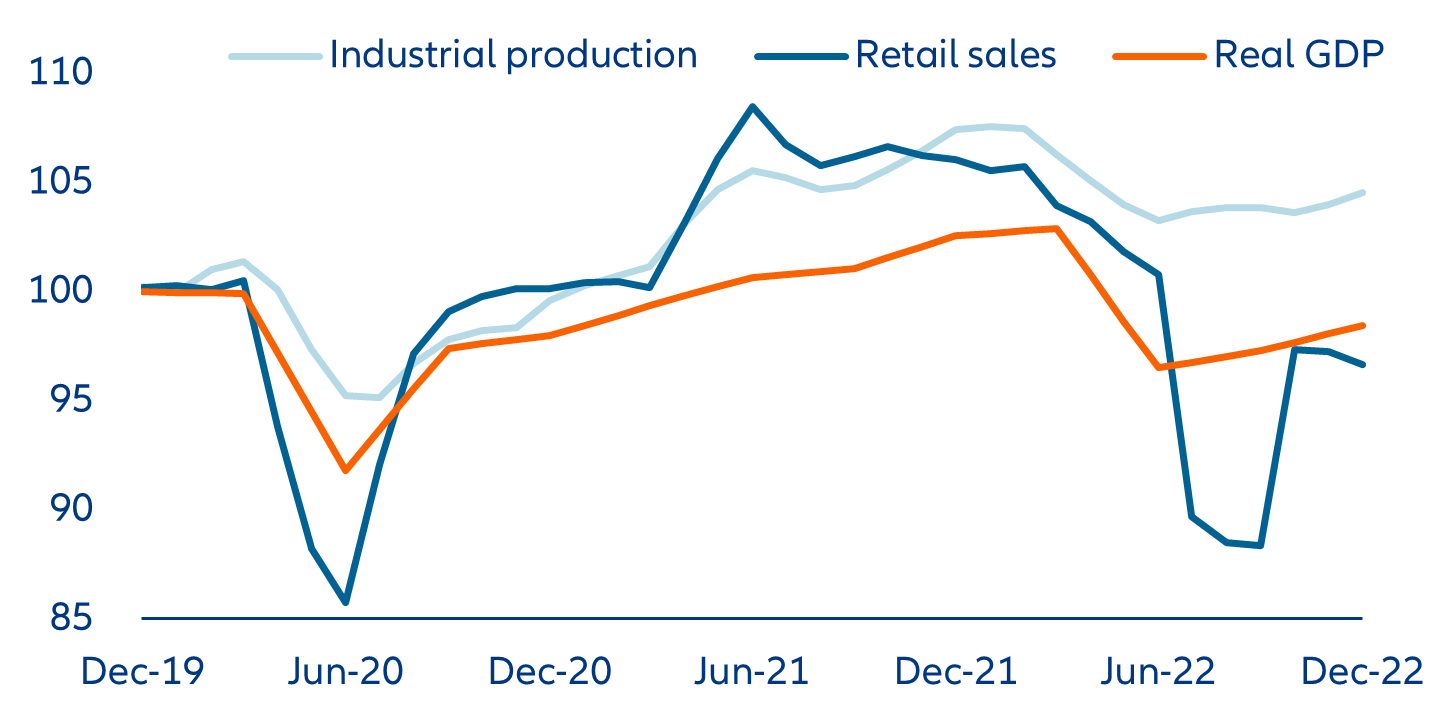

- Despite Western sanctions, the Russian economy held up much better than expected: real GDP contracted by just -2.1% last year. However, the outlook is challenging. We expect a further contraction of -1% this year.

