Member of the Board of Allianz

Connected Platforms will make insurance of the future ultra-personalised

Member of the Board of Allianz

Don’t get me wrong. A strong focus on technology and processes often means greater efficiency, which should enable quicker and more satisfying responses for customers. However, the wrong emphasis may lead to a ‘can’t see the forest of the customers through the trees of the workflows’ scenario. Efficiency should never come at the expense of the people whom those processes are designed to serve.

For this reason, legacy systems have proven to be a stubborn obstacle for insurance. Whereas our industry was the first to adopt many of the early cutting-edge computing powers more than a half-century ago, the hard-to-update IT infrastructure and overly complex processes hardly meet people’s expectations of delightful, intuitive customer service. And adopting emerging technologies alone cannot resolve the challenges. Automating inefficient processes bakes these flaws into the system.

No customer can afford to be frustrated, especially when they are relying on our services during some of the most vulnerable moments of their lives. At these times, they need more than just streamlined processes – they need compassion, reliability and holistic solutions that prioritise their well-being and safeguard their interests.

Customer-centricity as the radical idea

We must reimagine the insurance industry. This means removing friction from our customers’ lives and delivering the most relevant solutions to them. The sector’s future hinges on embracing this challenge, for if we fail to act boldly, we risk becoming irrelevant and will fail to forge growth in a landscape increasingly full of disruptors.

One could argue that the first step to reimagining insurance is to streamline operations—clarifying and refining workflows, eliminating inefficiencies, and building a strong, efficient foundation. However, true transformation goes beyond processes; it demands customer-centricity at its core.

Processes must be designed from the customer’s perspective, not the other way around. Customer-centricity is a radical idea for the insurance industry, which has long been reliant on distribution channels that disintermediated it from its end customers. But now, thanks to emerging technologies, this state is now within reach.

Industries like retail and hospitality have long set the benchmark for such experiences, and insurance must catch up or risk alienating our customers. This means insurers must focus not only on solving risks and problems but also on anticipating them – providing solutions before customers even realise they need them.

At Allianz, we refer to such predictive, intuitive solutions as Connected Platforms – these leverage emerging technologies to integrate data and services to create seamless, ultra-personalised experiences. With AI-powered communication and real-time data sharing available across devices and service providers – from healthcare to travel, motor repair, home and cyber protection – Connected Platforms redefine how individuals and businesses interact with insurers.

What if total peace of mind were a click away?

For instance, imagine this: your long-planned family holiday is disrupted by a health emergency. Instead of scrambling for help, your insurer steps in immediately not only as a claims provider but as an end-to-end concierge, arranging medical support, securing hotel accommodations and updating your travel plans – all without you lifting a finger.

Or imagine being warned of an incoming heatwave or fire by your insurer who provides proactive advice and practical tools to protect you, your home and your loved ones. Or if after devastating floods, your insurer provides de-humidifier services once the waters recede to protect the value of your home against mold. How would your perception of insurance change if it offered this level of ultra-personalised care across any channel you choose?

This isn’t speculative. Allianz is already delivering these solutions. Take, for example, how our platforms manage a car accident in Germany. Automatic detection technology can recognise an incident in real-time and trigger immediate assistance from Allianz Direct, Allianz Partners and Solvd, an independent, market-neutral company specialising in end-to-end motor claims and repair management solutions.

A well-being check ensures the customer is unharmed, while roadside repair and rental services are dispatched proactively. For minor damage, customers can upload photos, receive repair estimates instantly and book appointments – or opt for cash settlements in under 60 seconds. Need medical advice? Our clients can remotely check their symptoms with Allianz Partners’ telehealth services.

This is the promise of connected platforms: removing friction, simplifying lives and delivering with a single touchpoint that which assists our customers the most when the unexpected hits hard.

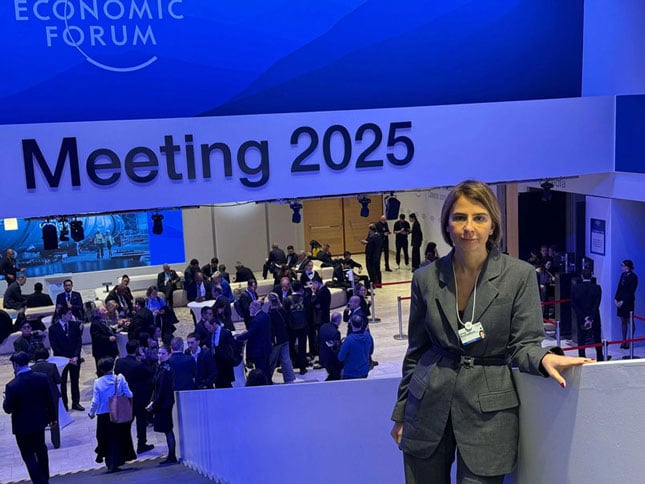

Expanding partnerships at Davos 2025

The World Economic Forum (WEF) in Davos offers an unparalleled opportunity to engage with global leaders, innovators and changemakers to shape the future of industries and societies. The event is perfectly timed to build on the momentum of Allianz’s recent Capital Markets Day, during which we presented the transformative potential of Connected Platforms to our analysts and investors.

These platforms, however, cannot exist in isolation. They rely on strong partnerships to deliver seamless and integrated services. The ability to partner is a special skill. The pinnacle of our Connected Platforms is the successful collaboration between Allianz and our partners, whose combined expertise and solutions create a comprehensive service network tailored to meet customer needs.

At Davos, we aim to deepen our relationships with partners and explore new cross-sector collaborations. This means engaging with leaders in mobility, healthcare and emerging technologies to advance the Connected Platforms initiative. By fostering partnerships, Allianz can broaden the scope of our solutions and integrate more services that anticipate and address customers’ everyday needs and critical moments.

From trust to transformation

Without transformation, our industry risks irrelevance and stagnation in a world where customer expectations are rising dramatically. Fortunately, established companies like Allianz are well-positioned to lead this change. Over the past years, we have gained valuable experience with emerging technologies and have the robust technological foundation to create seamless, end-to-end customer experiences. Our global footprint and deep expertise in local markets allow us to deliver tailored solutions that resonate with customers everywhere.

These strengths position us to succeed in a new era where emerging technologies combined with genuine care can build trust, deepen relationships and redefine insurance as a force for resilience and positive change.

Further information

About Allianz

The Allianz Group is one of the world's leading insurers and asset managers serving private and corporate customers in nearly 70 countries. Allianz customers benefit from a broad range of personal and corporate insurance services, ranging from property, life and health insurance to assistance services to credit insurance and global business insurance. Allianz is one of the world’s largest investors, managing around 761 billion euros* on behalf of its insurance customers. Furthermore, our asset managers PIMCO and Allianz Global Investors manage about 1.9 trillion euros* of third-party assets. Thanks to our systematic integration of ecological and social criteria in our business processes and investment decisions, we are among the leaders in the insurance industry in the Dow Jones Sustainability Index. In 2024, over 156,000 employees achieved total business volume of 179.8 billion euros and an operating profit of 16.0 billion euros for the Group.

* As of September 30, 2025.