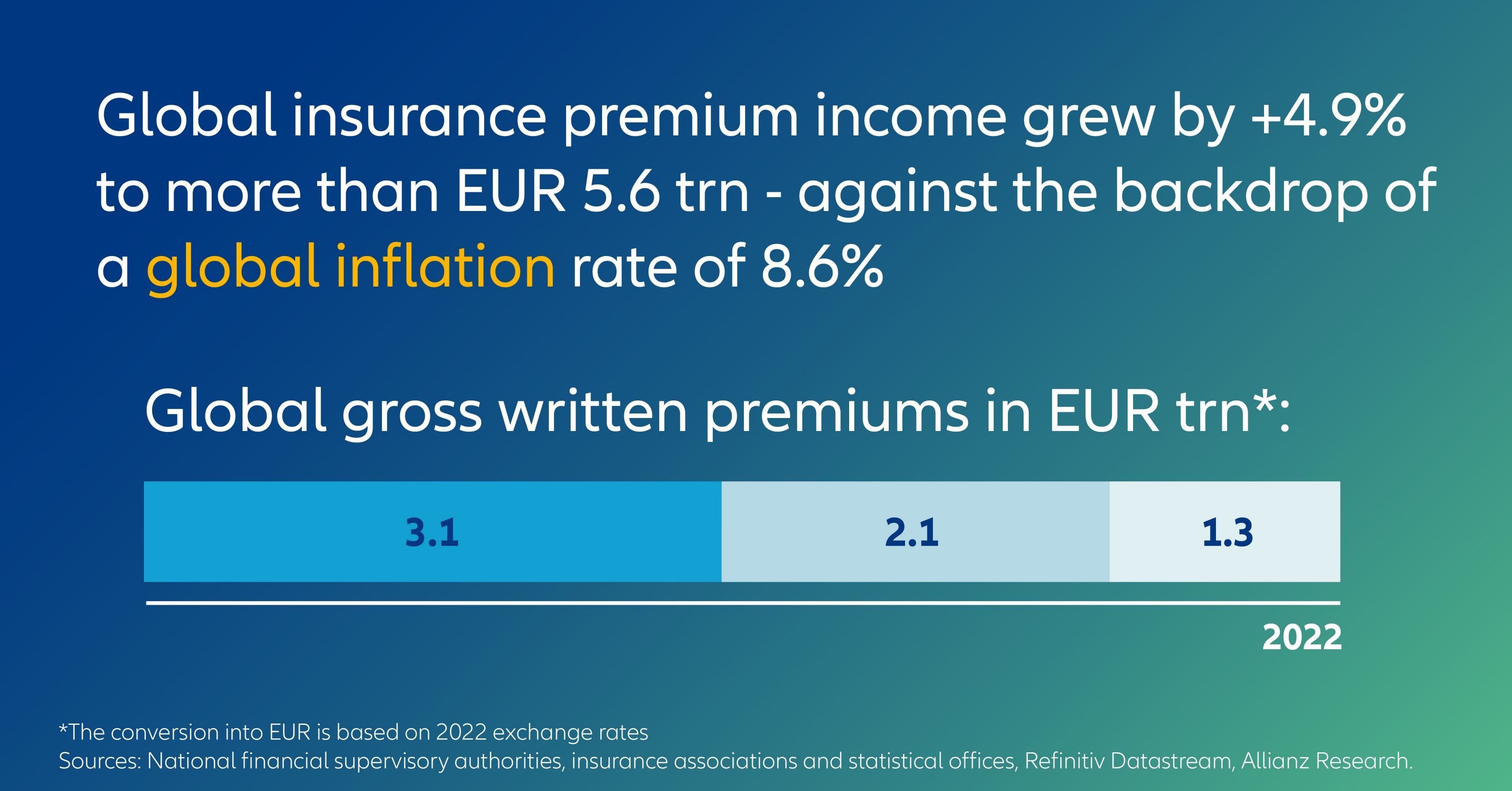

- Strong industry growth: The global insurance industry achieved significant growth in 2022, with premiums reaching a record high of over 5.6 trillion EUR.

- Resilience in turbulent times: Despite economic challenges, the insurance industry has shown resilience in the face of shocks, acting as a buffer and providing stability during times of high inflation and low growth.

- Long-term challenges: Demographics, deglobalization, decarbonization, digitalization, and debt pose long-term challenges for insurers, impacting inflation and requiring adaptability in a volatile economic environment.

- Future outlook: Premiums are expected to increase over the next decade. Technological advancements and challenges will reshape the industry.

- Shock absorber: Insurers play a crucial role in addressing these challenges because insurance is an essential shock absorber, as it flattens the curve of the economic cycle for its customers.

Insurance is a vital shock absorber in uncertain times

When the Great Fire of London caused the destruction of more than 13,000 buildings in 1666, it prompted the establishment of insurance offices with the purpose of safeguarding properties against similar disasters. Insurance was to mitigate the strain that significant occurrences could impose on an individual. Insurance plays a vital role in our lives and provides, according to research, peace of mind, by reducing stress and cortisol levels. It goes beyond serving just as a safety net since it also alleviates anxiety by assuring individuals that they are protected.

