Aesop’s ant was a hero. It saved for a rainy day while the grasshopper sang and danced. But if interest rates were low when the famed fable was written, Aesop may have been well-advised to tell the ant to invest rather than save.

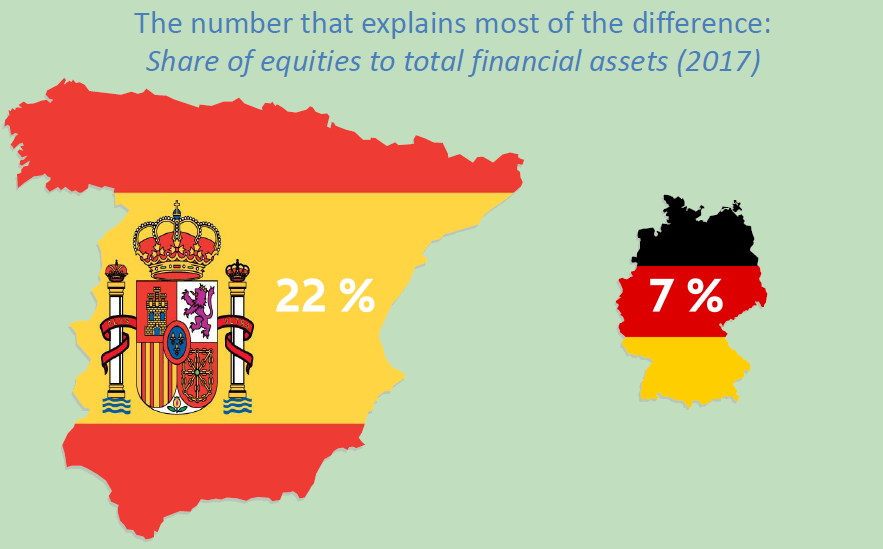

A modern-day version of Aesop’s fable has been playing out in the eurozone. The difference is that the now-wise grasshopper is winning by investing smartly.

The ant, on the other hand, is working harder to save more as its deposits bring no returns.

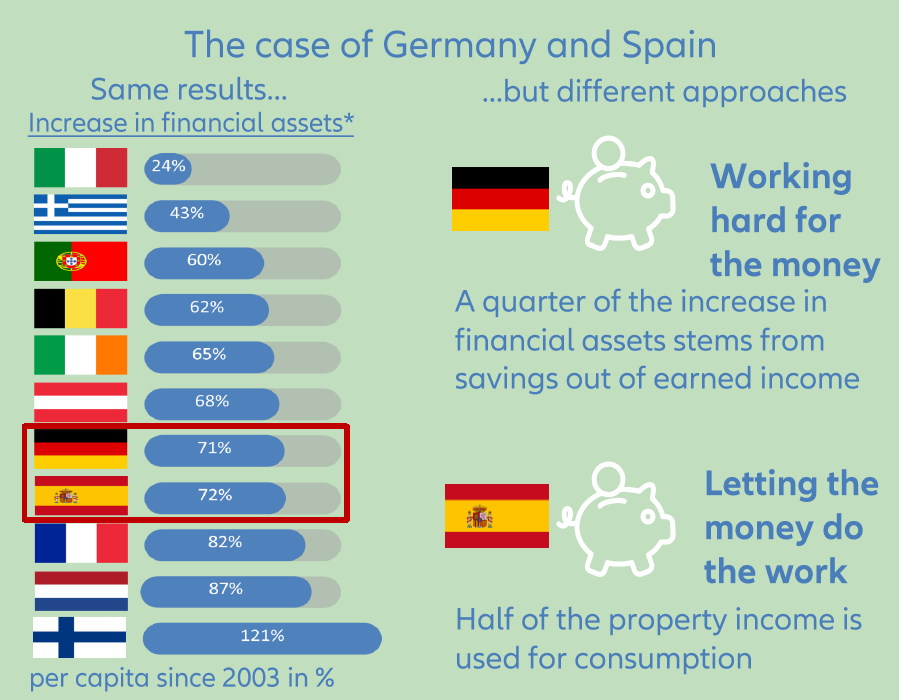

Allianz Research goes on the eurozone money trail to find out where the smart-saving grasshoppers and the hard-saving ants live...