Key principles

Remuneration is designed to be appropriate compared to peers, given Allianz Group’s range of business activities, operating environment, and business results achieved. The aim is to ensure and promote sustainable and value-oriented management of the Company that is in line with the corporate strategy. The key principles of Board of Management remuneration are as follows:

- Support of the Group’s strategy:

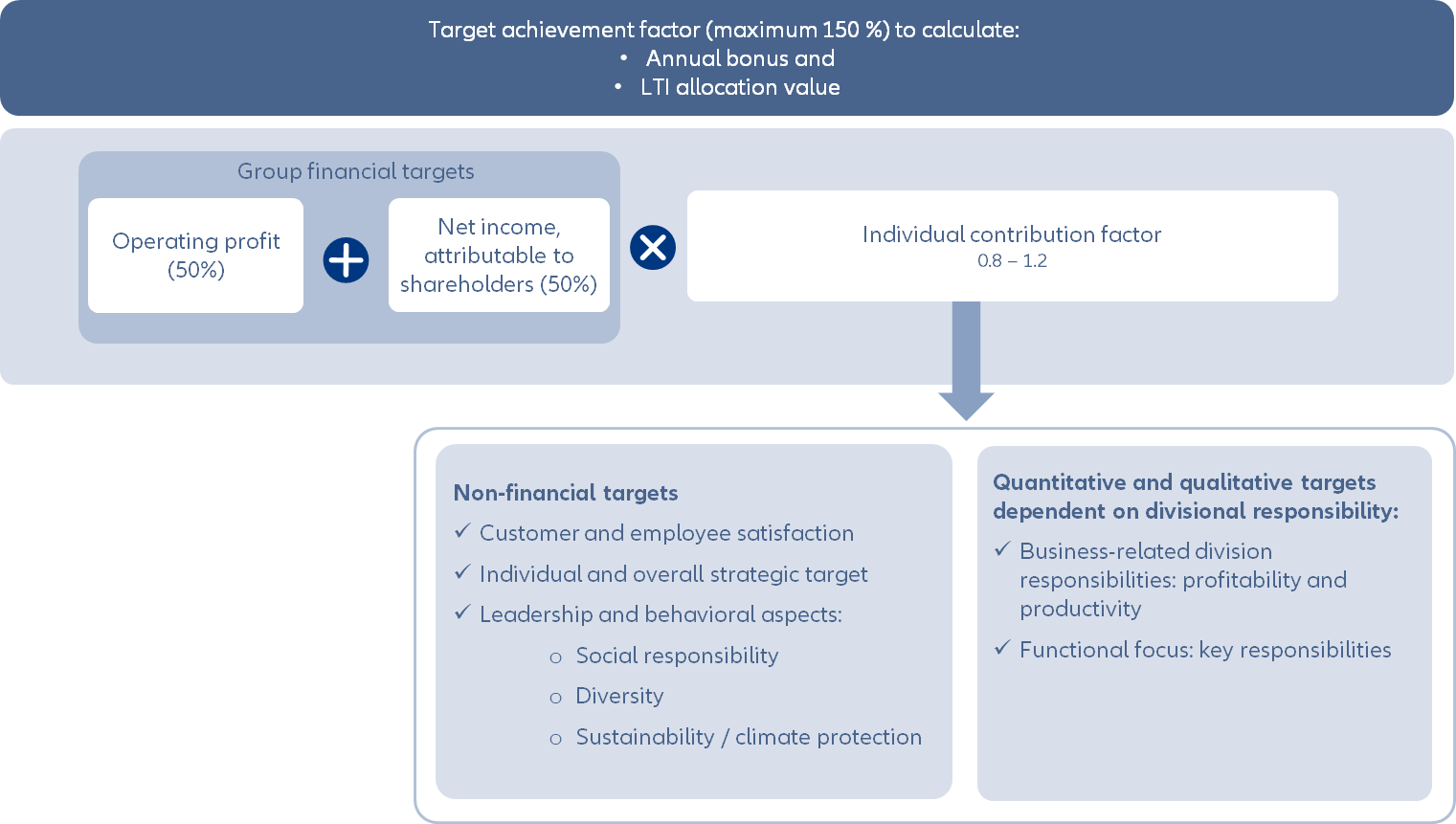

The design of variable remuneration and in particular of performance targets reflects the business strategy and sustainable long-term development of Allianz Group.

