- The outlook for Central and Eastern Europe (CEE) has slightly improved in recent weeks due to diminishing headwinds from lower-than-expected energy prices.

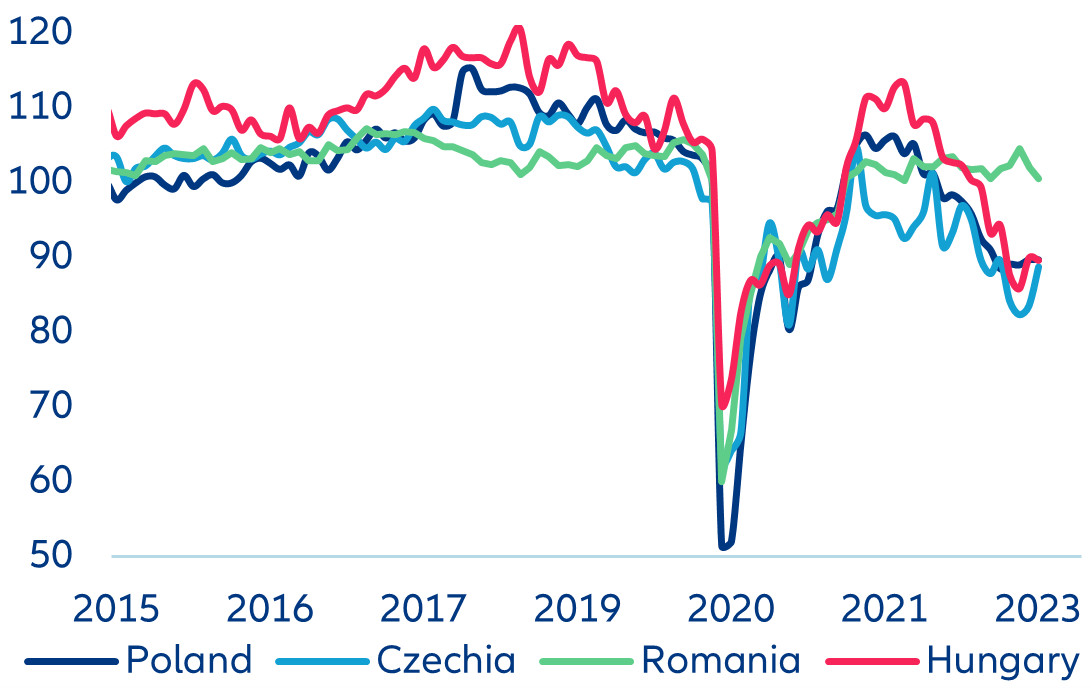

- Nonetheless, growth in the CEE-4 (Poland, Czechia, Romania, Hungary) remains subdued overall as the impact of continued high inflation, increased interest rates, weaker external demand and lower business confidence will take full effect this year.

