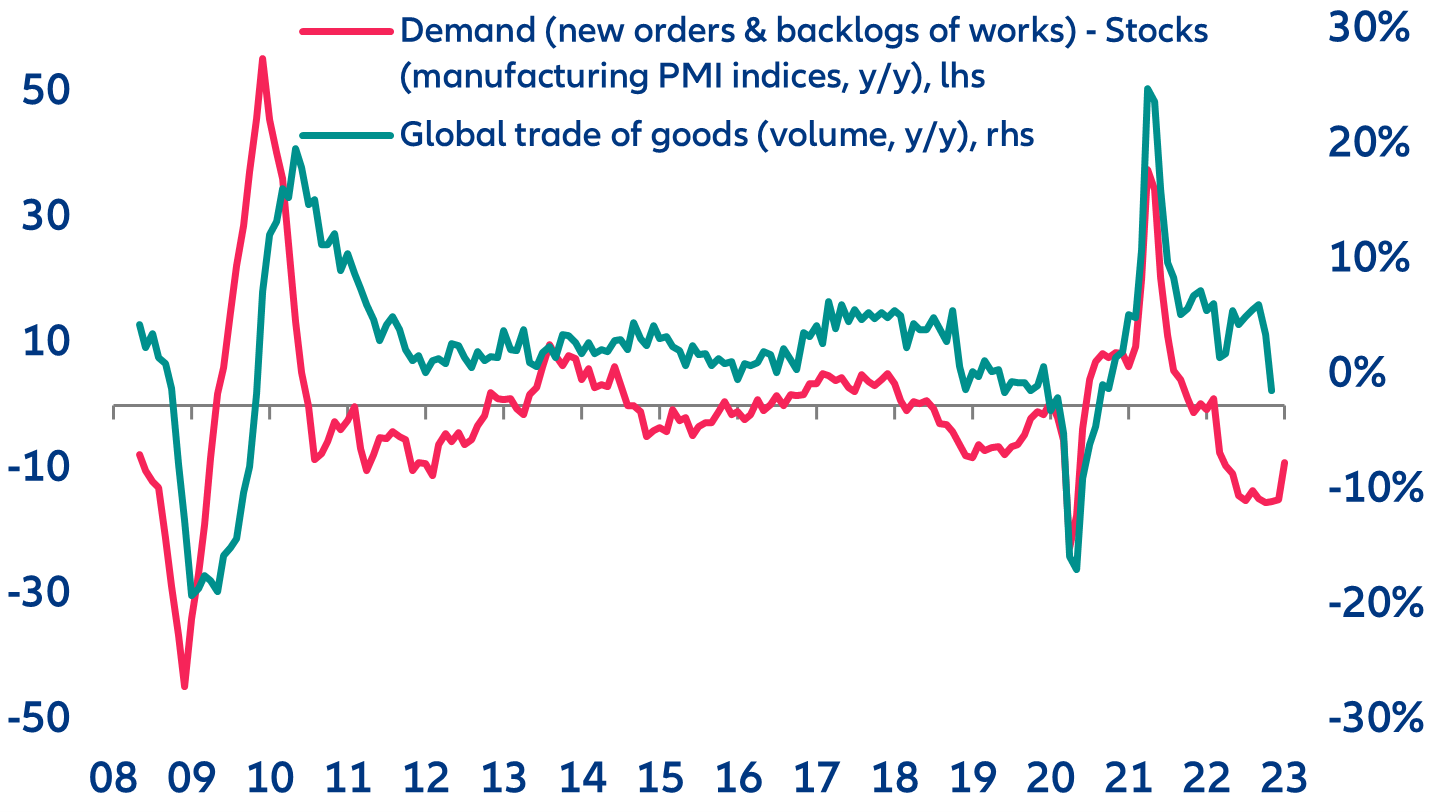

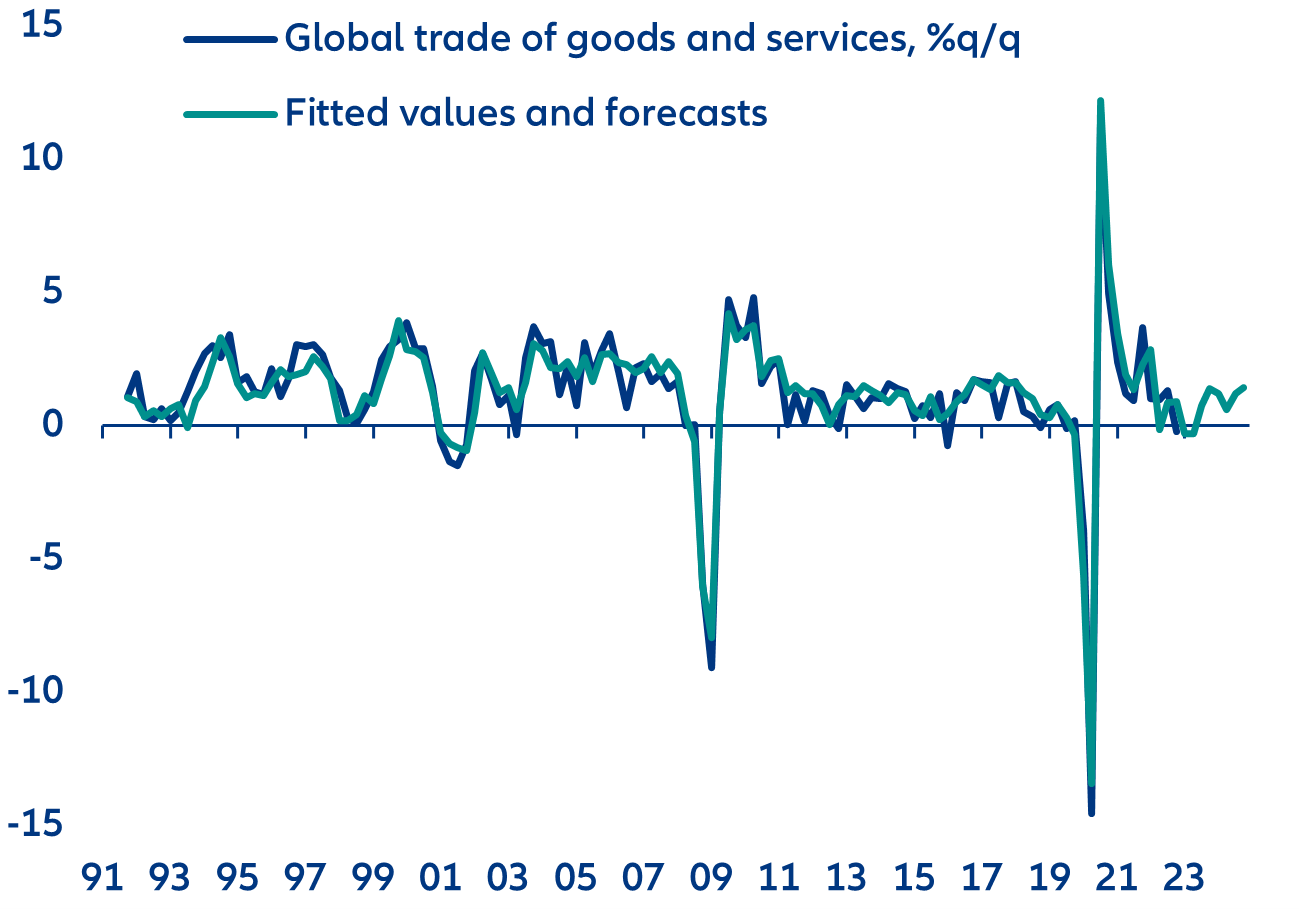

- After resilient performance in the first half of 2022, global trade deteriorated in the second half of the year and is likely to remain muted in 2023. However, China’s reopening reduces the risk of sudden stops in global supply chains, while moderately supporting global demand.

- We are revising slightly on the upside our forecast for global trade growth in volume in 2023, from +0.7% to +0.9%. Price effects should still be negative, resulting in a yearly contraction of global trade in value terms in 2023.

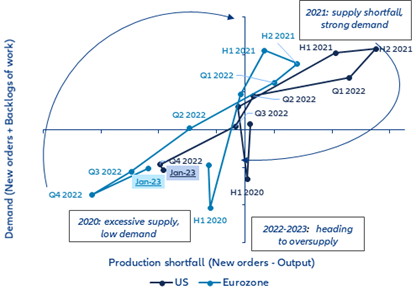

- For inventory management and supply chains, lessons have been learnt from the Covid-19 and post-Covid shortages. In fact, oversupply is likely to prevail in 2023 amid weakening demand, replenished inventories, increased capex and normalizing shipping conditions.

