2016 was the year of surprises. Britain voted to divorce the European Union and the United States shocked pollsters by electing Donald Trump as President, setting the stage for many controversial decisions including the U.S. pullout from the Paris agreement on climate change.

You’d think the political uncertainties would turn down the investment climate in these countries. But when it comes to renewable energy, the two retain their charm as attractive investments destinations, according to the Allianz Climate and Energy Monitor 2017.

Allianz Climate and Energy Monitor 2017

United In Power

Downloads

Related links

Still Great Britain

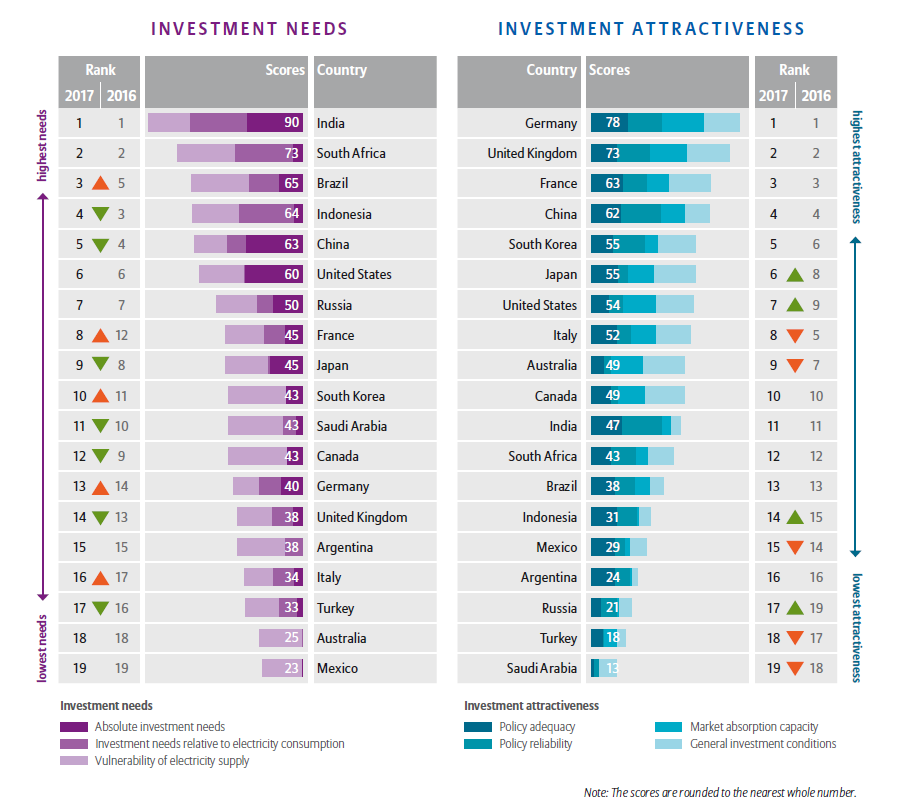

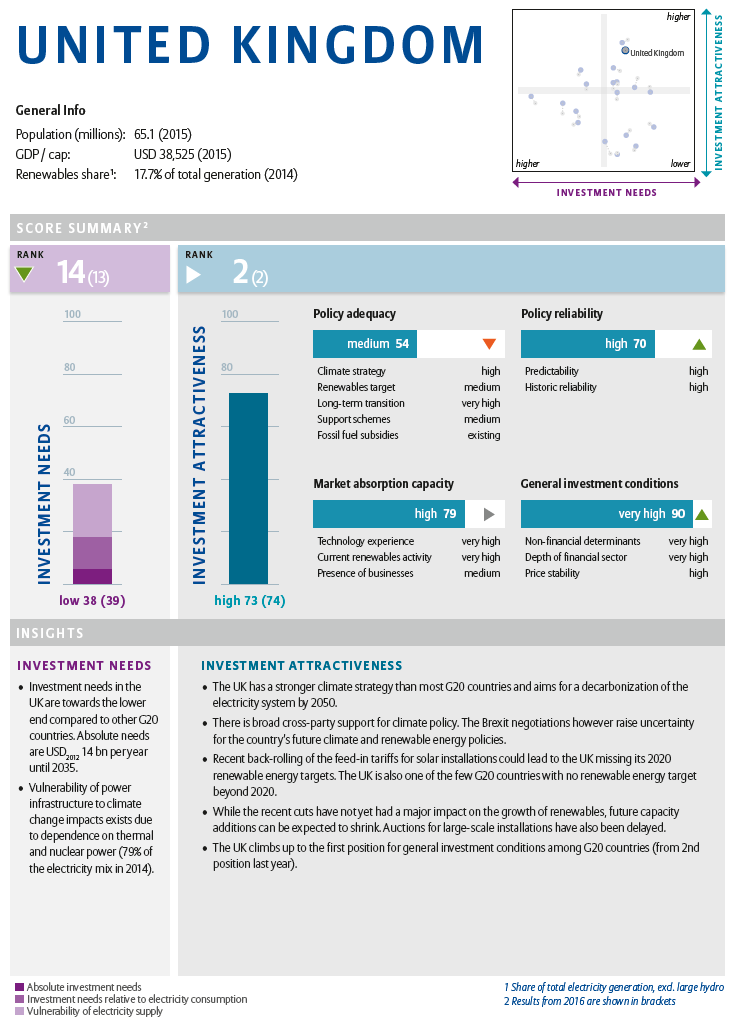

Brexit worries aside, the United Kingdom has the best general investment conditions among the Group of 20 (G20) countries when it comes to renewables, finds the Monitor. The UK is among the three most attractive investment destinations for renewables, with Germany being the first and France being the third. The country’s climate strategy, which enjoys broad-party support and aims for decarbonization of the electricity system by 2050, is stronger than those of most G20 members.