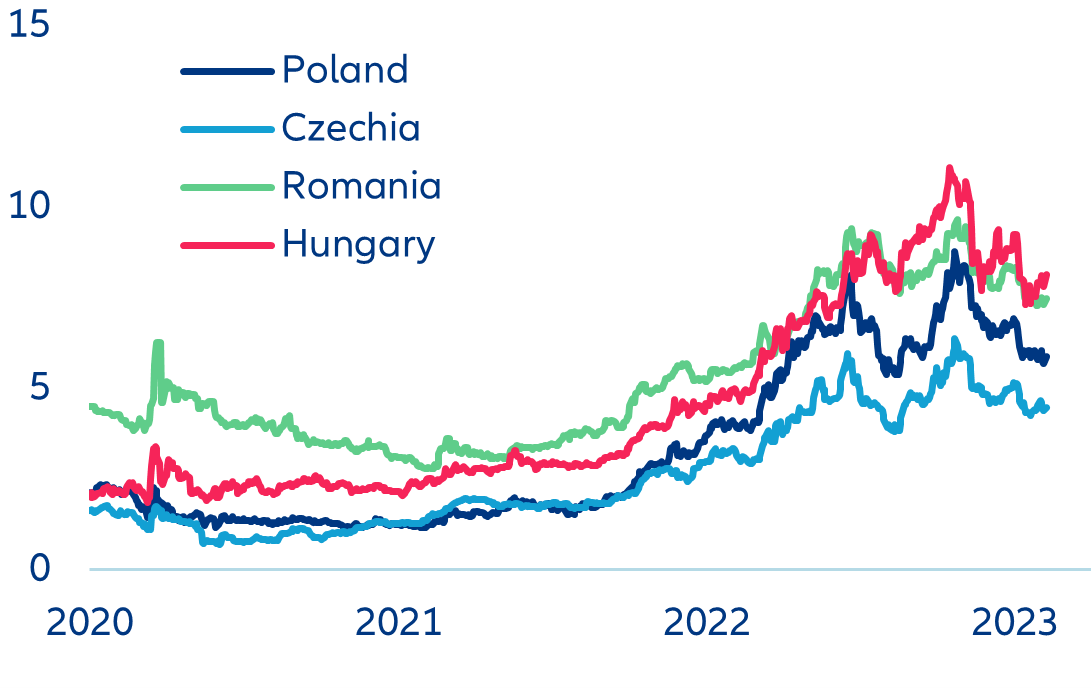

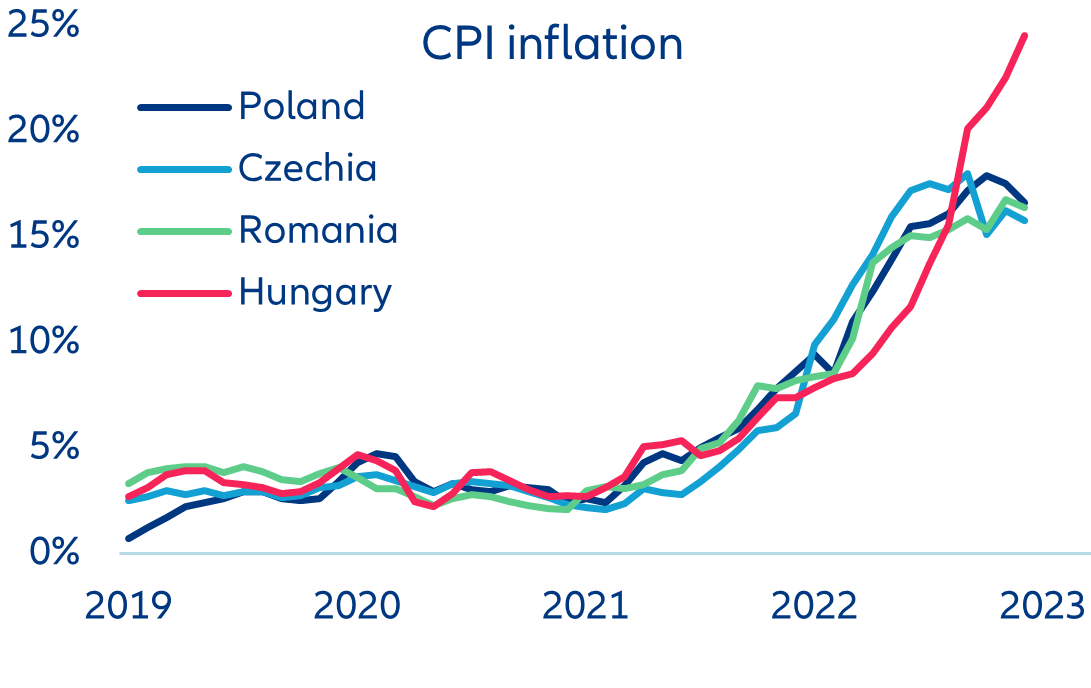

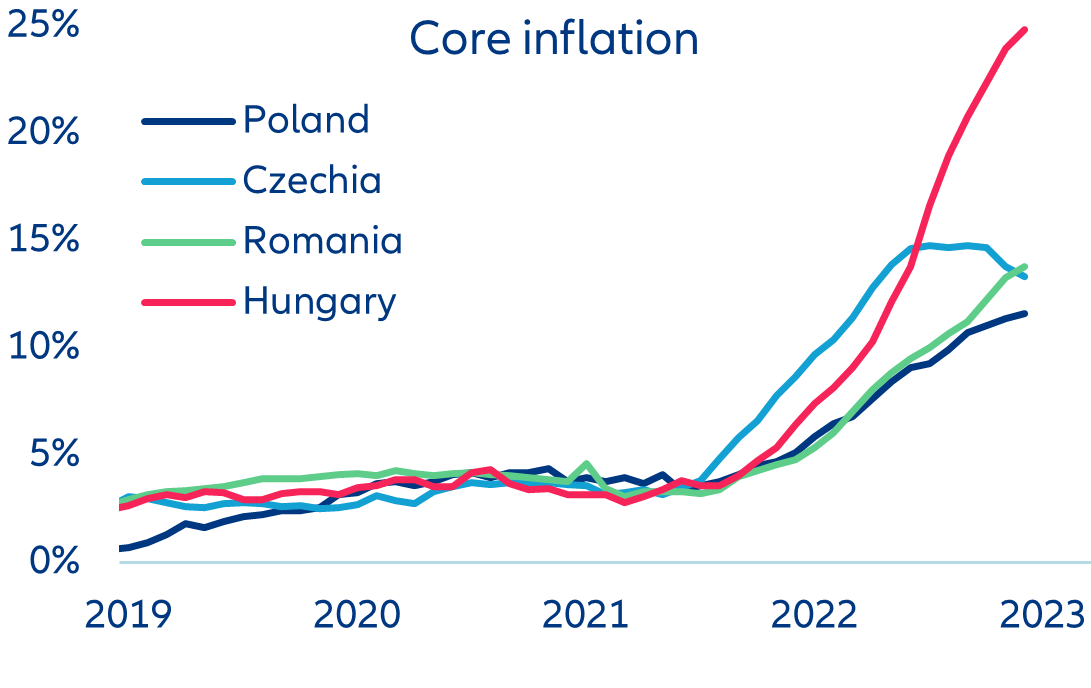

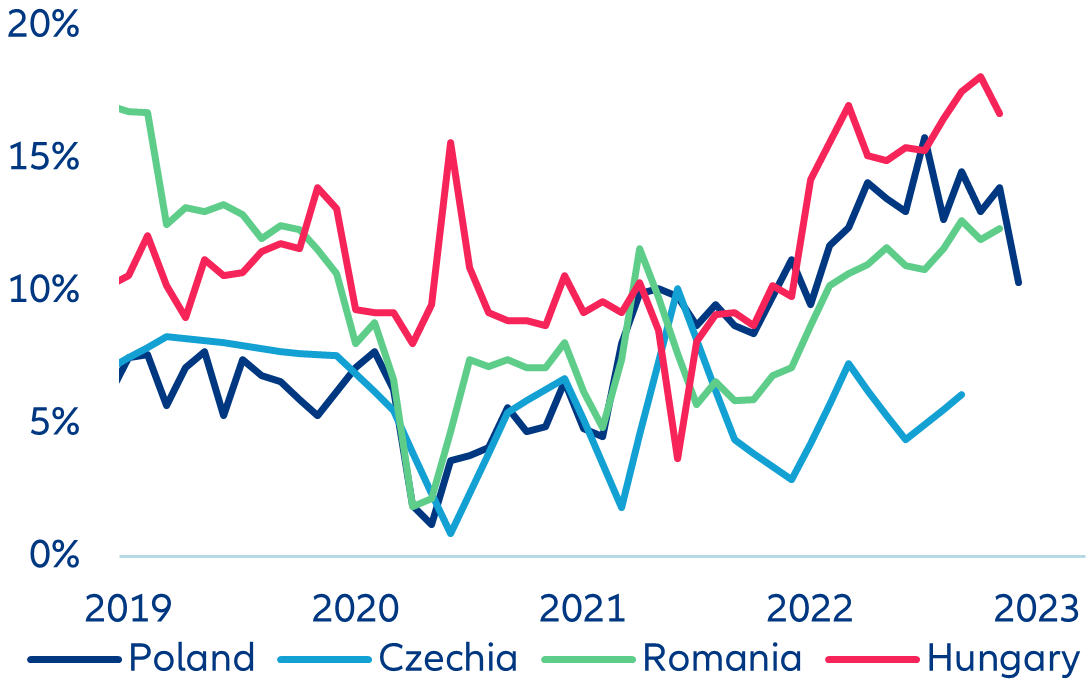

- Inflation has peaked in most CEE economies and the disinflation process may be happening slightly quicker than previously expected. However, inflation will remain above central banks’ targets over the next two years.

- Central banks in the CEE-4 were the first to halt their interest rate hiking cycles and, barring any new shocks, we expect some of them to also be ahead of the curve when it comes to the pivot. We expect Czechia to start easing in June 2023, followed by Poland in Q3 and Romania and Hungary at the end of the year.

In Focus

Monetary policy in Central and Eastern Europe ahead of the curve?

Market Movers

- German stagnation—rising insolvencies? German business insolvencies are rebounding albeit from a low level.

