- As expected, the Bank of England increased interest rates by +25bps today, but it will have to contend with stickier-than-expected inflation ahead. In March, inflation hit 10.1% in the UK, higher than in all other Western European countries, as well as the US. Easing food prices and normalizing supply chains, as well as negative base effects from energy prices, will bring inflation down to 4% by Q4 2023. By end-2024, we expect inflation at 2.5% y/y but this will still be 0.5% higher than the level in the US.

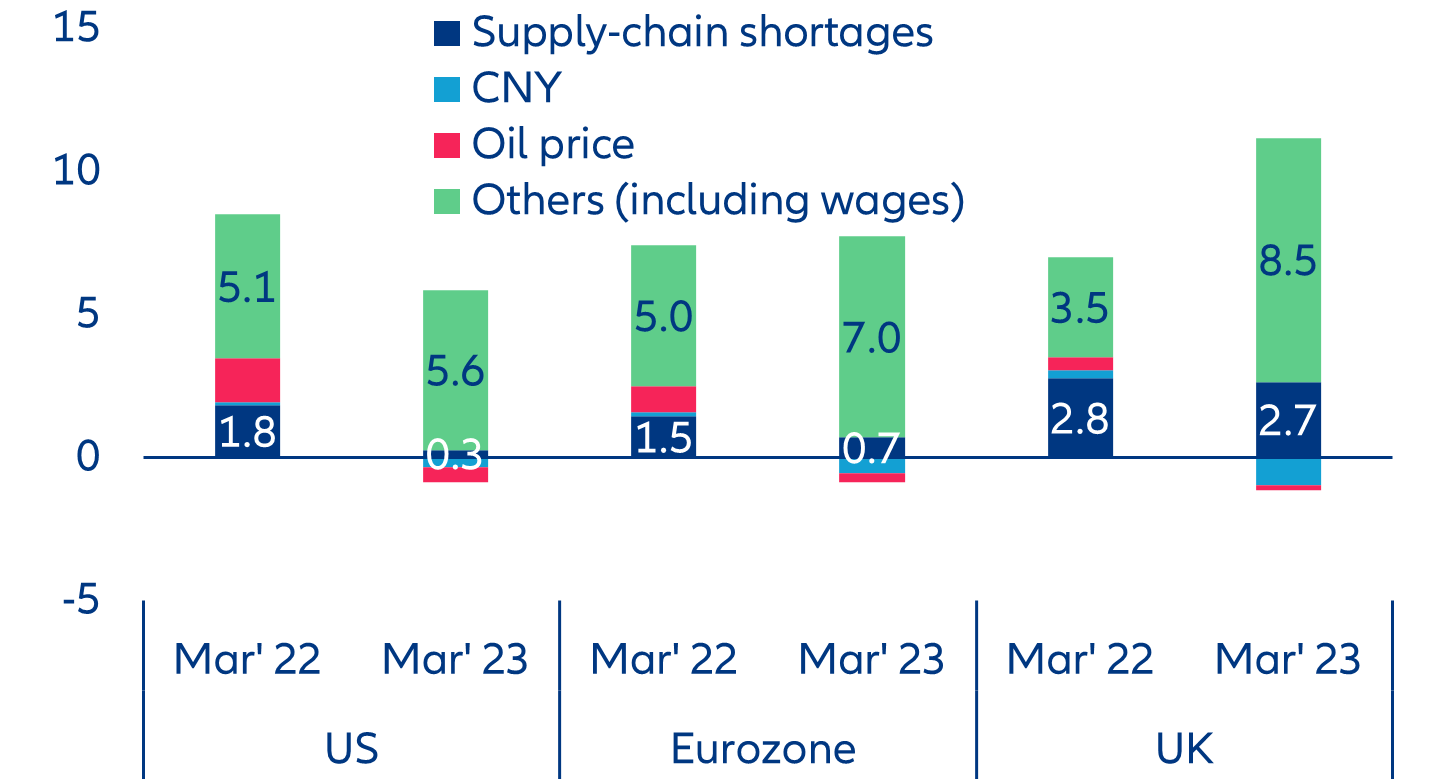

- A wage-price loop is the biggest concern. The share of inflation explained by wages has more than doubled in one year, much larger than in other Western European countries. We expect wage growth to stay close to 5% by end-2024 as slack in the labor market will be difficult to reduce, mainly due to Brexit and the high inactivity rate.