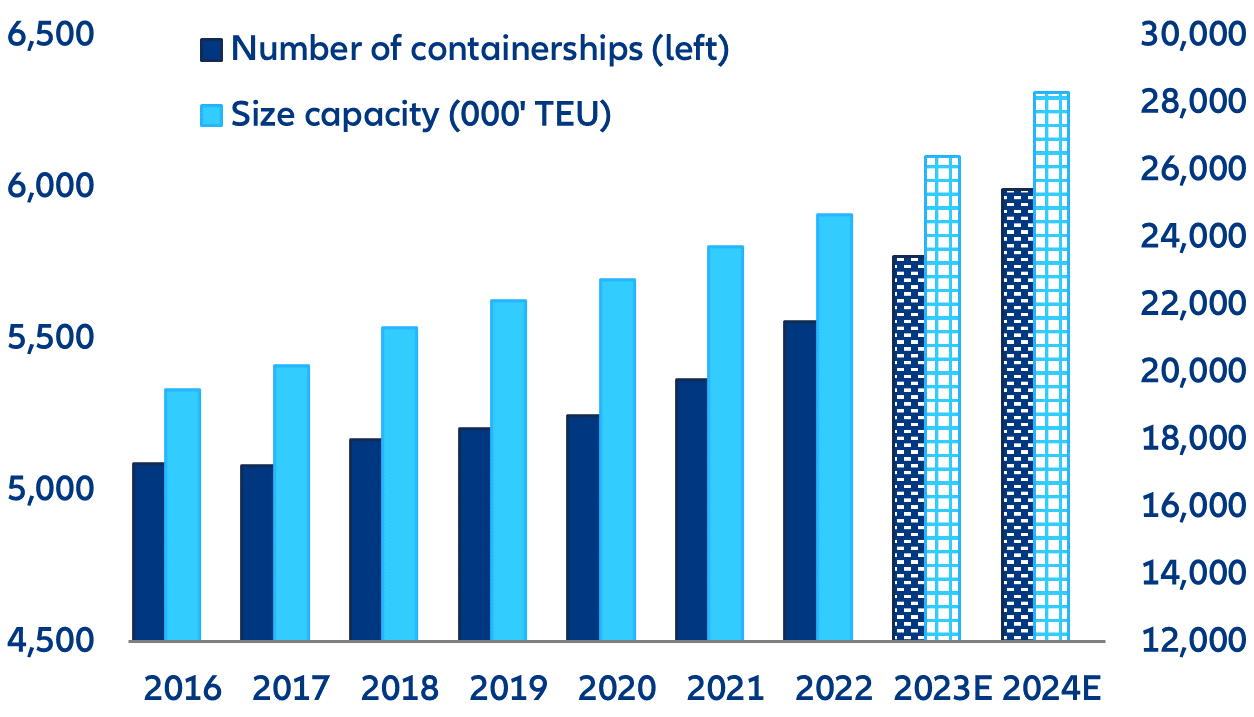

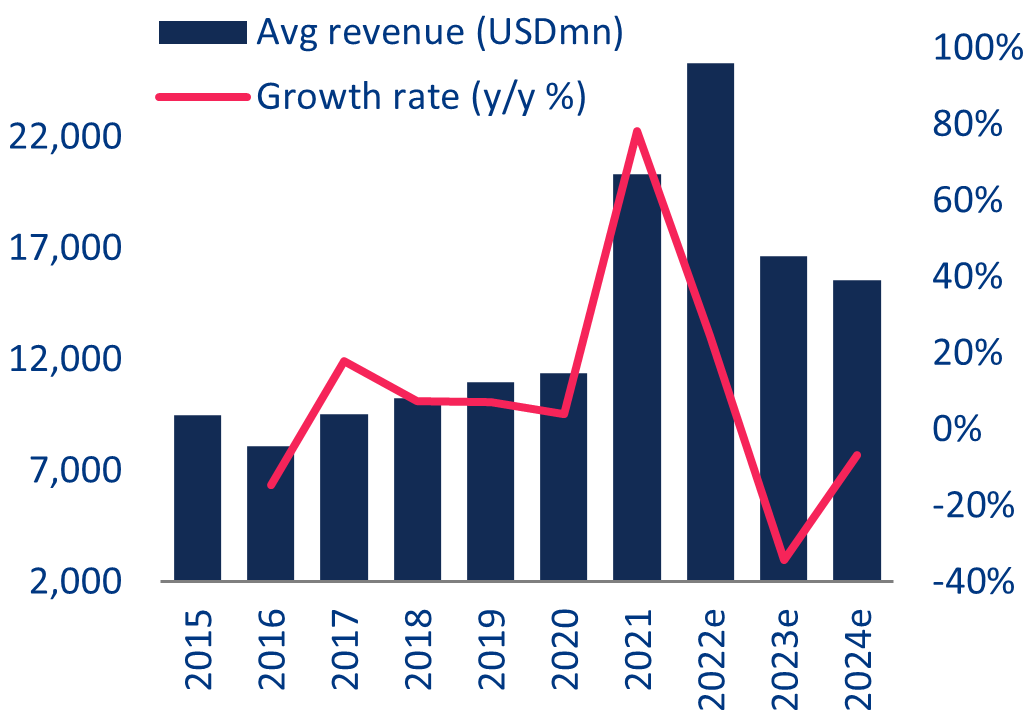

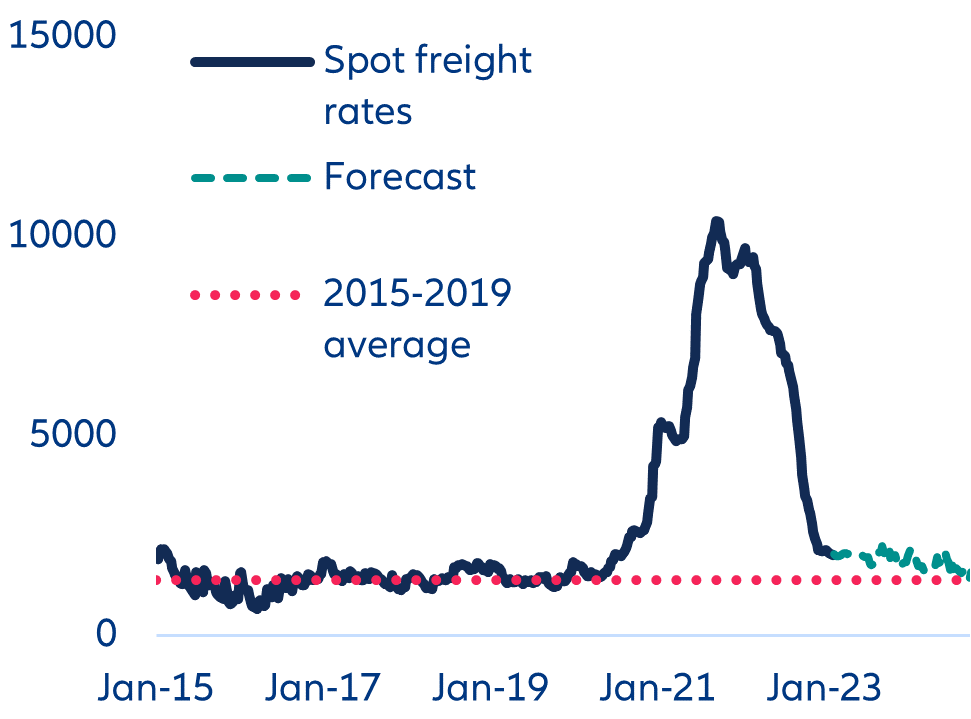

- Today’s oversupply has also been exacerbated by the expansion of ocean carriers’ fleets in 2022 (+4% y/y in number of vessels) using the excess cash generated by record-high shipping rates in 2021. In this environment, shipping costs are returning to their pre-pandemic levels.

- While cyclical conditions reduced supply-chain disruptions, we are not fully rid of the risk of shortages, given a widening trade finance gap, the need for better and more infrastructure and geopolitical tensions.

