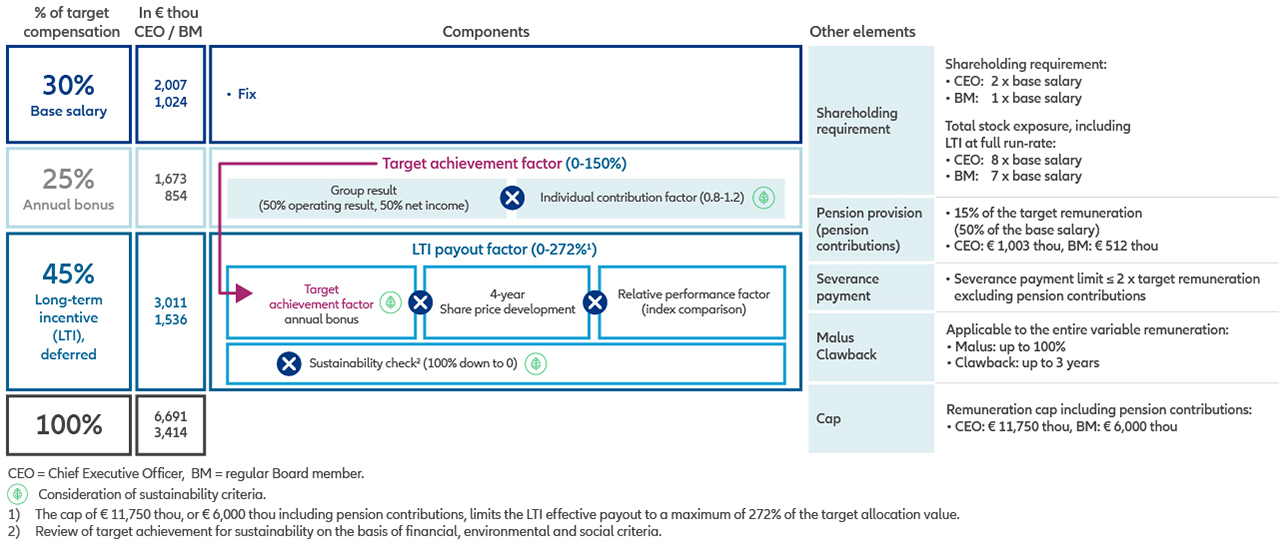

The remuneration of the Management Board consists of the fixed remuneration, the annual bonus, a long-term, share-based compensation, and the contribution to the pension plan.

The predominant part of the total target compensation is performance-related, with the share-based compensation being the most significant of all components. Together with other elements of the remuneration system such as the requirement to build up ownership in Allianz shares as well as malus and clawback, this ensures the alignment of the interests of the Board of Management and the shareholders.

Detailed information on the current remuneration system of the Board of Management of Allianz SE and the current Remuneration Report can be found here:

Swipe to view more

| Remuneration System |

The remuneration system of the Board of Management of Allianz SE was approved by the Annual General Meeting on May 5, 2021 under agenda item 5 with a majority of 87.14%. |

| Presentation | Summary of the remuneration system of the Management Board of Allianz SE |

| Remuneration Report 2023 | Remuneration Report 2023 (Annual Report Allianz SE 2023, p. 142 et seq.) |

Remuneration Reports from previous years can be found here:

Swipe to view more

|

Remuneration Report 2022 |

Remuneration Report 2022 (Annual Report Allianz SE 2022, p. 109 et seq.) |

|

Remuneration Report 2021 |

Remuneration Report 2021 (Annual Report Allianz SE 2021, p. 103 et seq.) |

Related topics

Remuneration of the Supervisory Board

Structure and level of the Supervisory Board remuneration are approved by the Annual General Meeting and are governed by the Statutes.

Executive remuneration

The general objective for all Allianz remuneration structures is to offer competitive reward in terms of components, structures and levels.

Annual Report

The Allianz Group Annual Report is available as PDF and in the Allianz Investor Relations App.