- The tide has turned for high yield credit. Since mid-April, high yield credit has entered a new decompressing regime characterized by a structural increase in risk premium, with market participants pricing in tightening financial conditions, still elevated geopolitical risk, uncertainty around the future inflation path, a deteriorating growth outlook and increased pressures on corporate balance sheets. Liquidity is also deteriorating: US corporate bond failed trades are now higher than during the initial Covid-19 outbreak, which is consistent with a recessionary/crisis-like environment. However, there is still no clear sign of an upcoming market breakdown.

- The aggregate quality of high yield credit remains relatively strong, with leverage, interest coverage, liquidity and profitability ratios remaining close to their highest levels in decades. This signals that strong cash balances may be able to provide a decent cushion for the asset class at an aggregated level in the mid to long-term. Yet, a timid increase in broad default rates is to be expected.

- Our macro-driven spread decomposition warns about short-term risks but depicts a stabilizing mid-term picture. The possibility of a further economic deterioration paired with the expected tightening in financial conditions and the elevated probability of additional volatility spikes should not provide any strong spread compressing effect in the short run. By year end and into 2023, the combination of declining equity volatility, the loosening of financial conditions and an economic reacceleration should start compressing high yield corporate credit spreads.

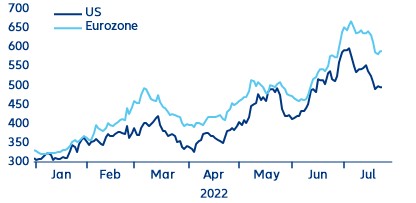

- In our baseline scenario, we expect corporate HY spreads to remain under pressure for the rest of the year with some decompression episodes in the pipeline. In this scenario, we expect the combination of a more dovish policy stance, a better-than-expected economic performance and higher-than-expected corporate resilience to keep spreads close to 500 and 525 for USD and EUR HY credit for the end of 2022 (vs 496 and 591bps for US and EUR HY currently) and to compress to 400 and 425 in 2023. However, if we hit our adverse scenario, we would expect high yield corporate spreads to widen to levels last seen during the onset of the Covid-19 crisis as higher policy rates and inflation will lead to a sharp repricing in defaults and rising credit risk. This initial widening will quickly revert in 2023 as easing monetary policy and fiscal support will kick in again.

Capital Markets

High yield: have the tourists left?

High carry and higher spreads before a U-turn in 2023

High yield credit remains under pressure

The tide has turned in credit markets, especially for the high yield (HY) segment. After widening only moderately until mid-April, despite the historically high rates sell-off, spreads have notably widened (US: +125bps and EUR: +180bps) compared to their respective long-term rates. Market participants have started discounting rising concerns about corporates’ debt-repayment capacity in a recessionary environment. This “new” corporate credit regime is likely to last until the end of the year as the further tightening of financial conditions, especially with the start of quantitative tightening (QT), still elevated geopolitical risk and the uncertainty over the future inflation path and its consequences on growth and corporate margins will keep the asset class in check. Against this backdrop, the prospects of slower demand, as well as the persistent pressure on cost inflation and supply chains, will continue to fuel an elevated dispersion at a single company and sector level, possibly underpinning the performance of the broader market towards year-end.

US and EUR high yield option-adjusted spreads (bps)

Sources: Refinitiv Datastream, BofA; Allianz Research

.jpeg)