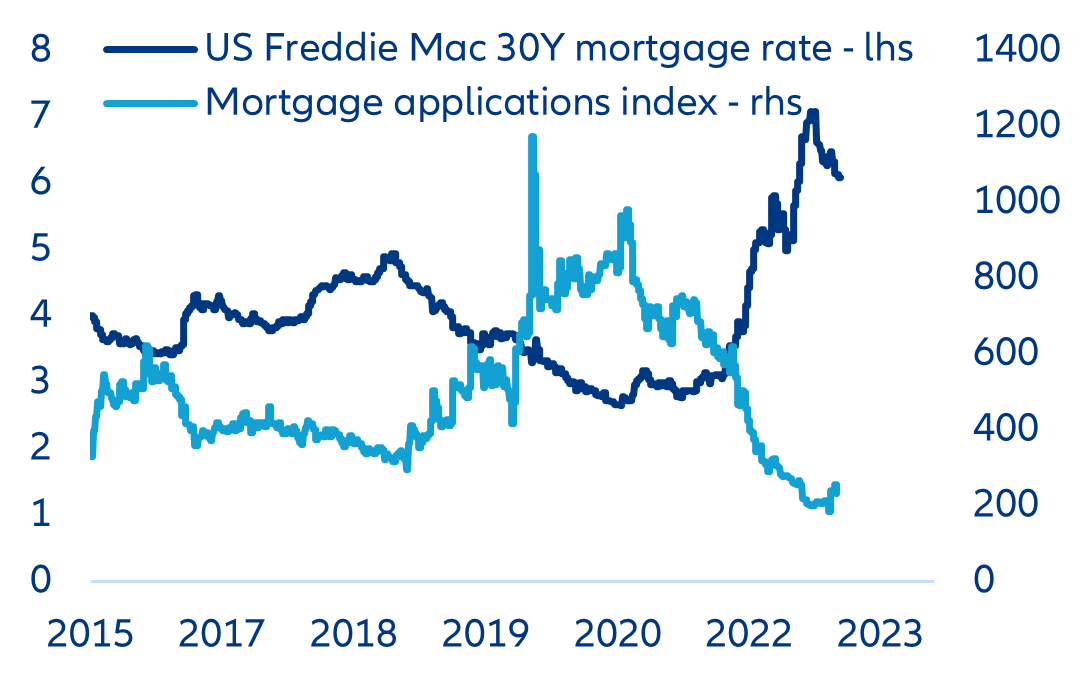

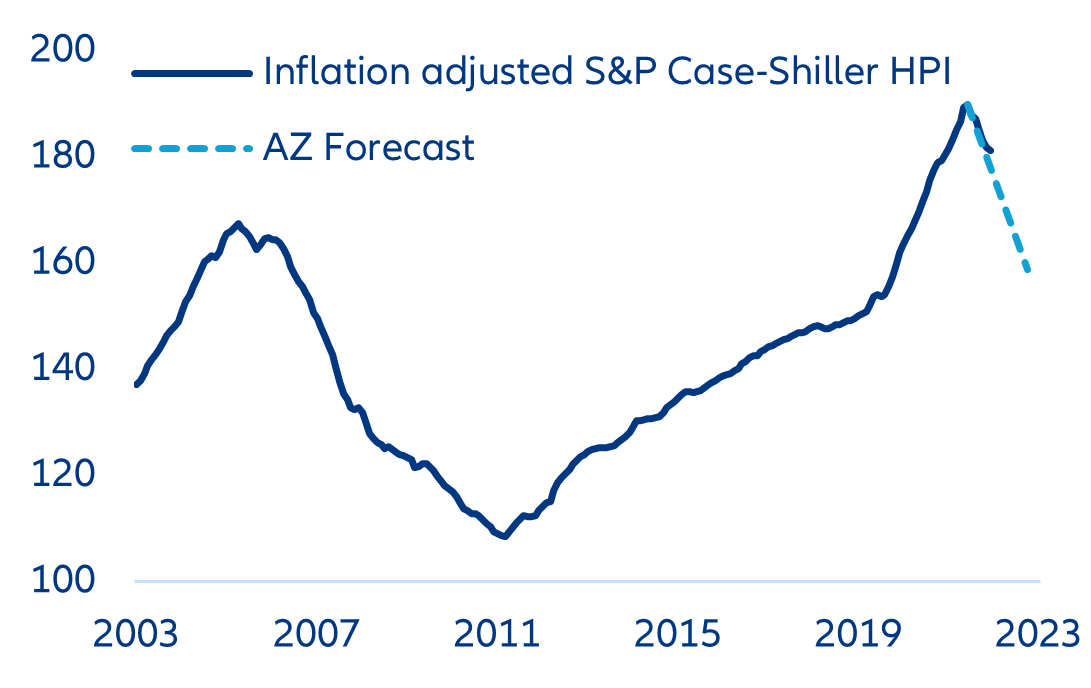

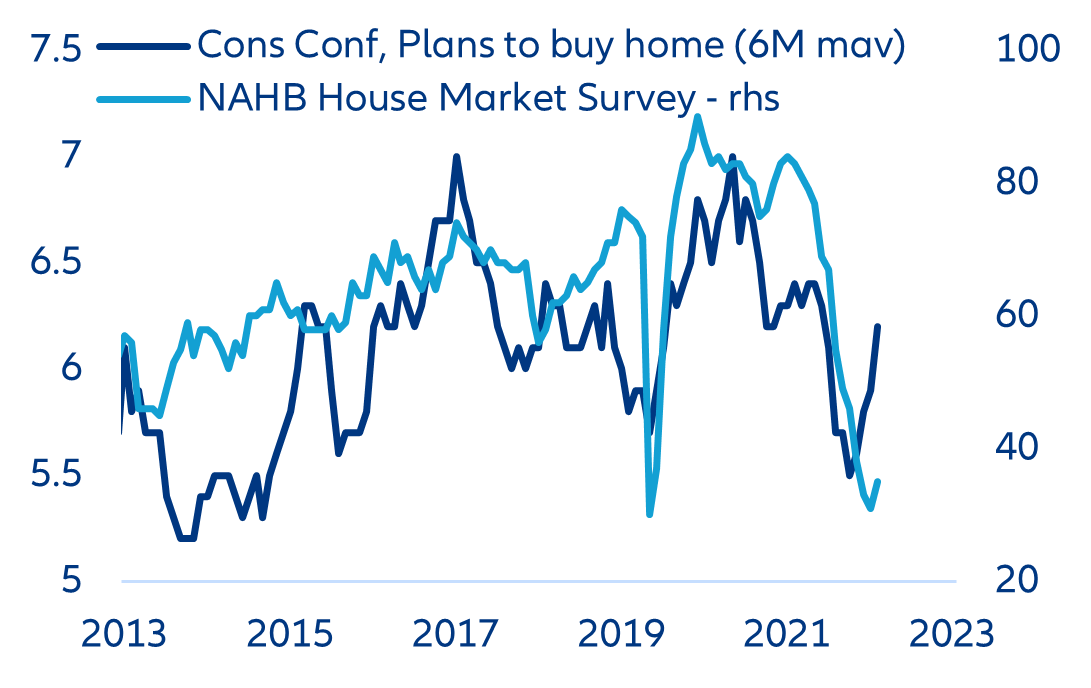

- US real estate—trouble (still) ahead? Some housing market indicators have stabilized, but downside risks continue due to weaker domestic activity. The outlook for commercial real estate remains negative, especially for the office sector.

