- The increasingly hawkish US Fed has triggered a “reverse currency war” as central banks tighten their stance more than would otherwise be necessary if inflationary pressures were less universal. The combination of tighter global financial conditions and persistently weak risk sentiment favors a substantially stronger US dollar and thus puts increasing pressure on many emerging market (EM) countries with unsustainable external imbalances.

- Eleven larger EMs are at risk of a balance-of-payments (BoP) crisis: Argentina, Chile, Colombia, Egypt, Ghana, Kenya, Tunisia, Pakistan, Hungary, Romania and Turkey. Assuming a global EM BoP crisis would result in strong recessions in these 11 markets, the direct impact on global GDP growth could be up to -0.3pp, while we would expect on balance limited contagion to other EMs.

- Seven of these eleven EMs – Argentina, Egypt, Ghana, Kenya, Tunisia, Pakistan and Turkey – also have an elevated sovereign default risk. In contrast, Chile, Colombia, Hungary and Romania face milder problems, for different reasons, and/or they have extra backstops, e.g. the EU and ECB for Eastern Europe. As a result, we do not expect these countries to default.

- However, significant downside risks could trigger a wider EM crisis: a deeper-than-forecasted global slowdown, China failing to contain its ongoing debt crisis and the consequences spilling over to other EMs or an entrenched energy crisis that keeps financial conditions tighter for longer. According to our initial estimations, if the Fed funds rate remains above 3.5% (or equivalent to 2.5% for the ECB) for longer than a year, we expect a second set of countries to be at risk (including Mexico, South Africa and Poland).

- Even without any increase in the outstanding debt, large EM countries have more than USD75bn in maturing hard currency bonds until end-2023 that they will need to refinance. We project a contained increase for our benchmark for EM USD spreads, with risks tilted to the downside. A the shock from tighter financial conditions (excluding a financial crisis), would increase EM sovereign spreads and BBB corporate spreads by between 0.65 and 1.25 for our set of countries.

Emerging Markets

Reverse currency war puts emerging markets at risk

Financial tightening, slowing growth and rising uncertainty are creating challenges for the most vulnerable countries.

Emerging markets stuck in a “reverse currency war”

The increasingly restrictive US monetary policy stance has had an outsized tightening effect on the rest of the world, with emerging markets (EM) being most affected. Central banks in most EMs started raising rates to counter the effects of rising commodity prices long before the US Fed pivoted to a more restrictive monetary stance. However, the Fed’s more aggressive rate hikes over the last three months to combat more persistent and broadening inflation have amplified pre-existing EM challenges. This month, the Fed proceeded with its third consecutive 75bps hike (to 3.25%) and raised its expectations for the coming year.

The rapid rise of US rates has also led to a considerable appreciation of the US dollar, which has not only squeezed FX-denominated borrowing in EMs but also exacerbated inflation by raising further the cost of commodities, most of which tend to be priced in US dollars. High inflation makes it virtually impossible for EM central banks to let exchange rates rebalance their external imbalances due to higher net capital outflows. Instead, they also need to raise rates to limit imported inflation at the risk of excessively tightening financing conditions. In this situation of a “reverse currency war”, the combination of monetary policy divergence and persistently weak risk sentiment favors a substantially stronger US dollar and puts increasing pressure on EMs, which are left with more serious policy measures, such as intervening in FX markets (or even imposing capital controls).

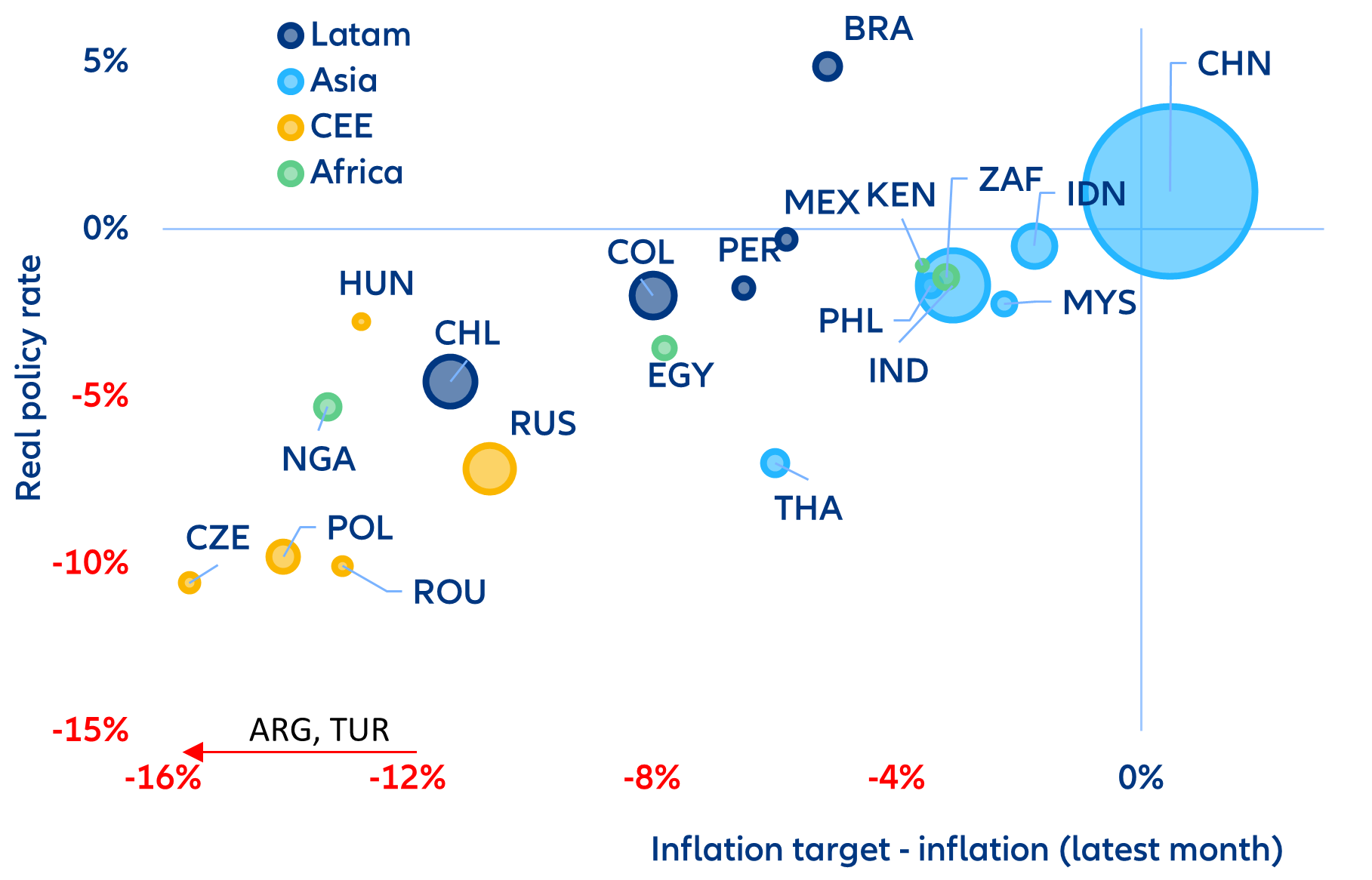

Negative real interest rates across emerging markets

Sources: Refinitiv, Allianz Research

Many developing economies do not have an inflation target, including those with a US dollar-pegged exchange rate, such as the Gulf countries. Bubbles indicated the relative size in terms of GDP.