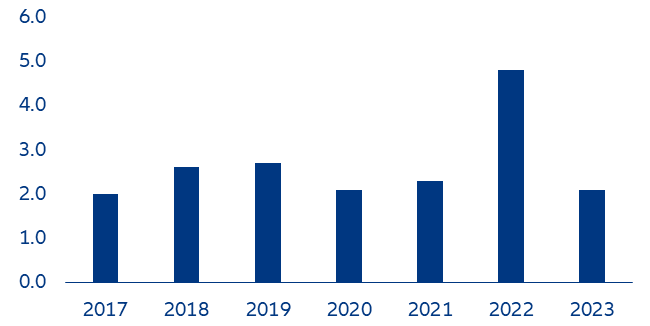

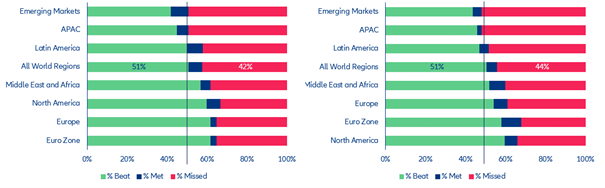

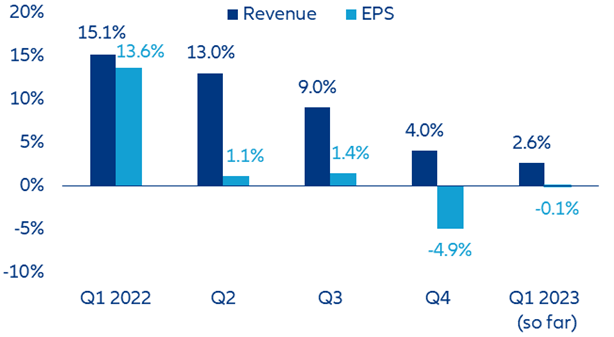

- All that glitters is not gold in the Q1 earnings season, with US earnings already in recession. While 62% of companies in Europe and the US beat estimates during the Q1 season, this is mainly because of already lowered analyst estimates. Even if revenue rose year-over-year (+2.6%), profit growth remained in negative territory (-0.1% y/y) and a corporate recession is looming, at least for the US, where earnings have already fallen back for two consecutive quarters. APAC firms went in the opposite direction: China’s reopening raised hopes for a stellar recovery in the first quarter but 59% of Chinese companies disappointed the market

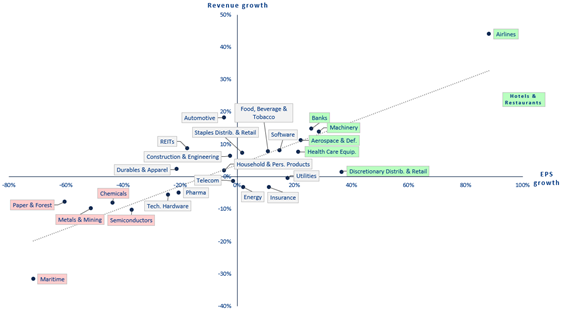

- In line with expectations, two sectors in particular had a big quarterly setback as earnings continue to normalize: maritime and energy. Overall, 10 out of 26 sectors managed to increase both sales and EPS, while eight sectors reported y/y declines. Basic materials posted the worst performance.

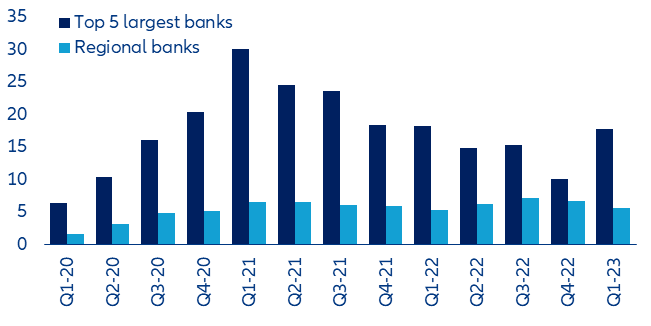

- European firms are losing two tailwinds as pricing power fades and the USD weakens. An earnings recession is on the cards for the back-to-school season in fall as the transmission of monetary policy tightening will be fully effective. Nevertheless, as anticipated in Q4, with pricing power fading for many sectors, companies worldwide had been preparing for a gloomy 2023 via staff rightsizing, operational restructuring plans and other cost-saving measures. This together with significantly lower energy bills should prevent a sharp earnings recession in the coming months.