- Alignment of pay and performance:

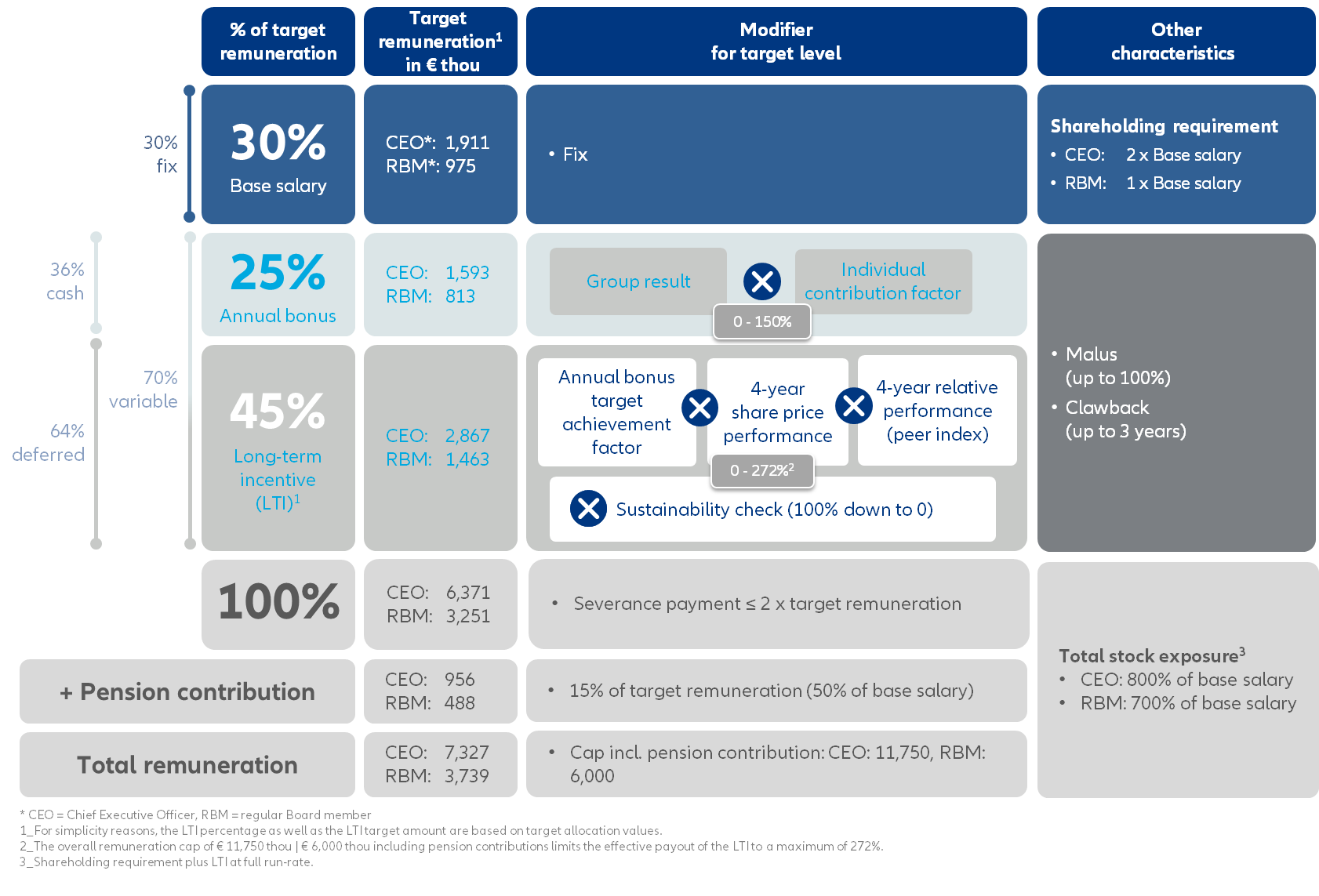

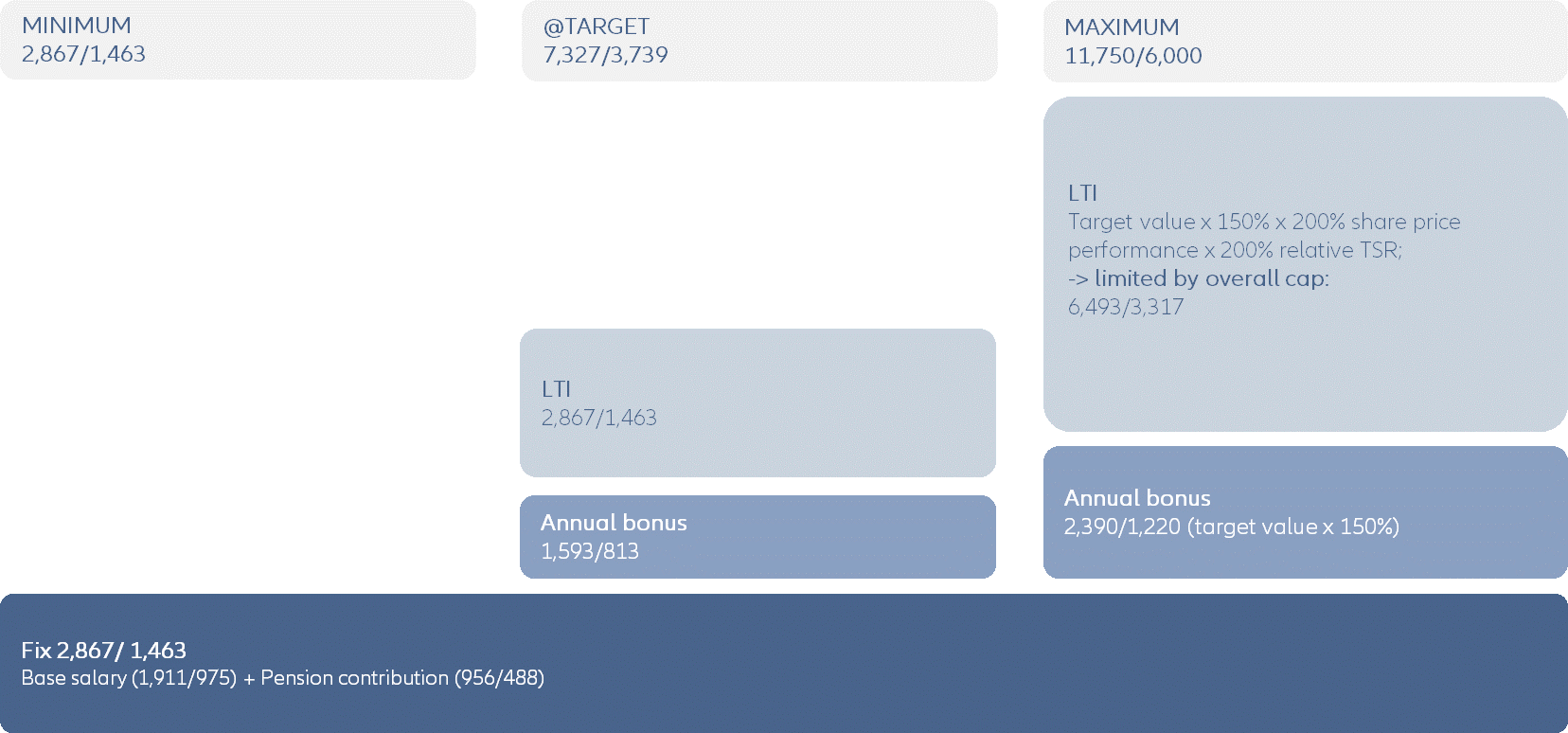

The performance-based variable component of the board members’ remuneration forms a significant portion of the overall remuneration, corresponding to 70% of the target remuneration.

- Sustainability of performance and alignment with shareholder interests:

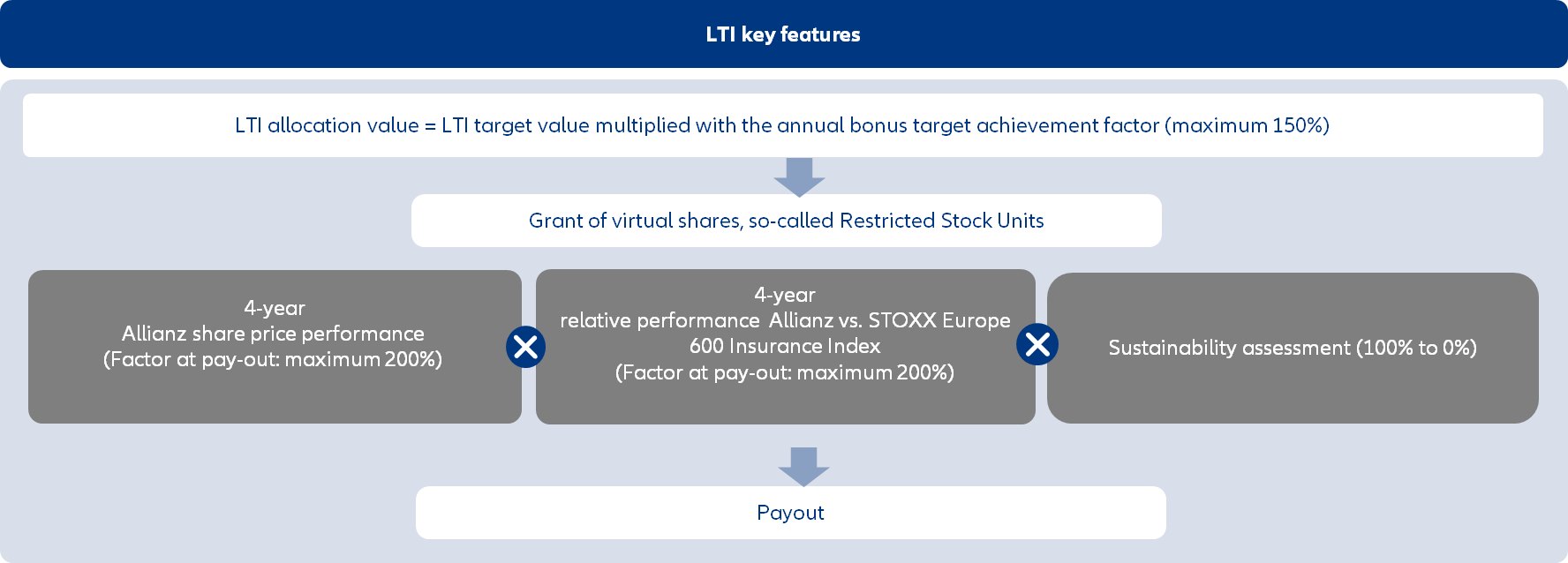

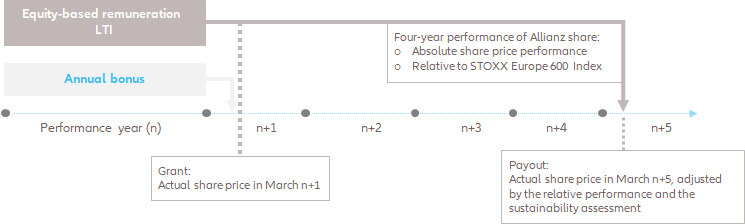

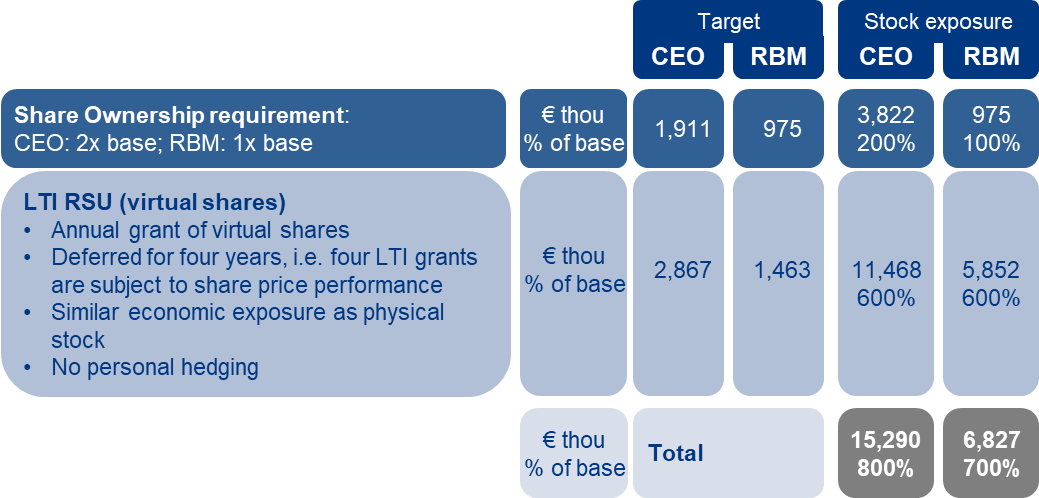

A major part of the variable remuneration reflects longer-term performance, with deferred payout (64%), and is linked to the absolute and relative performance of the Allianz share.

