Last update – September 2023

Pharmaceuticals

Pandemic-driven revenue growth has faded, but robust pipeline of new medicines will assure growth in the mid-term

Sector rating

LOW RISK FOR ENTERPRISES

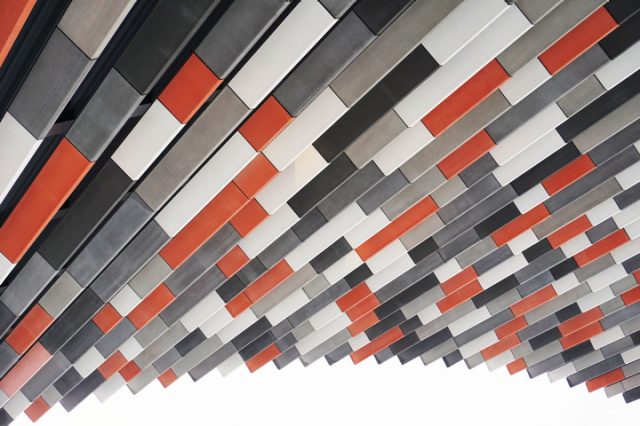

Fragmentation

Internationalization

Capital Intensity

Profitability

Strengths & weaknesses

- Large-scale sector with a wide, stretched market, offering a wide variety of products and services worldwide.

- Low fragmentation: the top 5 players together hold 30% market share, while the top 10 hold 50% of the market.

- High barriers to entry, notably as the sector requires significant investments in R&D as well as highly trained personnel (scientists), which is too costly for new companies.

- Despite the high expenditure in R&D (around 19% of revenues), companies in this sector are able to generate sufficient cash from operations to cope.

- Chronic disease cases have risen globally, making people more dependent on medicines and health supplements, which guarantees demand.

- Access to healthcare has been improving globally, especially in developing regions such as LatAm and Asia.

- Pricing power for treatments that benefit from patent protection since companies that produce generic drugs cannot replicate the formula. In parallel, this allows branded-drug sellers to have larger margins and absorb the inflation effect (higher ingredient prices).

- In order to ensure the safety, efficacy and quality of medicines, the pharmaceuticals sector is highly supervised and controlled, both globally (international standards) and locally (FDA in the US or EMA in Europe).

- Constant competition from generics and biosimilar drug producers as they can offer equally effective products at lower prices. As a result, generic drug-makers are constantly struggling to increase their profit margins.

- Although the approval processes for new medicines have been somewhat simplified in the last few years, they are still complex and lengthy, which delays the launch of new products to the market.

- The biggest players in this sector are American (and some European), which means that access to many medicines is not easy or affordable for people living in developing countries (LatAm, Africa, Asia).

Sector overview

Subsectors

Contact

Maria Latorre

Allianz Trade

Allianz Trade