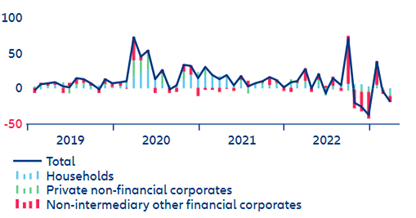

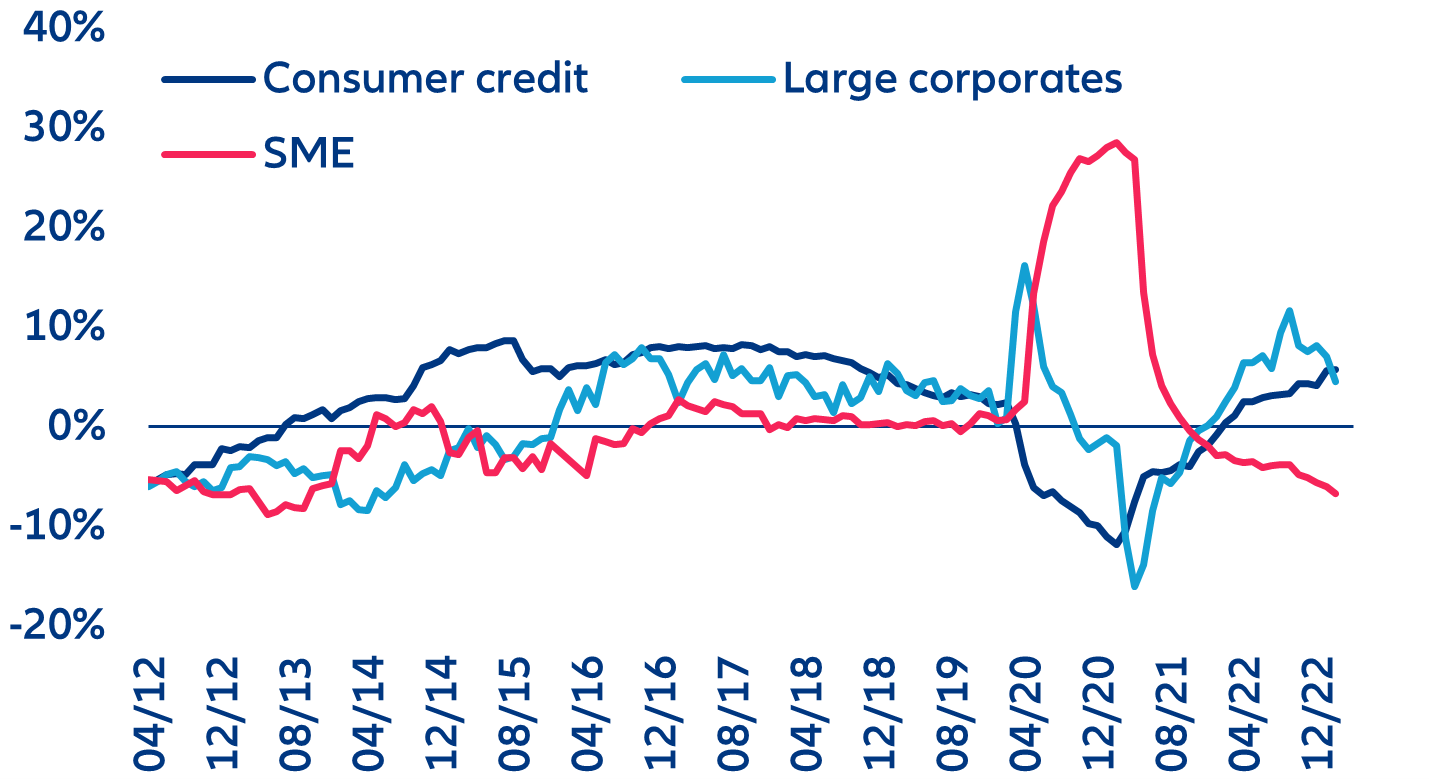

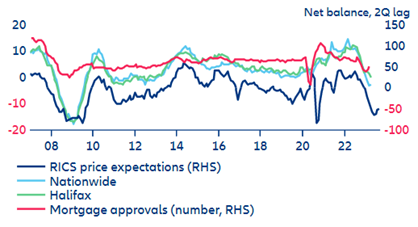

- The UK economy will start to show more signs of liquidity strains. Compared to past cycles, the transmission time from higher interest rates to the real economy has likely doubled from around seven months to more than one year. The resilient services sector has delayed the recession but banks’ credit conditions should start tightening in the coming months. Credit growth to SMEs is already contracting as much as seen during 2012-2013 but we expect this contraction to start to extend to households.

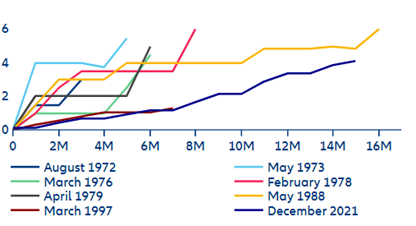

- Inflation remaining higher than in other advanced economies, rising global financial risks and the housing-market adjustment will push the Bank of England towards baby steps for longer. This means the bank rate will peak at 5% after three additional 25bps hikes by year-end and pivot only in Spring 2024, making it the longest hiking cycle in history. Overall, we do not think the Bank of England will cut interest rates by more than 100bps in 2024 as the housing-market adjustment will remain more moderate compared to the US (around -10% by end-2024). The inflation differential also bodes well for a 75bps rate differential for the US (expected at 3.25%) and should support a relatively stronger GBP (1.30 vs USD). Hence, UK rates will remain considerably above the neutral rate estimated between 1.25% and 2.5%.

In Focus

Bank of England: First to hike, last to pause and pivot

Türkiye – At a crossroads

This week, President Erdogan faces a tight race in Türkiye’s upcoming presidential and parliamentary elections, which will be crucial for shaping future economic policies. On average, pollsters considered relatively independent predict a narrow victory for the main opposition candidate Kilicdaroglu, most likely in a second round of voting on 28 May. However, polls do not consider Turkish expatriates voting abroad and may have a sizable margin of error. The ruling AKP party has recently seen a partial recovery in public support, likely thanks to several fiscal expansion measures delivered or promised by the government. It is likely to win around one-third of the votes in the parliamentary elections. The main opposition party CHP follows with a distance of some percentage points. Surveys project that the CHP-led Nation’s Alliance and the AKP-led People’s Alliance are neck and neck, though neither are likely to muster a majority in the parliament alone. But an opposition bloc, namely the Nation's Alliance together with the Labor and Freedom Alliance, led by the opposition pro-Kurdish HDP/YSP, could win a majority in the parliament.

There are still several uncertainties, including the conduct of the election in the mainly Kurdish region affected by the severe earthquakes in February 2023 (and thus the support for the HDP). There is also a possibility that a narrow opposition victory is challenged, as happened in 2019 when President Erdogan forced a re-run of the local elections in Istanbul after the AKP lost the vote (it eventually also lost the re-run).

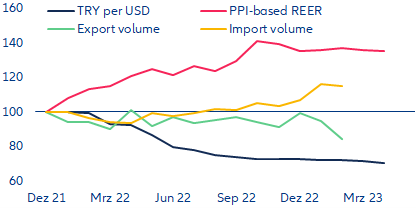

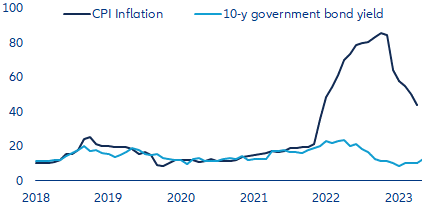

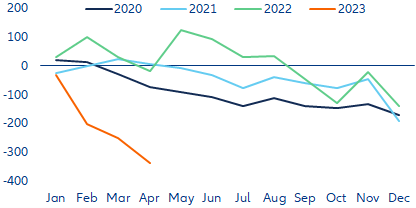

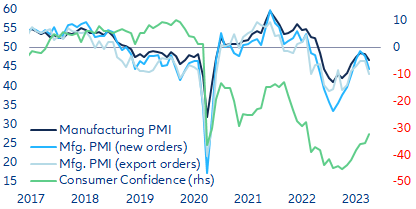

Whatever the outcome, the next government will have to cope with considerable economic and financing challenges. The main problems that have accumulated over the past years include a prolonged period of unorthodox monetary policies that has led to persistently high inflation and ongoing currency weakness and volatility; widening external imbalances and low foreign exchange reserves; lasting capital outflows amid sharply deteriorated investor confidence and increasingly excessive public spending.

