Ways of Working

Remote work need not stop at the border

Olaf, a year ago, your Mobility team developed guidelines and launched the Cross-Border Remote Work Tool, enabling Allianz employees to work from abroad. Haven’t Allianz employees been able to do that for years, for example on business trips?

Why was it important to Allianz to allow this?

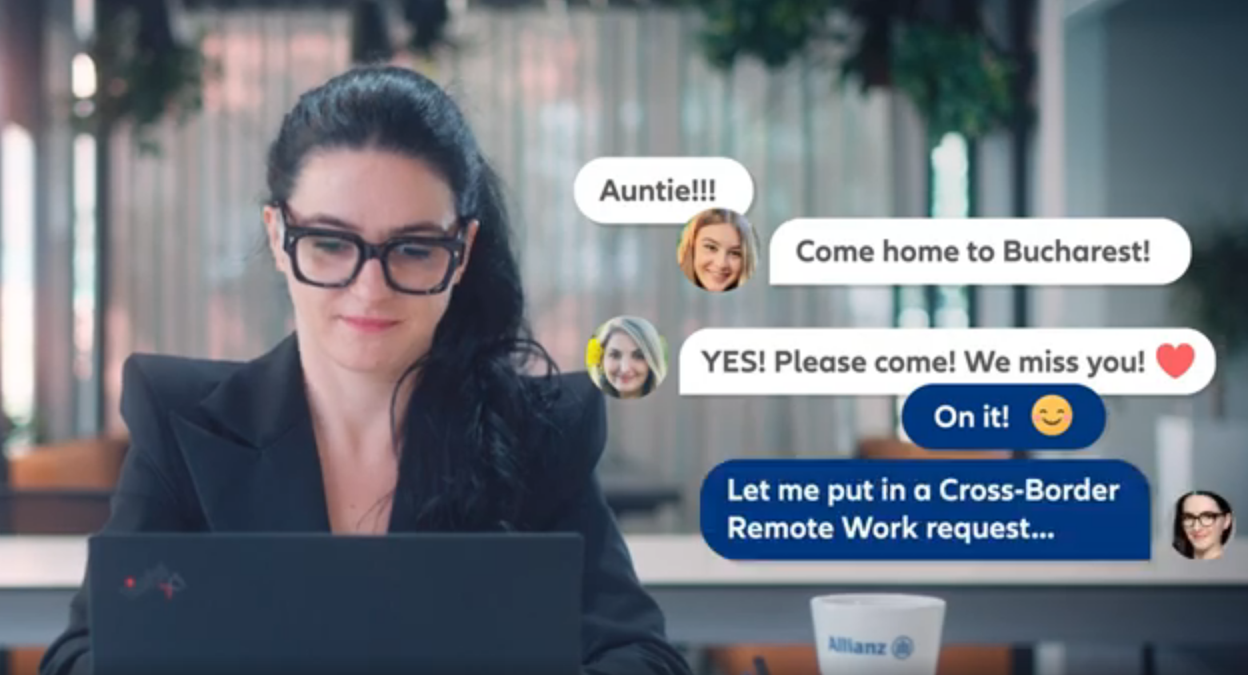

Our lives and the world around us are becoming increasingly more global, many of us have friends, family, and previous life experience scattered across various parts of the world. And in most locations Allianz’s workforce is international, we have 76 different nationalities at our holding company alone. For an increasing number of employees, the freedom to simultaneously work remotely and spend quality time with family and friends, or simply catch some sunshine in winter – is a valuable benefit of modern working life and essential for wellbeing.

This is why Allianz is offering eligibility for its employees to work remotely from abroad for up to 25 days per year – on top of introducing new global working standards defining the flexible Allianz Ways of Working. We are convinced that embracing this kind of flexibility improves employee morale, engagement and thus in the end also performance.

But why would you need a special tool to make that possible?

Working remotely from outside the country of employment can lead to high legal and financial risks for both the employer and the employee. Many companies are not allowing temporary remote work from abroad because the required assessment of the regulatory implications – like taxation, immigration and social security aspects - is too time-consuming or expensive.

The Cross-Border Remote Work Tool developed by the Global Mobility Team together with Group Tax and Allianz Technology is an automated inhouse solution ensuring full compliance with both the country of employment and the chosen destination.

How does the tool work?

The tool enables Allianz employees to self-assess their requests to work from abroad in a simple and fast way. By pooling all available data, it cuts through the confusion of countless possible country combinations and thousands of regulations. After answering only 6 questions, employees receive an immediate response whether their request is approved. Instead of triggering a multi-step, time-intensive, expensive manual process performed by external experts, Allianz employees can now check with a few simple clicks whether they can work remotely from the particular country of their choice.

And our intelligent Cross-Border Remote Work Tool keeps self-learning from each employee request involving new country combinations. The new data are embedded in the ever growing “brain” of the tool and are deployed for future assessments.

Can every Allianz employee access the tool? How many cross-border work requests are being granted?

The tool went live in October 2021. Currently circa 53,000 employees – 35% of our workforce – have access to it, and we are further rolling it out internationally.

In Germany, 5 out of 6 requests are handled automatically by the tool, and a majority are instantly granted. Our holding company Allianz SE, for example, receives circa 100 cross-border remote work requests per month. 80% of requests get a green light (permitted), 20% a red light (not approved). Out of these, ca. 15% (orange cases) require further manual processing before being labelled either green or red.

What has the resonance been so far, do you see further need for improvement or development?

The resonance, both with employees and other companies across different industries, has been extremely positive. Our innovative solution has helped Allianz employees take advantage of remote working capabilities globally. This kind of flexibility is something which is highly appreciated by employees and expected from an employer, especially after the pandemic experience.

And our innovative Cross-Border Remote Work tool is getting further external recognition, we won the #FEM (Forum Expatriate Management) EMEA award in both the categories Best Employee Experience & Engagement and Most Innovative Use of Technology in Global Mobility on November 2 this year, and the #HR Excellence Award in the category Hybrid & Remote Work on November 25.

But we are not resting on our laurels. We are constantly reviewing the user experience and improving our Cross-Border Remote Work Tool according to the feedback of our employees, e.g. by making it even more user friendly and thinking of ways it can further support colleagues who are temporarily working from abroad.

About Allianz

** As of December 31, 2023.

Press contact

Allianz SE

.jpeg)

.jpeg)