Even today, there are still fewer women in the workforce than men. According to the OECD, the global average amount of time women spend doing unpaid work such as household chores, and caring for children and the elderly, is 4.5 hours a day. The amount is less than half that among men. Calculations made by the Allianz International Pensions think tank show that one way the economic consequences of an aging population could be mitigated is if more women were to enter the workforce.

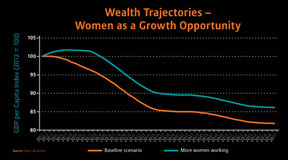

By 2035, aging populations in Germany, the UK, the US and Japan will cause the number of people in the workforce to plummet by up to 20 percent. Based on the experts’ calculations, the total wealth in these countries could also drop by up to 15 percent in terms of pro capita income.1

For instance, if the labor force participation rate of women in Germany were to rise from 69.5 percent to the current rate of men, 77.6 percent, the working population would grow by two million by 2022. Gross domestic product per capita would continue to drop over the long term, but this would not start happening until 2024. And even in 2060, the labor force would still be at nearly 1.5 million people more than today. If more women do not take up gainful employment, the demographic change could begin having a negative impact on the income per capita as early as this year.

“It is completely realistic to expect the future labor force participation rate among women will be as high as it is for men today,” says Brigitte Miksa, head of International Pensions. “Women, however, will have to be made aware of how important financial independence is today; also because of the high divorce rates.” In addition, companies will need to do more to help women balance their jobs and families, she said.

More than 80 percent of women in their mid-forties are working today. The large disparity between the participation rates of men and women as noted above is that employment among older women is very low. “I expect most women in their mid-forties today will – unlike their mothers and grandmothers – continue working until retirement. Not only because they grew up with a different understanding of gender roles, but also because the social framework forces them to do so; for example the danger of old-age poverty," says Miksa.

1 Based on the assumption that both per-capita productivity rates and employment levels remain constant.