- Germany is the only major economy that looks set to contract in 2023, with headwinds such as slowing demand for its exports (particularly highly cyclical goods such as cars, machine tools and chemicals), lopsided global growth in services over goods, the industry slowdown in the US and China and an inventory correction.

- Even if the government's economic plan is a step in the right direction, and will give growth a small boost, it is too small to restructure a EUR4trn economy. Germany struggles with structural challenges, including labor shortages, high energy costs, elevated regulatory and tax burdens, slow digitization and policy uncertainty. To address these, Germany needs measures that strengthen its position as a place to innovate, invest and create high-value jobs.

- While the government must create favorable conditions, companies also need to take countermeasures and actively implement the green and digital transition. The keys to economic revival in Germany are a leaner state and productive investment instead of subsidies. Transformation requires collaboration between the government and the private sector..

Fed’s financial losses matter – a strong incentive to pivot in 2024 if inflation subsides

With inflation and growth picking back up, we expect the Fed to deliver a final rate hike at its November meeting, after pausing in September. The CPI report released on Wednesday showed that inflation picked up to +3.7% y/y in August, a step up driven by higher gasoline prices. Furthermore, the pace of core price increases stepped up, to +0.3% m/m (after +0.2% in the two previous months). The further rise of the WTI price at the beginning of September should delay the pullback in consumer prices. Against this backdrop, the incoming economic data strengthen the expectation that Q3 GDP growth picked up pace through the summer months. Crucially, two powerful channels through which monetary policy is supposed influence aggregate demand

– house prices and bank credit – have picked back up. If sustained, this could prolong above-trend growth and risk re-igniting underlying price pressures. Therefore, on balance, we think that the FOMC participants will press ahead with a 25bps rate hike in November after pausing (as widely expected) at next week’s meeting.

We acknowledge, however, the large uncertainty surrounding this call: in order to further their hawkish stance, FOMC participants could also emphasize their ‘’higher for longer’’ narrative instead of hiking rates

Elevated interest rates are sending Fed’s financial losses into the red. The potential medium-term implications of the Fed making increasingly large financial operating losses are drawing increasing attention. This is the first time since 1915 that the Fed is making losses. Over the past 20 years, it had remitted an average of USD63bn annually to the Treasury. But starting in Q4 2022, the Fed started to make increasingly large operating (as well as unrealized) losses (Figure 1) as the mismatch between what it earns on its assets and what its pays on its liabilities is widening. Indeed, the Fed owns a very large portfolio of securities (mortgage-backed securities and Treasuries) that yield a fixed interest rate. As all of this portfolio – currently about USD7.3trn – was purchased prior to the rise in interest rates in 2022, it yields a very low effective interest rate, a legacy of the pre-Covid era, which we estimate at around 2.27 % in Q2 2023. Conversely, the Fed has to pay a variable, and sharply rising, interest rate on its liabilities (banks’ reserve balances and repurchase agreements): we estimate the effective interest rate on its liabilities to have been around 5.03% in Q2 2023, up from only 0.81% in Q2 2022. The cumulative operating losses stood at USD74bn in Q2 2023 (Figure 1).

Figure 1: Fed’s operating profit/losses, USD bn

Does it matter if a central bank makes losses? The Fed’s cumulated USD74bn losses have already largely outstripped the central bank’s USD42bn in capital. If the Fed was a commercial bank, it would be technically insolvent. But it does not really matter for a central bank to operate with negative equity: For instance, the central banks of Chile or Czechia have carried negative equity for a long time without being hampered in their ability to fulfill their objectives. A central bank’s credibility depends first and foremost on its ability to meet its mandate and sometimes making losses ‘’can be the price to pay for achieving these aims’’ (BIS, 2023).