However, there’s work to be done yet. Brexit negotiations have created uncertainty over the UK’s future climate and renewables policies and the country has no renewable energy target beyond 2020. It’s not unthinkable that capacity additions shrink in the future. Auctions for large-scale installations have also been delayed.

U.S. almost on track

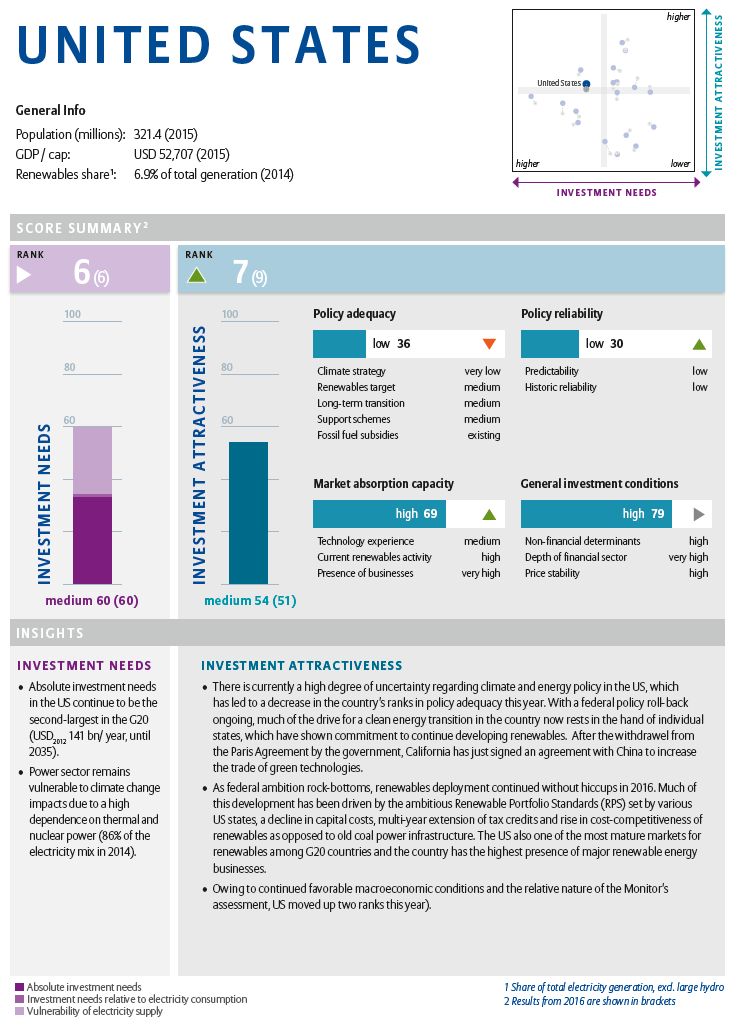

Interestingly, the high uncertainty around the U.S. climate and energy policy has done little to dim the appetite for renewable investments in the country. Uncle Sam moved up two notches in investment attractiveness rankings this year, coming in at the seventh position. Most of the support came from the strong commitment by individual U.S. states to clean energy. For example, California recently signed an agreement with China to increase the trade of green technologies.

Ignoring political rumblings at the federal level, deployment of renewables continued without hiccups in 2016, driven by the Renewable Portfolio Standards set by various U.S. states, a decline in capital costs, multi-year extension of tax credits and a rise in the cost-competitiveness of renewables versus old coal power infrastructure.

