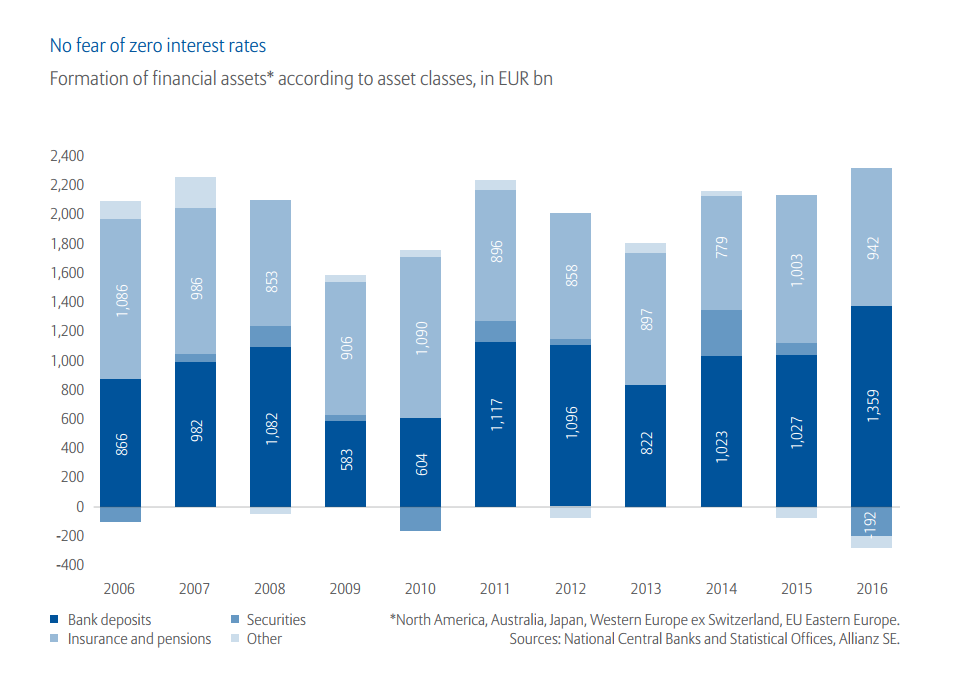

Before the financial crisis, around 40 percent of new funds went into banks. In the years following, this rose to an average of 50 percent, but last year this number was higher than 60 percent. The savings behavior is more marked in Europe, particularly in Germany, than in the United States.

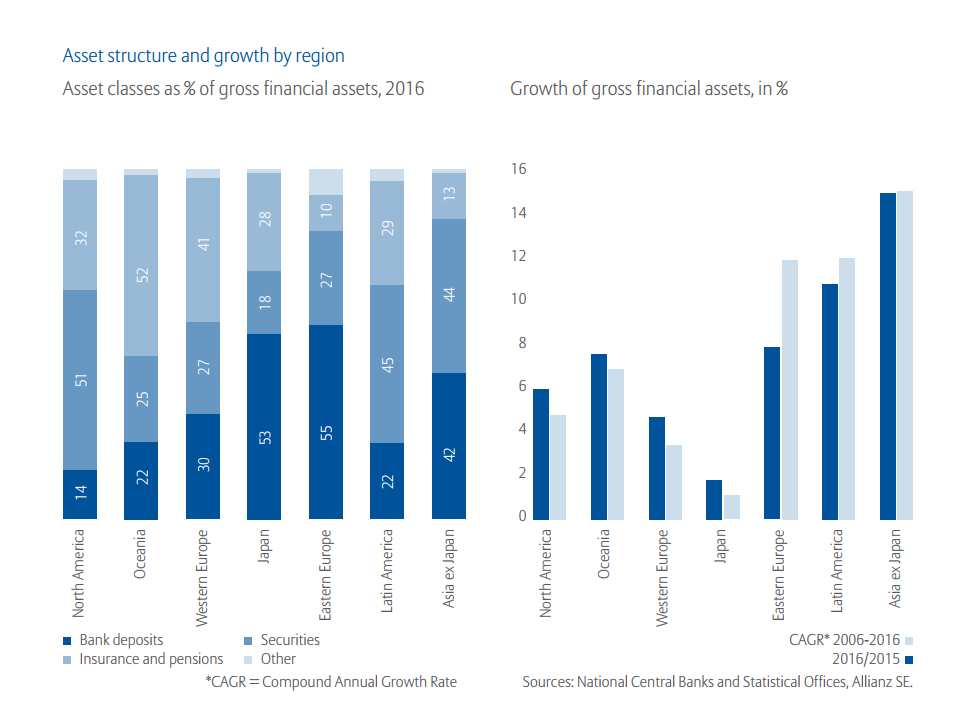

Americans bought securities worth more than 700 billion euros in the past five years, but Europeans have consistently sold securities, disposing of around 350-billion-euro worth. These differences in savings habits are also reflected in functional drivers of asset growth: In the U.S., three-quarters of asset growth came from changes in the value of their portfolios. In Europe and Japan, faith in bank deposits is high, so only half of growth was due to changes in the value of the portfolio. In Germany - the land of the “savings world champions” - it was a quarter.

“The last few years thus confirm the cliché that Americans are more willing to take risks and to trust the stock market with their money, while Europeans are more anxious and do not trust the markets, or no longer trust them,” says the report.

The Japanese have an even stronger preference for investments that can be liquidated quickly than those in Western Europe. Japanese households continue to hold more than half of their financial assets in the form of savings deposits. It is not surprising that the Japanese are skeptical about investing in the stock market, notes the report. A 100-euro investment in the Nikkei, the benchmark index of the Tokyo Stock Exchange, on December 31, 1999 would have achieved gains of just 0.95 euro by the end of last year, corresponding to a return of 0.06 percent per year.