Consequently, the opposition’s party manifestos include key economic policy proposals such as to restore central bank independence, lower inflation to single digits within two years, restore currency stability, revert ‘liraization’ policies and FX controls for exporters, as well as to return to more fiscal prudence. While there are some clear references to central bank independence, the manifesto is generally quite restrained on how most of these goals would be achieved. The rolling back of liraization and FX controls would be positive moves but, in principle, a comprehensive return to orthodox monetary policies is needed, including a sharp rise in interest rates, more or full exchange rate flexibility (less FX intervention) and the abolition of the costly FX-protected TRY deposits policy that was introduced in December 2021. So far, opposition officials have not explicitly mentioned plans for such changes if they win the elections, although some have made signals to that end.

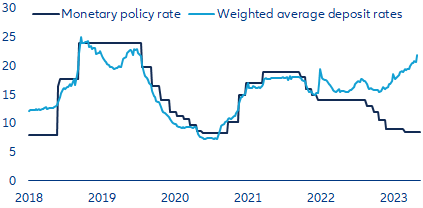

Interest rates need to be raised markedly in order to reduce inflation. We believe the monetary policy interest rate (currently 8.50%) should at least converge towards the weighted average deposit rates (currently in the range of 20%-25%, though probably also distorted at the moment) with which it was in line, by and large, before 2022 (Figure 1). This would also help to end the FX-protected TRY deposits policy.

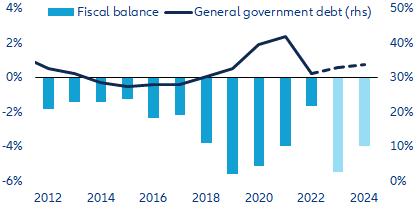

-5.5% of GDP this year (Figure 5). Looking ahead, the excessive public spending needs to be eliminated after the elections to avoid a sovereign debt crisis in the next few years.

Overall, the opposition’s economic policy proposals are a step in the right direction but will not be enough to turn around the Turkish economy. And it is unclear if there is appetite for more. Merely reinstating central bank independence, hiking interest rates, reverting some of the macroprudential measures and introducing a fiscal rule will not be enough to tackle the deep-rooted macroeconomic imbalances. A lengthy period of tight monetary and fiscal policies is needed to bring the economy back to a sustainable path. But this will likely come with economic and political costs such as lower growth, rising unemployment, currency depreciation and potentially increasing insolvencies, besides making the (new) government less popular. The appetite for this is likely to be low so a watering-down of necessary policies is possible.

If President Erdogan and the AKP win the upcoming elections, we expect a continuation of current economic policies, at least until local elections in spring 2024. As a result, high inflation (well in double digits), currency weakness, loose fiscal policy financed largely by local banks as well as macro imbalances including an insufficient level of FX reserves will remain in place. However, as this policy mix is unsustainable in the medium term, the risks of another severe currency crisis, eroding banking sector financials and deteriorating public finances would increase. Eventually, Turkish authorities might need to respond with strict capital controls.

All in all, Türkiye is at a crossroads and the upcoming elections could be a game changer for the medium-term economic outlook. Over the next two years or so, the Turkish economy will have to undergo a significant adjustment in order to lower macroeconomic imbalances and avoid a full-blown 2001-style financial crisis. An IMF funding program would be helpful and a new government would probably be more open to this. Regardless of the election outcome, the adjustment will be painful in the short term, though it may be less disorderly in the medium term under a CHP-led government.

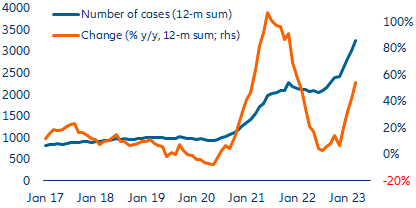

Note: The sharp increase from mid-2020 to mid-2021 was largely due to a change in the Polish insolvency legislation.

Sources: National statistics, Allianz Research

Energy-efficient housing – German building renovation wave or rip current?

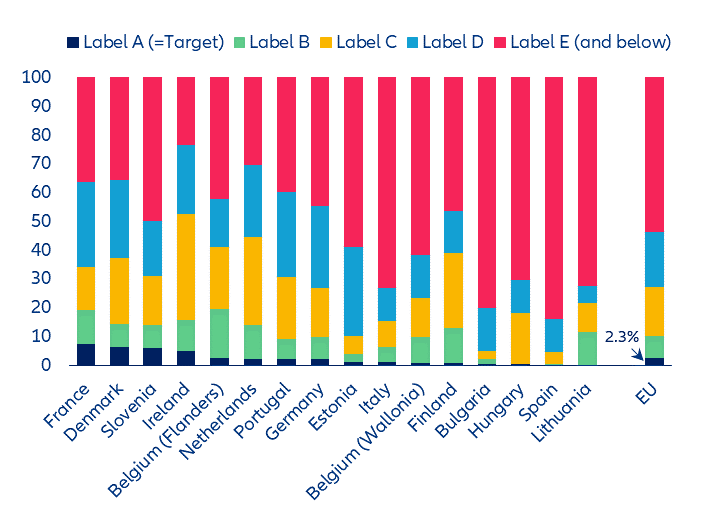

From January 2024, Germany’s proposed Building Energy Act will require newly installed heating systems to be 65% powered by renewable energy. The pace for energy renovations in Germany is set by the recent update to the EU Energy Performance of Buildings Directive (EPBD), which aims at renovating 15% of the building stock with the lowest energy efficiency to reach climate neutrality by 2050. The current version of the amended EPBD was adopted by the European Parliament in March 2023 and focuses on significantly lowering greenhouse gas emissions and energy usage in the EU’s building sector by 2030. The EPBD requires all newly constructed buildings to have zero emissions by 2028, with a deadline of 2026 for buildings occupied, managed or owned by public authorities. Solar technologies must be installed in all new buildings by 2028, if technically viable and economically feasible. Residential buildings undergoing major renovations will have until 2032 to comply.