Large, sustained losses can be problematic in the medium term as they may erode the public’s trust in the institution. However, current times may be different in regard to the size of current and future losses the Fed (and other central banks) are and will be making. Under our assumptions that the policy rate settles at 4.25% (upper band) in end 2024 and 3.25% in end 2025, we estimate that the Fed’s cumulative losses will keep increasing until the middle of 2025 to around USD186bn, or 2.8% of the Fed’s assets, before slowly reducing thereafter as the Fed starts to make profits again (Figure 2). Such large losses could end up drawing the public’s attention and start to erode its trust in the Fed’s ability to fulfill its mandate, including that of maintaining price stability. Indeed, the Fed creates bank reserves to cover operating losses, that is central bank money, which are in principle inflationary. Large losses can thus go against the Fed’s goal of price stability ultimately.

Bank of England – wages, margins and economic activity all say ‘hike’

There are three reasons why the Bank of England’s rates will peak at 6%. First, the tightness of the job market and the risk of a wage-price loop. The rebalancing of the UK labor market is ongoing but remains very slow. Job vacancies have fallen by -24% since their peak, but remain above trend (unlike in Germany, for example, Figure 5).

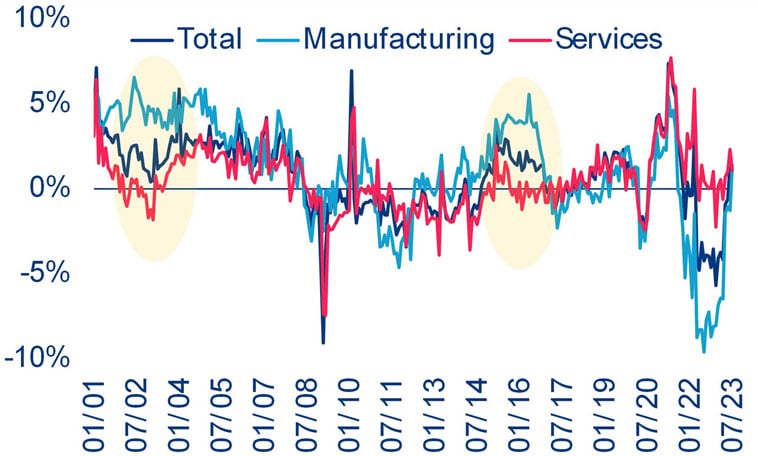

The fall in employment picked up speed (-207K 3m change in July, three times more compared to June) and the unemployment rate remains very low (4.3% in July, +0.1pp from one month earlier). However, despite labor shortages cooling down, there seems to be no turning point in wage growth which still runs above 8% 3m y/y in services and manufacturing, and will probably stay well above the Bank of England’s forecasts of 6.9% in September on average. Total real wage growth has been positive since June, and since April in the services sector (Figure 6).

This is clearly a trend to monitor in the coming months as a wage-price loop could become a real risk if real wage growth is positive during three out of the next four quarters, i.e. until mid-2024. The IMF has identified two such episodes in the past in the UK (2003, 2016), much less than in the US, which has seen six such episodes (1973, 1978, 1987, 1996, 2000 and 2017). Belgium and Germany, where wage growth is also currently very dynamic, have seen four (1999, 2005, 2010 and 2016) and three (1989, 2010 and 2017), respectively. As 2024 is a political year, we expect the minimum wage to be raised by at least another 7% after 9.7% this year, against inflation forecasts of 3.5% and 7% respectively, which means an acceleration in terms of the real wage growth. Total real wage growth is expected to reach a cumulative +3.9pps, compared to -3.1% in 2022 (Figure 7).

Allianz Pulse survey – German Angst

The differences between the generations are not very pronounced, even if the youngest participants (Gen-Z) are generally somewhat less anxious about the future. But even among them the pessimists clearly predominate: net percentage -22.5% vs -25.2% for the entire sample.

What also distinguishes this year's survey is the large discrepancy between the assessment of the general future outlook and that of the personal outlook. While in all years participants tended to see their own future as somewhat rosier than that of their respective countries, the gap was only as large as this year in pandemic times; in Germany, it reached an all-time high this year (Figure 10). The differences between the three countries are therefore no longer so pronounced. This also applies to the generational comparison. Although the "personal gap" is highest in the two younger generations (Gen-Z and Millennials) at around 50pps, it is also very high among the older participants at just under 30pps.

