- Globalization is changing, not dying, but recent crises have raised questions about the structure of global supply chains, and the exposure to geopolitically non-aligned suppliers. The world’s openness to trade has been plateauing since 2008, without showing a clear declining trend. But this overall trend masks the increasing divergence between regions, with stronger regional integration in Asia-Pacific and Africa (weaker in Europe and the Americas), as well as the development of certain technologies and sectors. At the same time, mounting geopolitical tensions are pushing the US and Europe towards reducing their dependence on China. In fact, China already started to lose market share in US imports since 2018 and the trade war, in part to the benefit of Asian competitors. Yet, ‘friendshoring’ is easier said than done.

- We find that computers & telecom, electronics, household equipment, metals, autos & transport equipment, chemicals and machinery & equipment are the most globalized sectors – and most exhibit a strong exposure to China. Together, they account for more than 50% of global trade. The supply provided by China to the rest of the world ranges from 6% (for autos & transport equipment) to 27% (for computer & telecom, electronics, household equipment) of global output in these sectors.

- More importantly, China is a critical supplier for 276 types of goods for the US, and 141 types of goods for the EU. Conversely, the US is a critical supplier to China for just 22 types of goods, and the EU for 188 types of goods. This means that, in an extreme scenario where US-China and EU-China trade relations are completely cut off, the US and Europe have more to lose: The loss of critical supplies would cost 1.3% of GDP for the US and 0.5% of GDP for the EU, but 0.3% of GDP for China. Note that as recently as 2018, the US’ critical dependence on China was around half of what it is today (0.7% of GDP vs. 1.3%).

- Mexico, South Korea, Japan, Vietnam, Indonesia, Brazil and Malaysia could be the best positioned as ‘friendshoring candidates’ for closer trade relations with the US and the EU. But the US and the EU could also look to increase bilateral trade cooperation. With 300 types of goods concerned, the EU actually comes up as the most frequent critical supplier for the US. But in terms of size of imports, these supplies represent just 4% of total US imports – compared with nearly 10% when it comes to US critical imports from China. A free-trade agreement could be an option to close this gap, especially as the EU is becoming very dependent on the US for energy supply (oil and gas).

Globalization 2.0

Can the US and EU really “friendshore” away from China?

Globalization is changing, not dying

After trade tensions that materialized under the Trump administration, the major crises of the past few years – the global Covid-19 pandemic and the ongoing war in Ukraine – have intensified doubts about the future of globalization, and increased scrutiny on supply-chain exposures. However, globalization is not dead yet. While intentions to reshore, friendshore or decouple from geopolitically non-aligned countries (e.g. China) seem to be rising, free-trade agreements are also still being signed and barriers to trade have been declining in 2022.

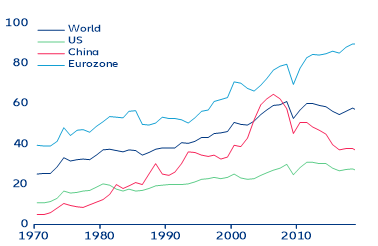

These contradicting trends mean that global trade flows have somewhat adapted to the different shocks, and sometimes reflect structural changes in the global economy. A quantitative measure, i.e. trade as a percentage of GDP, shows that overall globalization seems to be on pause – but it is not retreating. The share increased from 25% in 1970 to a peak of 61% in 2008. Beyond the volatility around the global financial crisis, the timid declining trend observed in the past decade is the result of a very visible decline in the share of trade in China’s GDP (36% in 2019 vs. a peak of 64% in 2006). This latter phenomenon is a natural one in the development path of an economy as it relies increasingly on a maturing domestic market rather than external demand. China’s global export market share has actually kept increasing during this period.

Trade in goods and services, as % of GDP

.jpeg)