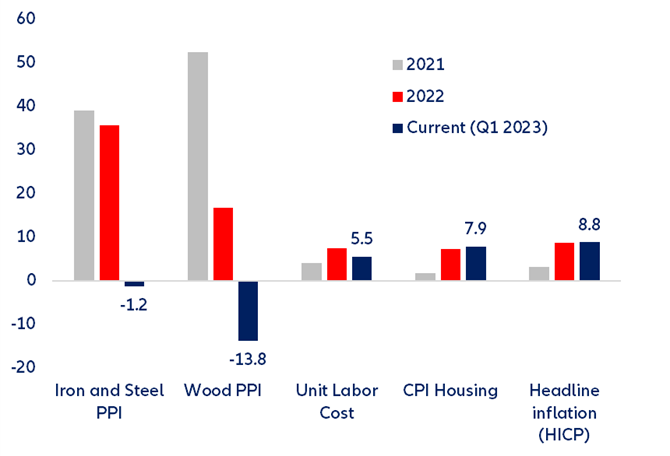

However, steep costs could stand in the way of achieving a climate-neutral building stock by 2045. While energy prices have declined, thanks to the government-imposed price caps on gas, higher construction costs as well as rising interest rates have made it challenging for households to replace fossil-fuel heating systems in keeping with emission-reduction plans. About half of German households will have to replace their heating systems as they are still dependent on gas and oil. But they also have to improve the energy efficiency of their homes. In older buildings, this can quickly add up to six-digit amounts. Despite some financial support, this is simply not affordable for many, especially against the background of high interest rates and tighter credit conditions. Moreover, there are not enough workers and material to carry out renovations. Capacity utilization of thermal insulation, windows and heat pumps among manufacturers was consistently high at 88% in 2019 and 94% in the first half of 2022. Thus, scaling up energetic refurbishments will only be possible if companies invest in additional production capacities for building materials and in construction. But this would not only run the risk of delaying the normalization of inflation but will also require clear political guidelines and planning.

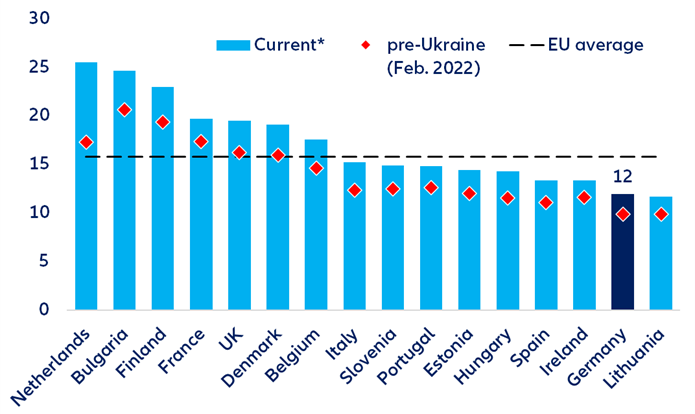

The building sector is the problem child of the German energy transition due to the slow electrification through heat pumps. Despite the crisis, emissions were 5mn tons above the sector target of 113mn tons CO2-equivalent. About 1mn heat pumps have been installed in Germany to date; another 5mn must be added by 2030. While the 40% increase of heat pump installations (230,000 units) last year is a positive development, achieving the climate targets requires more than twice the rate of installation each year (500,000); by 2030, this number would eventually have to rise to 800,000 units. Germany also does poorly if compared to European peers. Norway and Finland are leaders, installing 10 times more heat pumps per 1,000 households than Germany in 2021. In Sweden, the market share of heat pumps is already 90%. The Netherlands, which traditionally relies on natural gas, has also made the switch to heat pumps, favored by the price ratio of electricity to natural gas, advanced municipal heat planning and ambitious measures to phase out the use of natural gas for heating.

However, heat pumps alone won’t be enough to bring down emissions – buildings need to become more energy efficient. Progress in energy-related renovations has been very slow so far: less than 1% of the residential building stock undergoes energy-related renovations each year. Yet, the energy requirement of existing buildings is up to five times higher than that of new buildings. Around 16.5mn buildings in Germany would need to be renovated and would require renovation in a climate-neutral manner by 2050 at the latest, i.e. around 2,500 buildings every day. This also implies a gradual increase in the refurbishment rate from 1% currently to 4% each year.

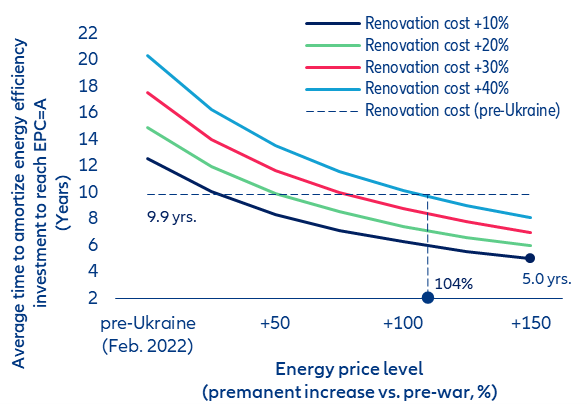

We find that energy-efficiency renovations have become less attractive as additional energy savings over the long run are insufficient to outweigh higher renovation and installation costs (due to the rising costs of materials and labor). The amortization time has increased by two years to about 12 years for an average dwelling if structural price pressures in the building and construction sector as well as labor costs remain contained and energy prices stabilize at higher levels. However, building renovations in Germany are still more attractive than in almost any other EU country due to higher relative energy savings and emissions-reduction potential (despite higher structural disincentives to renovations due to a high share of rental properties and a low annual building rate of just 0.6%). In addition, either a small pullback in construction costs or a stronger permanent increase in energy prices can restore the pre-war amortization time for building renovations in Germany of less than 10 years (which is probable if the government progressively increases the carbon price for fossil fuels) (Figures 10 and 11).

While energy-efficiency investments are self-financing, they are front-loaded and tend to exceed the financial capacity of most households. In this context, policy support needs to be scaled up urgently to reduce the carbon footprint of housing. Hence, demand for energy-efficiency improvements has remained below the levels required to align emission reductions in the building sector with the overall EU emission-reduction target. This raises the question of whether existing financial instruments (i.e., mortgages, home equity/consumer loans) can address this market failure, and to what extent this has implications for financial stability. We analyze the scale of public financial support needed to neutralize the net impact of energy-efficiency investments (renovation/retrofitting as well as greater electrification) by keeping the default risk of German households unchanged under no arbitrage conditions. Based on current household survey data, households would on average require either government grants covering about 25-30% of energy-efficiency investments or a reduction of their mortgage interest rate burden by about 10-20%.

