The Board of Management and the Supervisory Board will propose a dividend of 13.80 euros per share for fiscal 2023 to the Annual General Meeting on May 8, 2024 (+21.1% on previous year: 11.40 euros).

Dividend

Dividend for fiscal year 2023

The Board of Management and the Supervisory Board will propose a dividend of 13.80 euros per share for fiscal 2023 to the Annual General Meeting on May 8, 2024 (+21.1% on previous year: 11.40 euros).

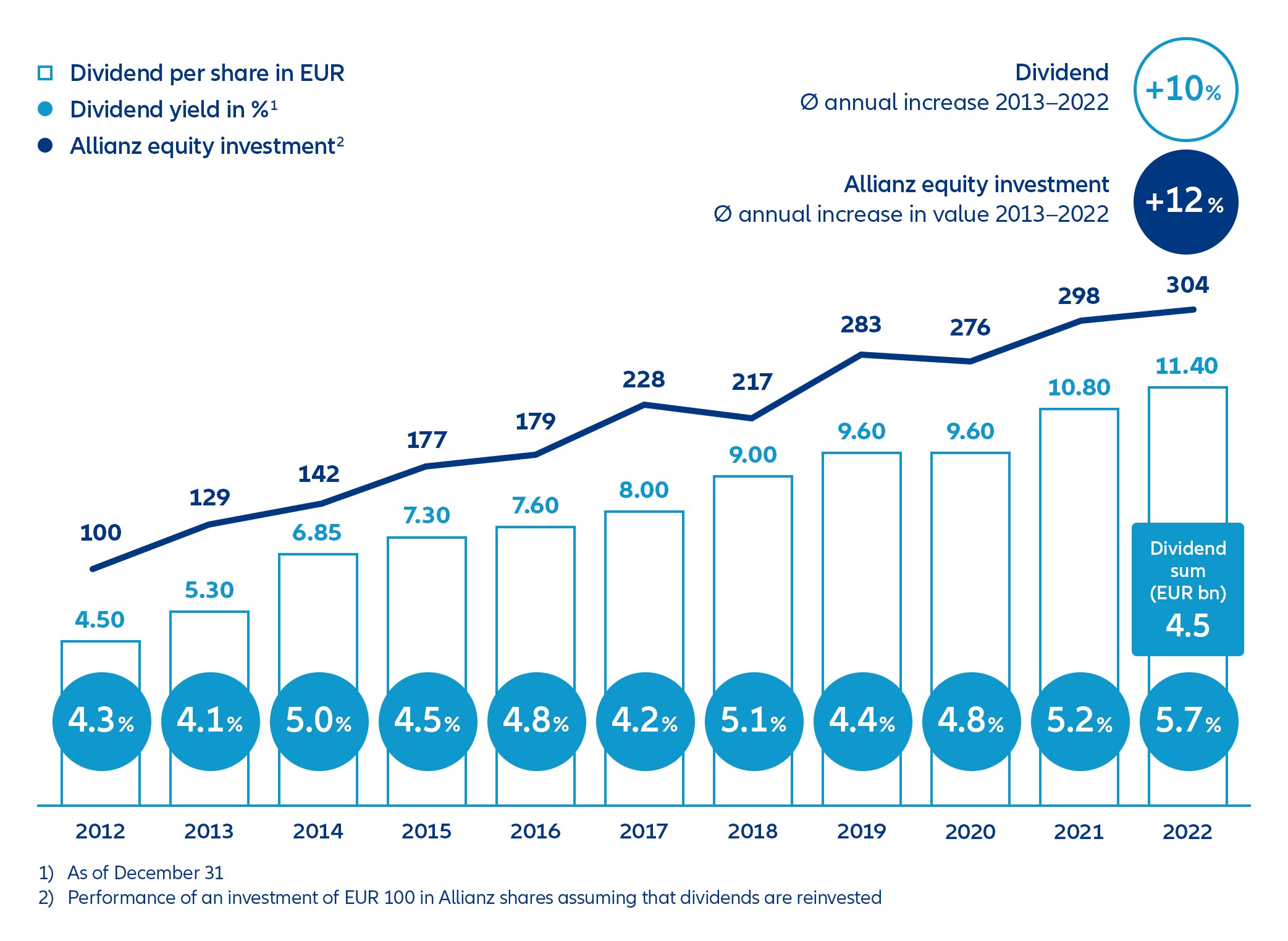

Dividend history

Allianz is one of the highest-dividend companies in the DAX. Due to our strong business development and an attractive dividend policy, the dividend has increased by an average of 10% over the past 10 years to 11.40 euros most recently.

As of May 4, 2023 (Annual General Meeting)

Dividend policy

Allianz SE strives to offer attractive dividends to its shareholders. The framework for this is determined by our net income and the need for an adequate capitalization.

- The regular pay-out is increased from 50 % to 60 % of Allianz Group net income (attributable to shareholders), adjusted for extraordinary and volatile items, e.g. amortization of intangible assets from business combinations, interest expenses from RT1 bonds, gains and losses from sale of operations, and non-operating market movements.

- In the interest of an attractive dividend policy, the further objective is to pay a dividend per share of at least the amount of the previous year.

- The dividend policy is subject to a sustainable Solvency II capitalization ratio of above 150 % (excluding transitional measures).

- The amended dividend policy shall already apply to the dividend for the fiscal year 2023. The Management Board therefore proposes to increase the dividend from Euro 11.40 (previous financial year) to Euro 13.80 for the fiscal year 2023 per share entitled to a dividend.

- In addition, Allianz returns excess capital to its shareholders on a flexible basis, e.g. through share buy-backs.

Published on February 23, 2024

Please note: This dividend policy represents the current intention of the Board of Management and the Supervisory Board and may be revised in the future. Also, the dividend payment in any given year is subject to specific dividend proposals by the Board of Management and the Supervisory Board, each of which may elect to deviate from this dividend policy if appropriate under the then prevailing circumstances, as well as to the decision of the Annual General Meeting.

Timetable

Swipe to view more

| 02/22/2024 |

Dividend proposal |

| 05/08/2024 |

Dividend resolution by Annual General Meeting |

| 05/08/2024 |

Dividend entitlement date |

| 05/09/2024 |

Ex-dividend quotation |

| 05/13/2024 |

Dividend pay-out (valuta)1 |

1 In accordance with § 58 (4) of the German Stock Corporation Act (AktG), the dividend is paid on the third business day following the resolution of the Annual General Meeting.

Taxation of the dividend for shareholders living abroad

In Germany a capital gains tax is levied on dividends and certain other capital income. Due to various international regulations, a full or partial relief from the capital gains tax is possible for individual shareholders living abroad under certain prerequisites.

Paying Agent

Paying Agent for shareholders: Commerzbank AG, 60261 Frankfurt/Main. Paying Agents for bondholders are indicated in the relevant terms and conditions which can be found here.

FAQ

Frequently asked questions on the dividend.

Related topics

Share price

Find out more about the current share price of the Allianz share and its share price performance.

Annual General Meeting

Our shareholders decide on the appropriation of net earnings on Agenda Item 2.

Results

We offer all relevant documents and webcasts on our quarterly and annual results at a glance.