When 2020 began, optimism was in the air.

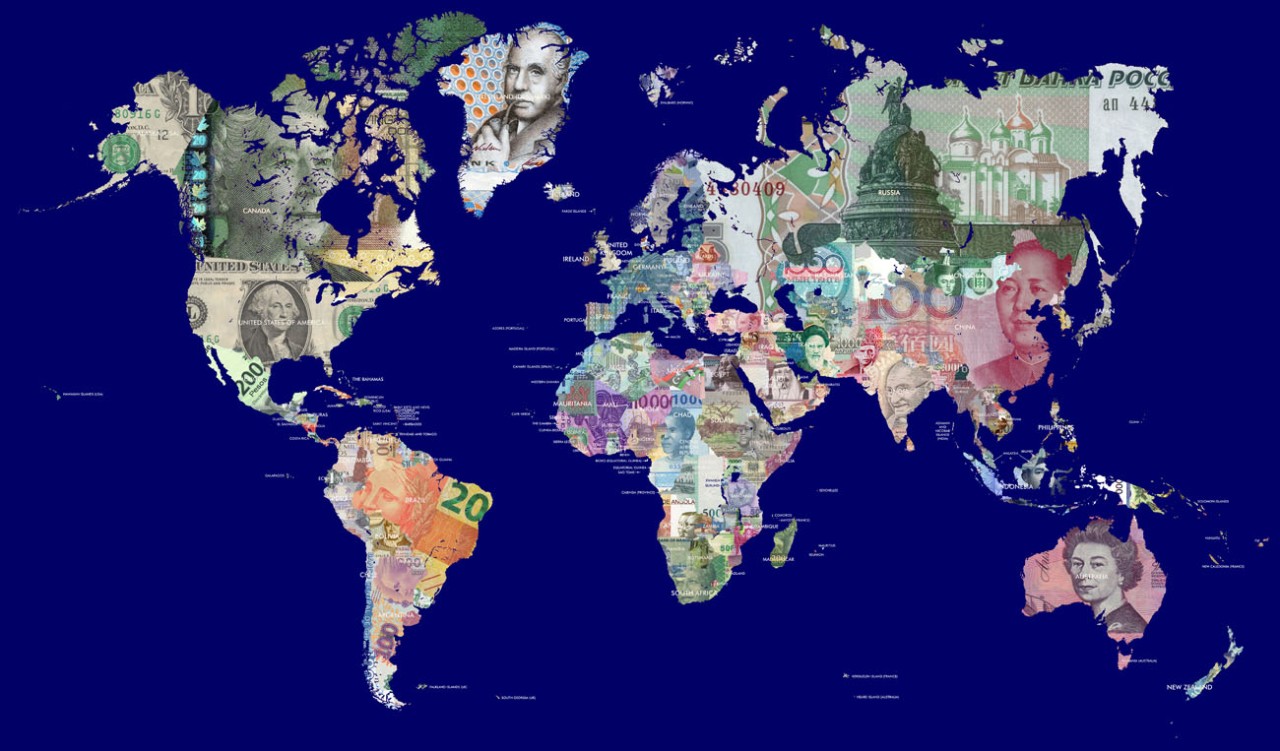

Allianz economists had forecast that the worst might be over for the global economy due to the end of the trade and industrial recession. They had seen global economic growth this year at a sluggish but steady 3 percent.

Six months later, all the projections are out the window, with the economy upended by the Covid-19 pandemic. While some countries are picking up the pieces in the aftermath of the pandemic, others are struggling to contain the outbreak.

Even after months of the carnage, coronavirus is yet to decisively reveal its cost - both human and economic.

Although it’s hard to predict the exact cost just yet, Allianz economists expect the global economy to contract by a sharp 4.7 percent this year, rebounding in 2021 as the situation comes under control.

In a recent report, they provide a quick snapshot of what the world can expect in the medium term...