UK – First to hike, last to pause and pivot

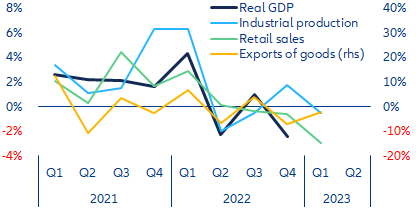

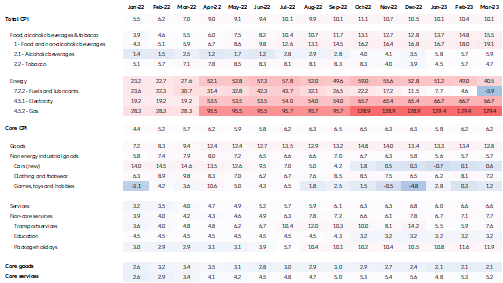

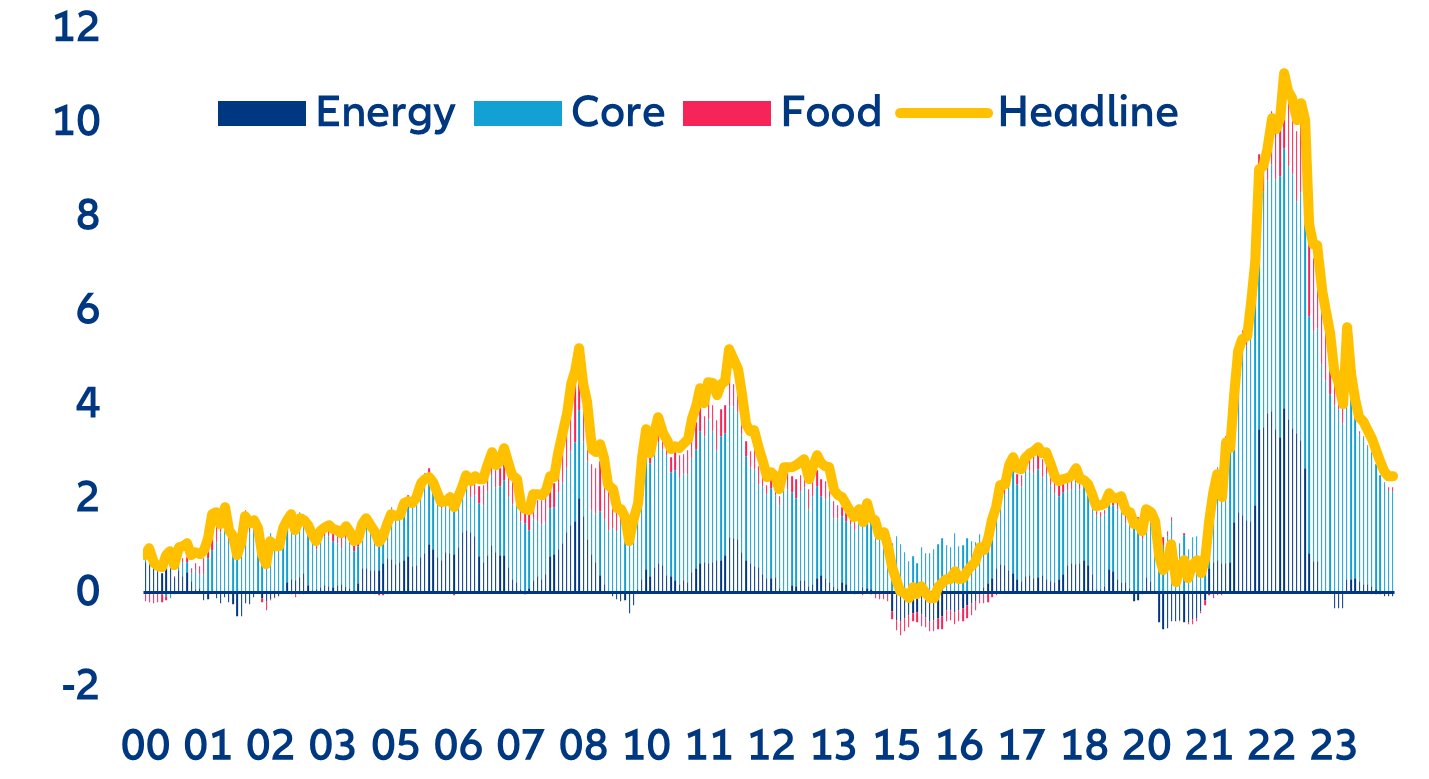

Despite the 25bps interest rate hike today, the Bank of England will have to contend with stickier-than-expected inflation. Even as global supply chains are normalizing and commodity prices are cooling, inflation hit 10.1% in March, higher than in all other Western European countries, and above the US inflation rate for the first time since the late 1980s. While fuel inflation turned negative for the first time in two years (-5.9% y/y), food prices accelerated (+19.2% y/y) and core inflation remained sticky at a high level of 6.2%, above the 5.5% rate in the US and 5.6% in the Eurozone. We estimate core goods inflation at 2.1% y/y in March from a peak of 3.4%, and core services CPI is likely to have remained above 5% (Figure 14).

