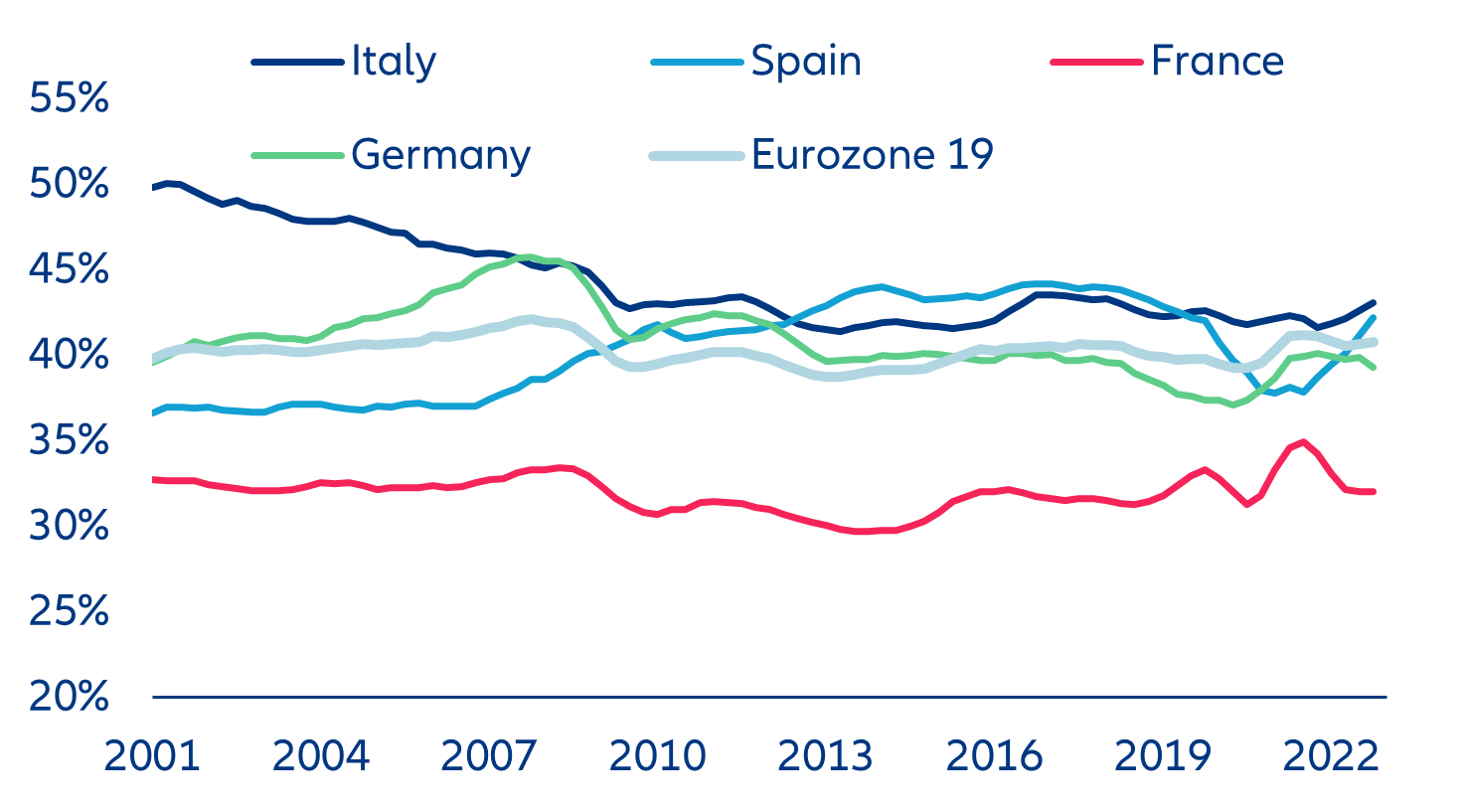

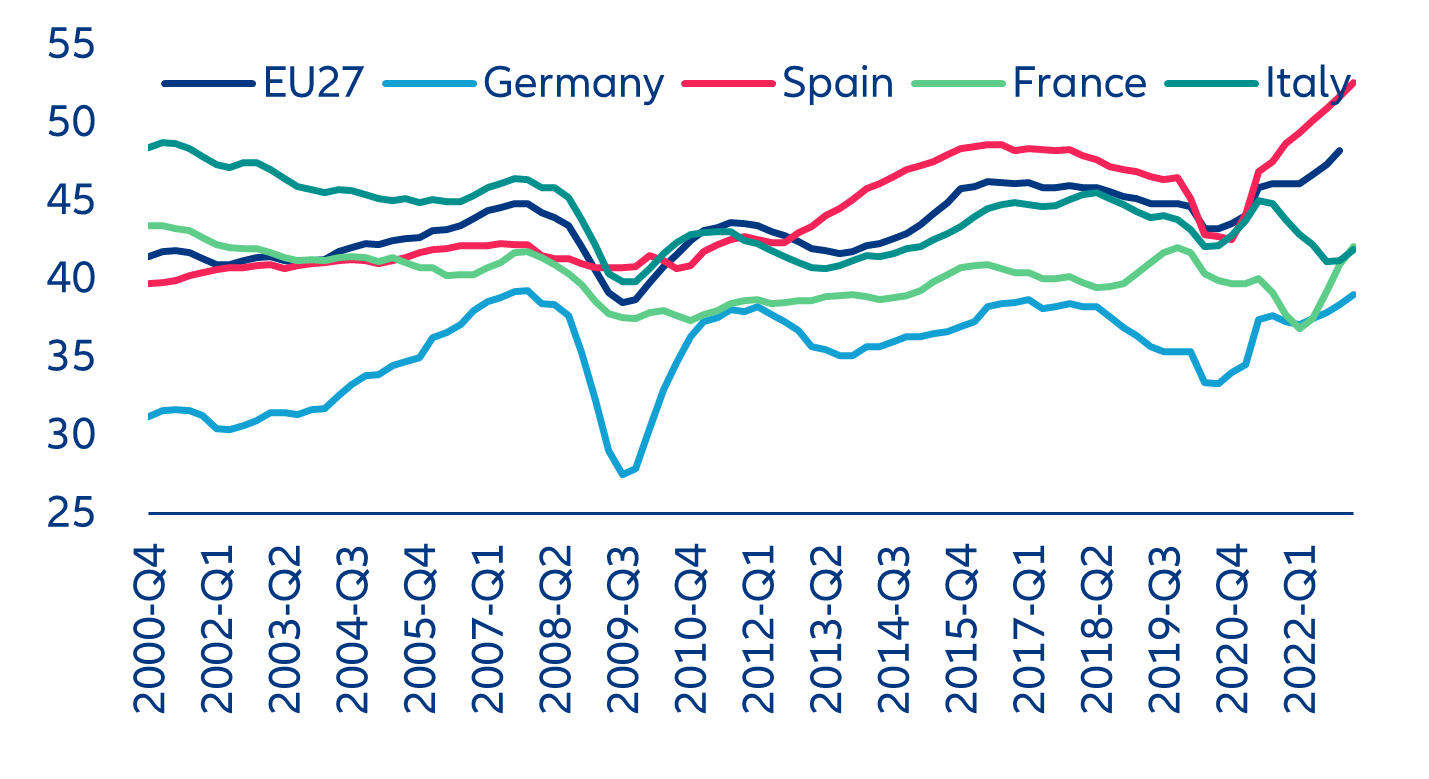

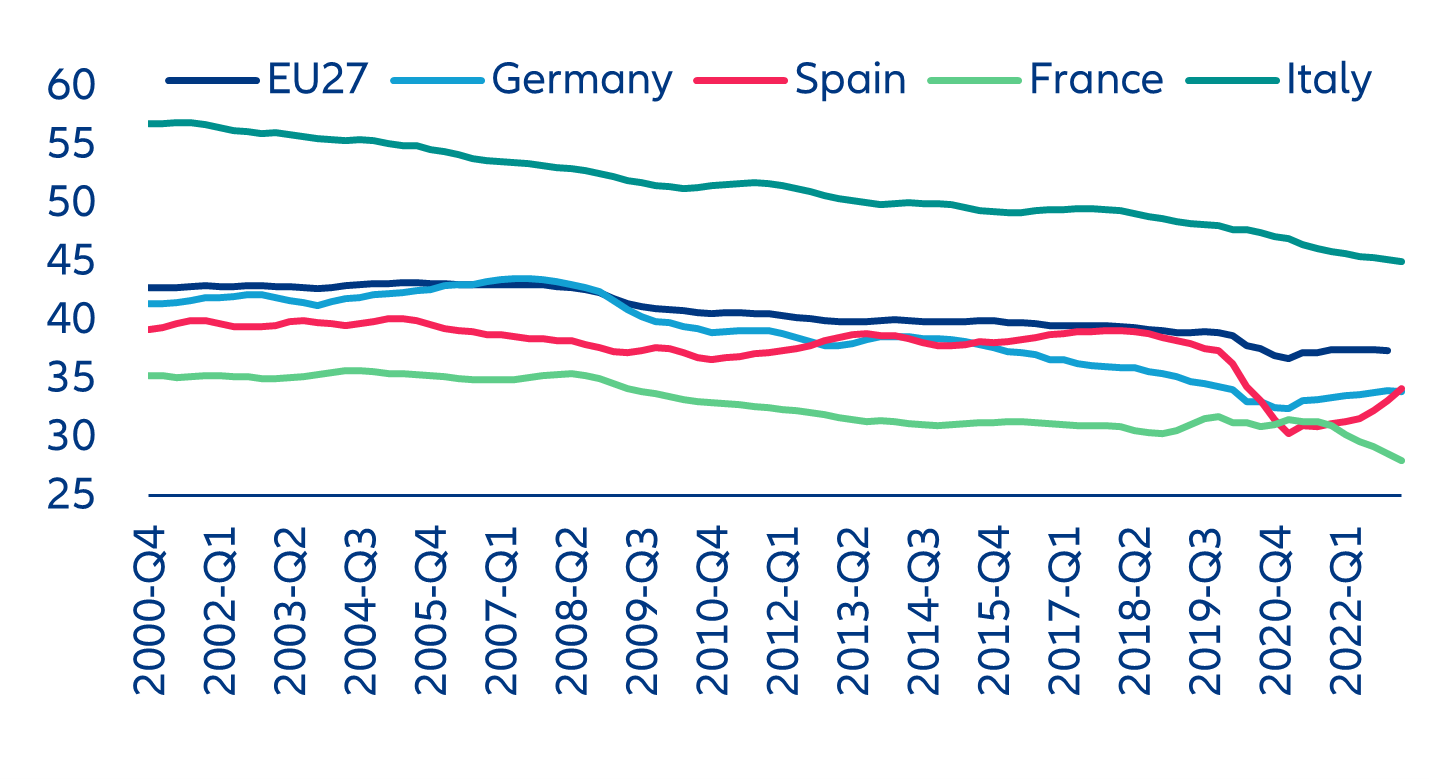

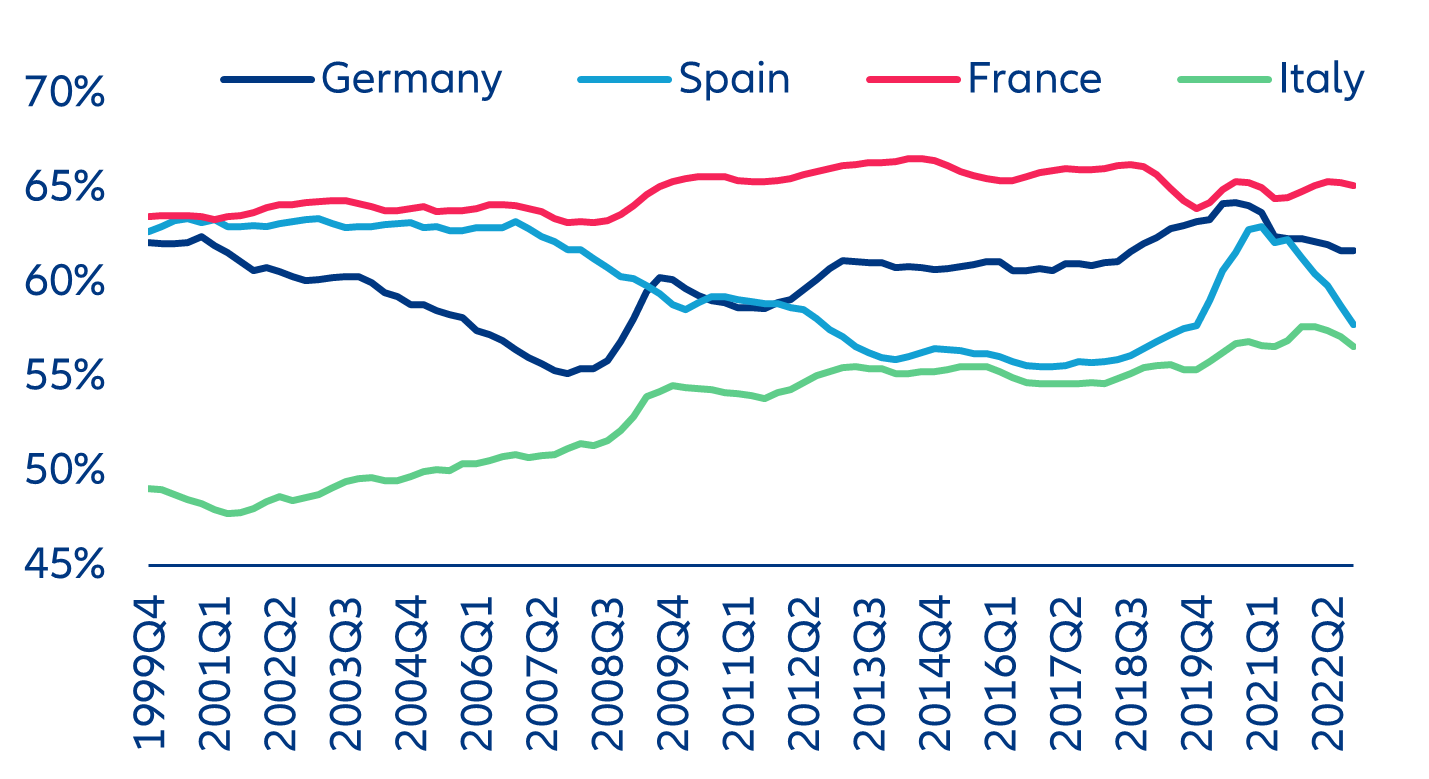

- Eurozone corporate profit margins reached 40.8% of gross value-added at end-2022 (+0.6pp above the long-term average). But the devil is in the details. Italy and Spain seem better positioned compared to Germany and France, notably in the manufacturing sector. However, excluding sectors with strong pricing power (such as transportation services and energy), margins are much lower and hit their lowest level since the mid-1980s in Q1 2023 in France.