Emergence of emerging markets

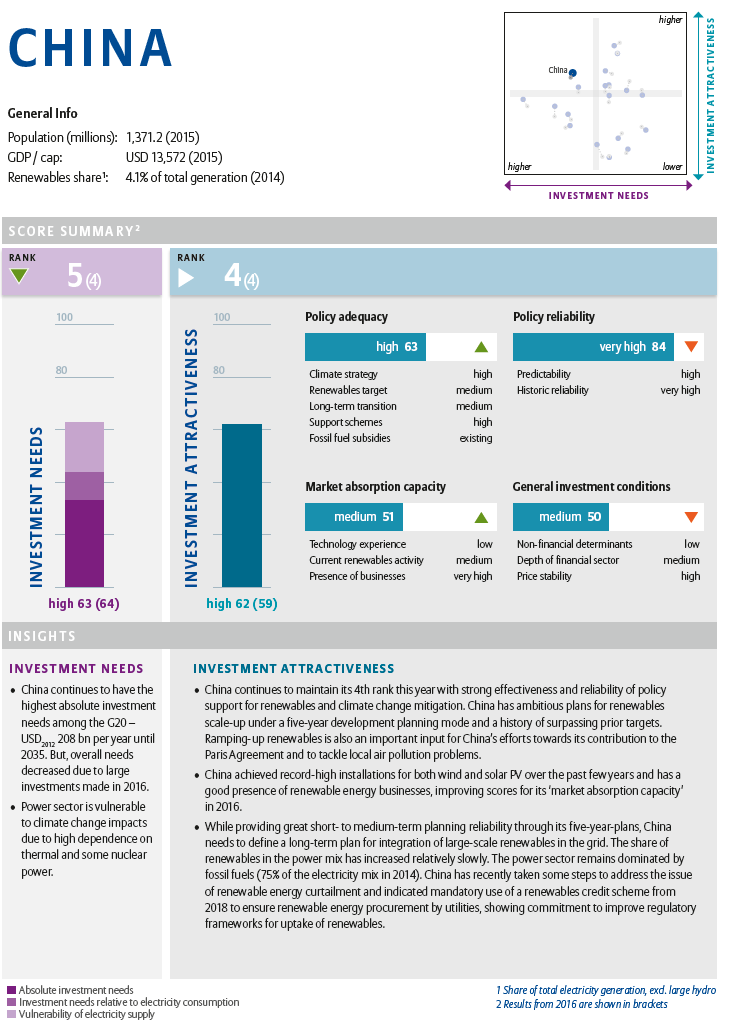

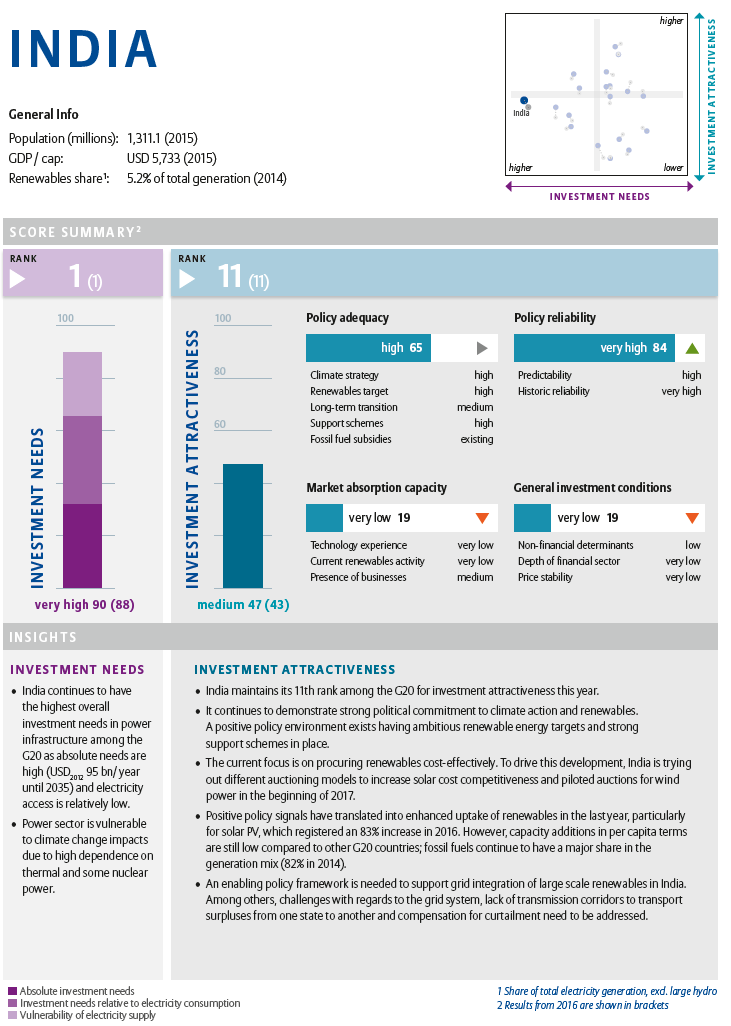

China remained in the ‘best performers club’, maintaining its fourth rank in investment attractiveness. With a roaring renewable energy market and a consistent policy push, the Red Dragon installed more solar photovoltaics in 2016 than did the rest of the G20 combined. Its neighbor India also stays committed to climate action, with policy support for large-scale deployment of renewable technologies, especially solar photovoltaic. The country aims to install 60 GW wind and 100 GW solar capacities by 2022. South Africa, Brazil and Indonesia were other emerging markets that enhanced their attractiveness scores last year.

