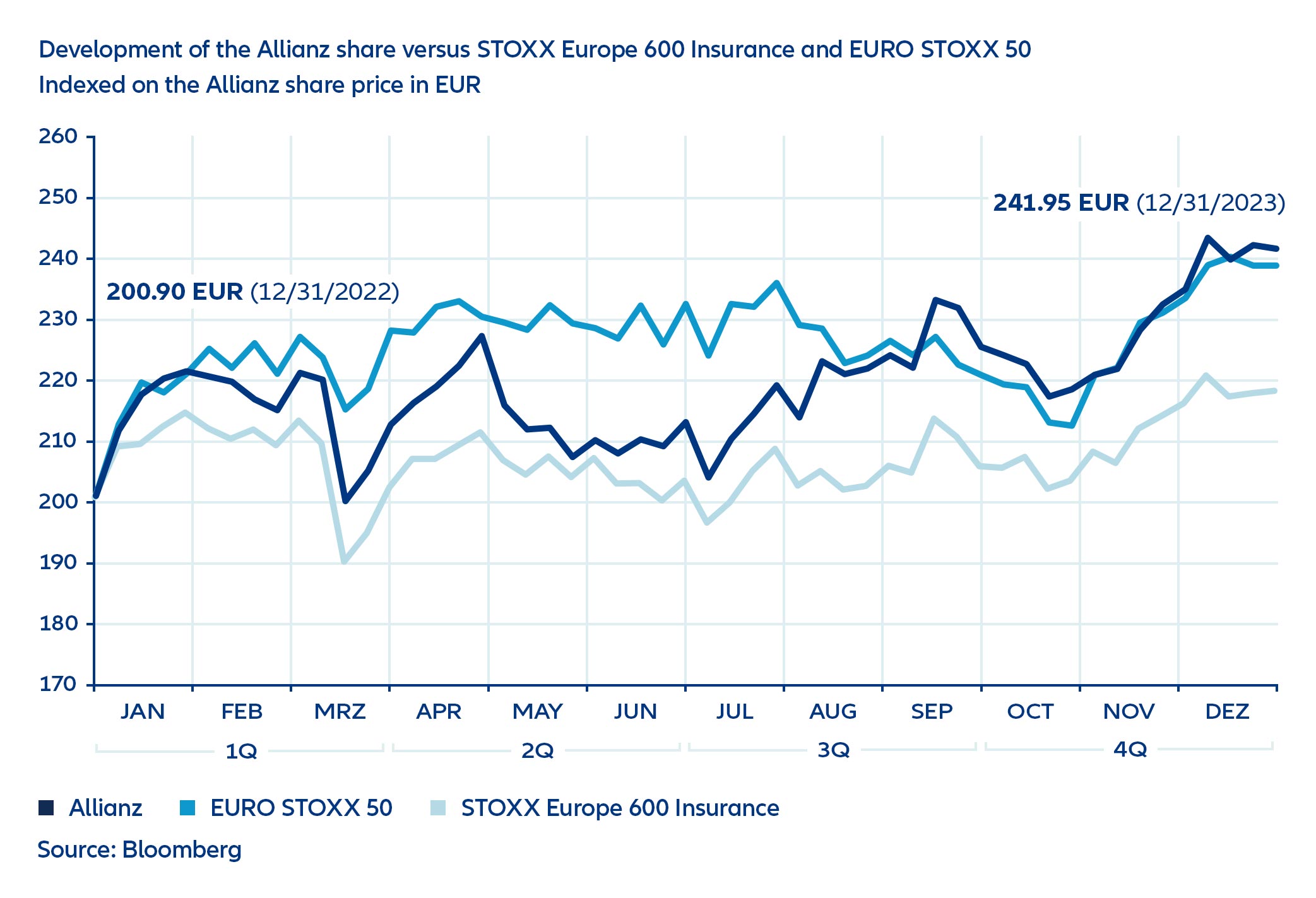

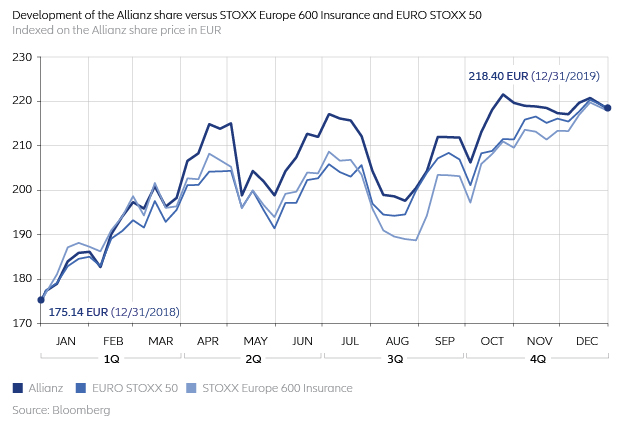

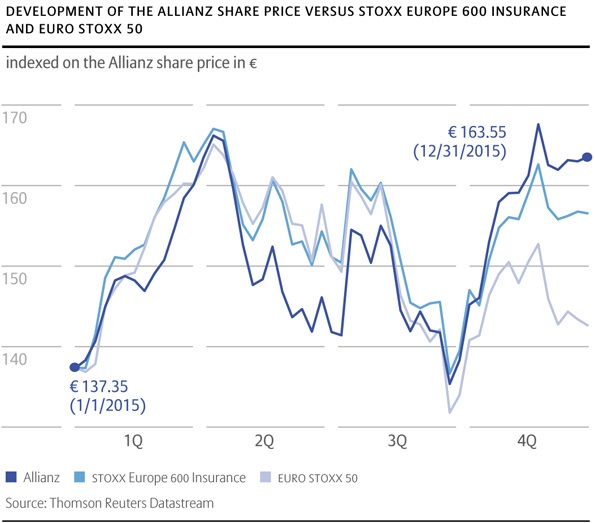

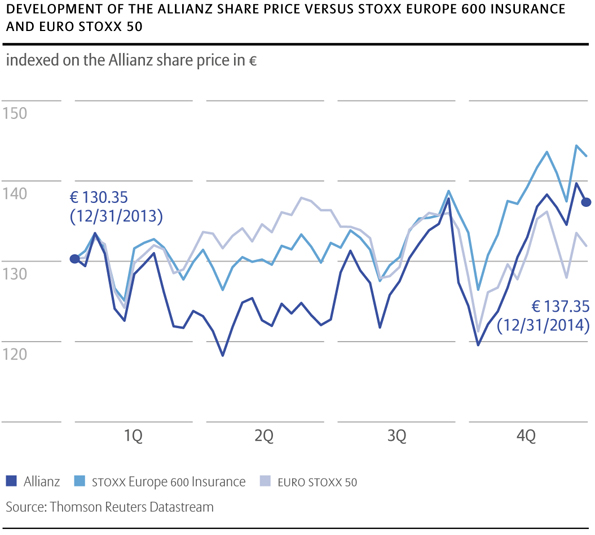

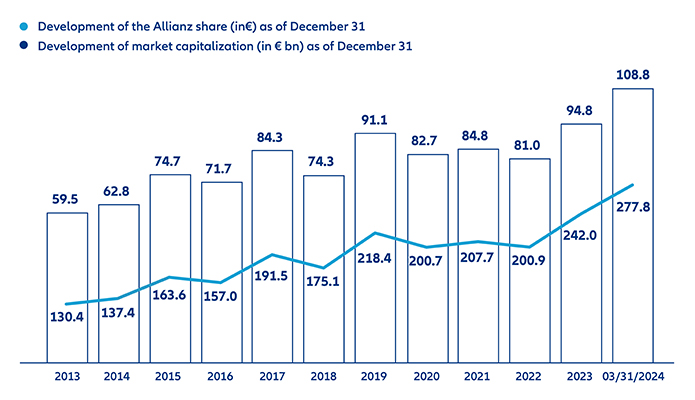

The European stock markets rose significantly in 2023. The EURO STOXX 50 was 19.2% higher than at the beginning of the year. The upward movement was largely driven by increasing optimism that the central banks' cycle of interest rate hikes was over.

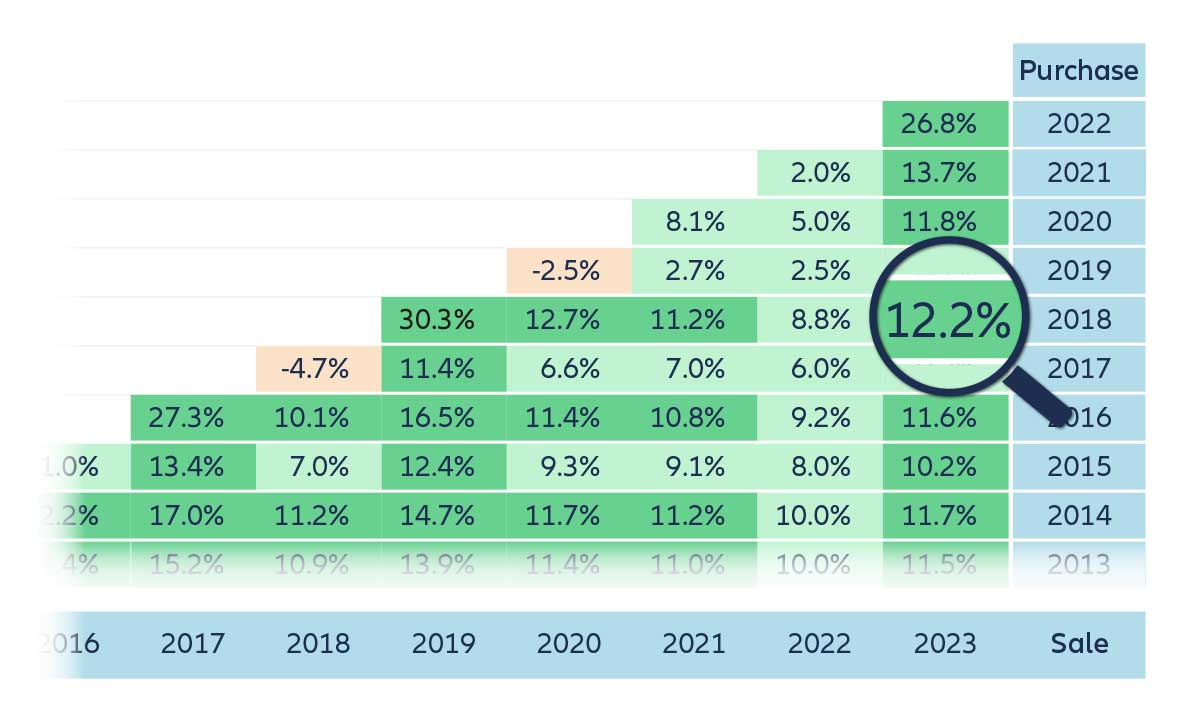

Although insurance stocks also recorded price gains, these were less pronounced than on the broader markets, as can be seen from the STOXX Europe 600 Insurance (+8.8%). The Allianz share performed significantly better with an increase of 20.4% to a closing price of 241.95 euros. Including the dividend of 11.40 euros, this results in an increase of 26.8%. Allianz shares were also an attractive investment in the long term. In a ten-year comparison, the average annual increase in value was 11.5%.