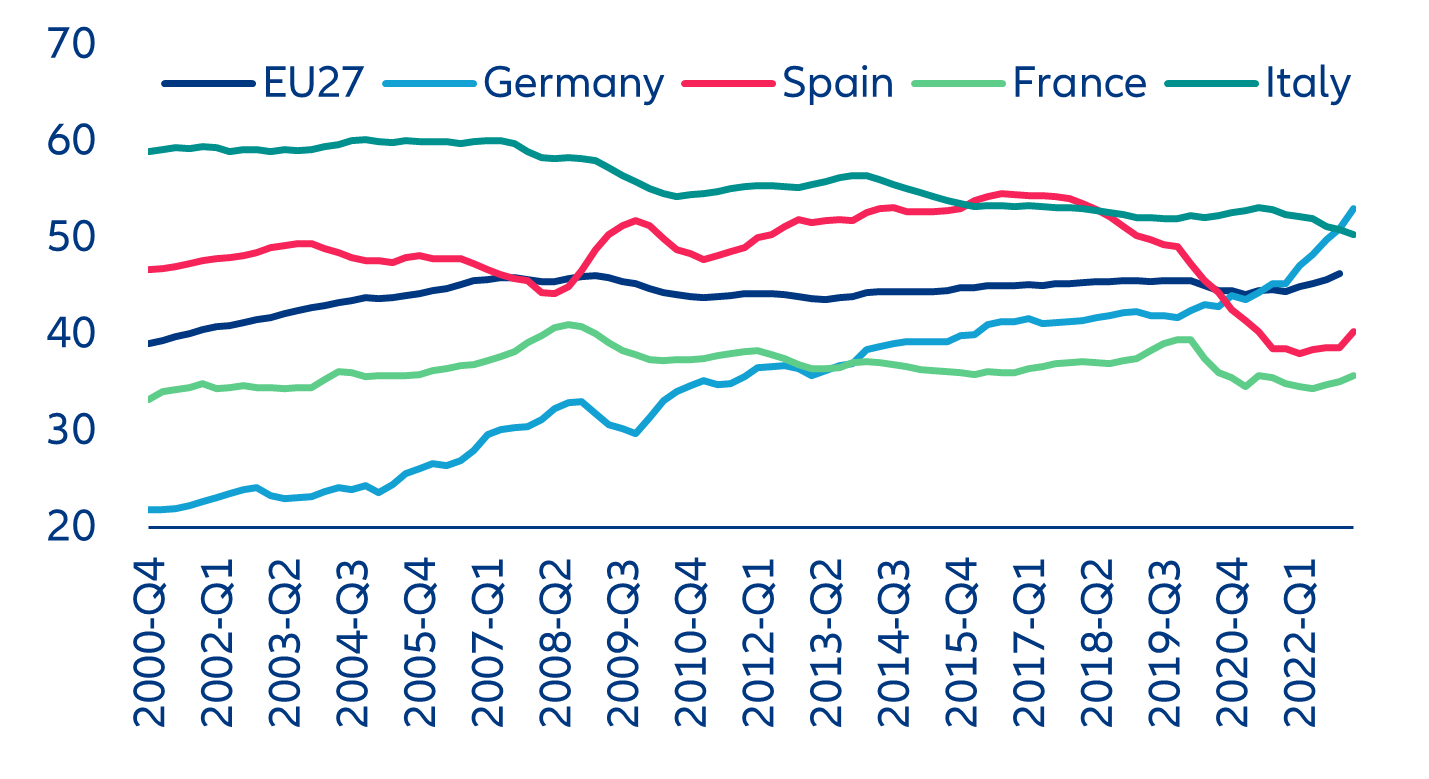

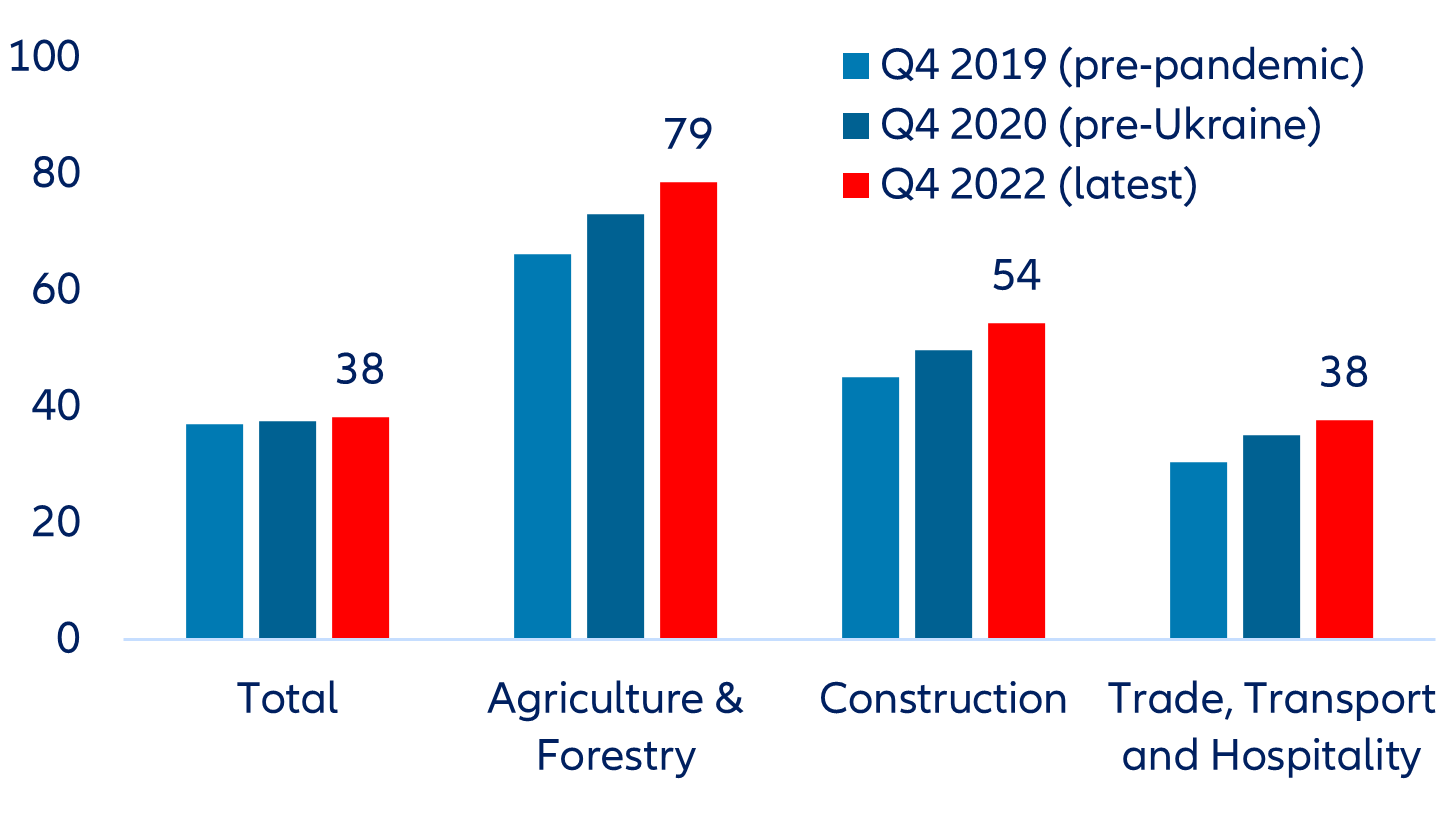

- Margins remain well below the pre-pandemic average in consumer services, with France being worst positioned (28% vs 37% in the EU and 45% in Italy). Despite resilient demand for services, companies face stiff competition, rapid wage increases and negative productivity growth (since the pandemic), limiting the extent to which they can increase their selling prices above input costs.

- German companies appear best in class in terms of profitability in the agriculture and construction sectors. Construction companies in particular have used the general upward trend in prices to significantly expand their profits to reach 53% of gross value added – even compared to other large European economies (36% in France, for example).