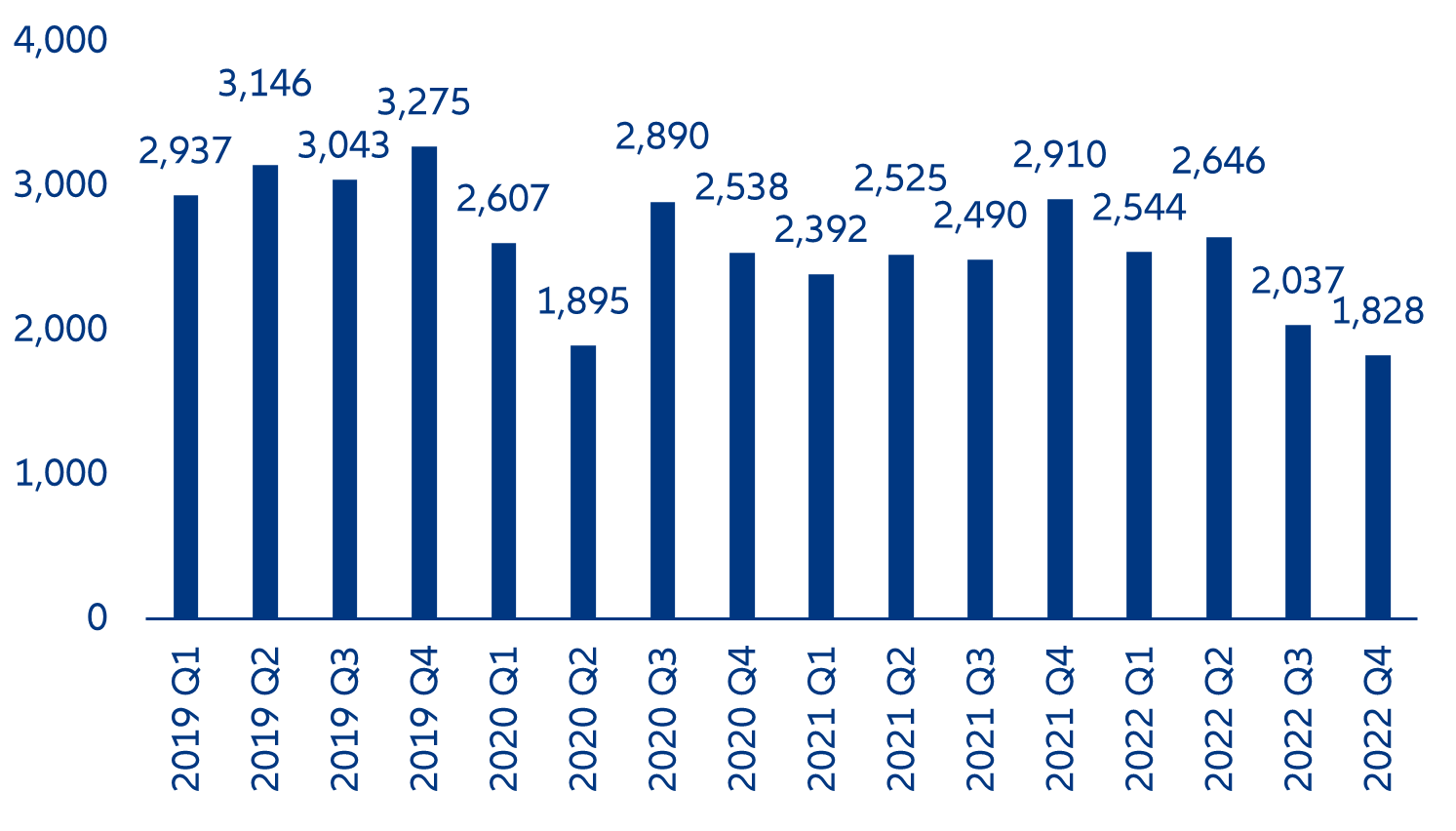

- Business insolvencies decreased by -12% y/y in 2022 thanks to several public support measures, including a debt moratorium (until October 2022), tax deferrals and preferential terms for corporate loans. Given the government’s continued fiscal space to maintain support for firms, we expect insolvencies to remain stable in 2023, close to the low posted last year.

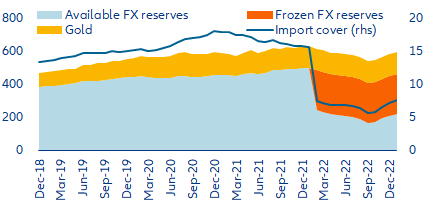

- While Russia’s (available) FX reserves have recovered since September 2022, the fiscal deficit will rise to -3.2% of GDP (from -2.3% in 2022) due to rising military spending and declining energy export revenues. The government will fund the fiscal gap through domestic bond (OFZ) issuance and withdrawals from the National Wealth Fund. Beyond 2023, budget financing may become more difficult.

In Focus

Russia’s war economy

What to watch

- Ukraine – Reconstruction needs to start now. The priority will be investment in infrastructure, health services, housing and schools, as well as digital and energy resilience. We believe that this will require at least EUR100-150bn of private investment (in addition to EUR350bn of foreign aid).