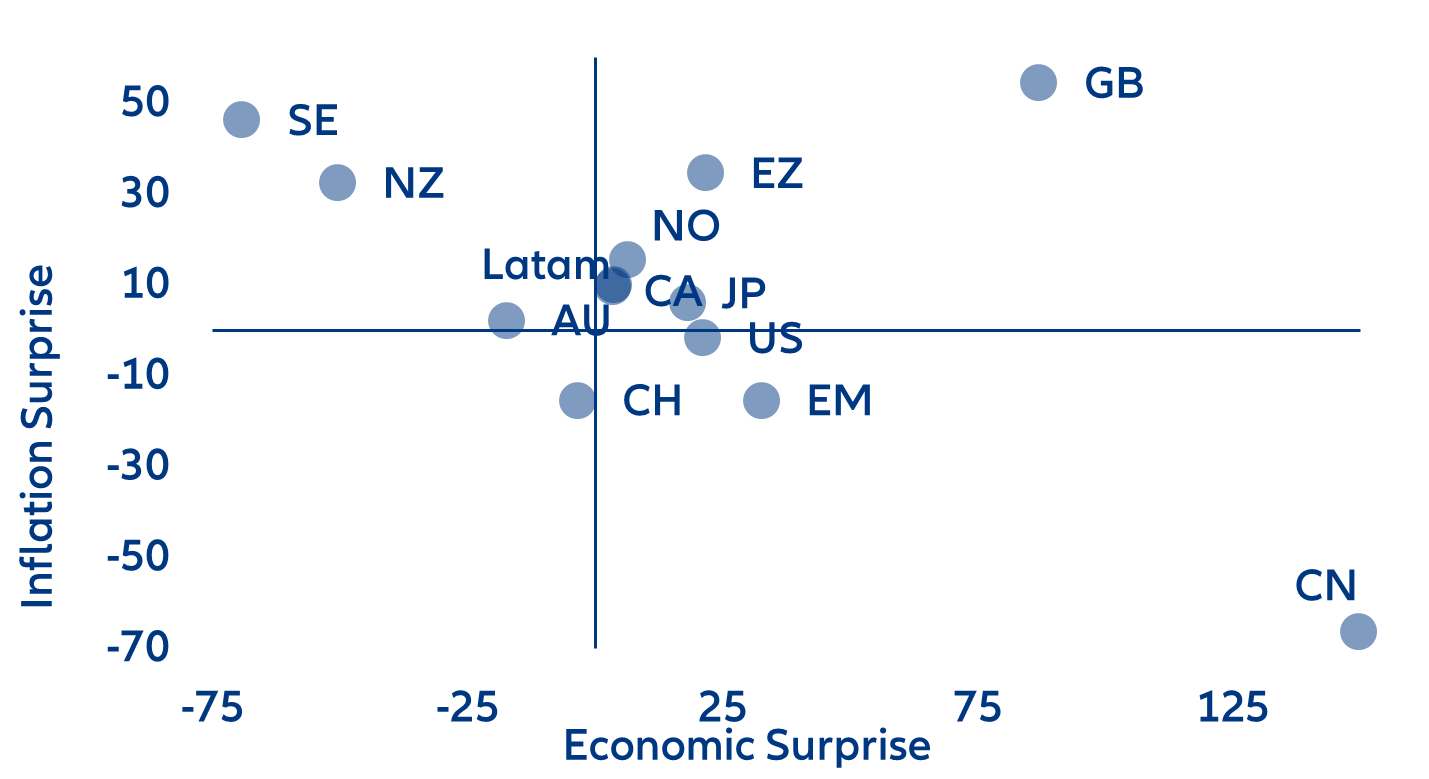

Looking ahead, we expect energy inflation to turn negative by December, given the expected Ofgem energy-price revisions that take place every three months. This along with the fall in agricultural commodity prices and retailers’ lower pricing power should support a deceleration in food inflation, which should reach close to 5% by December 2023. However, core services inflation will remain a cause for concern, notably as economic activity has surprised on the upside lately (Figure 15). Households compensated for the -1.3% fall in real disposable incomes in 2022 (a loss as high as in 2020 and double that of 2008) by reducing their saving rate to below pre-pandemic average and taking out more loans (+13.0% y/y credit card; +7.7% consumer credit). While this could persist for a few more months as consumer confidence is better than it was in fall 2022, record-high bank loan rates (above 11%) will make it unsustainable. Overall, we expect UK inflation to reach 4% y/y in Q4 2023. By end-2024, we expect inflation at 2.5% y/y but this will still be 0.5% higher than the level in the US.

