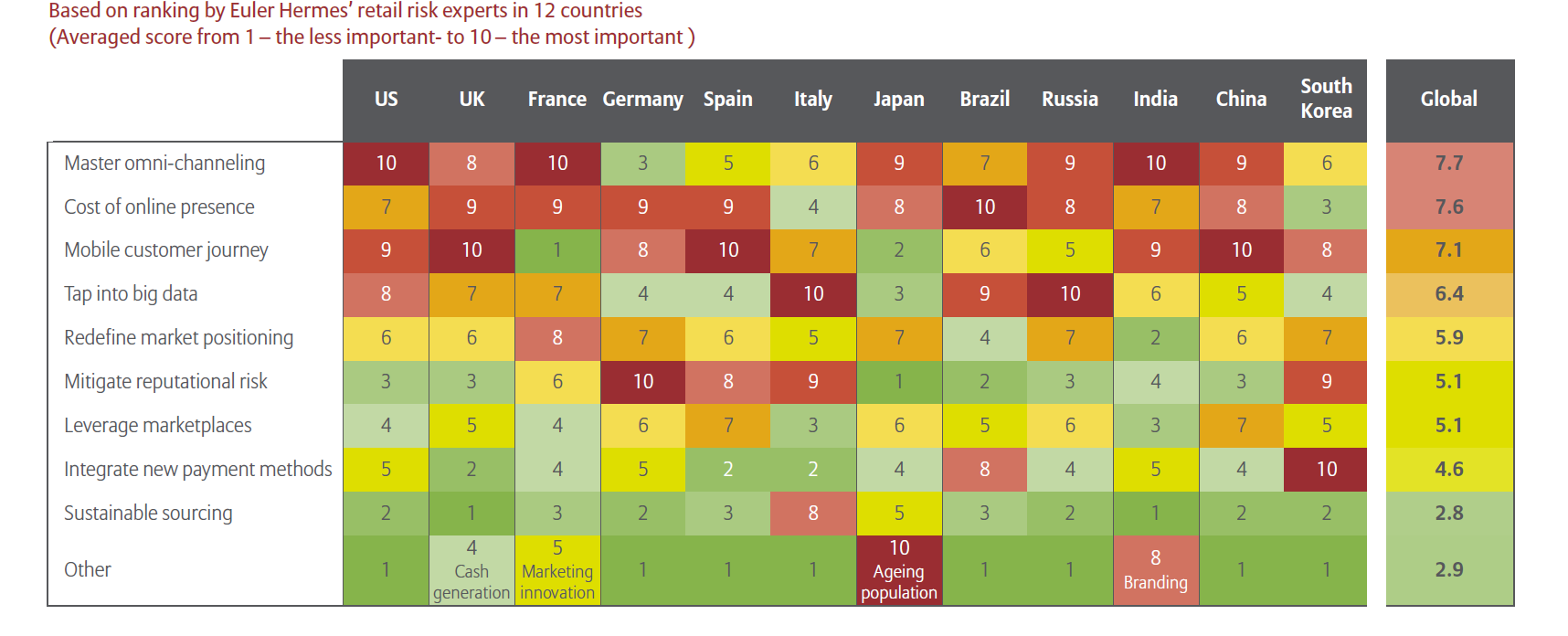

Retailers must master three major tools to attract the new-age shopper

#1. Omni-channeling

Simply put, approaching potential customers through more than one channel to meet their need for flexibility - online (mobile or desktop), phone or a brick-and-mortar shop. For customers, it is not just about where and what to shop, but also about how to pay and where to have the item delivered. Retailers struggle to tackle this massive challenge, break silos and de-compartmentalize digital and in-store channels of distribution.

#2. Mobility

Make yourself accessible to potential customers wherever they are, whenever they want. Most shoppers browse through their social media channels and shopping websites while sitting in a tram or relaxing on the couch. A retailer, by imagining customers’ live situations and adapting its accessibility to them, can stimulate a comfortable experience. Two important questions have to be answered here: ‘where’ (to shop or choose delivery) and ‘how’ (to pay or be informed, for instance). Developing a mobile customer journey can be achieved by digitalizing the offer and the spread of Internet of Things. Mobile devices are more affordable than desktop or laptop computers, compatible with nearly all platforms thanks to applications, and require less infrastructure development.

#3. The cost of online presence

Connected objects and digital platforms create a lot of data and the last thing you want is to be overwhelmed by heavy process costs and messy operations. Especially when you already have to deal with the duality cost of having a store footprint and online selling platforms. A data strategy can help – one which includes what information to keep, how to store this information and determine its purpose: Inventory and delivery management are, for example, two essential business operations that need to be handled in a structured and organized way.

For international retailers, force-fitting a global idea might not quite be the way to win over customers across geographies. Be ‘glocal’ instead – act global and think local.