In Focus

The silver lining amid muted global trade: normalizing supply chains

Market Movers

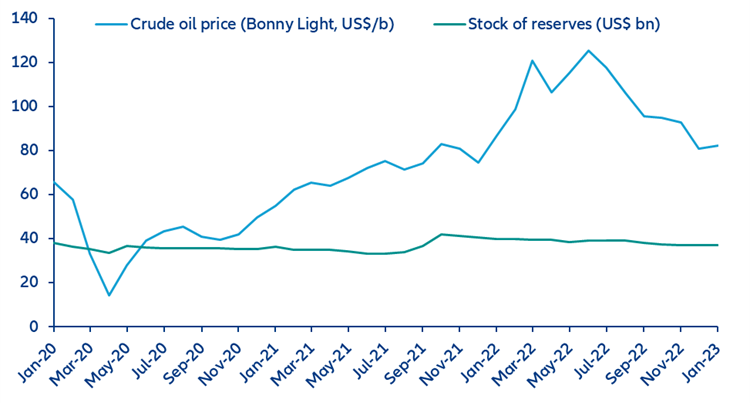

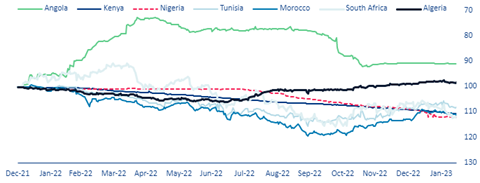

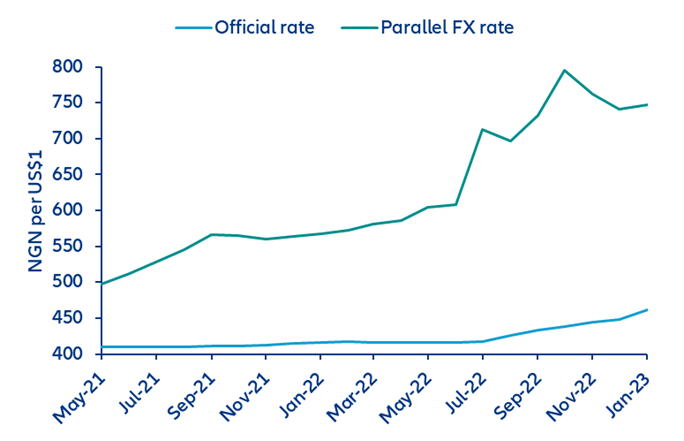

- Nigeria – Beyond the election transition. As Nigeria heads to the polls on 25 February, economic headwinds are intensifying. The next government will need to address falling purchasing power and demonstrate how the continent’s largest economy will keep up with the societal and green transitions.