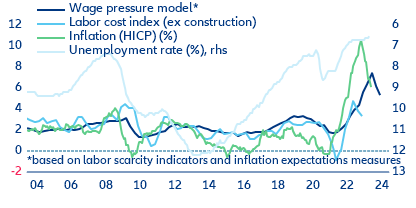

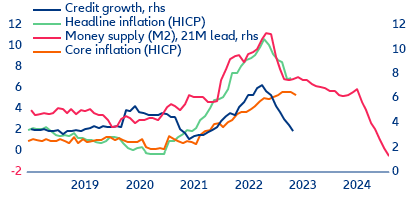

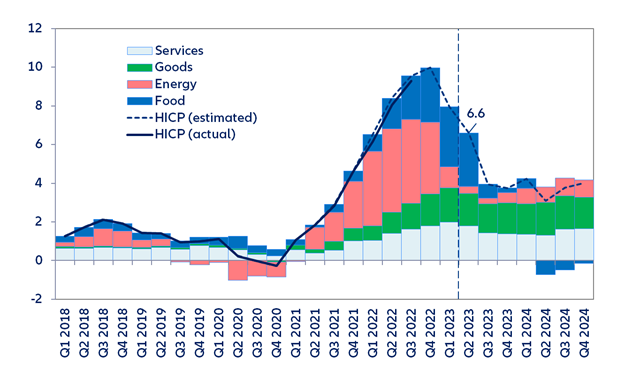

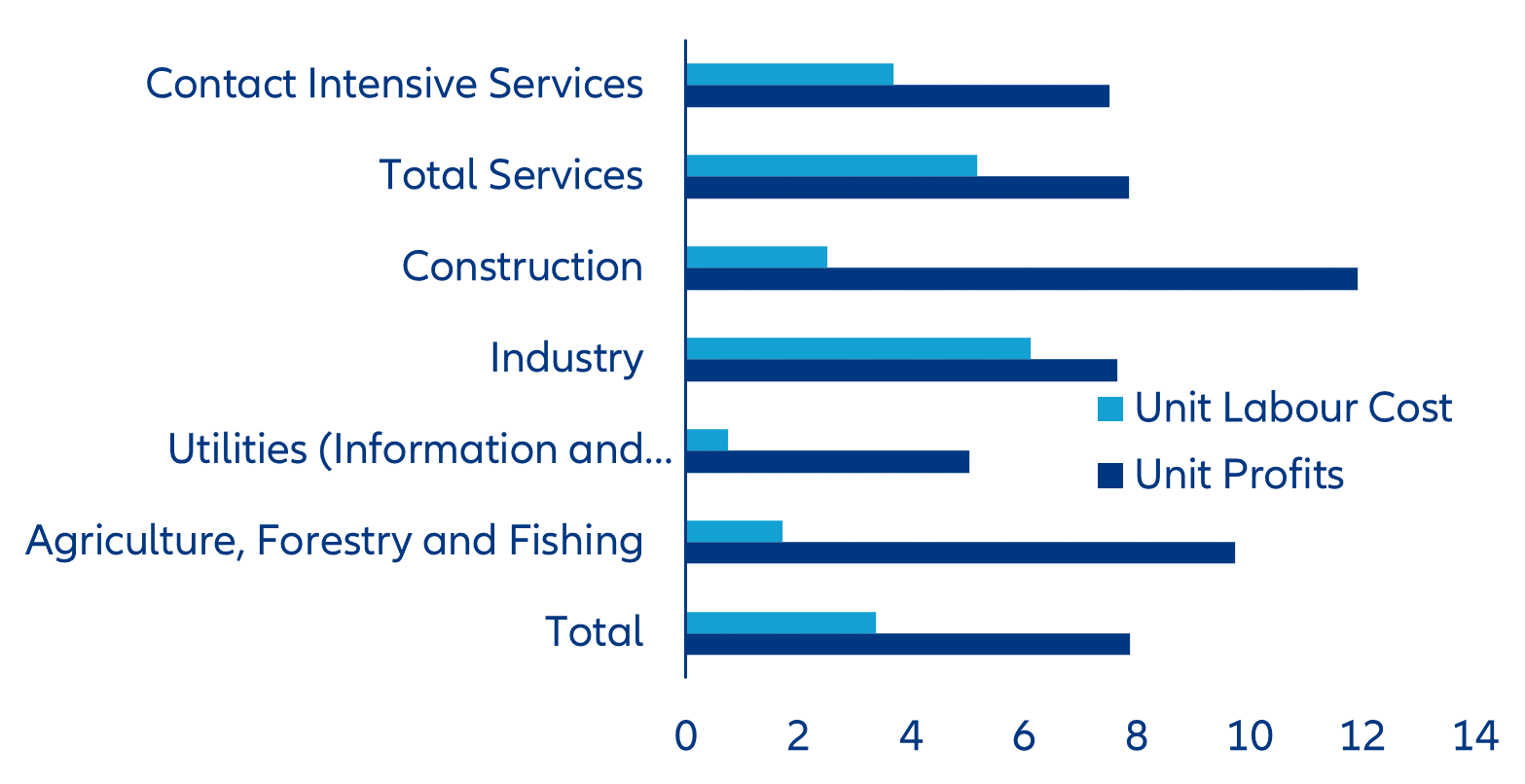

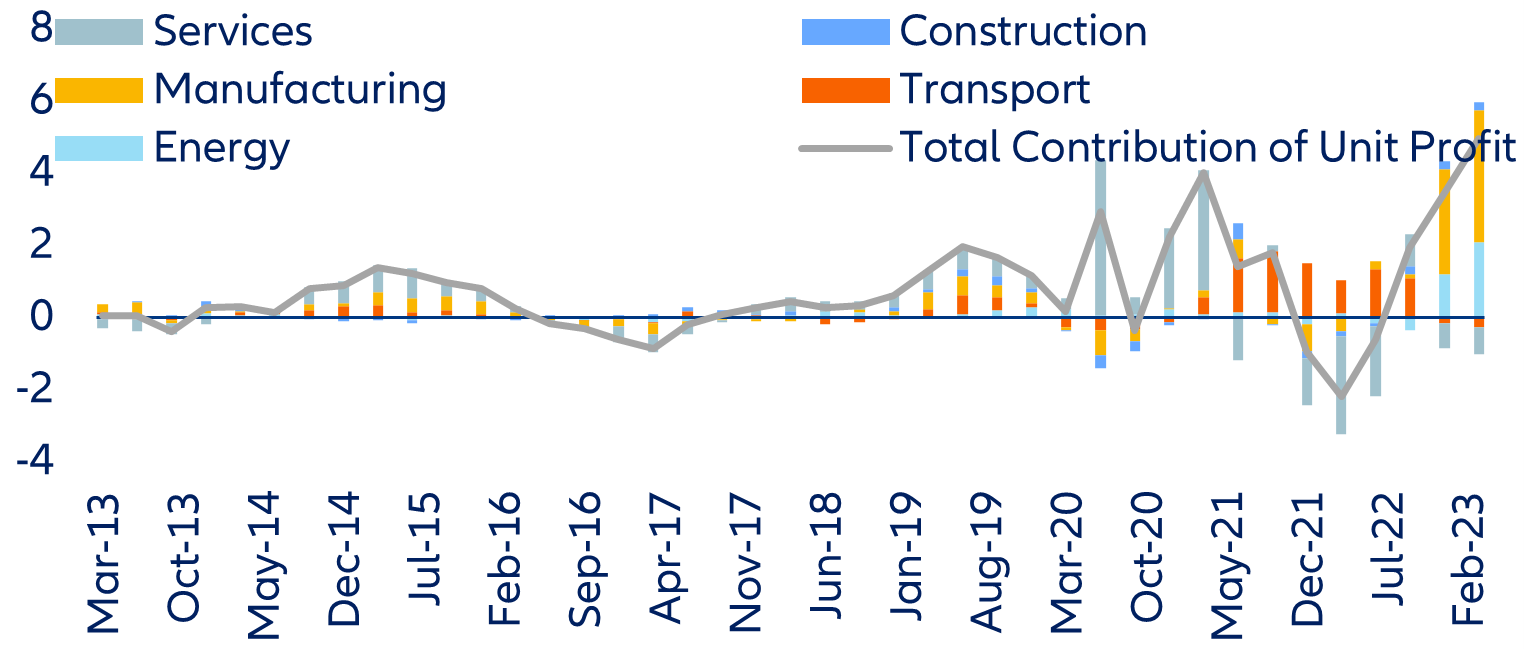

- Corporate profits should be past the peak amid strong wage pressures and diminishing pricing power (and even deflationary forces in metals, chemicals). While producer prices are decelerating strongly amid lower commodity prices, normalizing supply chains and growing deflationary fears in China, wage growth will remain high at least until early next year, which will contribute to squeezing corporate margins. The exception will be the services sector, which will delay the fall in service price inflation.

In focus – Past the peak – European corporate margins down again?

