- Rising political risks have exacerbated an already challenging economic outlook for Italy. Ahead of the snap elections on 25 September, a right-wing coalition comprising the Brothers of Italy, Lega and Forza Italia is currently leading the polls and is likely to secure the parliamentary majority. However, with the more moderate Democratic Party polling at 23%, and possible post-election coalitions not clear yet, a certain degree of uncertainty lies over the outcome.

- Campaign pledges center on expensive fiscal spending, which could put already stretched public finances to the test. To add to this, NGEU-related reforms will require timely implementation to secure the funds.

- Downside risks to the fiscal outlook will increase if the new government “snaps back” to pre-Draghi fiscal profligacy. More spending to shield vulnerable households and firms from the energy-price shock is necessary.

- Current debt dynamics are improving due to high inflation (above 5% also in 2023), but stabilizing debt over the medium and longer terms will require more fiscal effort given the expected slowdown of economic activity; we now expect GDP contract by 0.5% in 2023. While we do not anticipate a repeat of the 2018 fiscal struggles, much will depend on the election outcome and the draft budget for 2023.

- Capital markets have not reacted strongly (given elections were expected at some point). The widening sovereign credit spread relative to the German Bund mostly reflects the general increase in interest rates rather than Italy’s idiosyncratic risk.

Italian elections

Italy’s elections: Snapping back? Fiscal outlook has deteriorated but 2018 repeat unlikely

Right-wing coalition ahead in the polls

Energy crisis weighs on the fiscal outlook

Italy will hold snap elections on 25 September, two months after the coalition government led by Prime Minister Draghi collapsed. The Five-Star Movement triggered the government crisis after withdrawing its support for the planned cost-of-living aid package (worth EUR20bn), which resulted in the coalition’s right-wing parties Lega and Forza Italia abstaining from the subsequent confidence vote in the Italian Senate. The snap elections have been scheduled early instead of during the first semester of 2023 as previously envisaged.

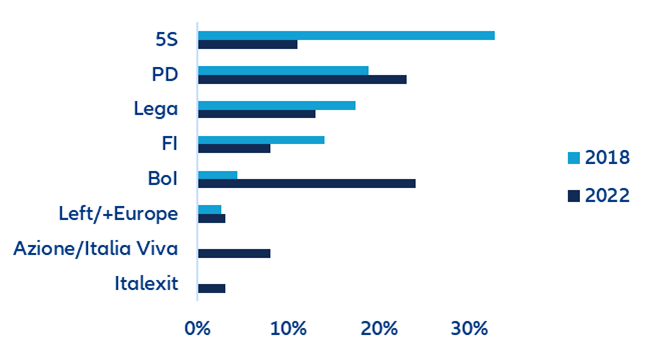

The next government is very likely to be right wing, which could challenge the European agenda. The right-wing “Brothers of Italy” is leading the polls at 24%, followed by the Democratic Party (PD) at 23%, Lega (14%), Five-Star Movement (12%), Forza Italia and Azione + Italia Viva (both 8%) (Figure 1). A coalition formed by BoI + Lega + FI seems the more probable outcome (likely to obtain around 45% of the vote), which is likely to obtain an absolute majority of seats in Parliament, according to the 2017 Italian electoral law. However, the PD can negotiate some support from smaller centrist parties (Calenda’s Azione and Renzi’s Italia Viva), even though establishing lasting relationships has been more challenging, given the presence of far-left support parties. After having lost many MPs during the year, the Five-Star Movement is running alone, and possible alliances remain very unclear and difficult at the moment. Overall, the risk of a hung parliament cannot be ruled out, given the fragmented structure of Italian parties.

The uncertainty over the political direction has added to worries about Italy’s deteriorating economic outlook. We expect a moderate recession starting in Q4 this year, resulting in an economic contraction of 0.5% in 2023 due to soaring energy prices (and broadening price pressures), coupled with deteriorating demand and plummeting confidence. Inflation will remain more persistent and average above 5% next year. Structural headwinds are likely to make for a shallow recovery towards the second half of 2023.

Italy - voting intentions (as of 6 September 2022)