Weatherproofing Your Retirement

Why Allianz Life US is Highlighting Extreme Weather as a Critical Consideration in Long-Term Financial Strategies

According to the 2024 Annual Retirement Study* from Allianz Life Insurance Company of North America, 82% of Americans would like a financial plan that addresses the growing costs and economic risks of extreme weather. Based on the findings of this research, Allianz Life has launched an innovative campaign to help financial professionals and their clients address these concerns in their long-term financial planning. In the following interview Lorinda Niemeyer, Head of Sustainability at Allianz Life, explains the thinking behind the new campaign.

At Allianz Life, we focus on helping Americans manage risk as part of their retirement strategy, including emerging risks that may not yet be part of the traditional retirement nest egg conversation. Economic risks and costs that can derail a retirement strategy – like inflation, market volatility and increasing health care costs – remain relevant.

But beyond these, the data is also clear: extreme weather is becoming more frequent, intense, and costly. We see headlines about extreme weather almost daily in the news, but there’s relatively little attention to how it directly impacts individual finances, retirement savings, and even health and well-being. This means we also need to factor in rising costs and other risks associated with extreme weather, such as skyrocketing homeowners’ insurance rates, that can also quickly erode retirement savings.

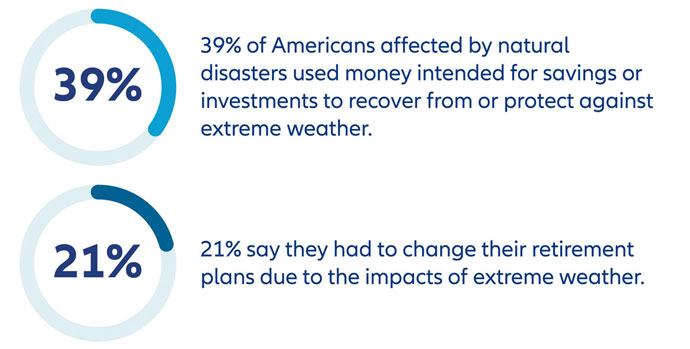

This is not just theoretical. In our study, nearly two in five (39%) Americans affected by a natural disaster used money intended for savings or investments to recover from or protect against extreme weather. Of those affected by a natural disaster, 21% had to change their retirement plans due to the impacts of extreme weather. Holistic, long-term planning is key to any solid retirement strategy, and anticipating the costs associated with extreme weather events should be part of the plan (see Graph I).

Extreme weather is increasingly impacting everyone everywhere, but it can take a particularly high emotional, health and financial toll on retirees. No matter which planning stage you are in and where you live, a financial plan should factor in the rising costs associated with increasingly extreme weather, including insurance, taxes, energy, and construction upgrades. Beyond these ongoing costs, the immediate costs of extreme weather can include paying for evacuation motel stays, recovery and re-construction, and even medical expenses.

For anyone, these costs can be a burden. But, for retirees on a fixed income, they can be financially devastating. Those who are still in the workforce can generate new income to help cover these unplanned expenses, but retirees may have to unexpectedly draw from their limited nest eggs. In the longer term, property values may also decline, which can jeopardize retirees who rely on real estate equity as part of their retirement funding.

Location is another consideration when thinking about the impact on retirees. While many parts of the U.S. are increasingly exposed to extreme weather events, this is particularly so in many target retiree destinations like Florida and the Southeastern and Southwestern U.S. For example, the cost of homeowners’ insurance increased by 35% across the U.S. from 2021 to 2023, according to the 2023 Policygenius Home Insurance Pricing Report. In Florida, over that same time, it surged by 68%. These costs are difficult to absorb if retirees haven’t planned for them.

This is why at Allianz Life US we focus on helping people create holistic retirement strategies that address the risks and financial costs of extreme weather, in order to protect their financial well-being and overall lifestyle, now and well into the future.

It’s not unlike how a financial professional can help his or her clients prepare for and address other risks, like inflation or rising health care costs. Some questions that retirees might ask, include:

- Where will I retire, and which extreme weather risks might I be likely to experience? For example, does this include preparing for extreme heat, flooding, wind, wildfires? Several tools exist that highlight for a given address which events are most likely (one of these is Allianz’ GloRiA-tool).

- How could the weather affect my health or even healthcare costs? For example, could increasing heat pose a risk to my health, or am I comfortable evacuating or waiting out a natural disaster at home?

- What other expenses and potential cost increases do I need to plan for? For example, are there building codes to address or housing upgrades to plan for, or rising costs related to insurance?

However, comprehensive answers always depend on your individual circumstances. So, please make sure to consult your financial advisor to help you address these questions.

Further information

About Allianz

The Allianz Group is one of the world's leading insurers and asset managers serving private and corporate customers in nearly 70 countries. Allianz customers benefit from a broad range of personal and corporate insurance services, ranging from property, life and health insurance to assistance services to credit insurance and global business insurance. Allianz is one of the world’s largest investors, managing around 761 billion euros* on behalf of its insurance customers. Furthermore, our asset managers PIMCO and Allianz Global Investors manage about 1.9 trillion euros* of third-party assets. Thanks to our systematic integration of ecological and social criteria in our business processes and investment decisions, we are among the leaders in the insurance industry in the Dow Jones Sustainability Index. In 2024, over 156,000 employees achieved total business volume of 179.8 billion euros and an operating profit of 16.0 billion euros for the Group.

* As of September 30, 2025.