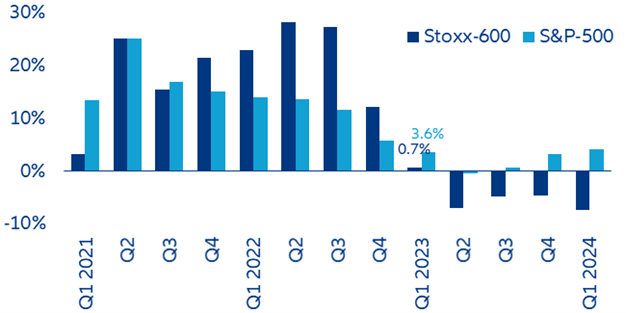

- Corporate guidance has deteriorated for full-year 2023 as only 25% of firms made upward revisions over the season. However, a mild recovery is expected from the beginning of next year. For Q1 2024, nine of the 11 sectors in the S&P 500 are expected to achieve profit growth: communication services (+20.5% y/y), utilities (+17.7%) and industrials (+15.9%) are expected to post the highest EPS growth rates.

In focus – Earnings recession to catch up with corporates

OPEC+ – divided and cornered in its own inflationary trap

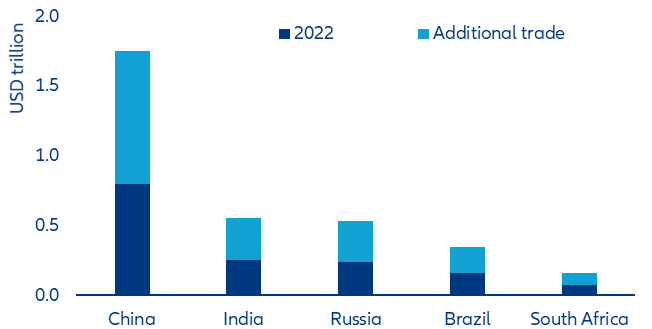

BRICS summit – China holds the keys to turning the group into a powerhouse

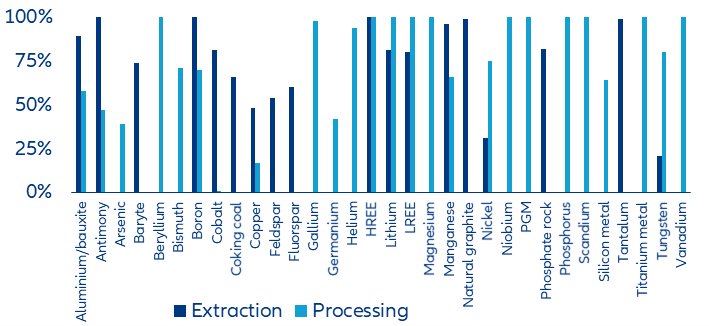

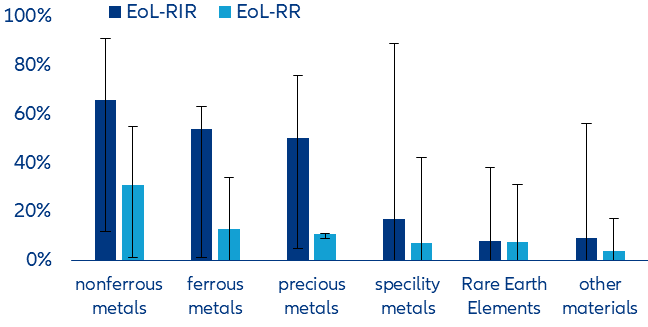

The EU Critical Raw Materials Act – recycling to the rescue?

