We look back on it wistfully, wishing that there was a way to turn back time. The ravages of the coronavirus pandemic make most of us want to go back to 2019 and skip forward to 2021.

There’s more to miss 2019 for.

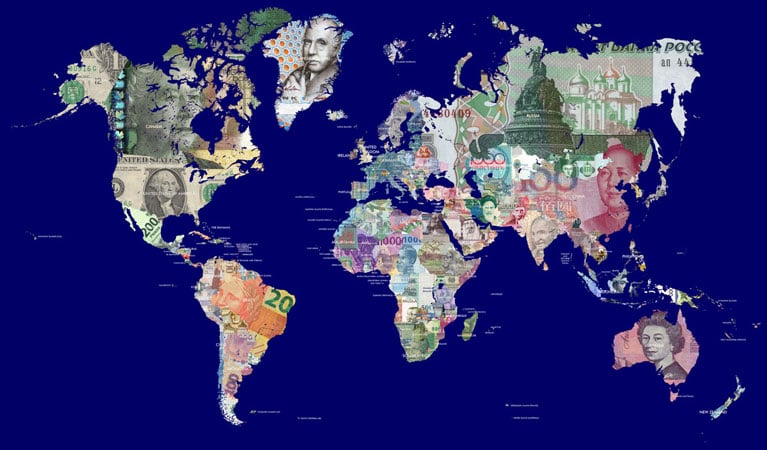

Turns out that despite political and trade conflicts, our collective wealth grew in the background at the fastest pace since 2005 last year.

This is just one of the surprising findings of the just-released Allianz Global Wealth Report.

Worldwide, gross financial assets jumped 9.7 percent to a record 192 trillion euros in 2019 as the capital markets cheered the injection of funds by central banks into the system.

Central banks and governments may well be the saviors this year too. If the first half is any indication, their steps to protect people from the economic fallout of Covid-19 just might help private households hold on to their financial assets in 2020.

And now for the sobering news.

We didn’t really have to wait for the pandemic to wipe out the progress made in making the world more equal in terms of wealth distribution. 2019 widened the wealth gap between rich and poor countries again, increasing the difference in net financial assets per capita to 22 times from 19 times in 2016.

This is still well below the gap of 87 times that we had in 2000 but the trend reversal is disturbing indeed.

More insights from the annual report, which checks the financial health of households in 57 countries...