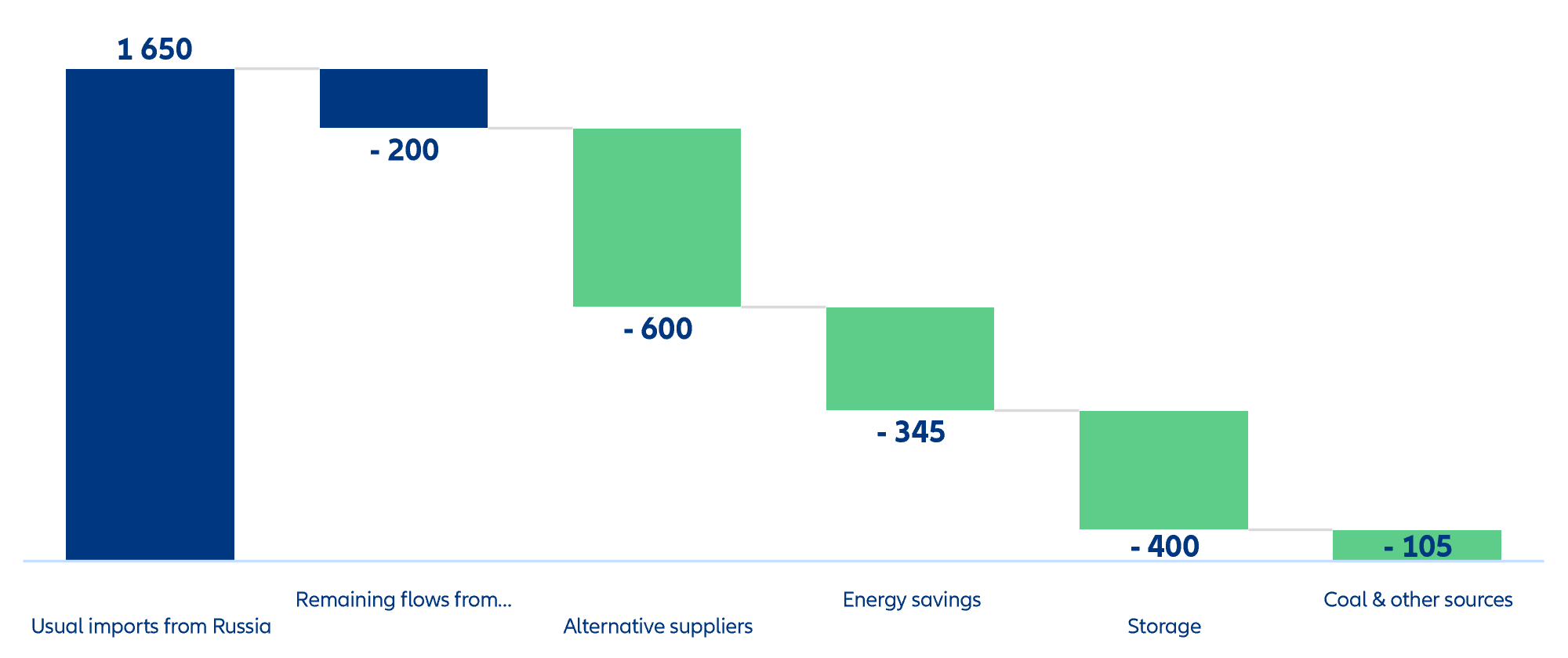

Higher oil prices yet Europe is closing its energy gap

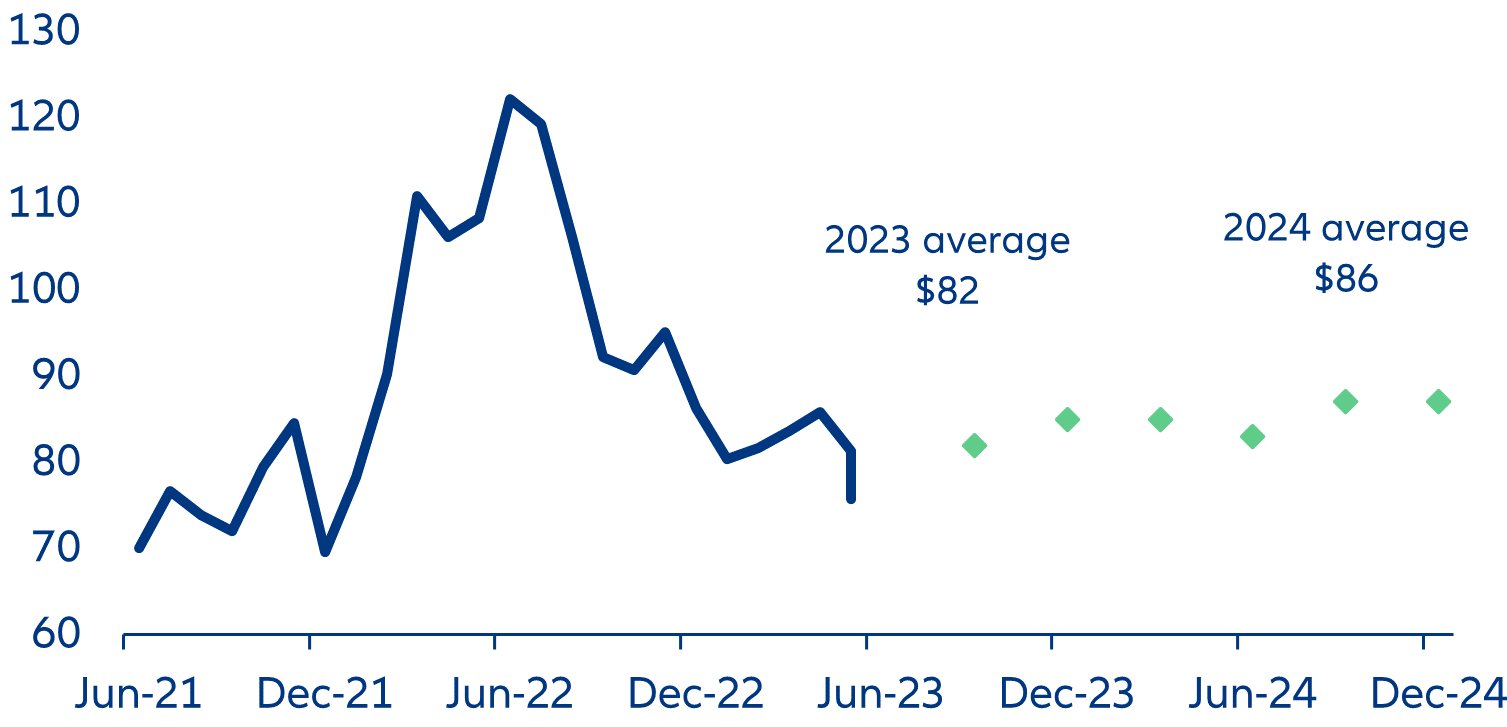

Oil prices should increase until the end of 2023 in response to persistent demand and supply uncertainties. A resilient global economy is keeping oil demand strong and the prospect of a positive summer season in the West will also support demand for transportation fuels. While oil prices have declined since the start of the year, short bets are likely to unravel in the coming months as the supply outlook has been shifting, too:

- The US shale industry, a key player in global oil supply, is prioritizing profits over volume. Although crude oil prices are still above the breakeven price for US shale players (estimated at about USD55/bbl), higher interest rates and growing wage bills have led the already highly leveraged sector to focus on profitability. This strategic shift will limit US oil output, thereby widening the supply-demand gap

- Saudi Arabia, the world's leading oil exporter, just decided to cut its oil production during last week’s OPEC+ meeting. This move is a strategic gambit aimed at stabilizing the global oil market and supporting oil prices. Saudi Arabia's commitment to reducing output will deepen the deficit, potentially pushing oil prices higher. But it will also pose risks to the country’s market share around the world.

Although all recent signals point toward higher oil prices, markets remain volatile. Geopolitical developments are adding a layer of complexity, with Russia holding the key to stabilize markets through compliance on its own production targets, and also paving the way to more Saudi exports towards Asia to ease some of the tension between OPEC+. Overall, we expect Brent prices to increase throughout the year and average USD82 for 2023 (Figure 1). Nevertheless, these rising prices are unlikely to fuel an inflation spiral as oil prices are likely to remain 20% below 2022 prices.

Central Banks are not done – Fed and ECB rates to peak only in September

US Federal Reserve: Holding off next week but to deliver two more rate hikes in July and September

