High food prices: great interest

in Allianz research study

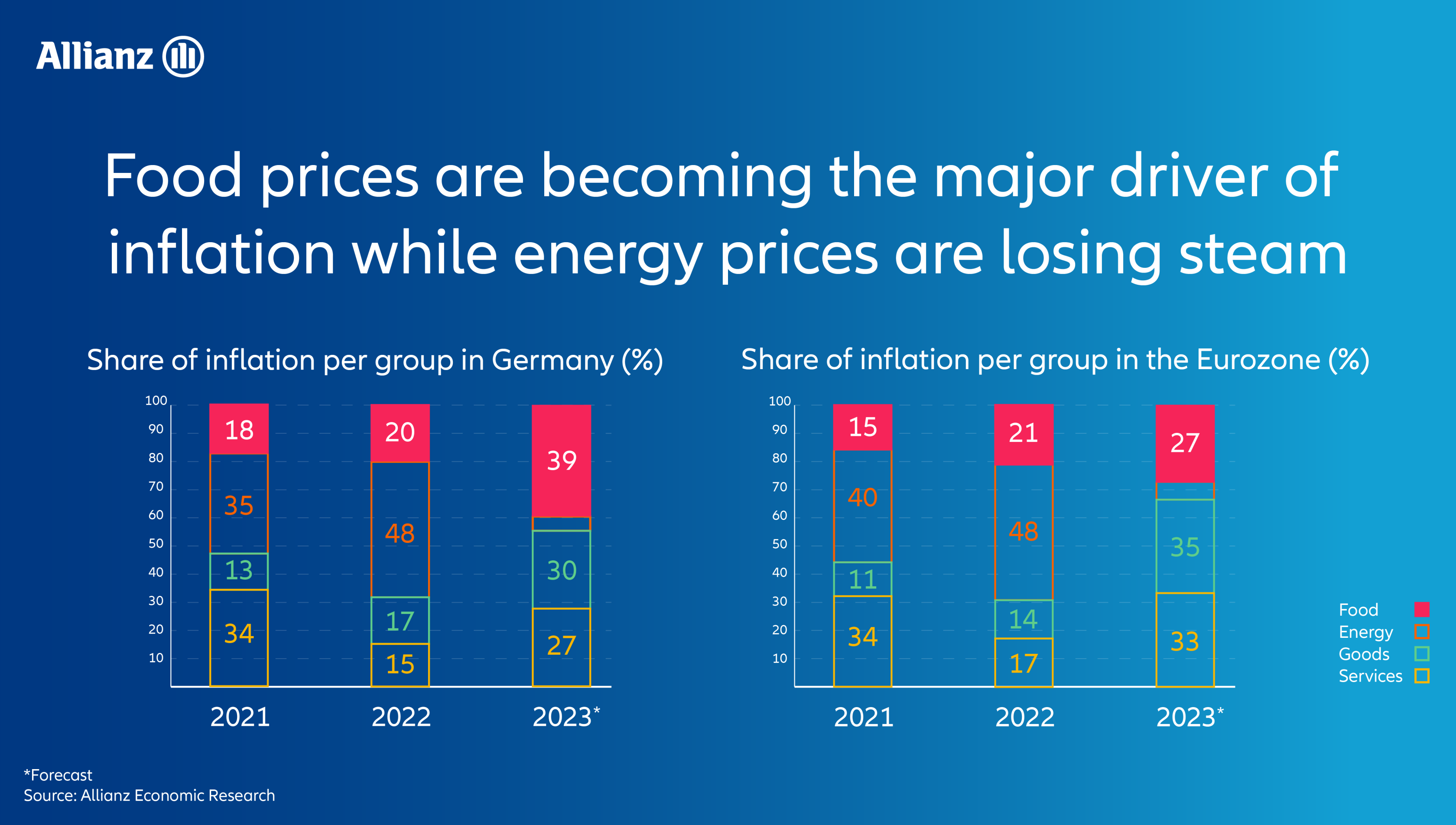

Since the beginning of this year, food prices have become a major driver of overall inflation. They are expected to account for almost a third of inflation in Europe and even more than 40% in Germany - last year it was less than a fifth (which is about twice the historical average). This puts food virtually on a par with energy costs. These in turn are also one of the main drivers behind rising food prices - but not the only one.

Rising operating costs of food producers and retailers seem explain a large part of growing imbalance between upstream raw material and downstream food prices. But our experts also observe that food manufacturers with market power have developed some appetite for reclaiming some lost margin last year by raising prices despite declining input cost (which would suggest the opposite). In fact, they have been raising prices much more than retailers.

Since mid-May 2022, about 10% of the increase in food prices in Europe cannot be explained by historical dynamics, producer and energy prices in our Allianz inflation model," says @Andreas_Jobst. "This is significantly more than before the pandemic and the Ukraine war. Back then, this 'unexplained part' was less than 3%. The situation in Germany is even more glaring: more than a third of the recent rise in food prices cannot be explained by the traditional risk drivers. Admittedly, wages have gone up, but energy prices are at pre-crisis levels. Given traditionally tough competition in food retail, some profit-taking could be one plausible explanation. This is not unusual – during periods of higher inflation, it is easier to push price increases. This time, however, the sheer scale of inflation has made these increases much more visible to consumers. And price increases are rarely undone even when the economy slows.

The topic is on many people's minds right now - accordingly, our study found its way into a wide range of top media outlets, such as Handelsblatt, Die Welt or Der Spiegel, and Andreas has given several interviews on radio, such as SWR Aktuell, and on TV, including the ARD program Monitor, n-tv, Vox News or Austrian Servus TV.

About Allianz

** As of March 31, 2024.

Press contacts

Allianz SE