It’s a dramatic rebound for an industry that, a decade ago, seemed like an old car model broken down at the side of a road, steam pouring from its engine.

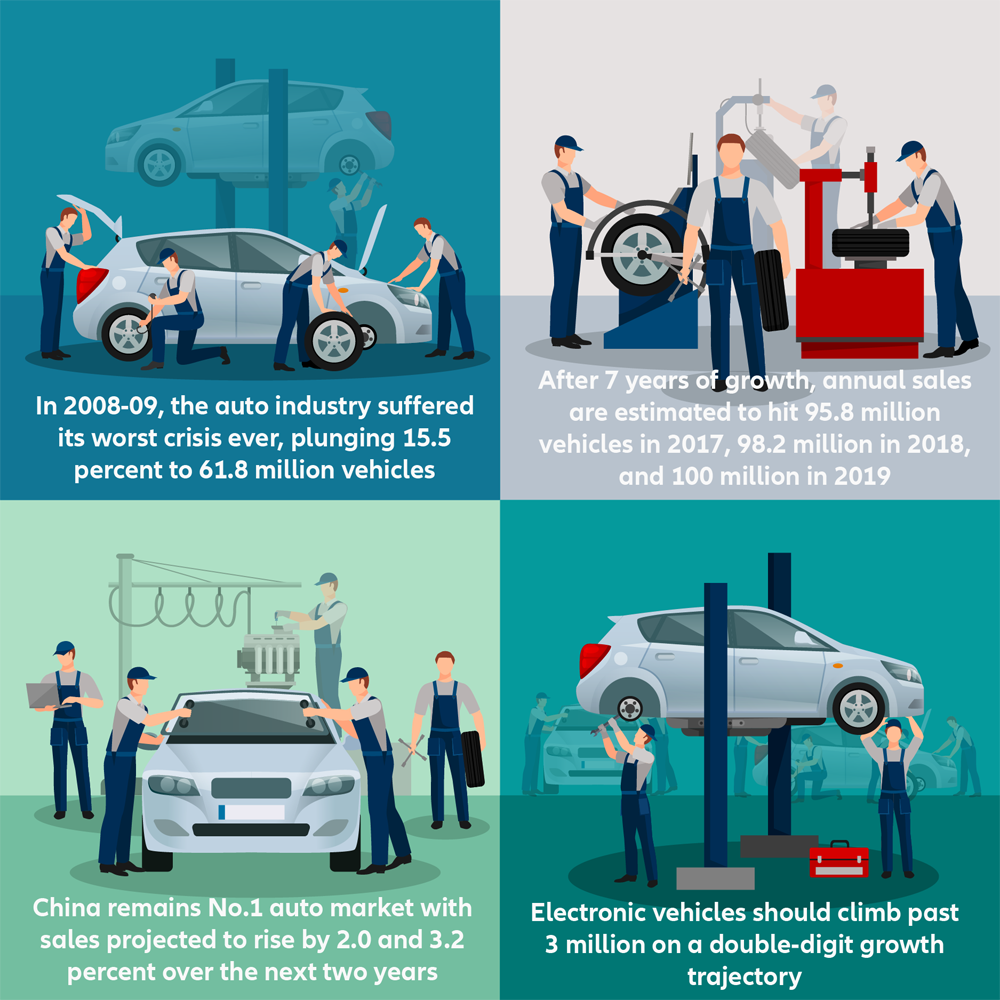

In 2008-2009, the auto industry suffered its worst crisis ever when production plunged 15.5 percent to 61.8 million vehicles. Faced with the freefall, many countries introduced car scrappage schemes and other sales incentives, and in the United States, executives from a couple of carmakers went cap-in-hand to the government for a bailout.

Now, after seven years of growth, it is estimated that annual sales this year will hit 95.8 million vehicles and rise to 98.2 million in 2018, on the way to the 2019 milestone. A new report from credit insurer Euler Hermes projects growth of 2.1 percent in 2017 and 2.5 percent in 2018.

“The market is continuing to grow, but is slowing. Cyclical factors, such as the elimination of tax advantages in China or tightening financial conditions, could derail these expectations,” says Maxime Lemerle, Head of Sector Research at Euler Hermes and one of the authors of the report. “Still, the trend is clear as the industry is experiencing strong growth in electric vehicles, the demand for mobile services and a rise in autonomous driving that can offset any downward forces.”

According to the report, titled ‘The Auto World Championship’, China’s decade-long domination as the number one auto market is set to continue, with sales projected to rise by 2.0 and 3.2 percent over the next two years despite slowing growth rates. By 2019, it is expected that more than 30 million new cars will be sold in China annually. The Indian market is the second largest and growth of 10.7 and 13.5 percent expected in the next two years.