By Ivana Kovacevic

Senior Editor at Allianz SE

Video: Nicolas Roa Santofimio

Infographic: Wilson Gotardello Filho

Additional contributors: Helena Rauch

By Ivana Kovacevic

Senior Editor at Allianz SE

Video: Nicolas Roa Santofimio

Infographic: Wilson Gotardello Filho

Additional contributors: Helena Rauch

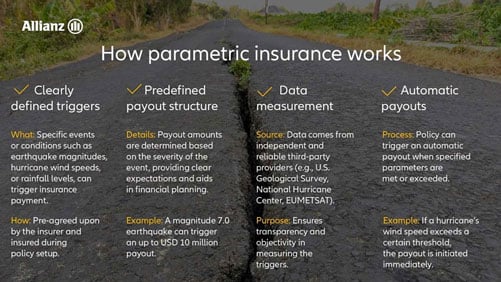

Parametric insurance offers several key benefits:

A notable example of Allianz’s parametric insurance application is the support given to UNICEF’s (United Nations Children's Fund) program. This arrangement uses the Children Cyclone Index to activate funding based on cyclone intensity and the potential impact on children, ensuring necessary measures are in place to protect them during such events. This innovative index combines meteorological data on wind speeds with demographic information to assess the vulnerability of children in affected areas.

“This is a great example of how Allianz can support aid agencies responding to those in need when an extraordinary disaster occurs, removing uncertainty about the financing in critical times,” says Grant Maxwell, Global Head of Alternative Risk Transfer (ART) at Allianz Commercial.

In Colombia, unpredictable weather threatens avocado and coffee crops, vital to the rural population. “Less than 3% of the more than seven million arable hectares in the country are insured against climatic eventualities,” says Esteban Delgado, Managing Director, Allianz Commercial, Colombia. “Crop failure can spell financial disaster for farming families.”

Allianz’s parametric agricultural insurance solution uses satellite data to monitor rainfall and trigger payouts when levels threaten crops. “Our own capital and sometimes credit is invested in our farms,” says Yovani Rodriguez, a local farmer. “By having this insurance in place, we know that when we are hit by damaging weather, our investments can be protected, if not 100%, then certainly in large part.”

So far, the insurance has protected over USD 1.5 million in investments, covering 390 hectares across 45 municipalities. Allianz's innovative solutions, developed with partners like Bancolombia, highlight the company’s commitment to sustainability. “Parametric solutions offer great potential to address the ‘protection gap’—the disparity between economic losses and insured losses,” says Lena Fuldauer, Global Sustainability and Resilience Lead at Allianz Commercial.

In Ivory Coast, Allianz's weather insurance utilizes the ESA Soil Water Index to provide critical coverage against drought and excessive rainfall. This advanced approach uses real-time soil moisture data to trigger automatic payouts, offering timely financial support to local cocoa farmers. Marcel Stäheli, Client Manager and Underwriter of Agriculture at Allianz Re, notes, "The precision of this technology ensures that our farmers can continue their work with confidence, knowing they are supported by robust, responsive insurance solutions."

This innovative insurance significantly impacts local economies by enabling farmers to secure loans and maintain productivity. In 2022, Allianz Côte d’Ivoire sold 444 policies with the help of OKO Finance, and by early 2023, the number already reached 1,015. By providing a reliable safety net, Allianz helps farmers invest in better agricultural practices, boosting productivity and income stability.

Ghana has experienced more than 30 major floods since 1955, severely affecting more than 4.5 million people. The 2015 flood in Accra was particularly devastating, causing 150 deaths and US$55 million in infrastructure damage. In response, a Tripartite Project, co-led by Allianz and co-funded by the InsuResilience Solutions Fund, has been established to develop a parametric flood insurance solution to quickly re-establish economic activity in low-income urban areas. The centerpiece of the project is a satellite-based Flood Footprint (FFP) Cover as the primary solution, with a basic Excess Rainfall Cover as a backup.

Launched in June 2022, the project aims to increase Ghana's climate resilience by providing tailored parametric flood insurance for the capital city of Accra, with an estimated benefit to approximately 1.6 million policyholders. The United Nations Development Programme (UNDP) is supporting the Ghanaian government in developing a contingency plan to ensure payouts are used effectively. The government is expected to decide on product implementation and launch by Q4 2024.

While parametric insurance offers numerous advantages, it is not without its challenges. Alongside scarce education and awareness, which refers to a situation in which the payout may not match the actual loss experienced, remains another often-cited concern. Addressing this involves carefully designing insurance triggers which more closely match the expected potential damages.

The success of parametric insurance is also dependent on the accuracy and reliability of data used to set triggers. To ensure data accuracy and reliability, Allianz works with trusted global data providers.

As the global landscape evolves, so does the spectrum of risks faced by businesses and communities. Allianz recognizes this shifting paradigm and continues to explore the potential of parametric insurance further.

The Allianz Group is one of the world’s leading insurers and asset managers with around 97 million customers* in nearly 70 countries. Allianz customers benefit from a broad range of personal and corporate insurance services, ranging from property, life and health insurance to assistance services to credit insurance and global business insurance. Allianz is one of the world’s largest investors, managing around 764 billion euros** on behalf of its insurance customers. Furthermore, our asset managers PIMCO and Allianz Global Investors manage about 2.0 trillion euros** of third-party assets. Thanks to our systematic integration of ecological and social criteria in our business processes and investment decisions, we are among the leaders in the insurance industry in the Dow Jones Sustainability Index. In 2025, over 156,000 employees achieved total business volume of 186.9 billion euros and an operating profit of 17.4 billion euros for the Group.

* Customer count reflects Allianz customers in consolidated entities that are part of the customer reporting scope only.

** As of December 31, 2025.