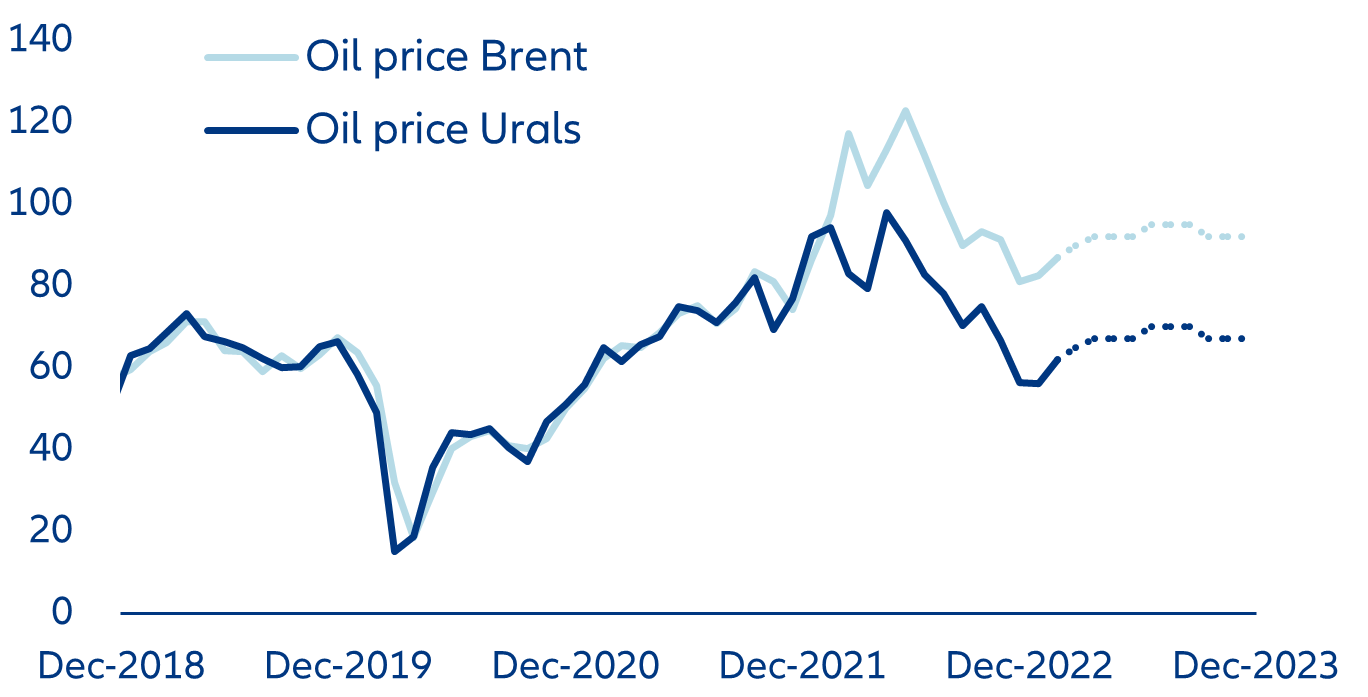

- Global energy markets – Fossil fuels remain expensive amid global trade reshuffling. Oil and gas prices dropped over the last months, but constrained supply and resilient demand will keep oil prices at USD92/bbl in Europe in 2023. Natural gas prices will be at at 75 EUR/MWh on average.

- Eurozone – energy inflation, quo vadis? Overall inflation will remain uncomfortably high, but energy inflation will drop precipitously during the coming quarters (due to strong disinflationary base effects), contributing less than 10% of overall inflation this year.

Ukraine – Reconstruction needs to start now

Ukraine’s economy is expected to stabilize this year, but downside risks loom large. After a contraction of output by -34% last year, we expect real GDP to grow marginally by about +1% in 2023. However, the ongoing war creates large downside risks to the economic outlook, especially the ongoing destruction of vital infrastructure, such as Ukraine’s power grid. Since October 2022, electric power has been rationed in Ukraine through rolling blackouts. The annual rate of inflation has accelerated from 10% to more than 25% and shows no signs of abating. Both growth and inflation outturns have put enormous pressure on fiscal accounts despite large-scale foreign aid. Ukraine’s public deficit has quadrupled, increasing public debt by 40pps, with gross external debt reaching 90% of pre-war GDP. The Ukrainian currency has also lost a fifth of its value against the dollar.

The rebuilding process needs to start as soon as possible to strengthen the country’s socio-economic resilience, but the reconstruction of Ukraine will be costly. The painful experience of past wars has taught us what it takes to rebuild countries ravaged by armed conflict. Aside from the immeasurable human suffering, wars destroy infrastructure, disorganize production and reshuffle trade flows. And they tend to bankrupt governments as economic activity collapses while debt builds up. If we take the post-WWII reconstruction of Western Europe as an example, the scale of the Marshall Plan in today’s purchasing power terms is comparable to the estimated re-building costs for Ukraine over the next 10 years (up to EUR1trn).

However, Ukraine cannot do it alone amid surging public debt and a rising fiscal gap. The cost of rebuilding infrastructure alone will likely require at least EUR300bn (incidentally the same amount that was required to upgrade infrastructure in East Germany during Germany’s reunification) – that is three times Ukraine’s total (fiscal) budget last year. Already in September, in its Rapid Damage and Needs Assessment (RDNA), the European Commission (together with the Government of Ukraine and the World Bank) estimated that the current cost of reconstruction and recovery in Ukraine amounts to EUR349bn. In the meantime, as the war drags on, this figure has more than doubled. So, for a credible commitment to rebuilding Ukraine, private external financing would need to complement public sector finances and development aid.

The priority will be investment in infrastructure, health services, housing and schools, as well as digital and energy resilience for a sustainable recovery and reconstruction. This will (i) increase Ukrainian refugees’ willingness to come back home, (ii) improve logistical (and trade) links to Europe and (iii) boost private investors’ appetite for investments in the country. We believe that this will require at least EUR100-150bn of private investment (in addition to EUR350bn of foreign aid).

Greater public-private collaboration can also help create a suitable investment climate, which is also an objective of the EU’s Rebuild Ukraine Facility. Attracting sufficient private investment would require further modernizing the state and its institutions; this will boost governance and respect for the rule of law, including permanently reducing the undue political influence of oligarchs.

Two essential elements need to be in place for this to work – credible security guarantees and foreign economic assistance. Without security guarantees to deter renewed Russian aggression, Ukraine will struggle to attract back human capital and import private foreign capital. The West needs to provide Ukraine with such credible guarantees (or some public sector backstop for businesses that invest in Ukraine while the country remains under attack). In addition, without generous foreign aid until the war ends, Ukraine’s economic recovery will be protracted; this might jeopardize both its young democracy and its gradually improving security situation. There is lots of goodwill in favor of Ukraine, but foreign aid is still too little. Greater coordination among supporting countries will be necessary, especially when the time comes to negotiate war reparations with Russia (in the form of reserve assets, securities, or contributions-in-kind, such as raw materials, oil, and gas.