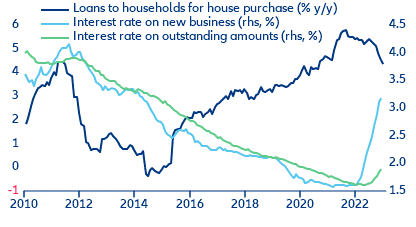

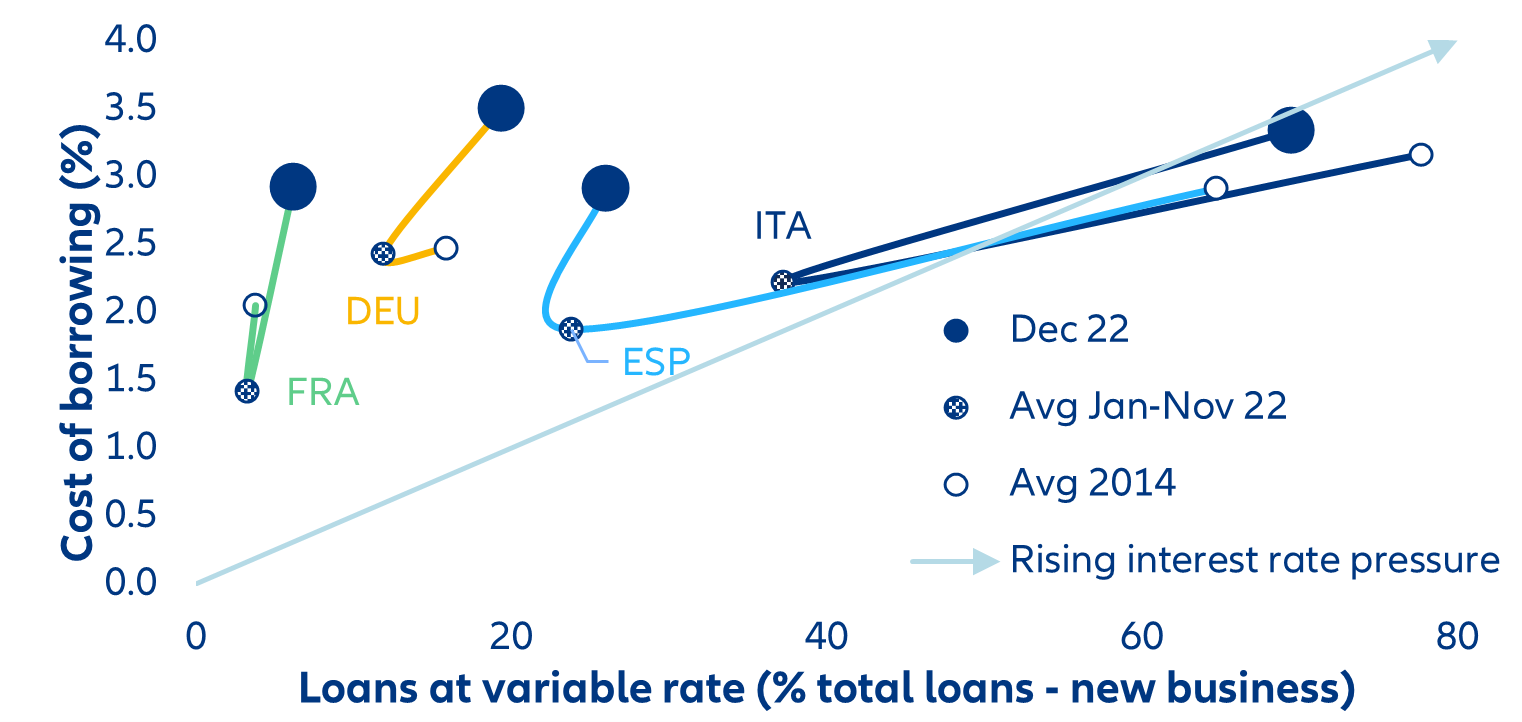

- Eurozone mortgages – Looking forward to the ECB pivot. Households are shifting to variable-rate mortgages, hoping for a quick return to lower interest rates. The first effects of higher borrowing costs are emerging.

- China – The reopening is going well but don’t get too excited yet. Mobility has shot up in cities but other indicators suggest that all is not back to normal yet.

Nigeria – Beyond the election transition

Eurozone mortgages – Looking forward to the ECB pivot

The structural shift to fixed exchange rates during the 2010s will help to partially cushion the impact of rising interest rates on house prices. Thus, a broad house price correction in Europe seems unavoidable, although it will differ in magnitude. We forecast accumulated real house-price declines of -3% in Spain and Italy, -5% in France and -8% in Germany in the next two years, compared to -15% in just one year in the US. Government support measures have mainly targeted the households that did not sign up for fixed-rate mortgages in the past, but these measures will only delay the impact. The longer interest rates remain high, the greater the threat to the sustainability of mortgage payments.

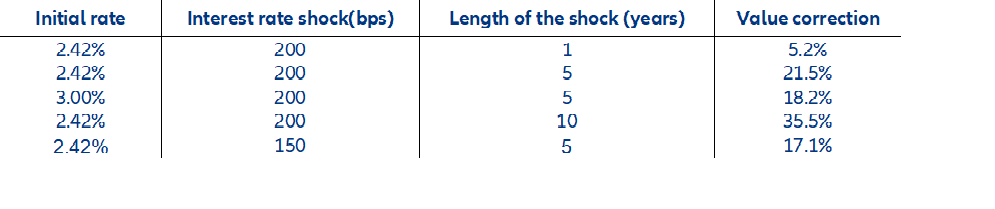

Below, we calculate the required decline in nominal house prices to compensate for the increase in interest rates to keep the total cost of purchasing a house equal (Table 1). Of course, this is a theoretical exercise in which we assume a perfect readjustment in the supply-demand equilibrium; in practice, a decline in the house price does not diminish the mortgage payment but rather reduces the relief from a forced sale.