- Making up for inflation—how Jane and Maxi can get their groove back. Investors holding a 60/40 portfolio of equities/bonds lost about ~20% on average last year; it will take them more than three years to fully recover their losses.

- Corporate performance—will inflation continue muting spending in 2023? Earnings have been weak for discretionary sectors, with EPS growth averaging -1.6% globally, though distributors and specialty retail performed significantly worse.

German stagnation—rising insolvencies?

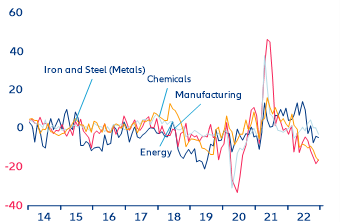

The outlook for Germany’s economy remains bleak despite improving business expectations. The slightly more upbeat message from recent survey data (ifo and ZEW sentiment indicators) was solely driven by better expectations, which still stand at historically low levels. Firms in the services and manufacturing sectors still report weaker current activity (amid declining orders), and uncertainty in the energy-intensive sectors has increased further. Industrial production, especially in energy-intensive sectors, considerably slowed in December (-3.9% y/y and -3.1% m/m, down from +0.4% m/m in November). Production in the energy-intensive sectors is now down by almost -20% compared with December last year. We continue to project a moderate recession in Germany (with negative growth also in Q1 2023 after a contraction of -0.2% q/q in Q4 2022), followed by a subdued recovery after mid-2023 and weak growth in 2024 as financing conditions are likely to remain tighter for longer (Figure 1).