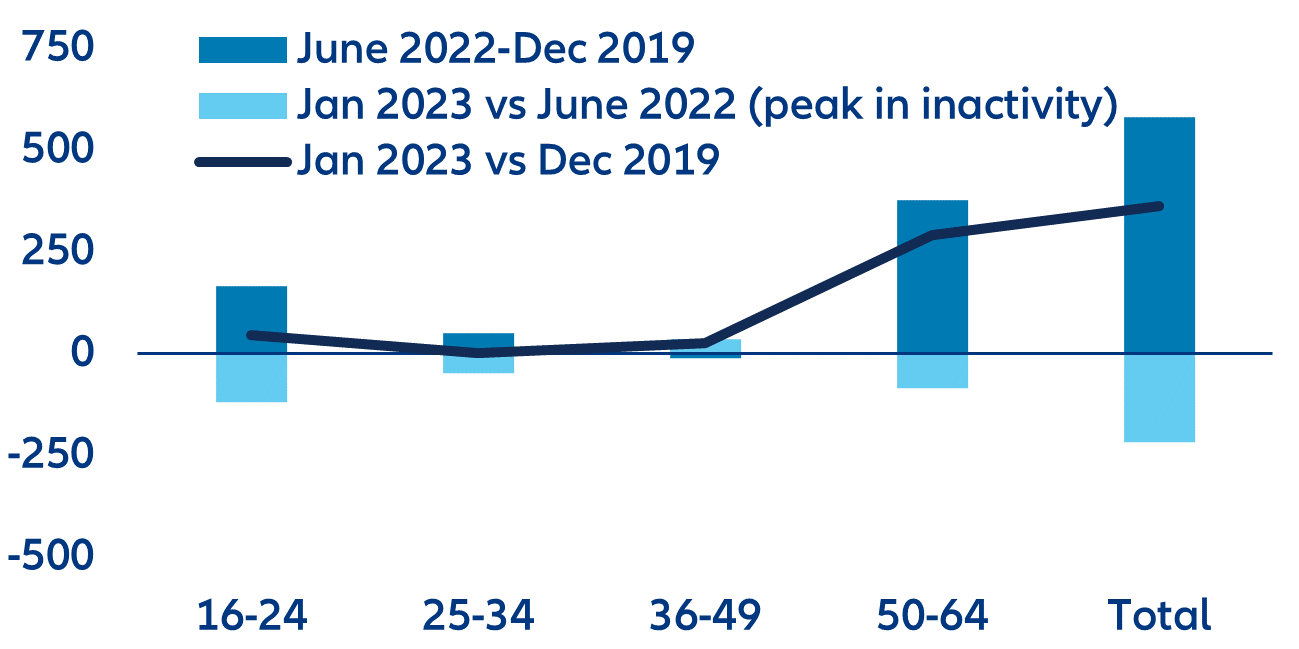

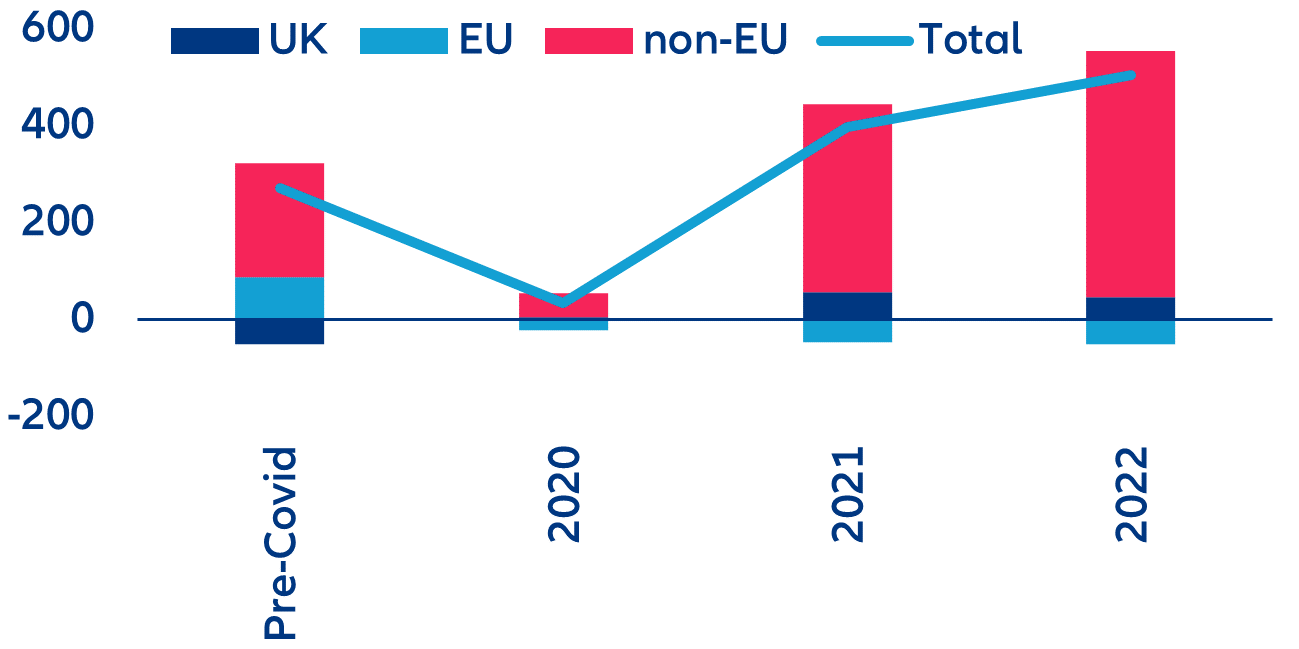

Several estimates place the medium-term NAIRU – the rate of unemployment consistent with stable wage growth – at 4.5% (against 3.8% currently and 4% expected at year-end). The participation rate stands at 63%, below pre-Covid levels and lower than that of the Eurozone and in line with that of the US. Since the Covid-19 crisis and Brexit, the UK has faced acute labor shortages, worse than those seen in the US. While job vacancies have reduced over the past few months as hiring intentions have been negative since mid-2022, they remain above trend growth and more than 60% above the pre-pandemic average in sectors such as utilities, construction, food and accommodation. In addition, recent surveys continue to show a large share of corporates finding it difficult to recruit (71% in March 2023). The rise of inactive workers (about half a million persons in 2022 compared to end-2019) is easing very slowly (+360K persons to 8.8mnn or 27% of total employed people early 2023). This trend is largely explained by the exit of elderly workers, which is not compensated by the entry of young workers (Figure 17a) nor by migration flows despite the significant pick-up in 2022 (Figure 17b). Considering that in 2022, 40% of non-EU inflows and 32% of EU inflows came to the UK for studies, with the right incentives in place, this could mean an additional workforce of 350K people in the coming years, close to the equivalent of the increase in inactive workers since 2019.