China – The reopening is going well, but don’t get too excited

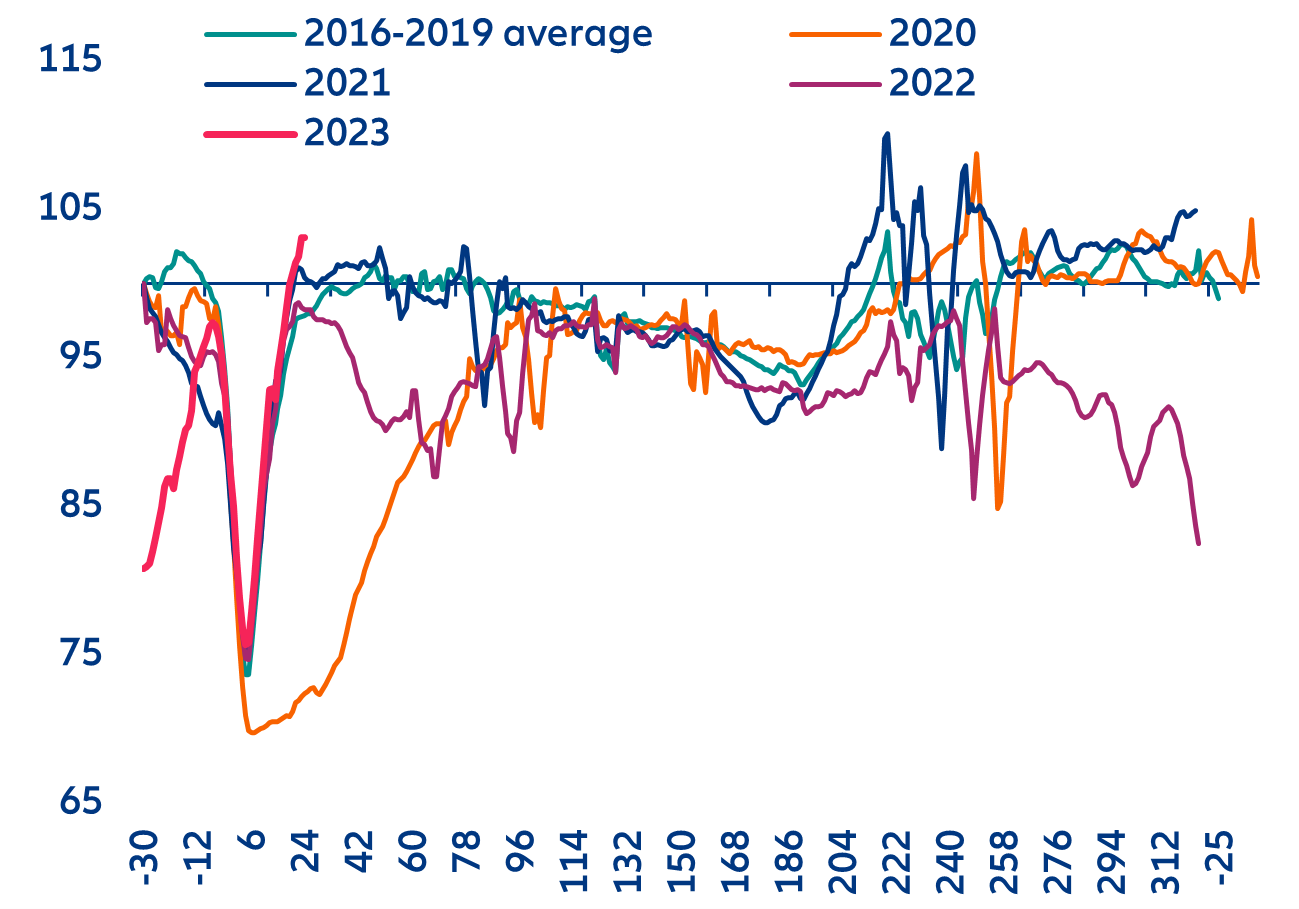

The post-Covid reopening is going well so far, though things are not fully back to normal yet. More than a month since the faster-than-expected full relaxation of Covid-19 measures, and roughly one month before 2023’s first batch of hard macro data releases, we think it is a good moment to do a pulse check on how China’s post-Covid reopening is going. Mobility within cities has shot up quickly, exceeding last year’s and pre-pandemic levels in the past few weeks (see Figure 6). However, other measures suggest that all is not back to normal yet. Long-distance travel clearly improved from last year, but still remain less than half the volumes observed before the pandemic, while cross-border travels were less than 40% of the pre-pandemic level in early February. Overall, high-frequency indicators are all going in the right direction, and point to a rebound in private consumption in 2023.

[1] See Allianz Research quarterly economic and capital markets publication (link)