It is therefore worth looking at the health and performance of the industry as a whole. How resilient is the industry in face of economic and geopolitical shocks and what future challenges does it face? The newly published Allianz Research’s Global Insurance Report 2023 takes a closer look at the industry’s performance and charts the future developments against the backdrop of a volatile economic environment.

Key takeaways:

Strong growth in 2022

Navigating higher interest rates and inflation

The economic outlook for the next few years is centered around normalization characterized by slow growth rates. The economic environment will require adjustments, particularly in response to geopolitical tensions.

In the short- to medium-term, the most significant impact on growth is likely to come from changes in interest rates, potentially leading to financial market dislocations. Despite some turmoil, the banking system as a whole has been relatively resilient due to tighter regulations, but remaining weaknesses in the regulatory framework need to be addressed promptly.

Despite ongoing efforts to combat inflation, further rate hikes cannot be excluded due to persisting inflation. This means that real household incomes will remain under pressure, impacting private consumption. In 2023, both inflation and interest rates will continue to influence economic development, leading to extremely low growth figures for this and the following year.

Though insurers have tools to mitigate inflationary impact, navigating such an environment remains challenging. Slowing growth, declining real incomes, investment cutbacks, price corrections, and market turbulence impact new business and investments.

Looking ahead to long-term outlook, five structural drivers, referred to as the "Five Ds" (demographics, deglobalization, decarbonization, digitalization, and debt), will determine inflation. These trends have inflationary effects due to factors like wage pressures, increased input costs, rising CO2 prices, digitalization's market power, and rising debt. Demographics, deglobalization, and debt pose the highest inflationary pressure over the long term. For insurers, this means that managing their balance sheets becomes more challenging in a volatile economic environment with frequent policy changes and interventions.

Future brings change

Despite higher inflation—or perhaps precisely because of it—premiums are set to increase by 5.2% over the next decade, adding 4,190 billion EUR to the global premium pool, with the majority of it located in the life segment.

In the life segment, the annual growth of +4.7% over the next decade is likely to lag well behind general economic growth of +5.2%. Insurance penetration will thus fall by 0.3 percentage points to 2.8%. Asia is set to continue driving growth in the worldwide life business, with an estimated annual growth rate of +7.5% (excluding Japan). The region is anticipated to contribute approximately 50% of the overall premium growth. This figure surpasses the combined premium growth of North America and Europe combined.

Significant changes are on the horizon for the life business, impacting all aspects of the value chain and the overall business model. The technological advancements, particularly in customer interactions, will require adaptation. Amidst these changes, insurers must not lose sight of their social relevance in providing additional private and capital-funded protection to address demographic shifts and the limits of public pension systems.

The P&C segment is expected to have an annual growth rate of +5.0%. This growth rate is similar to the previous decade and general economic growth. Similar to the life segment, Asia (excluding Japan) will be the primary region driving growth.

Changes are anticipated in the P&C segment as well, particularly in the motor business with the rise of new mobility services that will reshape the industry. Additionally, the P&C segment will face increasing risks associated with the climate crisis and emerging technologies. Efforts to mitigate climate change will require significant investments and a greater need for risk protection.

“Preserving its social relevance, the industry is facing a fundamental change in its business model,” said Patricia Pelayo Romero, co-author of the report. “The value proposition of insurers will evolve, from pure financial compensation to risk management and holistic service offerings to prevent and mitigate risks.”

The health segment is expected to grow by +6.7%, surpassing the growth rates of other segments. The majority of new premiums, around 60%, will still be generated in the U.S.

Similarly to other segments, the health insurance industry will undergo significant technological changes in the coming years. Risk management and prevention are also key focuses for the segment. However, the most significant change and challenge in the health segment stems from advances in medicine itself. Individualized treatments will become more prevalent, raising questions about costs and access. Inequality in healthcare could worsen, as recently reported by Edelman as well. The health insurance industry faces a crucial role in addressing this challenge and living up to its social responsibility by promoting inclusivity and ensuring broad access to medical progress.

“Insurance proves its worth in turbulent times of high inflation and low growth,” said Ludovic Subran, chief economist of Allianz. “The insurance industry cannot undo inflation, but it can smooth out the impact over time, acting as a kind of buffer. According to Eurostat, for instance, inflation in personal P&C insurance like motor and property trailed headline inflation by a wide margin last year. Insurance is an essential shock absorber, as it flattens the curve of the economic cycle for its customers.”

Read the Global Insurance Report 2023 in detail here.

About Allianz

The Allianz Group is one of the world’s leading insurers and asset managers with around 97 million customers* in nearly 70 countries. Allianz customers benefit from a broad range of personal and corporate insurance services, ranging from property, life and health insurance to assistance services to credit insurance and global business insurance. Allianz is one of the world’s largest investors, managing around 764 billion euros** on behalf of its insurance customers. Furthermore, our asset managers PIMCO and Allianz Global Investors manage about 2.0 trillion euros** of third-party assets. Thanks to our systematic integration of ecological and social criteria in our business processes and investment decisions, we are among the leaders in the insurance industry in the Dow Jones Sustainability Index. In 2025, over 156,000 employees achieved total business volume of 186.9 billion euros and an operating profit of 17.4 billion euros for the Group.

* Customer count reflects Allianz customers in consolidated entities that are part of the customer reporting scope only.

** As of December 31, 2025.