Global energy markets – Reshaped by the war in Ukraine

Europe’s energy crisis is not over yet; fossil fuels should remain expensive in the next few years. Although Europe managed to source LNG from other parts of the world and maintains rather strong inventories (at about 64% as of 21 February) thanks to a milder winter, the energy crisis is not over yet. Assuming a persistent stoppage of Russian gas flows to Europe via the Nord Stream pipeline, with a low probability of some resumed imports in fall 2023 (potentially triggered by peace talks between Ukraine and Russia), available pipeline gas will remain limited. In addition, as about 70% of globally traded LNG is tied to long-term contracts, available volumes might fall short; recent long-term contracts signed with partners such as Qatar and the US will only begin from 2026. Oil supply will also remain constrained, with Russia responding to Western sanctions by reducing crude oil output and OPEC taking a conservative stance in managing production. While gas demand has declined in Europe, lower oil demand due to this year’s global economic slowdown is yet to materialize in consumption data.

Amid this mixed picture, prices for both oil and gas will remain high for the next couple of years (Table 1). We see oil prices averaging 92 USD/bbl in 2023 and 88 USD/bbl in 2024, while TTF natural gas prices would average 75 EUR/MWh in 2023 before consolidating slightly to 60 EUR/MWh in 2024. Prices could rise even further in the event of (i) better economic activity, (ii) further supply cuts from producers or (iii) insufficient gas savings in Europe. On the other hand, (i) a sharper slowdown in economic activity and (ii) a faster energy transition (through greater efficiency or increased electricity availability) could have the opposite effect.

Eurozone – energy inflation, quo vadis?