“This year’s Monitor shows that emerging economies increasingly take on a leadership role and are credibly enhancing their renewable energy financing frameworks out of self interest,” says Simone Ruiz-Vergote, Managing Director at Allianz Climate Solutions. “These countries present good prospects for renewable energy investing if policy support and market capacities are maintained.”

However, while both countries have a high ambition for the energy transition, their power systems are still dominated by fossil fuels. China provides great short- to medium-term planning reliability through its five-year plans, but needs to define a long-term plan for integrating large-scale renewables in the grid. In India, capacity additions in per-capita terms remain low versus other G20 countries. Fossil fuels continue to dominate the power sector in both countries – as much as 75 percent of the electricity in China and 82 percent in India came from fossil fuels in 2014.

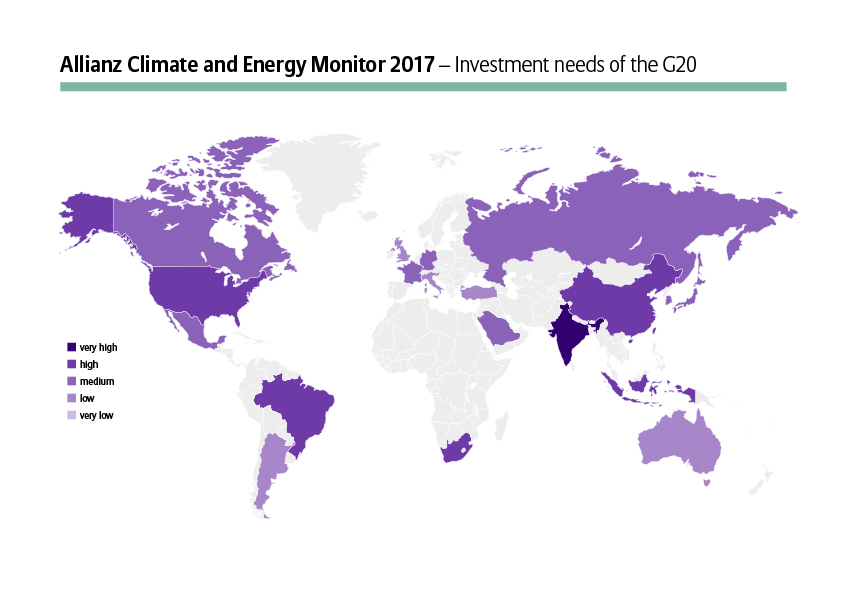

As for absolute investments, China, the U.S. and India have the biggest needs, says the Monitor. China needs $208 billion while the U.S. needs about $141 billion annually until 2035.

Call for action

According to the Monitor, G20 countries need to roughly double their annual investments to align their power infrastructure with the 2 degree-Celsius pathway set out in the Paris agreement. The absolute investment needs of G20 nations stand at $709 billion per year between 2014 and 2035. Here, private investors such as Allianz play a key role – the company has so far invested 4.6 billion euros in renewable energy and aims further investment in the future. ”Reliable and stable regulation enables access to larger pools of capital at lower cost,” says Axel Zehren, Chief Financial Officer, Allianz Investment Management. ”Hence, an integrated approach can help reduce the costs associated with the shift to a low-carbon economy.”

About the Allianz Climate and Energy Monitor

The Allianz Climate and Energy Monitor ranks G20 members on their attractiveness as potential destinations for investments in low-carbon electricity infrastructure. Further, it considers their current and future investment needs in line with a trajectory compatible with the 1.5-2.0 degree Celsius temperature limit of the Paris agreement. The Monitor was produced by Allianz Climate Solutions in collaboration with Germanwatch and NewClimate Institute for Climate Policy and Global Sustainability GmbH.

Further Information

Forward Looking Statement disclaimer

As with all content published on this site, these statements are subject to our Forward Looking Statement disclaimer:

Press contact

Anja Rechenberg

Allianz SE

Phone: +49 89 3800 4511

Thomas Liesch

Allianz Climate Solutions

Phone: +49 89 3800 12889