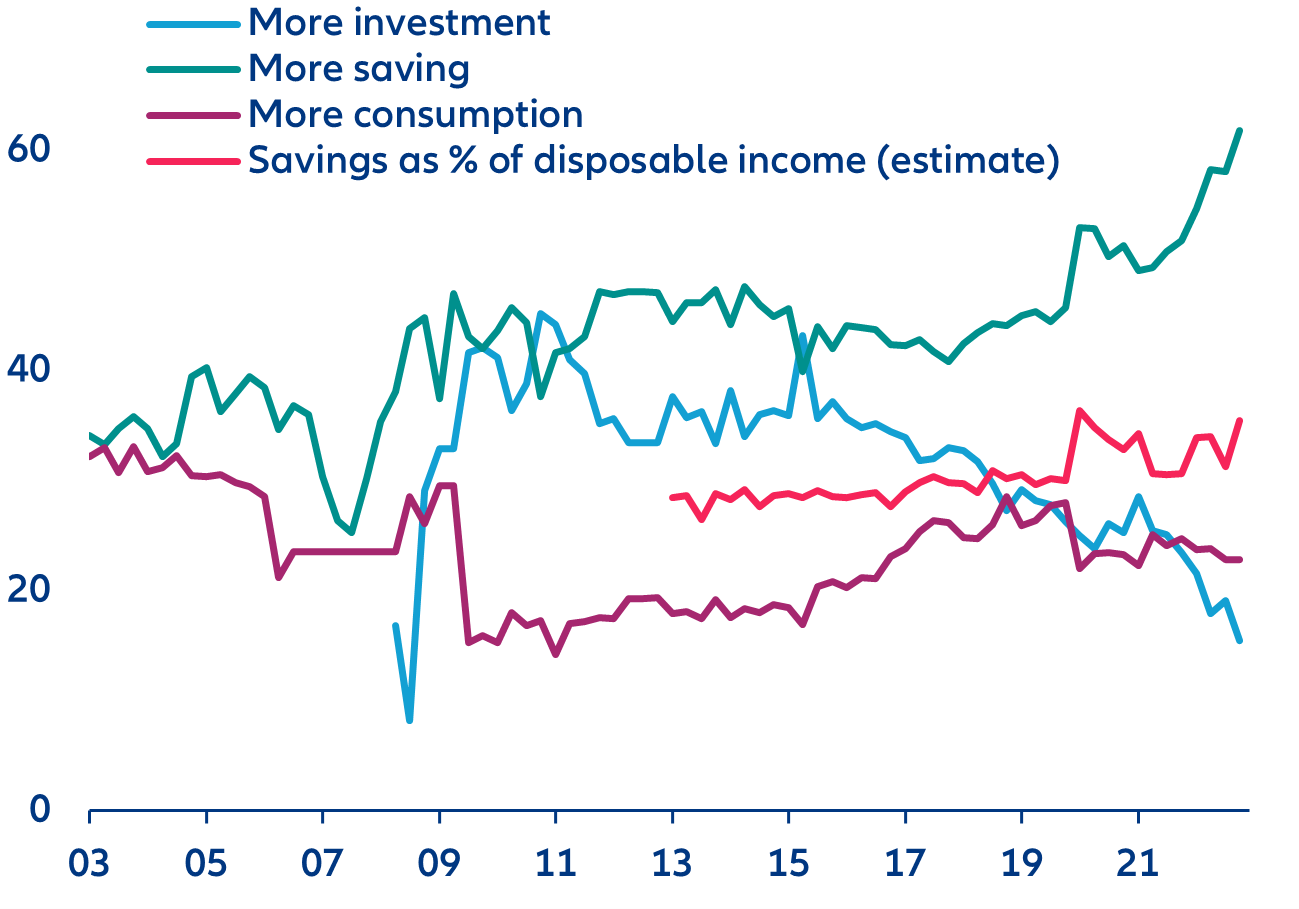

Policymakers will do what is necessary to stabilize the real estate market – but don’t expect a strong trend reversal. Data released this week show the housing price index based on 70 cities stabilizing (at +0.1% m/m), after five consecutive months of sequential declines. This is consistent with recent policy moves, with regulators putting in place a mechanism that allows cities facing housing-price declines to set mortgage rates for first-time homebuyers below the official floors. While prices may be stabilizing, other data suggest that the amount of sales is still weak. High-frequency data show that transaction volumes in the 30 main cities declined by nearly -25% y/y so far in February. January credit data showed a deceleration in household medium-to-long term loans (which are mostly mortgages). Going forward, policymakers are likely to retain an accommodative stance to maintain a stabilization in housing prices, make sure that already begun construction projects can be brought to completion and avoid any systemic risk. That said, we do not foresee a strong trend reversal in the real estate sector, given that authorities likely aim for consolidation among developers, and their long-held stance is that “housing is for living in, not for speculation”.

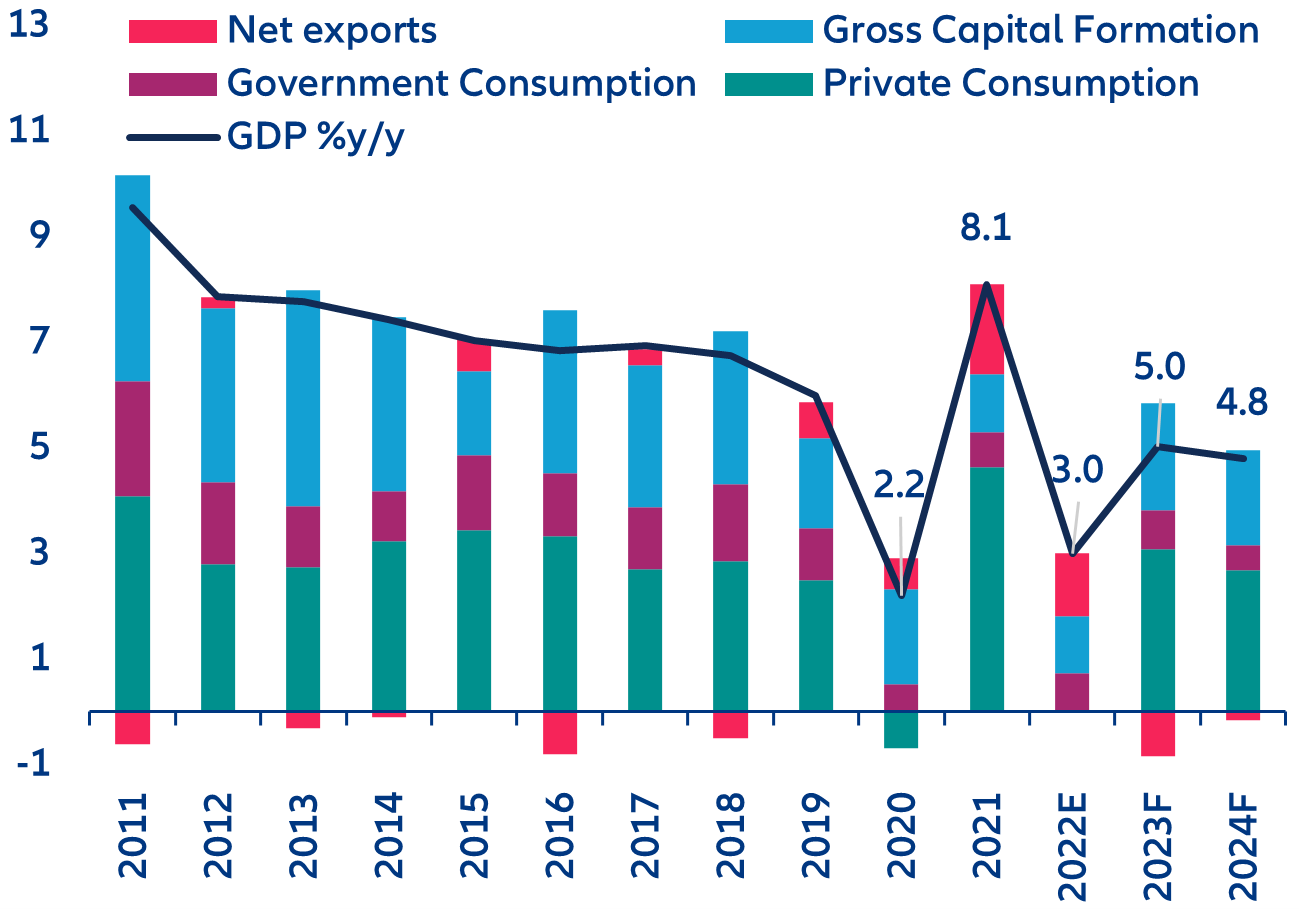

We expect the Chinese economy to grow by +5.0% in 2023 and +4.8% in 2023 (compared with consensus expectations at +5.2% and +5.0%, respectively) – see Figure 8. Net exports are likely to contribute negatively to overall growth in the context of slowing external demand (and improving imports). Private consumption will be the main positive driver, while an overall still accommodative policy stance should support investment. The kicking off of the annual “lianghui” parliamentary meetings in early March will provide more details into authorities’ plans for this year, with official economic targets for 2023 to be revealed on 5 March.