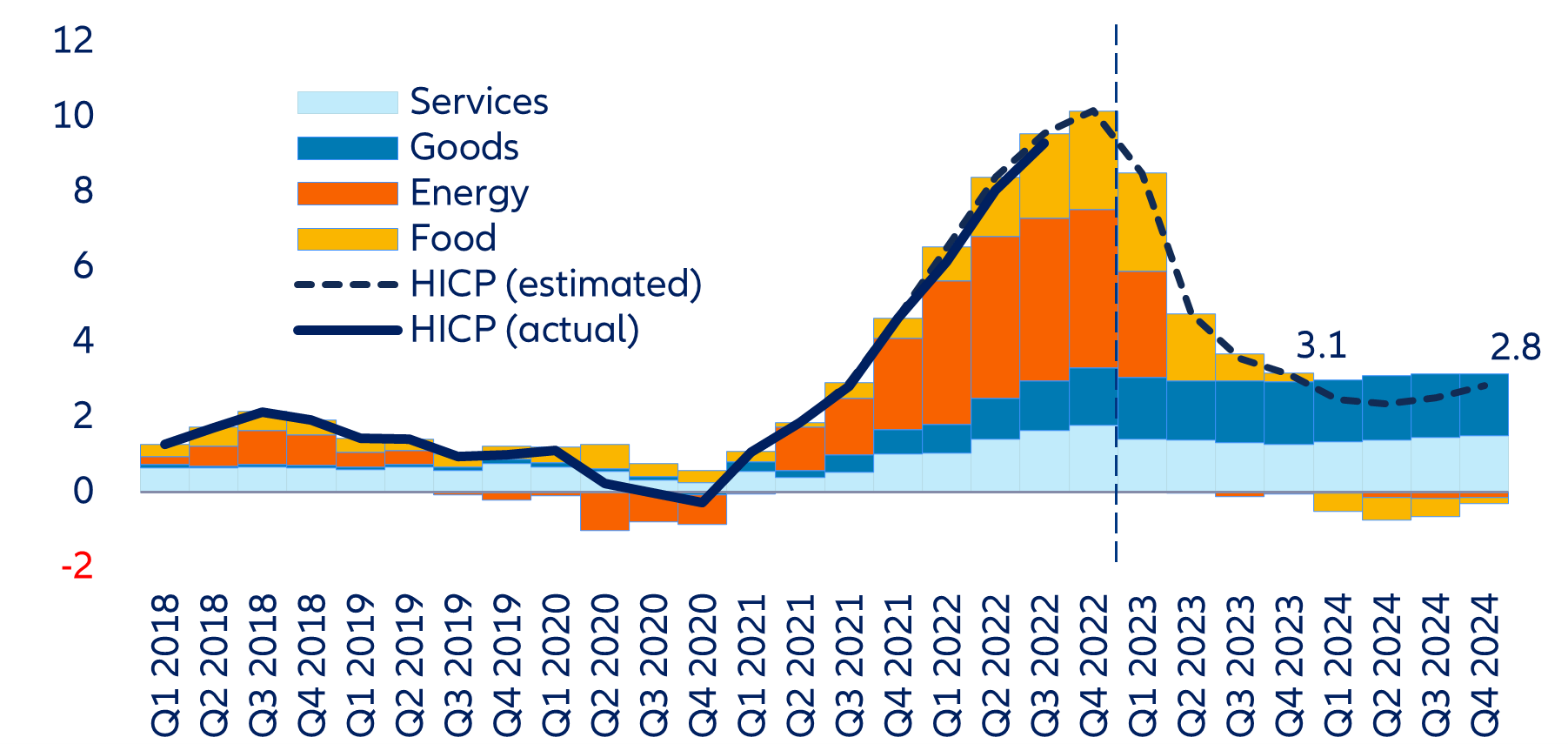

Though inflation has slowed over the last couple of months – largely due to the impact of government support measures aimed at capping energy costs and declining gas/oil prices – price pressures will stay strong during the first half of this year. Last year, the effective embargo on most energy imports from Russia resulted in a surge of electricity and gas prices for most European households. Governments gradually scaled up measures to mitigate the blow by seeking alternative gas supplies, encouraging reductions in energy demand and imposing complete (or partial) price caps. As a result, oil and natural gas prices have come down by about 50% from their mid-year peaks. Given the continued uncertainty about energy supply later in the year when natural gas consumption with pick up again, we expect governments to continue spending further. However, they are likely to tread more carefully as poorly targeted measures could slow down the overall reduction in inflation. Annual inflation still runs above 8% (compared to last year) – that is more than four times the ECB’s price stability target of 2%. With a smaller-than-expected drop of German headline (HICP) inflation from 9.6% in December to 9.2% in January (and less than the fall 8.6% implied by Eurostat’s flash HICP data), Eurozone headline inflation for January has just been revised up from its flash estimate of 8.5% to 8.7% today.