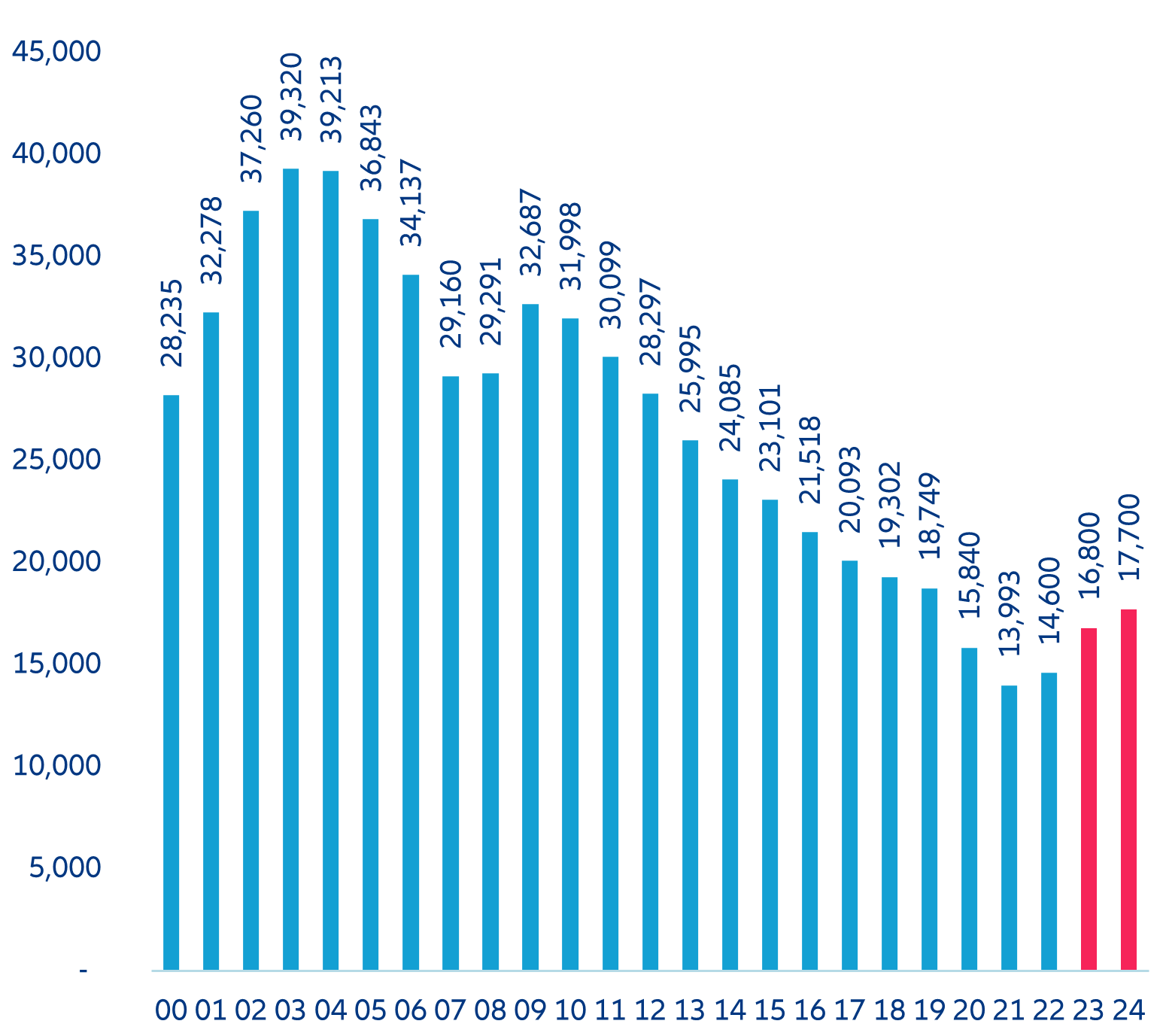

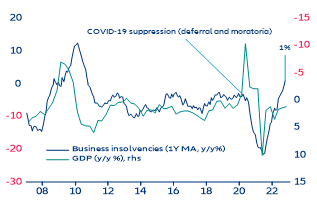

German business insolvencies are rebounding albeit from a low level. The current economic weakness has not left companies unscathed. Despite improving expectations (and scaled-up government support), more and more companies are coming under pressure due to the persistent triple threat of higher input prices, rising labor costs and tighter financing conditions weighing on business prospects. Extrapolating the trend from official data on insolvencies until October, the number of insolvencies is likely to have reached 14,600 cases in 2022, up by +4% over the year after a +19.5% increase in the last quarter. We expect insolvencies to continue increasing to 16,800 cases (+15%) this year (Figure 2). In fact, the one-year moving average of changes in insolvency cases indicates that the pace of new cases brought to German courts has been the highest since the European debt crisis (Figure 3). That said, the number of insolvency cases remains historically low; as a result, the noticeable increase of insolvencies over the last few months implies only a gradual normalization rather than an impending wave of bankruptcies. Germany’s corporate sector still looks comparatively robust compared to other countries. Globally, we expect insolvencies to rise by another +19% this year, reaching pre-pandemic levels (after +10% last year).

