The history of insurance is a patchwork of bits and pieces from around the world.

As far back as 3rd millennium BC, Chinese traders used risk transfer and distribution methods as they took their wares through turbulent waters across the seven seas.

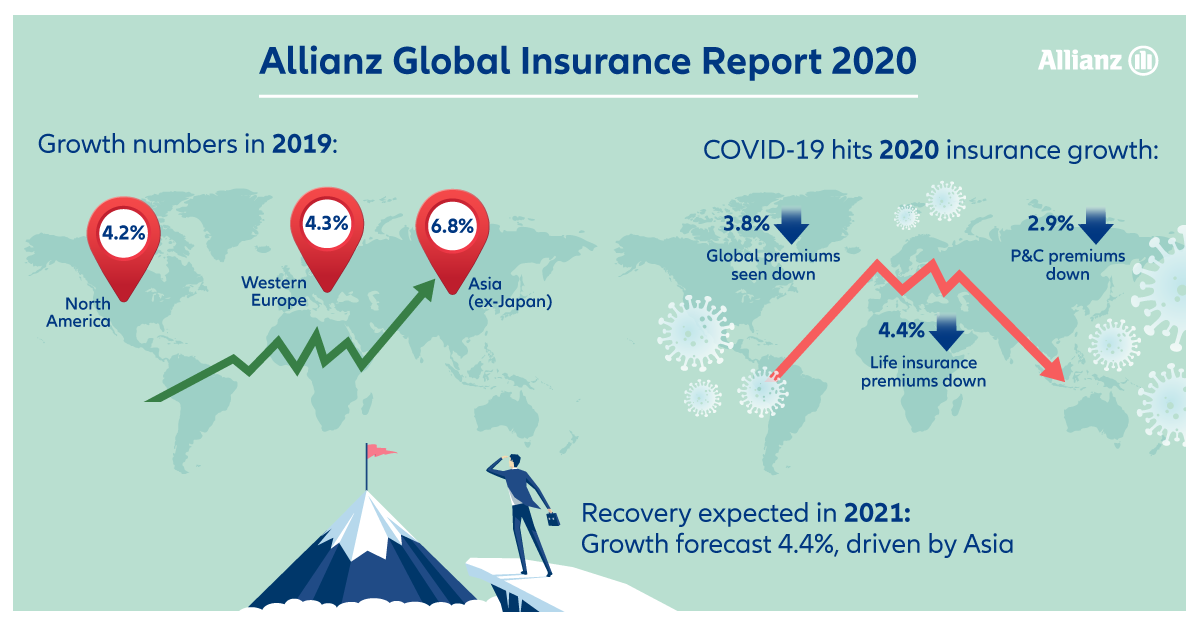

Symbolically returning to that legacy, Asia is emerging as the pivot for the insurance industry. “Asia was the region first hit by Covid-19; it will also be the region that recovers first,” says Allianz economist Michaela Grimm. “Higher risk awareness and pent-up demand for social protection will drive growth in the coming years, with China in the lead.”

Traditionally, the U.S. and Western Europe have dominated the industry, with respective share of 38 percent and 36 percent at the onset of the great financial crisis.

Since then, however, the trend has been shifting East.

In 2019, total premiums in Asia (excluding Japan) totaled 947 billion euros, half of which were in China. There’s much potential still to be tapped. Fast development and a growing middle class, coupled with relatively low insurance density, make China a lucrative market. Adding to its attractiveness is the fact that the Chinese market is a frontrunner in the application of Artificial Intelligence (AI) and data analytics.

“For the next couple of years, we expect double-digit increases in premiums in the Middle Kingdom,” says Michaela. “Up to 2030, China’s premium pool will grow by a whopping 777 billion euros – the market size of the UK, France, Germany and Italy combined. China and Asia will emerge even stronger than before from today’s crisis.”

However, this year won’t be pretty in Asia either. Premiums are expected to decline 0.7 percent, with life insurance shrinking 1.8 percent. P&C will grow slightly, by 1.9 percent.

Over the long term, average growth in Asia is seen at 8.1 percent until 2030. In comparison, Western Europe is forecast to grow at 2.2 percent and North America at 3.5 percent.

“After the challenging decade following the great financial crisis, a battle-tested European insurance industry proved remarkably resilient during Covid-19,” says Allianz economist Patricia Pelayo Romero. “The outlook, however, is less encouraging. As in other fields, Europe is falling further behind the U.S. and particularly, Asia.”

Asia (excluding Japan) is set to become the biggest insurance market by 2030, with a share of 35 percent versus 24 percent now. Meanwhile, the share of North America and Western Europe is forecast to shrink to 30 percent and 21 percent, respectively, from 34 percent and 27 percent now.