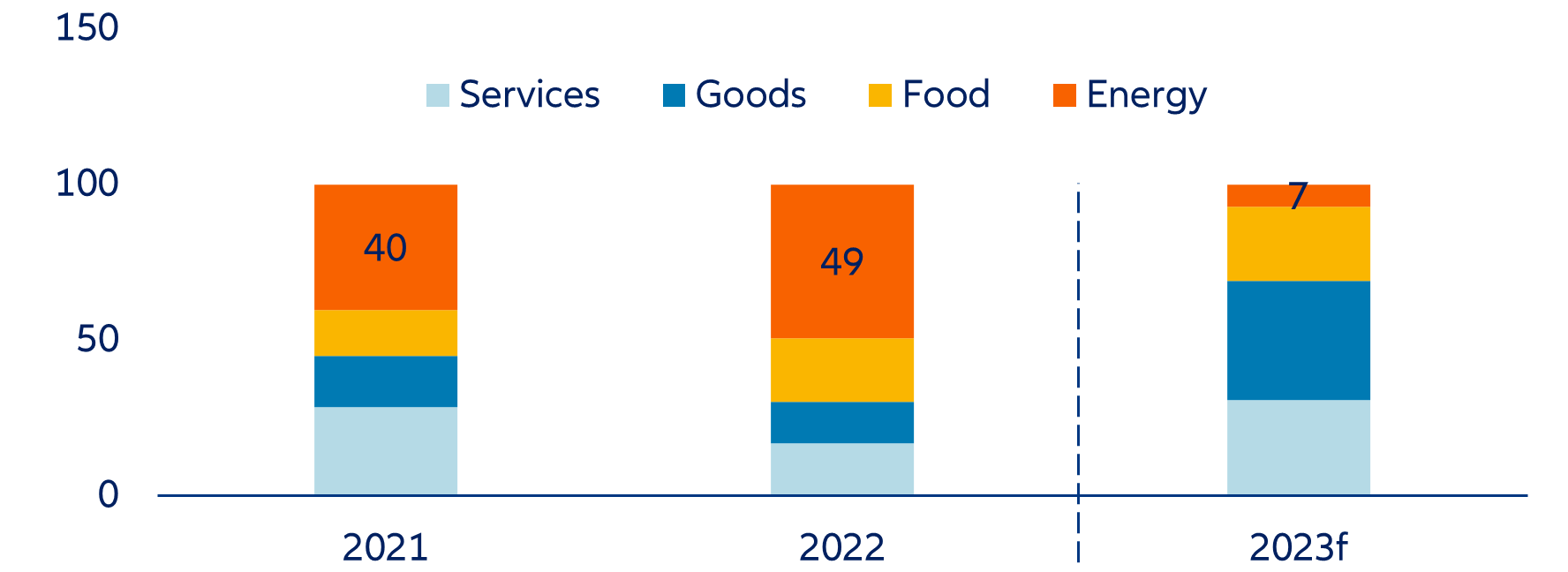

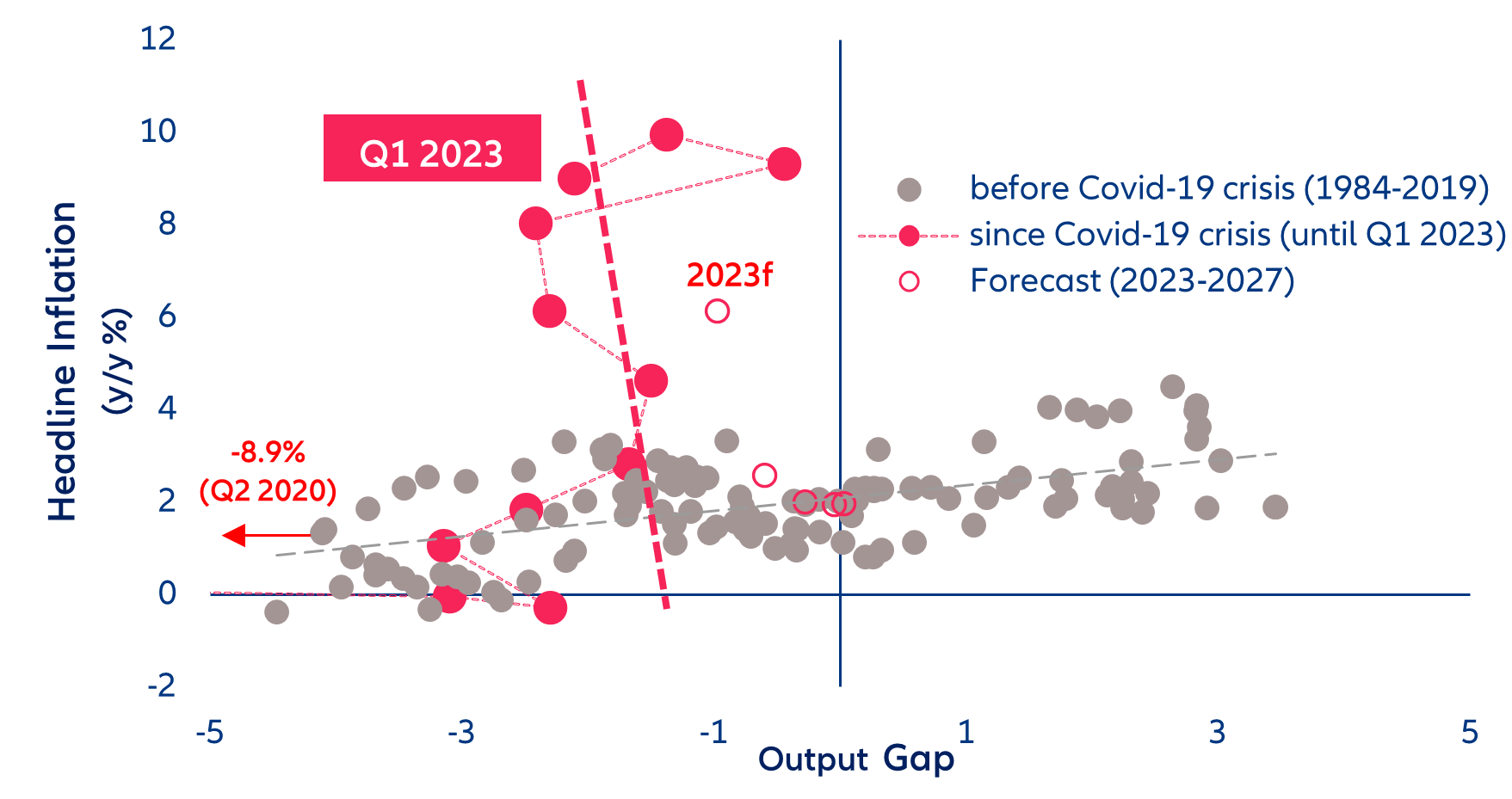

However, energy inflation will drop precipitously during the coming quarters (due to strong disinflationary base effects) and represent less than 10% of overall inflation this year. We expect that inflation will remain unusually high this year, but from Q2 onwards, energy price pressures will shift to price pressures from goods and services (“core inflation”), which have gained momentum over the recent months. For energy (and food) inflation, base effects are becoming increasingly powerful now, especially in countries where the implementation of price breaks occurred only later in the year. Based on our latest energy price forecast (see above), we expect that energy will contribute only 7% to total inflation in the Eurozone this year, down from 49% in 2022 (Figure 2). For instance, in Germany, there will be large impact on energy prices in March and April due to the public sector support for households via make-up compensation for the surge in electricity prices during the second half of last year. Despite declining energy inflation, the negative supply shock to inflation still creates a challenging environment for monetary policy. Since the “divine coincidence” of low inflation during times of slowing growth does not apply, the ECB would need to formulate a forward-guidance on its policy rate path that does not excessively slow aggregate demand (also considering that the economic impact of tighter financing conditions operates with considerable lag) (Figure 3). We expect the ECB to raise the effective policy rate to 3.25% until May and maintain a restrictive stance in 2023 despite stagnating growth.

In focus – Russia’s war economy

State support also prevented a wave of business insolvencies. Business insolvencies decreased by -12% y/y to 9,055 cases in 2022, the lowest level in two decades. Only the transportation/logistics (+7% y/y to 546 cases), scientific and technical activities (+2% to 538 cases) and hotels/restaurants (+13% to 198 cases) sectors saw increasing insolvencies. Trade and construction remained the two sectors with the largest number of insolvencies (2,234 and 2,106 respectively), together accounting for nearly half of the country’s bankruptcies. The government implemented a moratorium on filing bankruptcy applications by creditors (except developers) from 1 April to 1 October. Yet, in 2022 as in 2021, the ending of the moratorium did not trigger a massive rebound in the number of bankruptcies because of the additional (direct and indirect) support to the economy amid sanctions, notably those linked to the ‘war economy’.

While we expect protracted economic weakness in Russia, the prospects for business insolvencies remain uncertain since they are strongly linked to the government’s (financial) abilities and (political) willingness to support businesses. At this stage, as the government still has the financial means to maintain support for firms, we expect a prolonged low number of business insolvencies in 2023, potentially close to the low posted in 2022.