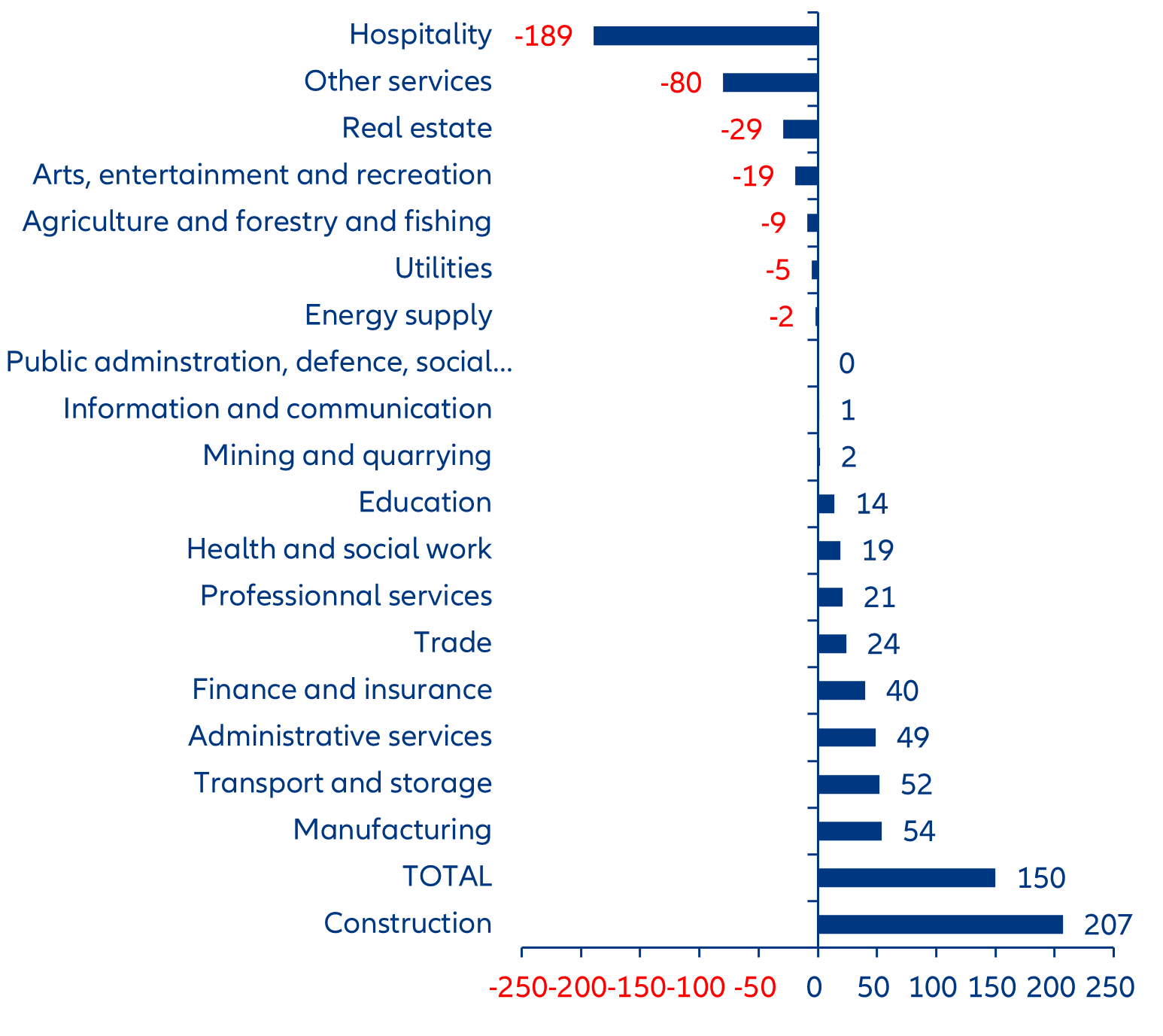

Sectors most exposed to energy and input prices are more at risk, with significant variation within sectors, especially in manufacturing. Construction tops the list (+207 cases ytd, +10%), ahead of manufacturing (+54 cases, +7%) and transport/storage (+52, +6%). However, several sectors have been spared so far, such as hospitality and real estate, where insolvencies have declined. Firms in the manufacturing sectors are unevenly exposed to current challenges. We see a faster increase of insolvencies mostly in data-processing equipment and electronics (+16), rubber and plastic goods (+16), furniture (+14), foodstuffs and fodder (+13). Insolvencies increased moderately in the trade sector, which remains the second-largest source of bankruptcies after construction (Figure 4).

US real estate—trouble (still) ahead?

