Senior Editor at Allianz SE

GenAI in the insurance industry: job killer or job creator?

Senior Editor at Allianz SE

Mixed feelings about GenAI

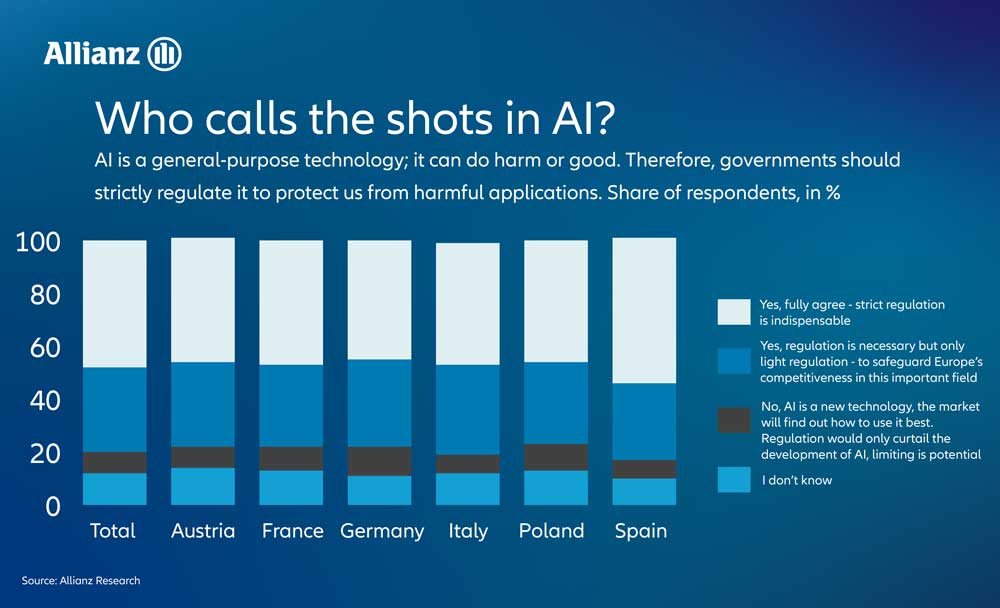

Public sentiment toward GenAI is mixed, leaning to a less optimistic side. Allianz Research’s survey of over 6,000 individuals across six European countries (Austria, France, Germany, Italy, Poland and Spain) showed 36% of participants expressing concerns about AI risks and 46% fearing job reductions. More troubling, 51% believe AI could widen the skills gap and increase inequality, with only 21% optimistic about its economic benefits.

This skepticism contrasts with expert projections. Goldman Sachs anticipates that GenAI could boost global GDP by 7% and lead to a 1.5% annual productivity gain in the U.S. over the next decade. McKinsey forecasts a global economic boost of up to EUR 16-24 trillion. Despite these optimistic predictions, concerns about inequality and job displacement persist.

The job market: Threat or opportunity?

The International Monetary Fund (IMF) expects 60% of jobs to be affected by the GenAI revolution. Allianz Research’s survey found that 46% believe AI will make employees more efficient, leading to job cuts. This belief is stronger among lower-income respondents, with only 27% expecting AI to create new jobs, compared to 42% in higher-income brackets.

However, research suggests GenAI might not cause massive labor dislocation. Instead, AI tools could enhance productivity and bridge the performance gap between high- and low-skilled employees. In a study of 5,179 customer support agents, AI increased productivity by 14% on average, with a 35% improvement for novice and low-skilled workers. This suggests AI could democratize access to skills and reduce wage disparities within companies.

Insurance industry: A data-driven transformation

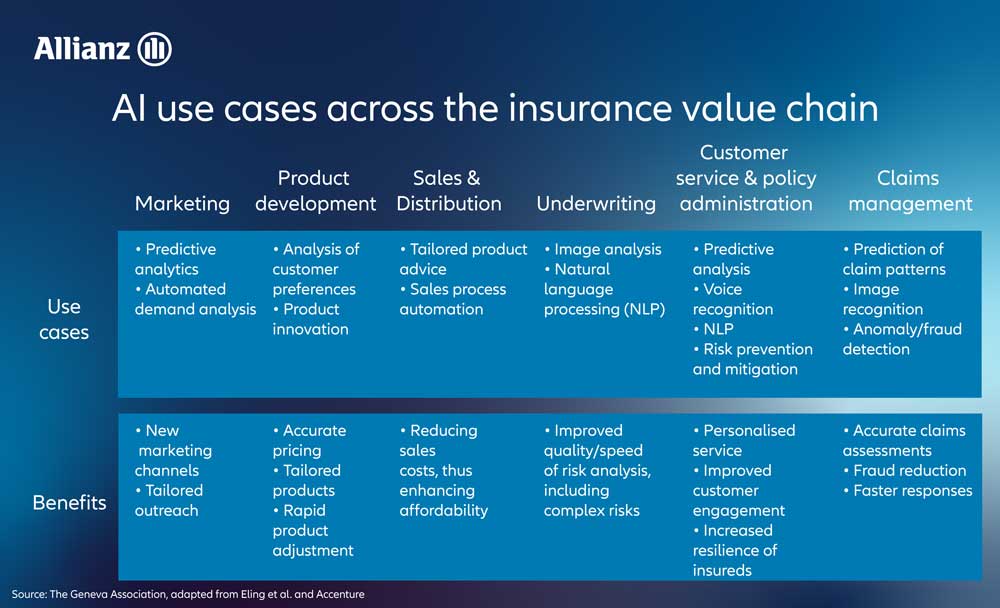

The insurance industry stands to benefit immensely from GenAI. Predictive analytics can enhance marketing strategies and product development, while real-time data analysis can improve risk detection and enable usage-based insurance. Automated processes could streamline customer service and claims settlement, leading to greater efficiency and customer satisfaction.

In addition, economic models suggest the correlation between productivity gains and labor reductions in the insurance sector is modest. A 0.622% increase in productivity would result in only a 1% decrease in labor. Moreover, AI could help tackle the challenge of a shrinking workforce amid aging populations, freeing up labor for reskilling.

Balancing innovation and regulation

GenAI promises significant economic benefits and transformative changes, but it also raises concerns about job displacement and inequality. The path forward will require a delicate balance of innovation, regulation, and societal engagement to ensure the benefits of GenAI are broadly shared.

Read the full report here.

Further information

About Allianz

The Allianz Group is one of the world's leading insurers and asset managers serving private and corporate customers in nearly 70 countries. Allianz customers benefit from a broad range of personal and corporate insurance services, ranging from property, life and health insurance to assistance services to credit insurance and global business insurance. Allianz is one of the world’s largest investors, managing around 761 billion euros* on behalf of its insurance customers. Furthermore, our asset managers PIMCO and Allianz Global Investors manage about 1.9 trillion euros* of third-party assets. Thanks to our systematic integration of ecological and social criteria in our business processes and investment decisions, we are among the leaders in the insurance industry in the Dow Jones Sustainability Index. In 2024, over 156,000 employees achieved total business volume of 179.8 billion euros and an operating profit of 16.0 billion euros for the Group.

* As of September 30, 2025.