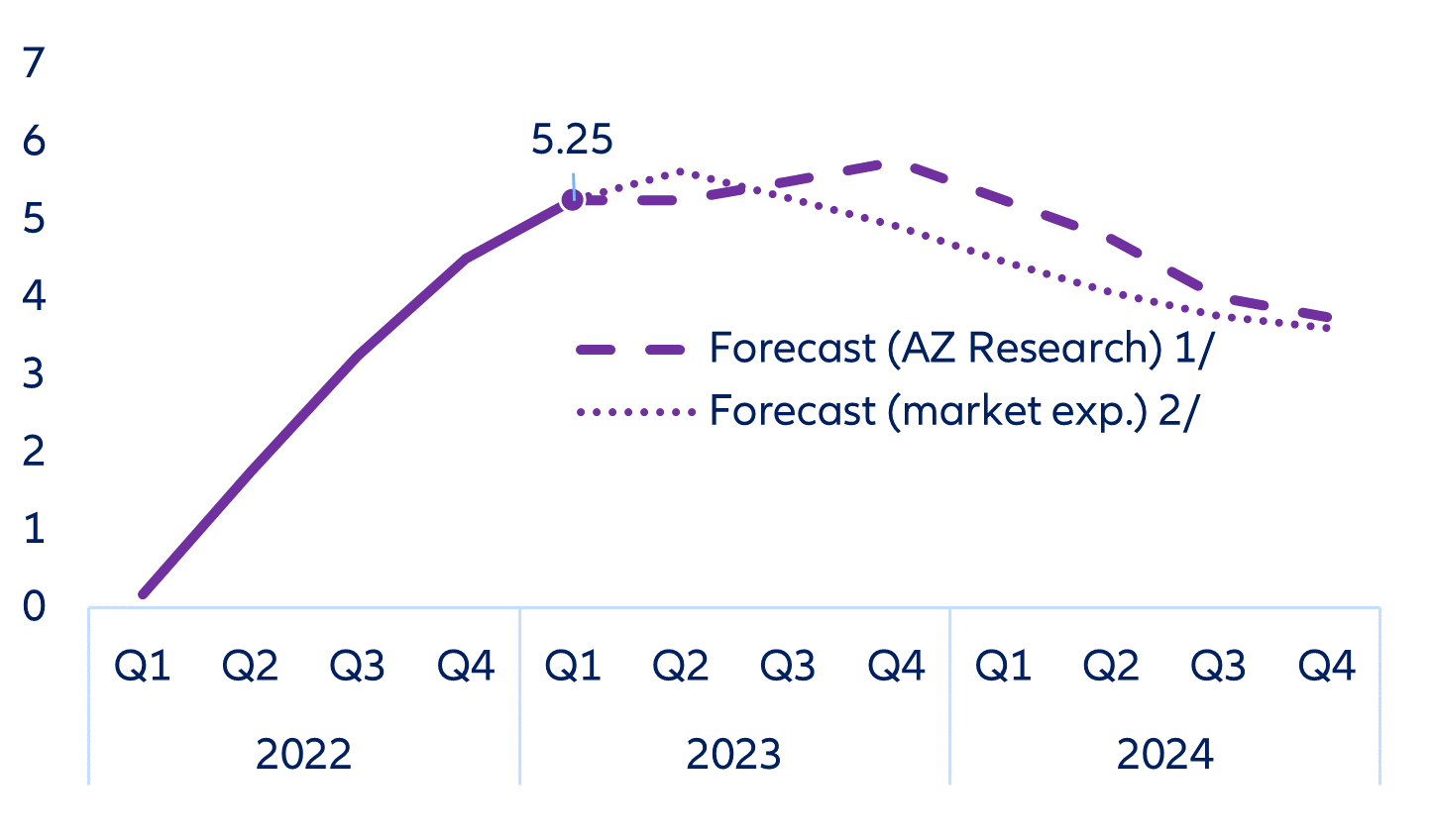

However, several FOMC participants poured cold water on the idea of hiking in June, opting for a ‘wait and see’ approach. Phillip Jefferson, who has been nominated to be the Fed’s next Vice Chair, argued that “skipping a rate hike” would allow officials to “see more data before making decisions about the extent of additional policy firming”. FOMC participants are very mindful that monetary policy operates with long and uncertain lags. They are probably worried that the cycle may turn down abruptly in upcoming months. For instance, renewed bouts of stress in the banking sector could trigger a credit crunch. Also, while hard data have come out strong, the latest business surveys point to rapidly cooling momentum, while the household employment survey reported a decline in jobs (in contrast to the payroll survey) in May and an uptick of the unemployment rate. However, we think that the reality of strong economic momentum will strike back at the FOMC in upcoming weeks. Business surveys have tended to send excessively downbeat messages over the past few months (negative sentiment and softer goods price probably bias the results).

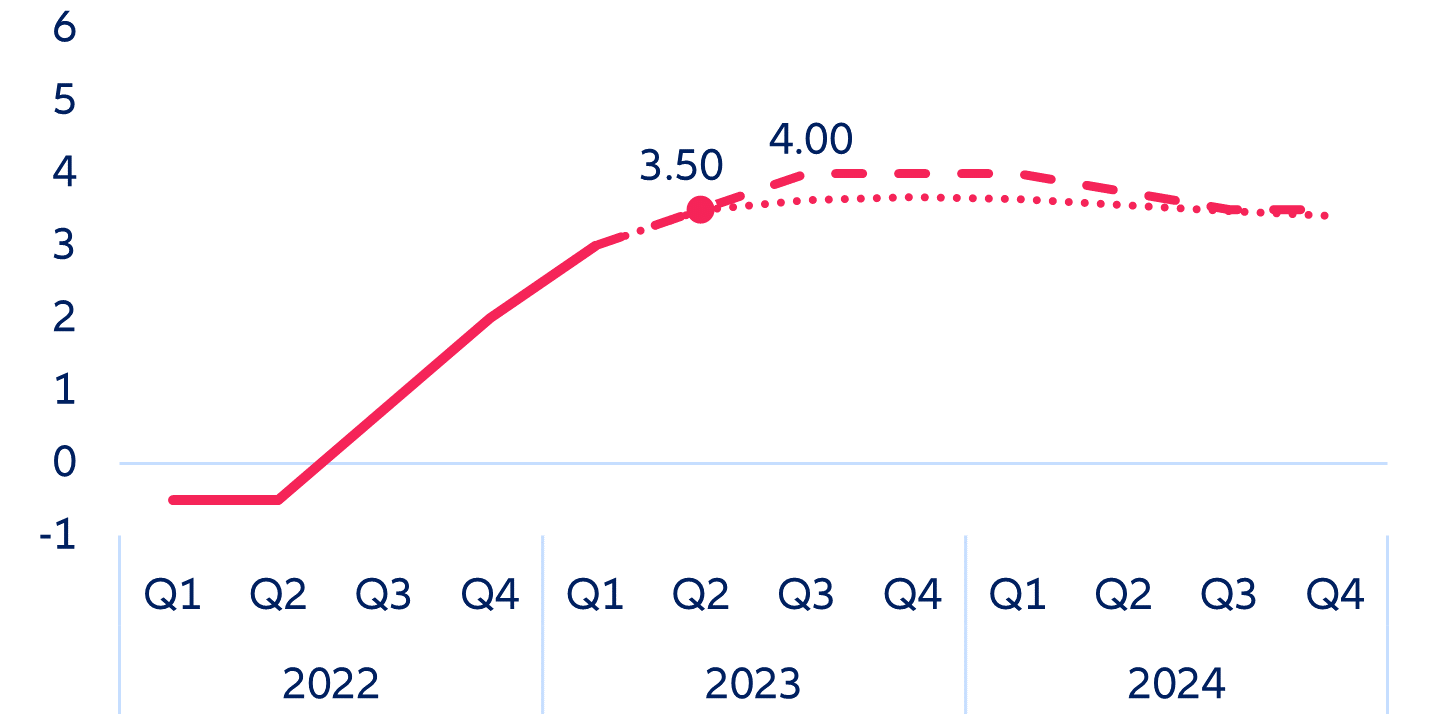

Whether or not the Fed delivers another rate hike is a close call, but overall, we think that FOMC participants will hold off this time (Figure 3). However, we expect the Fed to resume hiking both in July and September by delivering two final 25bps rate increases as still elevated wage and price pressures force its hand. Weaker momentum should materialize in end 2023-early 2024. As a result, the Fed should reverse course in Q1 2024.

ECB: Two more rate hikes before the summer break and a final back-to-school hike

Broad price pressures still create a challenging environment for monetary policy in the Eurozone. The conspicuous decline in inflation is unlikely to dissuade the ECB from further raising interest rates. Also the lack of spillover effects from US banking-sector stress means that financial stability concerns will be insufficient for the ECB to abandon its restrictive monetary stance. However, the disappointingly small rebound in German industrial production in April, deteriorating business confidence, and stagnant investment suggest that the ECB would need to decide on a policy rate path that does not excessively slow aggregate demand (considering that the impact from rapidly tightening financing conditions operates with considerable lag).