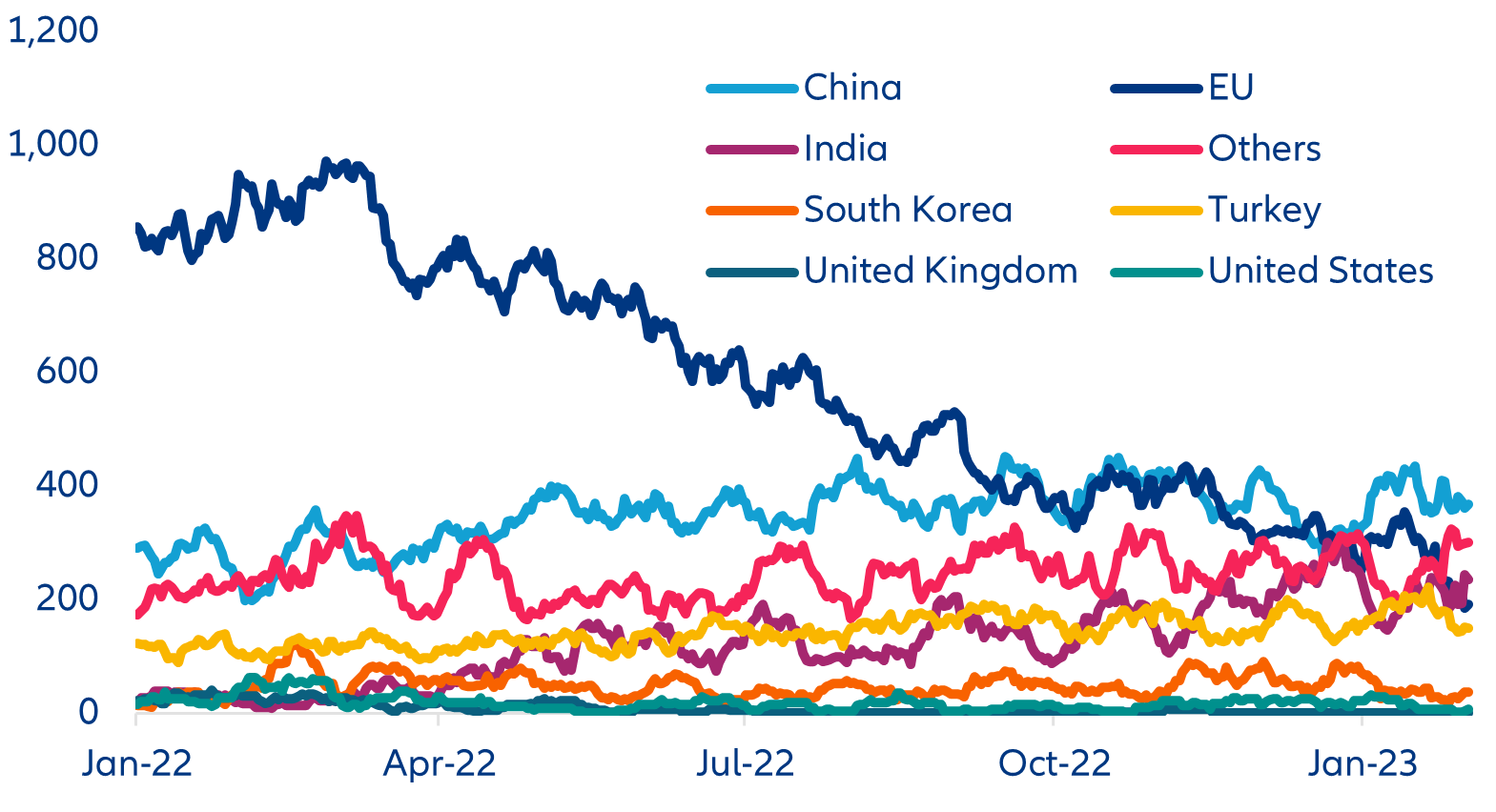

2023 will be another challenging year for Russia; we expect the economy to contract by approximately -1%. Continued uncertainty over the war will weigh on consumer and capital spending, both of which we forecast to decline between -1% and -2% this year. Russian oil revenues are also set to decline due to lower prices and export volumes. Following the EU’s embargo and the G7 countries’ price cap (at 60 USD/bbl) on seaborne Russian crude oil imports from early December 2022, Russian seaborne crude oil exports shrank by at least -12% m/m in December, taking its overall oil exports down by around -7% m/m. More importantly, the price spread between dated Brent Blend and Russia’s Urals grade widened by nearly 3 USD/bbl to an average 25.50 USD/bbl in December-January compared to the average 21.60 USD/bbl in the previous two months. Moreover, in early February 2023, an EU ban on Russian oil products also came into force and is expected to weaken domestic refining output. China, India and Turkey are now the main buyers of Russian oil and some of their imports have been “re-blended” and sold on to countries with sanctions in place.

Going forward, Russia will try but find it increasingly difficult to circumvent additional sanctions in this manner. We expect the output of Russian oil and oil products to be around -5% lower in 2023 compared to 2022 and an average price of 66 USD/bbl for Urals in this year, down from 81 USD/bbl in 2022 (Figure 6). Russian gas revenues will also be significantly lower than in 2022. Data on gas exports are less transparent but since Russia halted most of its gas supplies to the EU in September 2022, gas export volumes in 2023 will clearly be lower, especially as gas exports cannot be as easily re-routed as oil exports. Moreover, we currently forecast the average price for natural gas in 2023 at 75 EUR/MWh (Dutch TTF), down from 132 EUR/MWh in 2022.

Falling oil and gas export revenues are expected to weaken Russia’s currency. The RUB has lost -16% against the USD since the imposition of the embargo and price cap in early December. This trend is likely to continue and we forecast the RUB to depreciate by an average -10% against the USD in 2023 (after it had gained an average +5% last year, thanks to the sound policy response to an initial knee-jerk sharp depreciation in March). A weakening RUB will lead to inflationary pressures; we expect consumer price inflation to remain in the lower double digits for most of 2023, which will also constrain consumer spending.

