Economist Insurance & Wealth

How savers fared: strategies and outcomes across the Eurozone

Economist Insurance & Wealth

Head of Insurance, Wealth and Trend Research

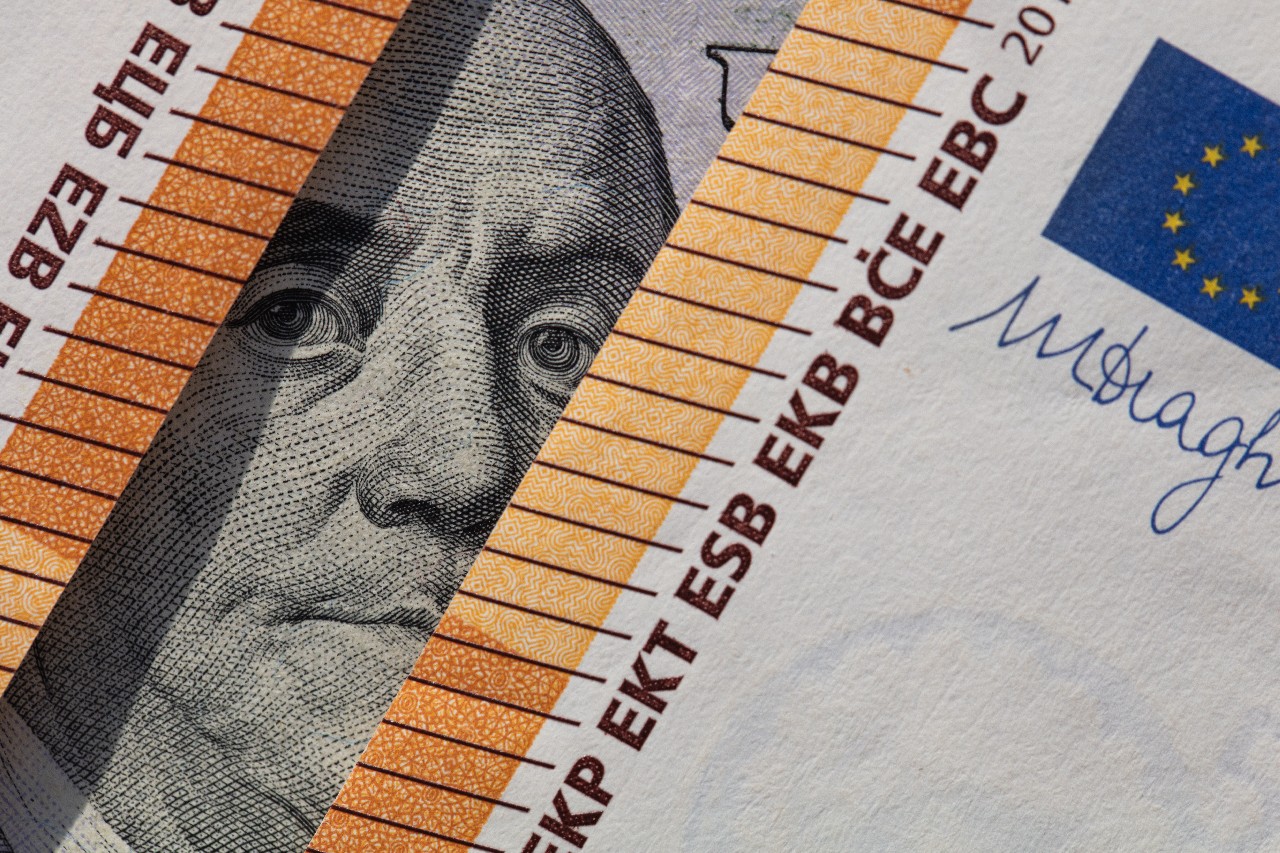

A new report from Allianz Research compares the saving strategies of households across countries and generations in the eurozone to see how savers fared. This was during a tumultuous period that included the global financial crisis and the euro crisis, which resulted in an era of zero or even negative interest rates. Following that came the coronavirus pandemic and Russia's invasion of Ukraine.

Focusing on nine countries, the report uses implicit return on savings to illustrate the stark contrasts in investment outcomes. Germany's conservative approach yielded a nominal return of 2.1%, the lowest in the analysis, while the more adventurous strategies of the Netherlands and Finland returned more than 4%. France returned 3.3%, suggesting that a middle, more secure path still leads to respectable growth.

The generational analysis reveals a grim outlook for Millennials, who, unlike previous generations, have faced a severe onslaught on their assets just as they began their wealth accumulation journey. In contrast, Baby Boomers sit atop the wealth pyramid, having capitalized on the booming markets of the past. But not all is lost for the youngest generation. Against the backdrop of the end of the savings glut and the rising demand for capital driving the green and digital transformation, Gen Z savers have a good chance to outperform all their predecessors – if they align their savings behavior to the new realities, i.e. increase their savings rate and lean more on capital markets.

Download the report “The best is yet to come: A comparison of savings across countries and generations in the eurozone”.

Related links

About Allianz

** As of March 31, 2024.