In focus – Germany needs more than a plan

Slowing global demand and a more fragmented global economy are eating into German exports. In the first half of 2023, German exports rose by a total of +3.3% y/y to EUR797.8bn while goods worth a total of EUR699.1bn were imported into Germany. This was 4.3% less than in the first half of 2022. The trade balance is still not back to pre-pandemic levels and with global and especially Chinese demand set to remain lower for longer, the trade balance is unlikely to recover for some time. Overall, German businesses are more susceptible to the fluctuations of the global manufacturing cycle due to the specialization of companies in exporting highly cyclical goods such as cars, machine tools and chemicals. In the past, vertically integrated industrial value chains have proven to be an advantage in global competition and have been able to compensate for some cost disadvantages (i.e. wages, regulation, energy). But now global fragmentation and de-risking have brought an end to this.

Germany also currently faces lopsided global growth in services and goods. Consumers are eager to spend gains in income on services rather than on the kinds of goods that Germany produces. In contrast, countries such as the US, France or Spain are more services-oriented. In Germany, 18.5% of the value added in GDP comes from manufacturing (compared to 9.3% in France or 10.7% in the US), while 62.7% of value added in GDP stems from services (compared to 70.3% in France and 77.6% in the US). German services are mostly based on a vast industry-services network, efficient logistics and customer-specific after-sales services that are mostly connected to manufacturing and do not meet current consumer demand.

In addition, Germany is highly exposed to US manufacturing and the Chinese slowdown. US industrial output has fallen into recession and is expected to contract further in the second half of 2023. German exports have dropped by -11.8% y/y in the first half of 2023 (Figure 12). At the same time, the Chinese post-pandemic reopening has not resulted in stronger demand for imports. Instead, German exports to China fell by -7.9% y/y in the first half of 2023.

Finally, an inventory correction will cause a further fall in manufacturing output. After a more-than-usual increase in inventories when pandemic-related shortages ceased, retailers are now paring back their stocks of inputs and finished goods amid flagging demand. With its huge export-oriented manufacturing sector, Germany will again be hit harder than most other European economies.

Will the government’s latest rescue plan save the day? Some of the cyclical issues are intertwined with more structural headwinds that hold Germany back. These include pervasive labor shortages, excessive energy costs partly caused by misguided energy policies in the past, high regulatory and tax burdens, slow digitization and policy uncertainty. Compared to the troubles of 1995-2004, however, Germany today enjoys record employment, high demand for labor and a rather comfortable fiscal position. That makes it much easier to adjust to shocks. Nevertheless, the current downturn may serve as a wake-up call. While growth-enhancing reforms were blocked until 2002 by the then center-left coalition, the current government shows less resistance and recently put forward a rescue plan. The 10-point economic plan tries to tackle the headwinds and to create stimulus for the economy. The Growth and Opportunity Act makes up the core and complements existing measures to provide tax support for companies and climate-friendly investments. These include an investment premium, tax-loss deduction, improved depreciation terms, a temporary reintroduction of declining-balance depreciation options for movable assets and residential buildings and strengthening tax incentives for research and development. They are expected to result in a tax cut of EUR7bn per year up to 2028. The expanded depreciation options provide a stimulus of EUR500mn specifically for housing construction.

While the plan is a step in the right direction, and will give growth a small boost, it is too small to restructure a EUR4trn economy. Even before announcing the current plan, the government attempted to create some stimulus for investments through industrial policy. But the problem is not a lack of funds, it is the nature of the administration itself. Germany currently has to pay the price of its partially misguided past energy- and managing-rather-than reforming policy choices. As net-zero targets are achieved and energy prices remain higher for longer, a loss of some of energy-intensive industries is inevitable. This will hurt as the chemical and metal industries are among the most research-intensive ones and produce more innovations on average than other industries. As they generate about 20% of industrial value add in Germany and employ about 16% of the industrial workforce, this will have a significant impact on prosperity.