Determination of the remuneration system

The Management Board’s remuneration is decided upon by the entire Supervisory Board, based on proposals prepared by the Supervisory Board’s Personnel Committee. If required, the Supervisory Board may seek outside advice from independent external consultants. The Personnel Committee and the Supervisory Board consult with the Chairperson of the Management Board in assessing the performance and remuneration of Management Board members. The Chairperson of the Management Board is generally not involved in the discussion about his own remuneration. The Supervisory Board designs the remuneration system for the Management Board members in accordance with the requirements of the German Stock Corporation Act (AktG) in its currently valid version as well as with regulatory requirements and the recommendations of the German Corporate Governance Code, while ensuring clarity and comprehensibility. Feedback from investors is also considered.

The remuneration system for the Management Board thus adopted by the Supervisory Board and submitted to the 2021 Annual General Meeting for approval applies to all current and future service contracts of Management Board members. The Supervisory Board regularly reviews the remuneration system for the Board of Management. In accordance with the requirements of § 120a (1) AktG, the Supervisory Board will present the remuneration system for the Management Board members to the Annual General Meeting in the event of any material changes, but at least every four years.

In exceptional circumstances and in accordance with the statutory provisions (§ 87a (2) AktG), the Supervisory Board may temporarily deviate from the remuneration system described below, if this is necessary in the interests of the long-term well-being of the Company. The assessment may take into account both macroeconomic and company-related exceptional circumstances, such as impairment of the long-term viability and profitability of the Company. Any deviation requires a prior proposal by the Personnel Committee. The components of the remuneration system from which deviations may be made in exceptional cases include in particular the base salary, the annual bonus and the long-term incentive (LTI), including their relationship to each other, their respective assessment bases where applicable, the target setting and target achievement assessment principles, and the determination of any payout and payment dates. The duration of the deviation shall be determined by the Supervisory Board at its due discretion, but should not exceed a period of four years. In a crisis situation, for example, this provision is intended to allow the appointment of a new board member, for instance with crisis management expertise, with a remuneration structure that temporarily deviates from the remuneration system.

Determination and adequacy of the Management Board remuneration

Based on the remuneration system, the Supervisory Board determines the target total remuneration and regularly reviews the appropriateness of the remuneration. This is based on both a horizontal comparison (i.e., with peer companies) and a vertical comparison (in relation to Allianz employees). Again, the Supervisory Board’s Personnel Committee develops respective recommendations, if necessary with the assistance of external consultants. The structure, weighting and level of each remuneration component shall be adequate and appropriate.

Horizontal appropriateness

The Supervisory Board regularly benchmarks the Board of Management’s remuneration against other DAX companies and selected international competitors, taking into account the situation of the Allianz Group as well as its longer-term performance, relative size, complexity, and global reach.

Vertical appropriateness

This comparison is based on the target remuneration of a Management Board member and the average target remuneration of employees as well as members of the upper management of Allianz Group in Germany.

Adjustment of remuneration

The Supervisory Board may also adjust the target remuneration of the Management Board members insofar as this is appropriate to ensure that the remuneration of the Chairperson of the Board of Management or a regular member of the Board of Management is appropriate with regard to their duties and performance. In doing so, it shall take into account the comparison of board remuneration horizontally and vertically. The aim of this rule is to adjust board remuneration moderately on the basis of horizontal and vertical compensation trends and thus avoid major remuneration increases. It does not constitute an automatic adjustment, but requires a justified decision by the Supervisory Board in each case. Such a moderate adjustment of the target remuneration does not in itself represent a significant change to the remuneration system.

The Supervisory Board is also entitled to take appropriate account of extraordinary unforeseeable developments when determining the amount of the variable remuneration. This rule takes up a recommendation of the German Corporate Governance Code and allows to adjust the remuneration in rare unforeseeable exceptional cases. Conceivable cases of application include, for example, significant changes in accounting rules or in the tax or regulatory framework, as well as catastrophic events not yet known at the time of target setting. The application of this rule may also lead to a reduction in the variable remuneration.

Remuneration structure