In focus – The silver lining amid muted global trade: normalizing supply chains

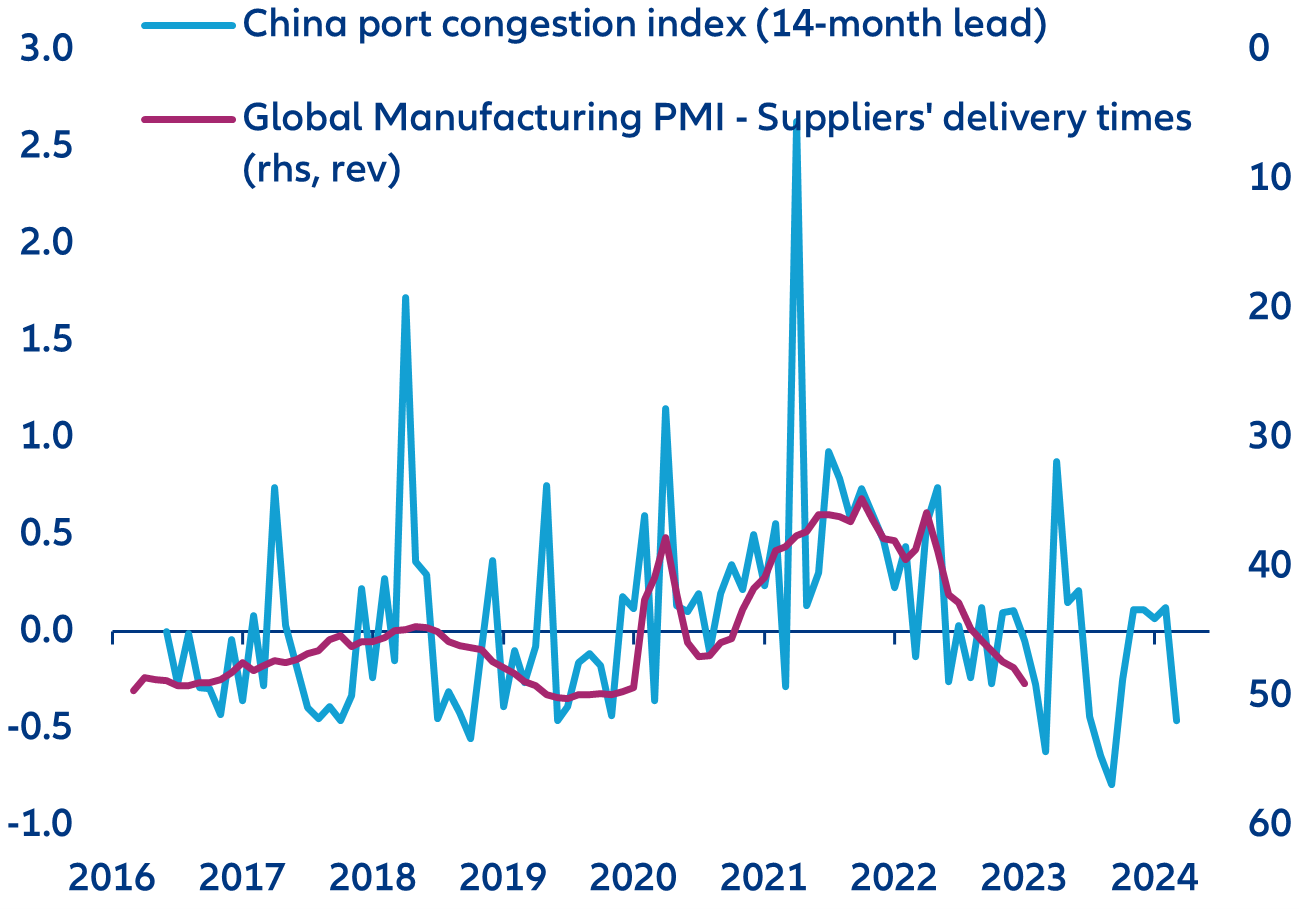

Note: The China port congestion index is a proprietary indicator we created based on port call data, using the four-day difference between exports and imports (the number of days a ship stays in ports on average), normalized with the average and standard deviation of the pre-crisis period (2015-19)