Germany’s transformation process is already in full swing. Companies have begun to leave Germany for locations with cheaper energy. Nevertheless, the German government has proposed an 80% electricity price subsidy for heavy industry (Industriestrompreis), which carries a EUR30bn price tag – though this is not yet decided. It has also drafted subsidy plans for clean production in heavy industry worth around EUR20bn and EUR20bn of subsidies have already been earmarked for chip production plants, of which EUR10bn alone will go to Intel. Yet, it remains to be seen whether this will be enough to drive private investments in Germany, the way investments associated with the Inflation Reduction Act contrary have pushed up new plant investments in the US (Figure 13).

On the positive side, Germany is still strong in patent applications and investments in research and development. But German expenditure has flatlined in recent years. Moreover, a country attractive to founders looks different: venture capital has dropped in recent years and the flatlining of new enterprises and start-ups might be another signal that the attractiveness of Germany as a business location is in decline (Figure 14). In the future, gains in value added will likely stem from sectors not among the traditional strengths of Germany, such as close contact personnel services, software, big data and entertainment. To succeed, Germany will need to make and keep its economy sufficiently flexible to cope with such shifts. Hence, it needs to get its policies right. The Future Financing Act, which allocates EUR1bn annually, aims to facilitate start-up financing and going public while addressing capital market barriers. Additionally, the Promote the Future initiative plans to invest EUR20bn in education and research. However, the effectiveness of these initiatives remains uncertain due to the vague implementation plans.

Germany also urgently needs to cut red tape and accelerate digitization to attract investments. Simplifying regulations, reducing bureaucracy and strengthening administrative capacity are crucial. The government must prioritize faster planning and approval procedures to facilitate economic investments. The current proposal addresses data access and use, pharma clinical trial regulations and the digitization of key administrative services. This is long overdue and essential, particularly in administration. But there are other missed opportunities from the past that Germany also needs to catch up on to address the backlog in digital services.

The skilled worker immigration act, which lowers barriers to skilled immigration, is a positive step to address the labor shortage. Education and research face significant challenges, including insufficient funding and personnel, hindering access to quality education and limiting women's participation in the workforce. Addressing these issues is crucial for Germany's long-term success in fostering innovation and entrepreneurship. However, the skilled worker immigration act would need to be complemented by tax and pension reforms to incentivize domestic labor supply alongside skilled immigration. Automation can help mitigate the skills gap and labor shortage by speeding up processes and utilizing scarce talent. The winning hand is a highly trained, engaged workforce working in concert with cutting-edge technology and automation. While automation can make jobs more inclusive and safer, it can also provide instant and on-demand training. Concerns about job displacement are countered by predictions that new technologies will create more jobs than they eliminate. For instance, the World Economic Forum estimates that by 2025, new technologies will create at least 12mn more jobs than they eliminate.

Expanding trade relations and securing raw material supply are crucial for Germany's green transformation. This provides a great opportunity to recreate Germany's business model in a sustainable manner, but significant investment efforts from both the public and private sectors are needed to shoulder the massive decarbonization task. Germany is at the heart of a promising EU green tech manufacturing base. No other G7 country – or China – exported more green goods than Germany as a share of GDP. The government needs to dare to achieve more green progress and push green technologies as they both support Germany’s path to climate neutrality while benefiting the economy. But change is unavoidable for most companies and industries and the economy needs policies that focus on improving the framework conditions, securing necessary investments for an adequate supply of cheap, low carbon energy and promoting the research and development of new products and services with potential for value add.

Finally, German companies also need to take countermeasures themselves and be open to reforms. They should design work processes in a way that they can react quickly to shocks, and anticipate geopolitical changes and impeding decarbonization. The keys to economic revival in Germany are a leaner state and investment instead of subsidies. Transformation requires collaboration between the government and entrepreneurial action. The government must create favorable conditions, while companies must actively implement the green and digital transition.