Russia is also facing a labor market shortage as hundreds of thousands of Russians have fled the country, either out in rejection of the war or to escape mobilization. At the same time, around 300,000 of mostly working-age men have been drafted into the army. Unemployment fell to a record low of 3.7% in December 2022, down from 4.3% a year earlier. A markedly widening budget deficit will be another challenge for Russia in 2023, though we expect it to be manageable (see below for more details) and thus supportive for mitigating the recession. Despite the range of challenges for the Russian economy in 2023, we forecast only a modest full-year recession of -1%. This is mainly due to base effects and actual quarterly real GDP growth in Q3 and Q4 2022, which provides for a mild carry-over into 2023 (estimated at -0.3%).

Russia’s international reserves have recovered since September 2022 and we expect the Russian economy to be able to cope with Western sanctions in 2023 and beyond. The Central Bank of Russia (CBR) has continued to publish monthly data on gross international reserves but has halted the release of the components gold and foreign currency reserves. Gross international reserves fell from USD630bn in January 2022 (i.e. just before the war) to a temporary low of USD541bn (including frozen FX reserves due to Western sanctions) in September, about half of which was due to the USD’s strength weighing on the valuation of assets in other currencies. Since then, they recovered to USD597bn in January 2023. A reversal of the valuation effect played a role in the recovery, but the record-high current account surplus of USD227bn (around 11% of GDP) in 20223 and the de-dollarization of external trade have likely been more important. The Chinese renminbi is gaining increasing popularity in Russia’s external trade so that forthcoming export earnings cannot be frozen by Western sanctions anymore. Under the assumptions that gold reserves and frozen FX reserves have remained roughly stable at USD133bn and USD242bn (half of total FX reserves in February 2022) since the war began, respectively, available FX reserves fell from USD242bn in February 2022 to a temporary low of USD166bn in September and then recovered steadily to USD222bn in January 2023 (Figure 7), despite a narrowing current account surplus in Q4 2022 and falling oil and gas export revenues, in particular in December-January. Current available reserves are sufficient to cover a healthy 7.7 months of imports. We forecast the annual current account surplus to decline to around USD113bn (5% of GDP) in 2023, mainly due to lower energy export revenues. Yet this still large surplus should help to retain the current level of available FX reserves for this year. In a more conservative but less likely scenario where available FX reserves fall to USD160bn by end-2023, import cover would still exceed five months. And in a worse scenario, Russia would still have the possibility to monetize part of its gold reserves.

Russia’s fiscal deficit will widen in 2023 due to rising military spending and declining energy export revenues. The government posted a sizeable fiscal surplus in the first half of 2022, thanks to surging energy receipts and seasonally low public spending. However, that surplus was nearly wiped out in Q3 and moved into a large deficit in Q4, owing to declining gas revenues (as gas exports plunged) and rising expenditure, including a seasonally peak in spending in December. Eventually the fiscal deficit amounted to -2.3% of GDP in 2022. The Russian government has projected a narrowing of the shortfall to -2.0% of GDP in 2023. However, we believe this is too optimistic, especially as the year started with a large monthly deficit of RUB1.76trn in January, roughly half the annual deficit in 2022. We expect military spending and social expenditures to rise in 2023 while spending cuts on infrastructure and administration should keep the overall rise in budget expenditures in check. We further expect budget revenues to decline this year, mainly because of projected falling energy receipts as described in detail above. The government plans to levy a one-off "voluntary" tax on big business and expects RUB0.3trn thereof. But even if realized, that will be only a drop in the ocean. We forecast a fiscal deficit of around RUB5.2trn in 2023 as a whole, equivalent to about USD68bn or -3.2% of GDP.

Russia will finance the 2023 fiscal deficit through domestic bond (OFZ) issuance and withdrawals from the National Wealth Fund (NWF, a sovereign wealth fund). The Ministry of Finance restarted OFZ issuance in September 2022 and was able to finance most of last year’s fiscal deficit through this channel. Large domestic banks, mostly public ones, took up over 90% of the bonds issued until end-2022 since they had limited investment opportunities while having ample liquidity. In January 2023, however, Russian bank’s share in government bond purchases fell to 60%. Hence the government began to tap the NWF to finance the fiscal shortfall posted so far this year. On 1 February 2023, the NWF assets were estimated at RUB10.8trn, equivalent to around USD155bn. Since about one third of these assets is estimated to be frozen due to Western sanctions4, liquid NWF assets amounted to approximately RUB7trn, or USD100bn, equivalent to 4.5% of GDP or so. It is worth noting that the RUB exchange rate functions as an automatic stabilizer. If the RUB depreciates, as we forecast for 2023, the RUB value of export revenues received in foreign currency will increase and thus fiscal revenues will also rise in RUB terms. Overall, we can conclude that a fiscal deficit of -3.2% of GDP in 2023, as we forecast, will be manageable for the government and allow it to fund military activities for at least another year. That said, it should be noted that a substantial drawdown of the NWF, as well as planned expenditure cuts in 2023, would have crucial medium- and long-term effects for the economy and the welfare of the Russian people.

Download

Contact

Allianz SE

Allianz Trade