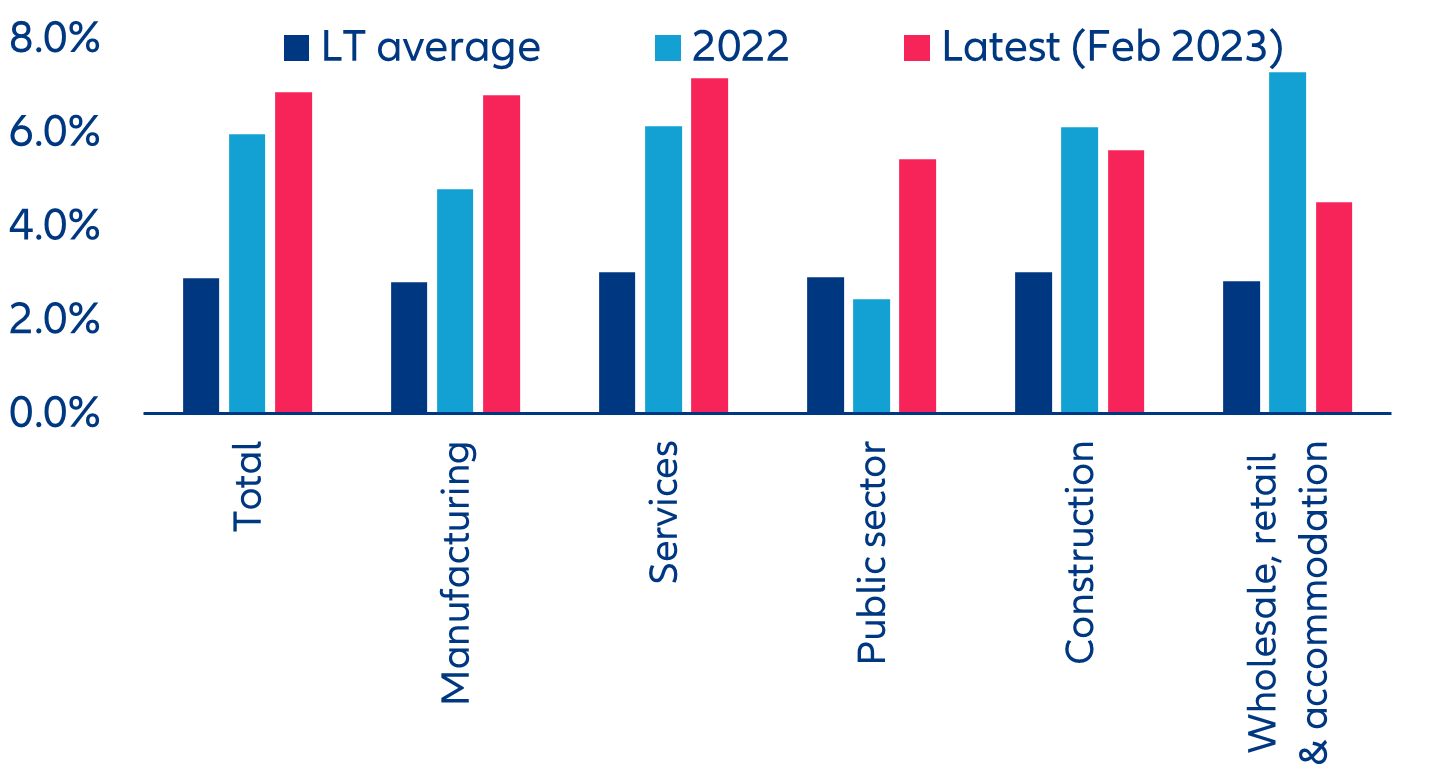

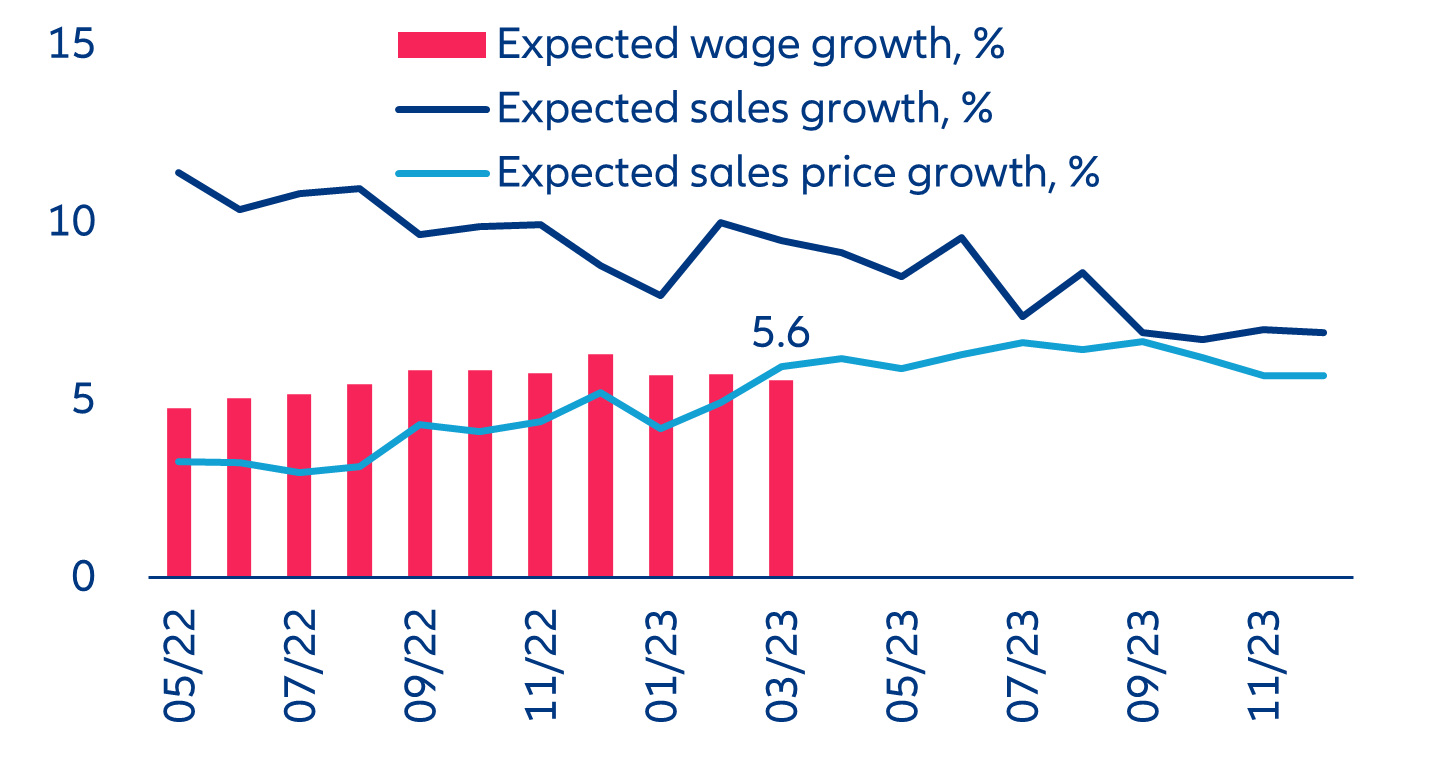

Against the resilience in activity and continued high inflationary pressures, wage growth continued to accelerate (6.9% y/y in February 2023) even in the manufacturing sector, which has been in recession since Fall 2022. Wage growth stands at a high of 7.2% in the services sector (Figure 198) and prospects for wage growth remain high, according to the latest Bank of England Decision Maker Panel as price and volume expectations only adjusted slightly on the downside (Figure 2019). In addition, households’ inflation expectations in the next 12 months stand at a high 5.2% (-1.1pp vs last summer peak), and 3.6% for the next five years (-1.2pp vs last summer peak).

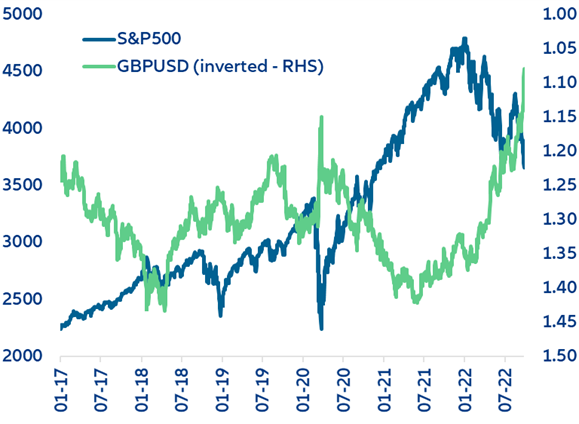

The pound appreciation could bring some relief to inflation, but rising global financial risks and the housing-market adjustment will push the Bank of England towards taking baby steps for longer, making this the longest hiking cycle in history. The bank rate is likely to peak at 5% after three additional 25bps hikes by year-end, and pivot only in spring 2024. More hawkish monetary policy and better-than-expected economic data have boosted the British pound this year: Out of all the G10 currencies, the GBP has performed the best against the USD (+5%), bouncing back from the low of 1.07 seen during the financial market panic in September 2022 to 1.26. This appreciation is more than welcome to give some relief to inflation as the UK’s FX pass-through to import prices is one of the highest in Europe, given its dependency on foreign inputs (around 55% of UK import prices are estimated to reflect changes in FX, compared to 10% in Germany and 5% in France). The import share is highest for manufacturing goods, notably food, clothing and transport. Overall, 29% of UK consumer expenditure is dependent on imports.

While expectations of more rate hikes by the BoE later in the year should lend further support to the currency, we expect further gains to be somewhat limited (+2-3% to GBPUSD 1.30). However, the looming recession in the US and doubts about the resilience of growth in China, as well as the lingering risks of another energy crisis on top of financial stability risks, cast doubts on global growth. As the pound has a high negative correlation with risk aversion (Figure 23), a downside correction cannot be ruled out if external factors worsen. This reinforces our view that the BoE will have little room to cut rates significantly next year. Overall, we do not expect the Bank of England to cut interest rates by more than 100bps as the UK’s housing-market adjustment will remain more moderate compared to the US (around -10% by end-2024). This would mean that rates will remain around 4% in 2024, considerably above the neutral rate estimated between 1.25% and 2.5%.

Sources: Refinitiv, Allianz Research

Sources: Refinitiv, Allianz Research