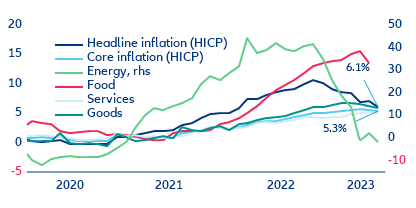

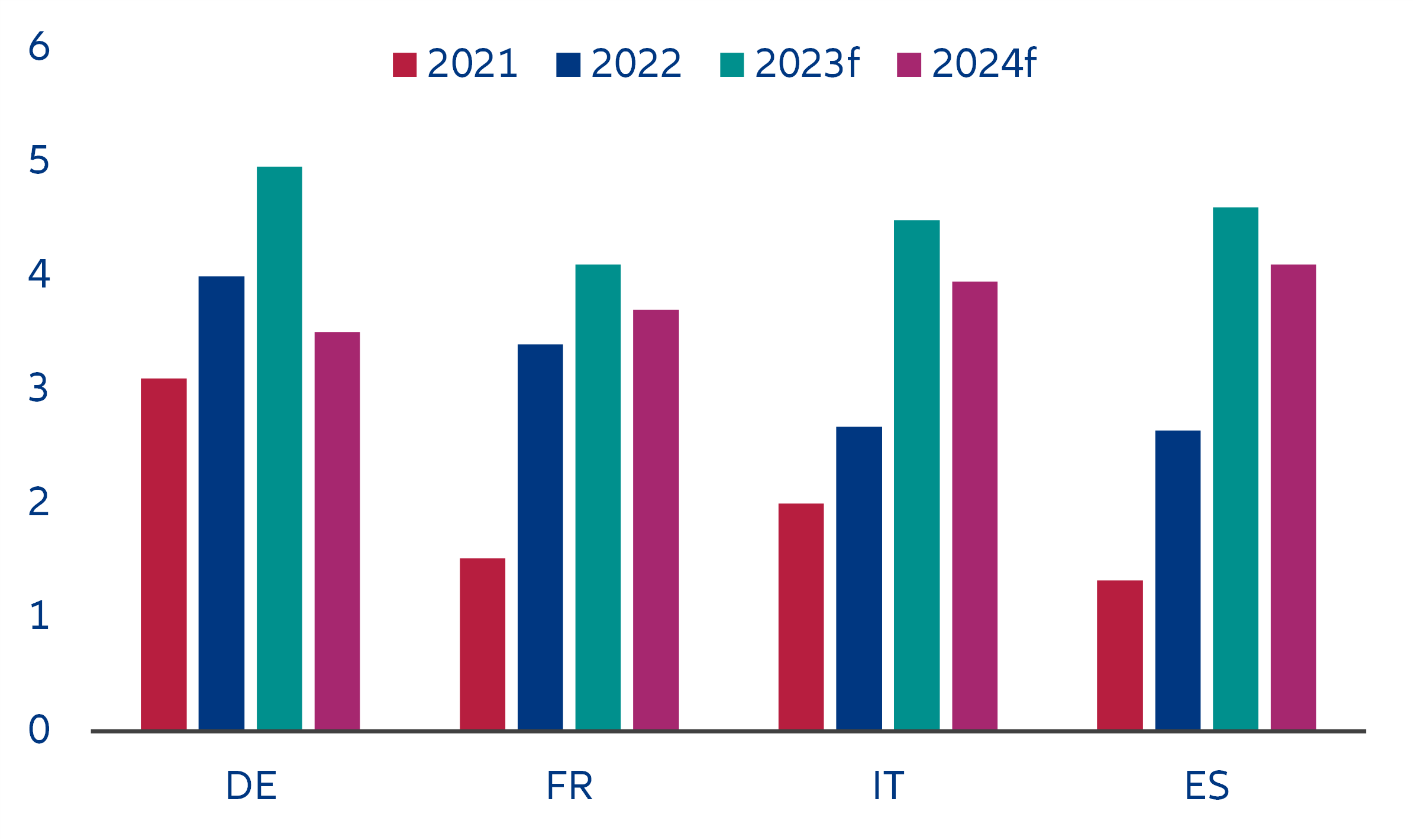

Since the normalization of inflation is more protracted than in the US, high core inflation will reinforce the ECB Governing Council’s conviction that further rate increases are still needed (Figure 7). After the 25bps hike at the last meeting we forecast three more 25bps hikes in the next policy meetings in June, July and September for a terminal rate of 4.0%. This would mean the ECB maintains a restrictive stance in 2023 despite stagnating growth until Q1 2024.

Bank of Japan’s change of heart – only slight changes in 2023 to remain supportive and possibility of important shift in 2024

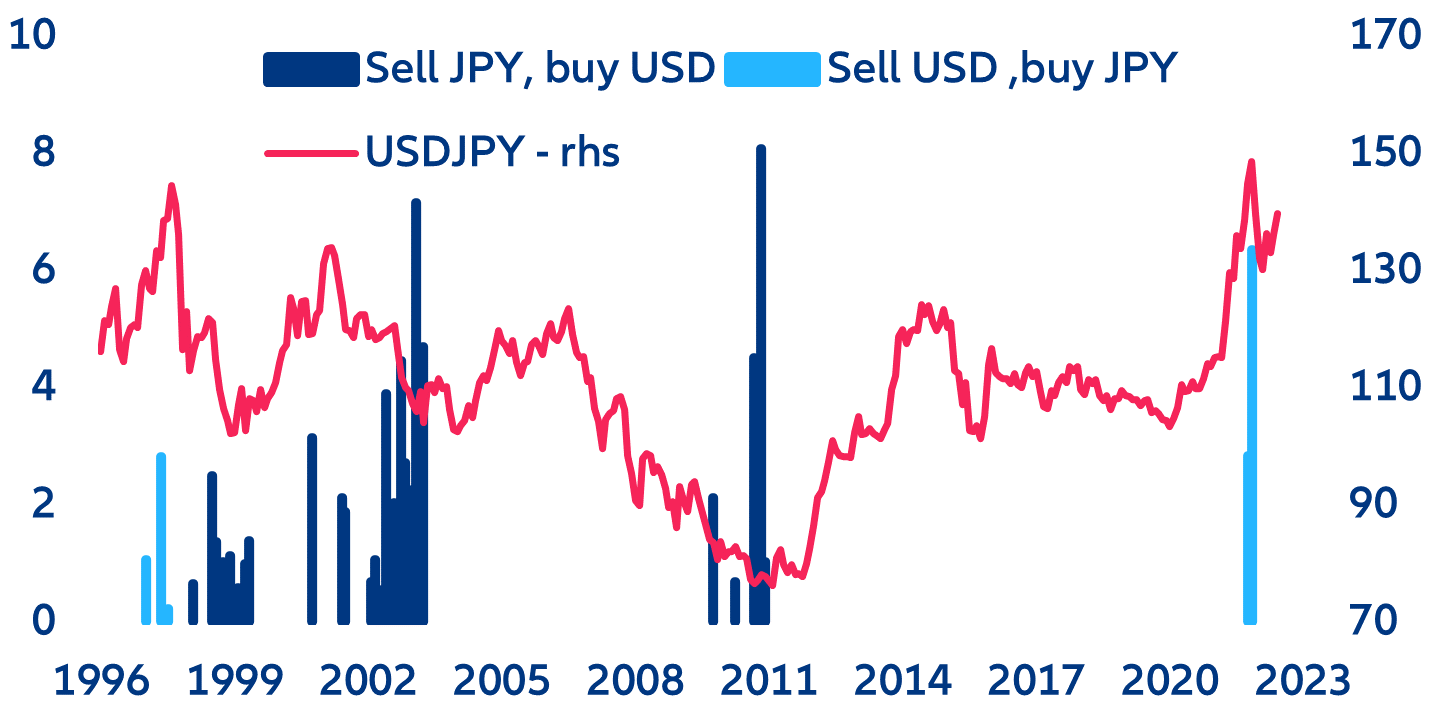

The BoJ decisions will have implications for the rest of the world, given Japan’s creditor status and its large holdings of foreign assets. The increase in yields that would follow the exit (total or partial) from YCC would increase the investment appetite for Japanese bonds. The return to the market would be welcomed by both Japanese investors repatriating their money or overseas investors in search of attractive yields on a safe-haven asset. Furthermore, it would coincide in time with the gradual withdrawal from the market of other central banks in advanced economies. For instance, Japanese investors (both public and private sector) hold around 6% of French sovereign debt.

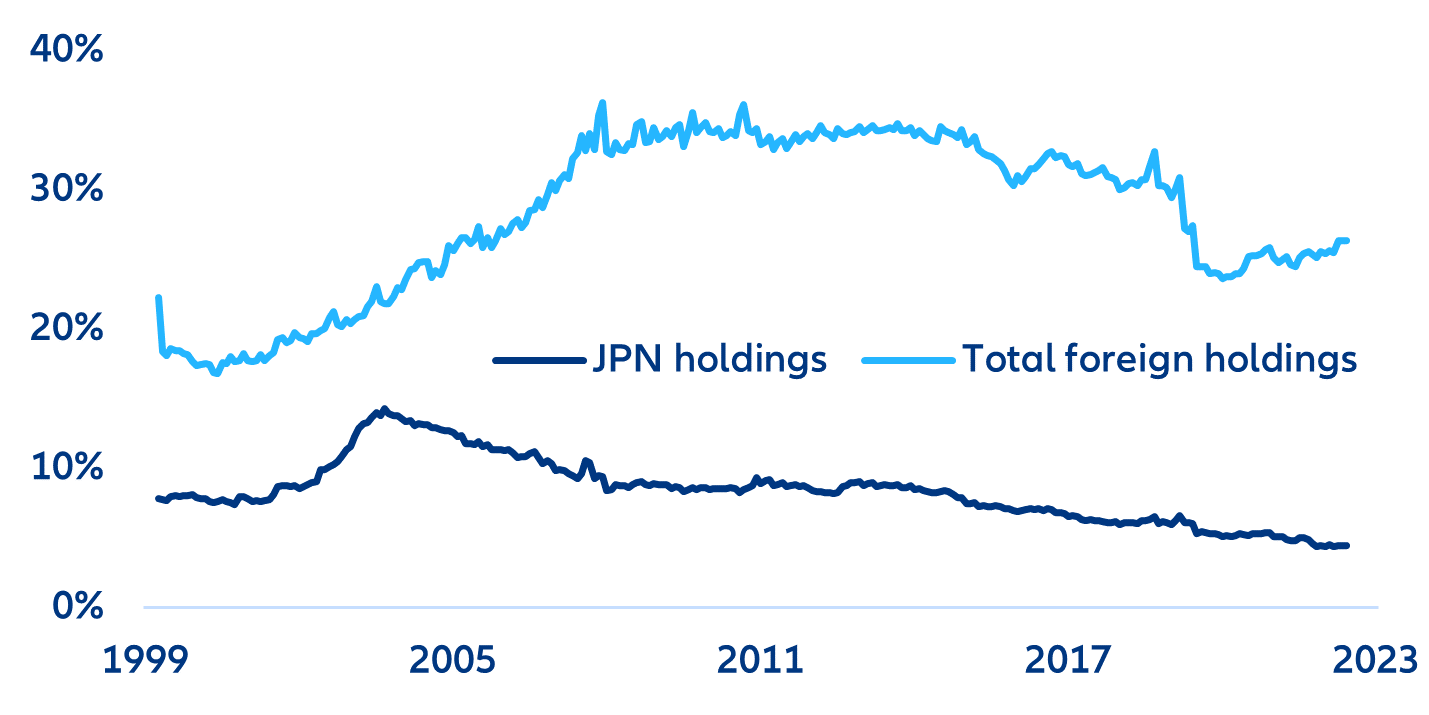

At the same time, the BoJ might rebalance asset purchases towards US Treasuries to contain a potential appreciation of the JPY (as they did in the early 2000s). It is rather in the event of continued inaction when Japanese intervention to avoid a further depreciation puts upwards pressure on US yields. After all, Japan is the second- largest holder of FX reserves and the main foreign holder of US debt (although very close to China, and with a share that has decreased over time (Figure 12)).

