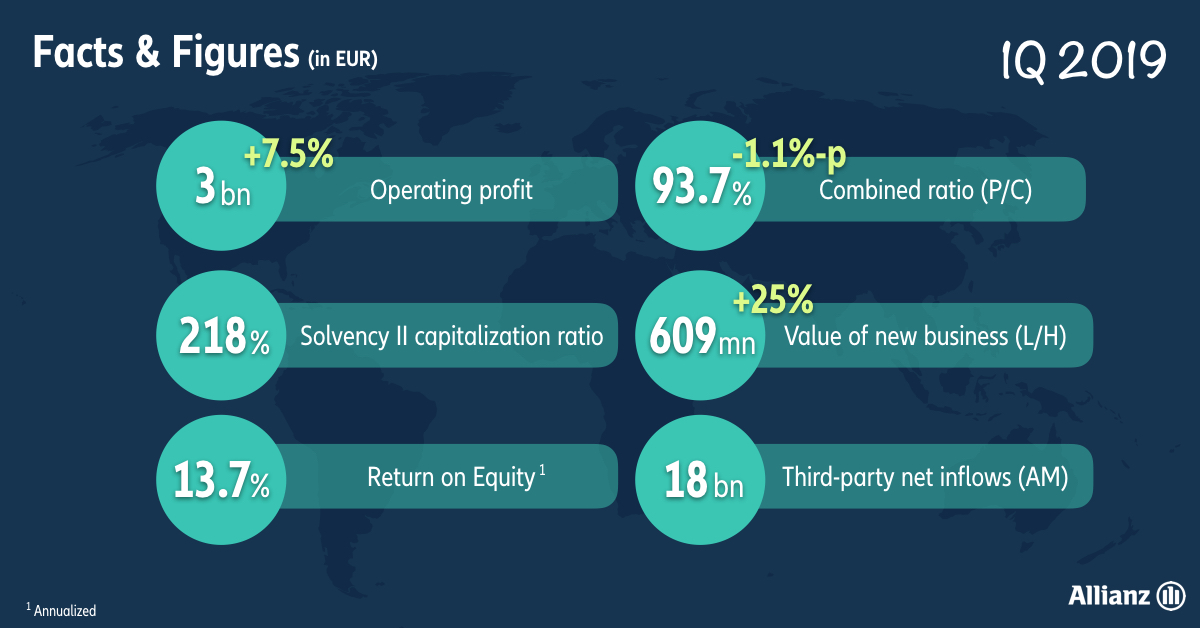

Allianz Group continued its successful course from 2018 with a strong first quarter 2019. The results demonstrate the resilience of our business segments and continued progress in executing our Renewal Agenda. Internal revenue growth, which adjusts for currency and consolidation effects, was 7.5 percent. Total revenues grew 9.1 percent to 40.3 (2018: 36.9) billion euros. Operating profit increased by 7.5 percent to 3.0 (2.8) billion euros, mostly due to our Property-Casualty business segment as a result of strong premium growth, lower claims from natural catastrophes and an improved expense ratio. Our Life/Health business segment operating profit grew slightly as higher loadings and fees and favorable true-ups more than offset a lower investment margin. Higher expenses due to investments in business growth led to a small decline in the Asset Management business segment’s operating profit.

Net income attributable to shareholders grew 1.6 percent to 2.0 (1.9) billion euros. Higher operating profit was largely offset by lower non-operating investment income and, to a lesser extent, higher taxes.

Basic Earnings per Share (EPS) increased 4.5 percent to 4.65 (4.46) euros. Annualized Return on Equity (RoE) amounted to 13.7 percent (full year 2018: 13.2 percent). The Solvency II capitalization ratio stood at a comfortable level of 218 percent at the end of the first quarter 2019, compared to 229 percent at year-end 2018, driven primarily by the effects of the current share buy-back program (minus 4 percentage points) and following previously announced regulatory and model changes (minus 4 percentage points).

On February 14, 2019, Allianz announced a new share buy-back program of up to 1.5 billion euros. 2.8 million shares have been acquired by March 31, 2019, representing 0.7 percent of outstanding capital.

“Allianz achieved strong results in the first quarter putting the group on track to meet its 2019 full-year targets,” said Oliver Bäte, Chief Executive Officer of Allianz SE. “Our customers continue to seek quality and service, both of which we are consistently focusing on. Despite economic and political volatility, we are very well positioned to further develop our franchise.”