- Up until 2019, global disinflation pushed down corporate investment.

- However, since 2020, the return of inflation has failed to reverse the trend.

- This is paradoxical because corporates never had it so good in terms of net profit margins, return on capital employed, cost of funding and effective taxation of profits.

- Instead, CAPEX has been dwarfed by cash accumulation, share buybacks and dividends.Alongside sticky long-term inflation expectations, increasing concentration (market power) and subjective factors are the most plausible explanations for the weakness of investment.

- Should this weakness persist, it could backfire on inflation.

Up until 2019, global disinflation pushed down corporate investment; however, since 2020, inflation has failed to lift corporate investment

Changes in inflation reflect demand and supply. So, when global inflation is accelerating – as it has since mid-2020 – the question to ask is whether demand or supply is causing such an acceleration. Undoubtedly, policymakers’ response to the Covid-19 crisis – namely mixing easy monetary policy with expansive fiscal policy – was designed to stimulate demand and has succeeded in doing so. Undoubtedly, too, the Covid-19 crisis, and then the war in Ukraine, have disrupted global supply chains. But beyond these well-known and much-commented-on factors, what about corporate investment? Has it played or could it play a role in fostering inflation by constraining supply?- To shed some light on this important issue, we look at the relationship between headline inflation in the OECD and global net corporate investment. By headline inflation in the OECD, we mean the annual rate of change in the total OECD all items price index. By global net corporate investment, we mean the aggregate net CAPEX-to-EBITDA ratio of the constituents of Refinitiv’s global market indices (see appendices 1 and 2). By net CAPEX, we mean capital expenditures (CAPEX) minus depreciation and amortization.

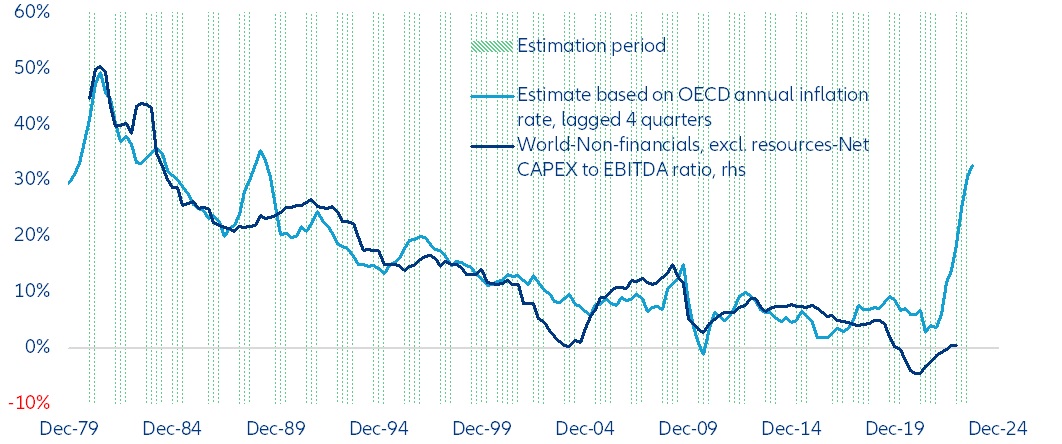

- For non-financials excl. resources, the net CAPEX-to-EBITDA ratio has decreased from 50% in 1980 to -4.5% in Q1 2021. In Q4 2022, it was close to 0%. From 1979 to 2019, the OECD headline inflation rate has consistently led the net CAPEX-to EBITDA ratio by four quarters. During this period, 1pp of annual inflation has been worth on average – four quarters later – 3.2pps of net CAPEX-to-EBITDA. Without any ambiguity, Granger causality tests indicate that, during these four decades, the causality has run from inflation to corporate investment (and not the other way around). In other words, if one wished for more investment, one should first have wished for more inflation.

- With global inflation accelerating from 0.9% to 10.4% since mid-2020, had the past been any guide to the future, the net CAPEX-to-EBITDA ratio should have surged to about 20% by the end of 2022, and should reach about 30% by the end of 2023. But for the time being, higher investment remains to be seen.

The (broken) link between inflation and the net CAPEX-to-EBITDA ratio: waiting for Godot

Sources: Refinitiv, Allianz Research