In focus – Past the peak – European corporate margins down again?

In Germany, construction companies in particular have used the general upward trend in prices to significantly expand their profits. Besides the agricultural sector, construction has seen the largest increase in profit margins on average – also compared to other large European economies (Figures 15 and 16). While there was still a high order backlog in German construction – both in terms of volume and value – dating back to before the pandemic and the war in Ukraine, it was amplified by low capacities, increased building-material prices and delivery bottlenecks. The cost of material has dropped again after supply-chain disruptions were resolved, and persistently low salaries in combination with strong prices increases have led to increased margins in the sector, particularly in civil engineering.

Similarly, Italy’s construction sector was able to increase prices given the pick-up in demand in the last couple of years. Indeed, the tax credit related to the “super bonus” measure implemented to improve the environmental efficiency of the housing stock pushed up demand but at the same time inflated construction-related prices. Even though we expect the housing-efficiency investment to continue, also supported by the NGEU resources, and so demand to remain buoyant, we expect a correction in the coming quarters, given also that the generous government support has been fine-tuned and re-targeted.

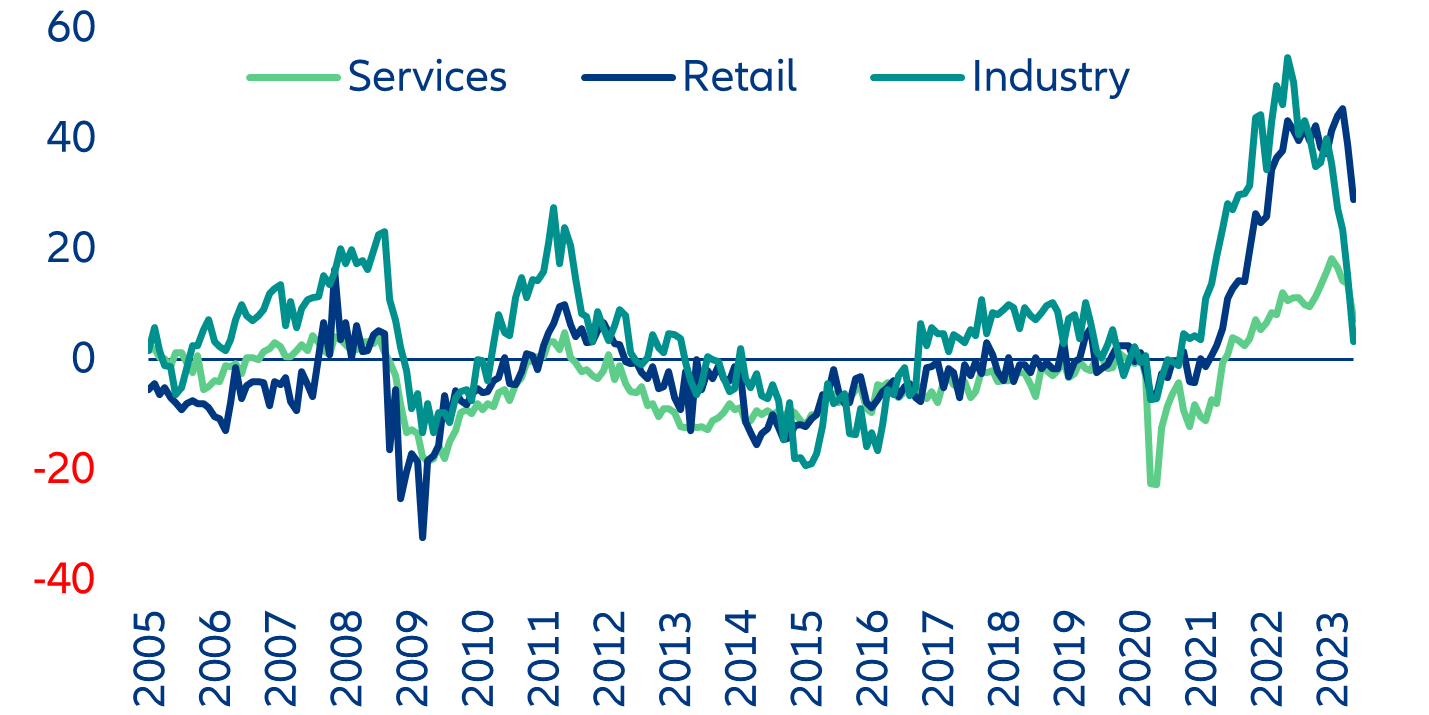

The margin catch-up in the services sector should keep services inflation sticky this year. The latest PMI surveys on prices suggest that margins started to recover in Q2 2023 in the services sector amid easing input costs (such as energy) and improved global supply conditions. According to the latest ESI surveys, corporates in the services sector plan to keep selling prices elevated in the months ahead (Figure 25), which should support margins. Accelerating wages should, however, put a lid on large margin expansion. Overall, we expect the partial catch-up of services margins to limit the decline in services price inflation this year.

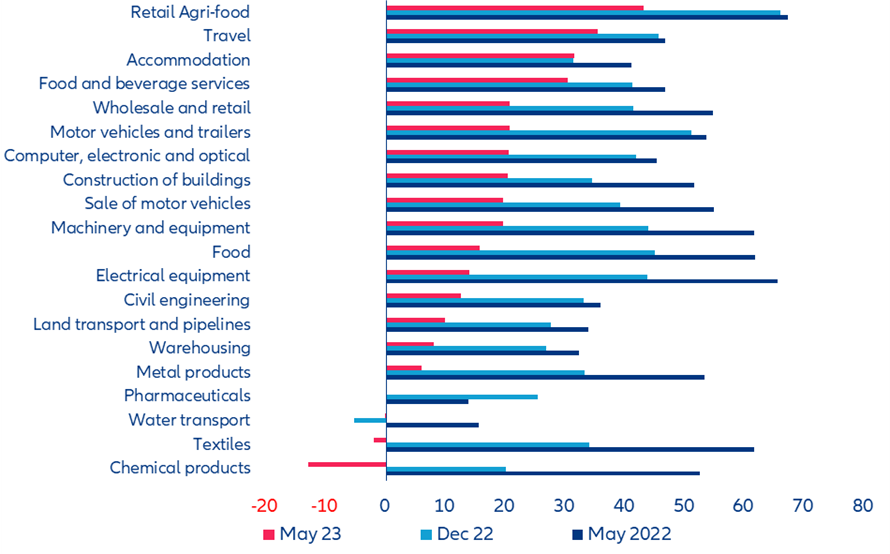

However, in other sectors (food industry, manufacturing, energy and retail), we expect some margin squeeze by the autumn, which should contribute to push down headline inflation toward +4-4.5%, from +5.1% in May. Corporates in the retail and manufacturing sectors already expect to ease their selling prices in the months ahead (Figure 24). While for now cooler selling prices largely reflect sharply lower input prices and the ending of supply-chain disruptions, we expect margins to take a hit from the autumn. Demand for manufacturing goods has been declining since mid-2022 and we expect further falls in the months ahead as goods consumption is typically more sensitive to tighter financial conditions than services consumption. Retail manufacturers in particular will be forced to take a margin squeeze as high inventories need to be depleted. In the food industry and retail, we also expect some margin squeeze amid public and government outcry over elevated margins. This should contribute to the rapid deceleration in food inflation that we expect from end-2023. Lower food inflation will be the main pull-down factor to headline inflation by end-2023, dragging it down by around 1pp between May and Q4 2023.