Sources: UNCTAD AIS database, S&P Global, Allianz Research

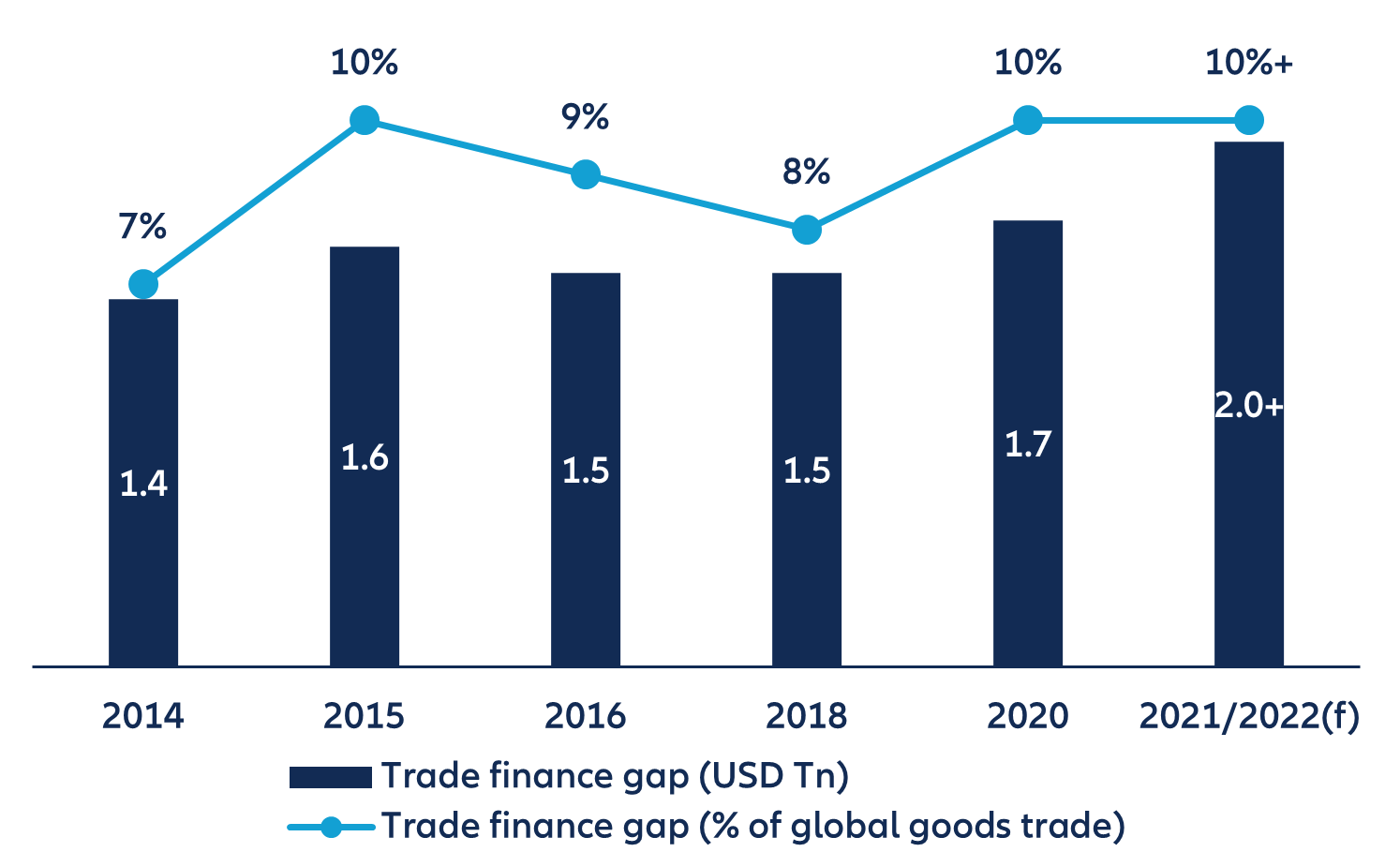

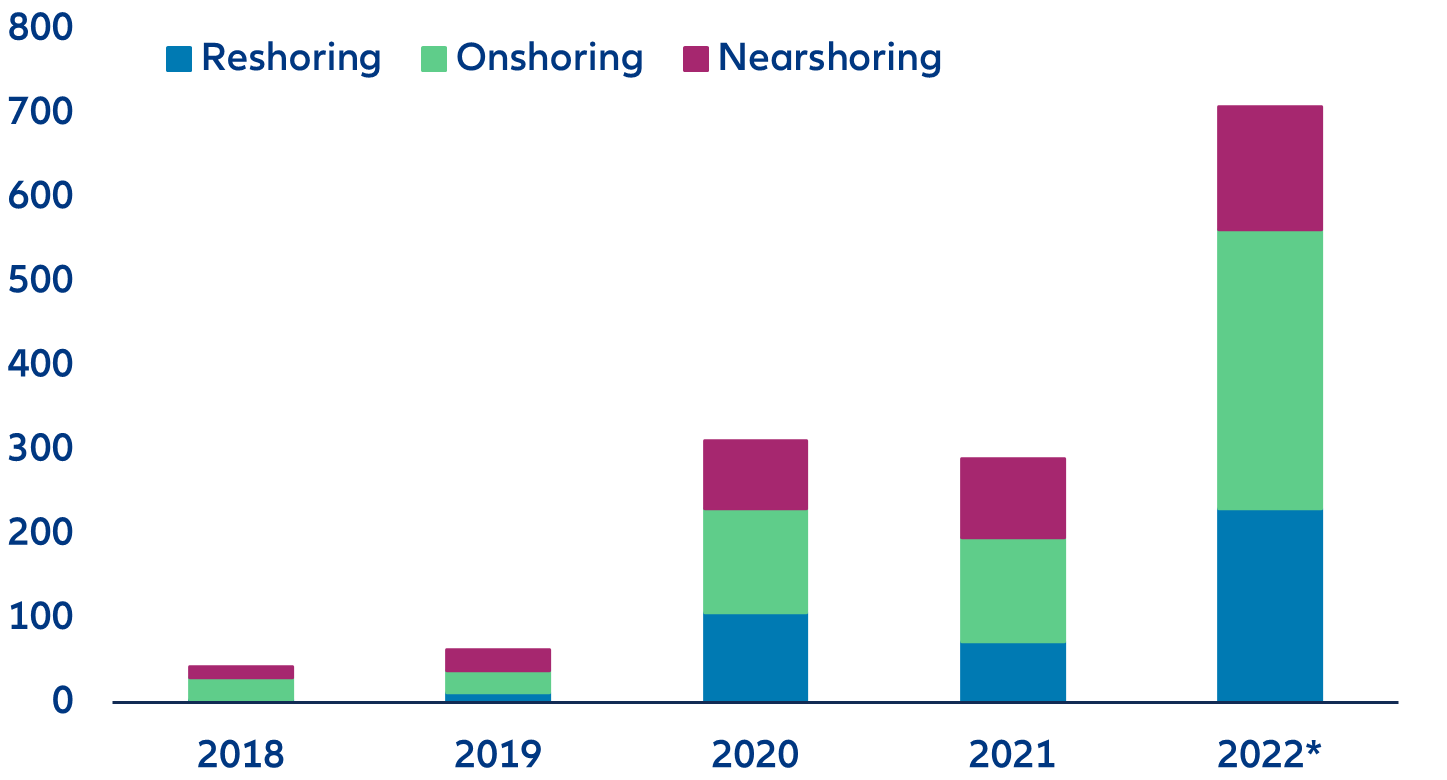

While cyclical conditions have reduced supply-chain disruptions, we are not fully rid of the risk of shortages. In the short-term, tightening funding conditions and rising interest rates are affecting companies and could potentially widen the trade finance gap (see Figure 16). This shortfall of funding means that some trade flows cannot materialize, potentially hindering the normal functioning of parts of supply chains. Another risk stems from infrastructure quality and availability[1]. After all, adding containers and ships without increasing the domestic infrastructure to load and unload them would still lead to congestions in shipping. The US planned USD17bn of additional spending on port infrastructure and waterways in late-2021, but the EU is still lacking a large-scale investment plan. Finally, geopolitical tensions could also be a source of shortages – as evidenced by the war in Ukraine. Trade tensions and protectionism can also affect the availability of traded goods (e.g. US ban on semiconductor exports to China, China’s ban on export of technology used to make solar panels etc.). Widely discussed trade patterns such as reshoring, nearshoring and onshoring (see Figure 17) could help in dissolving supply-chain bottlenecks, but they seem be more talk than walk and the large-scale feasibility can be questioned.