In focus – Earnings recession to eventually catch up with corporates

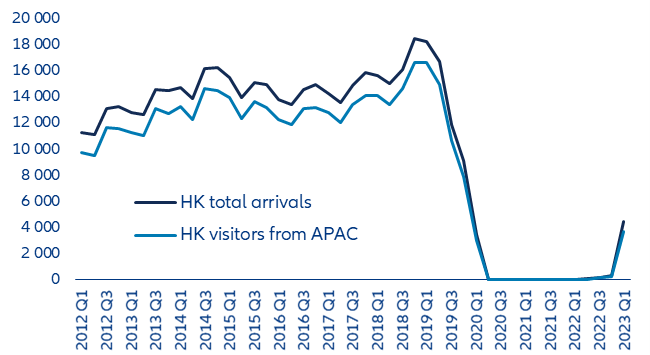

All that glitters is not gold in the Q1 earnings season. Even if 51% of companies at the global level outperformed expectations, this is not as impressive as it might seem considering that analysts had sharply cut their estimates just before the season started, a practice that has become quite common in recent quarters. This was particularly true in the US, where 62% of firms beat forecasts for EPS growth as the consensus moved from growth of +1.4% y/y in January to a drop of -5.1% y/y in April. In addition, 76.9% of S&P 500 companies exceeded EPS expectations, compared to the long-term average of 66.3% in terms of upside surprises for the index. However, APAC firms went in the opposite direction: China’s reopening raised hopes for a stellar recovery in the first quarter but 59% of Chinese companies disappointed the market.

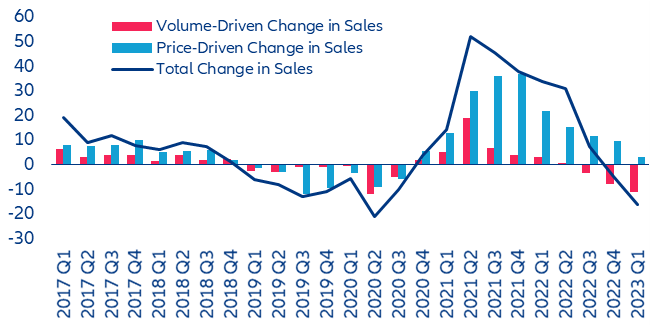

Business deterioration persists and will continue to be a concern over the next two quarters. Even if revenue is still rising year-over-year (+2.6%), profit growth remains in negative territory (-0.1% y/y) and a corporate recession is looming, at least for the US, where earnings have already fallen back for two consecutive quarters (Q4: -2.8% and Q1: -0.7%). As anticipated in Q4, with pricing power fading for many sectors, companies worldwide had been preparing for a gloomy 2023 via staff rightsizing, operational restructuring plans and other cost-saving measures, which, together with a significantly warmer-than-expected winter that lowered energy bills led earnings to fall this quarter less than initially expected. Still, as costs cannot be reduced infinitely, profits are set to fall in coming quarters.

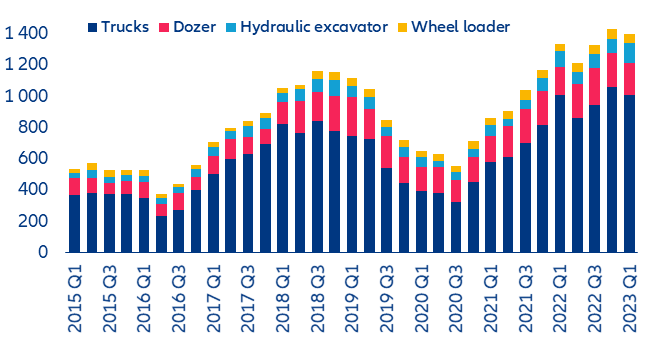

Basic materials, which includes metals & mining, chemicals and paper, continued to struggle as EPS slumped by -46.9% y/y in Q1, after falling by -45.9% y/y in Q4 2022. China’s reopening is not providing the much-needed and expected recovery for the metals & mining sector in particular. With the notable exception of metals linked to the energy transition, prices of most metals are not likely to recover in the short-term, given the looming recession.

Sales fell for the second consecutive quarter in the chemicals sector (-4.7% y/y in Q4 and -16.0% y/y in Q1), particularly in base chemicals (-29.2% y/y) and in intermediate & derivative chemicals (-18% y/y). In contrast, plastic, resins & fiber managed to grew by +5.5% y/y. The deterioration is largely explained by continuously waning demand, which has negatively impacted both price and sales volumes. Even if natural gas prices have receded from recent highs, they continue to be responsible for the deterioration of margins in the sector. As a result, the sector’s earnings prospects for 2023 remain at risk. We expect Europe's chemical firms to continue lagging behind US peers.