Making up for inflation—how Jane and Maxi can get their groove back

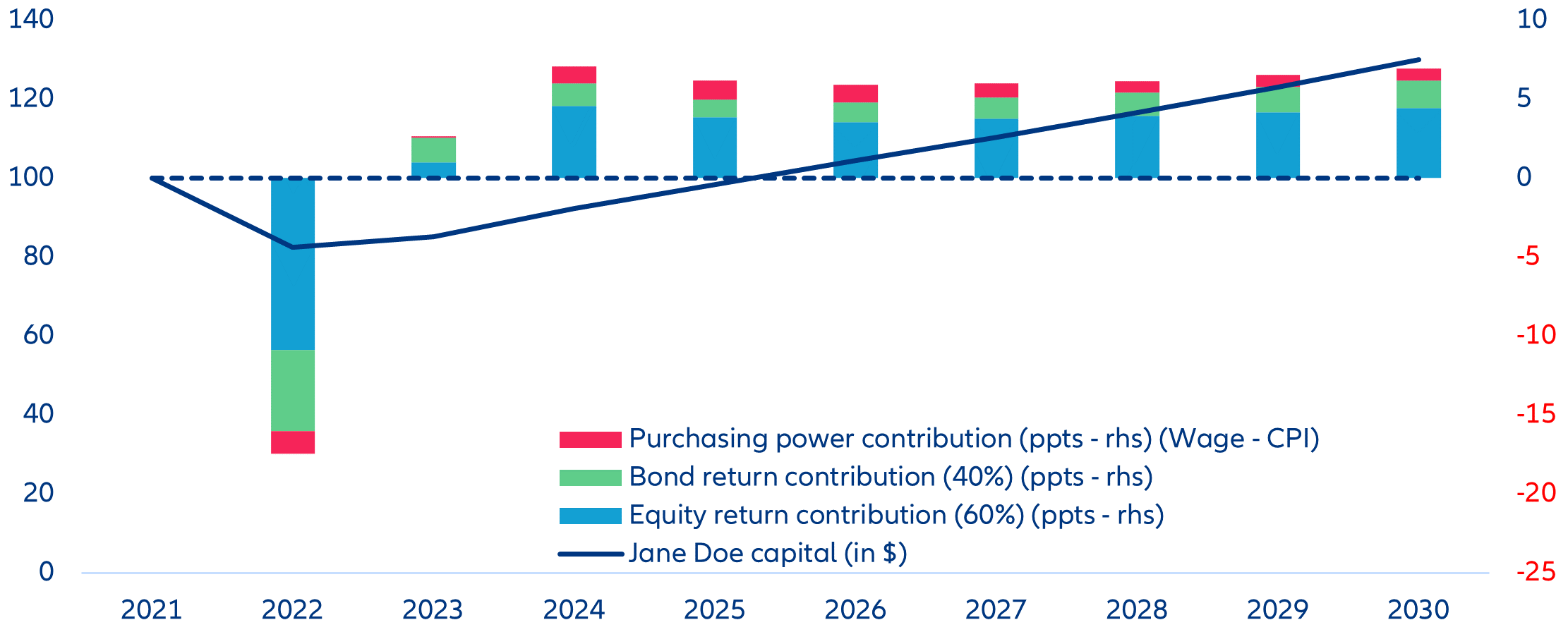

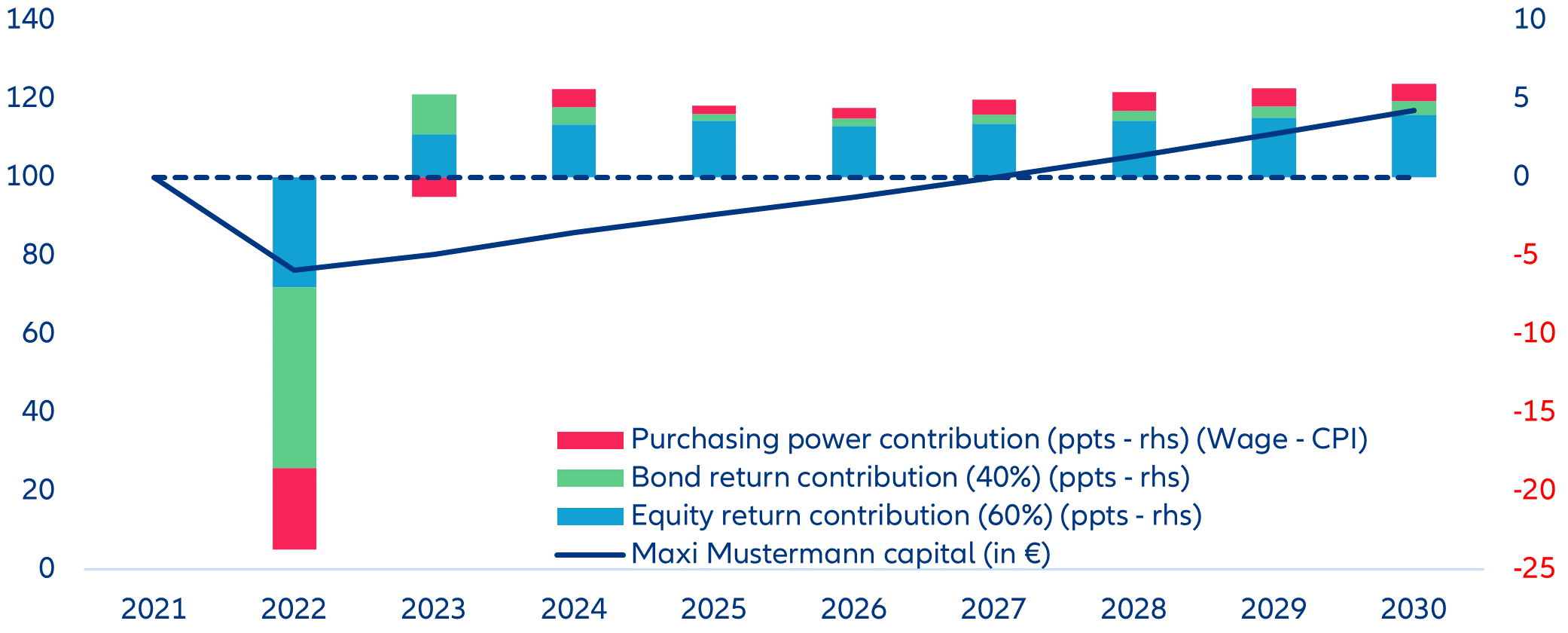

Investors holding a 60/40 portfolio of equities/bonds lost about ~20% on average last year; it will take them more than 3 years to fully recover their losses. In recent years, and especially since Covid-19, retail investors have become more engaged in capital markets. As fascinating as it has been to observe the erratic behavior of “meme” stocks and cryptocurrencies, 2022 ended with a market implosion, leaving new retail investors exposed to sizeable losses. So how long will it take for average investors to recoup their losses? To find out, we recreate a probable path for an average 60/40 portfolio of equities/bonds for both US and Eurozone investors: Jane Doe and Maxi Müller, respectively. In this hypothetical scenario, we assume a USD/EUR100 investment in the local stock market and local government bonds at the end of 2021, adjusting for the loss of purchasing power due to the high inflation regime. Our results suggest that 2022 left US investors with an average loss of -17 % while their European peers suffered an even greater blow of -24%. Based on our current macroeconomic and capital market forecasts[1], it would take up to four years for investors to make their money back (assuming no changes to the portfolio structure intact), Figures 8 and 9).

[1] See Allianz Research quarterly economic and capital markets publication (link)

As more retail investors participate in capital markets, it is increasingly important to provide the right tools to boost financial and risk literacy. Tech advancements for trading, excess savings during the pandemic and yield-seeking at a time of low interest rates and rising inflation are all driving more investors into capital markets. But in our 2020[1] survey, we found that only 32.4% of Americans and 42.2% of Germans had basic financial literacy competencies. Financial skills can aid households to make the best of their financial decisions – from budgeting to saving and investments. Equipped with the necessary tools, households will be able to weather economic storms, or cushion the blows that our brave new world may throw their way.

[1] Financial and Risk literacy: Resilience in Times of Covid-19.

Corporate performance—will inflation continue muting spending in 2023?

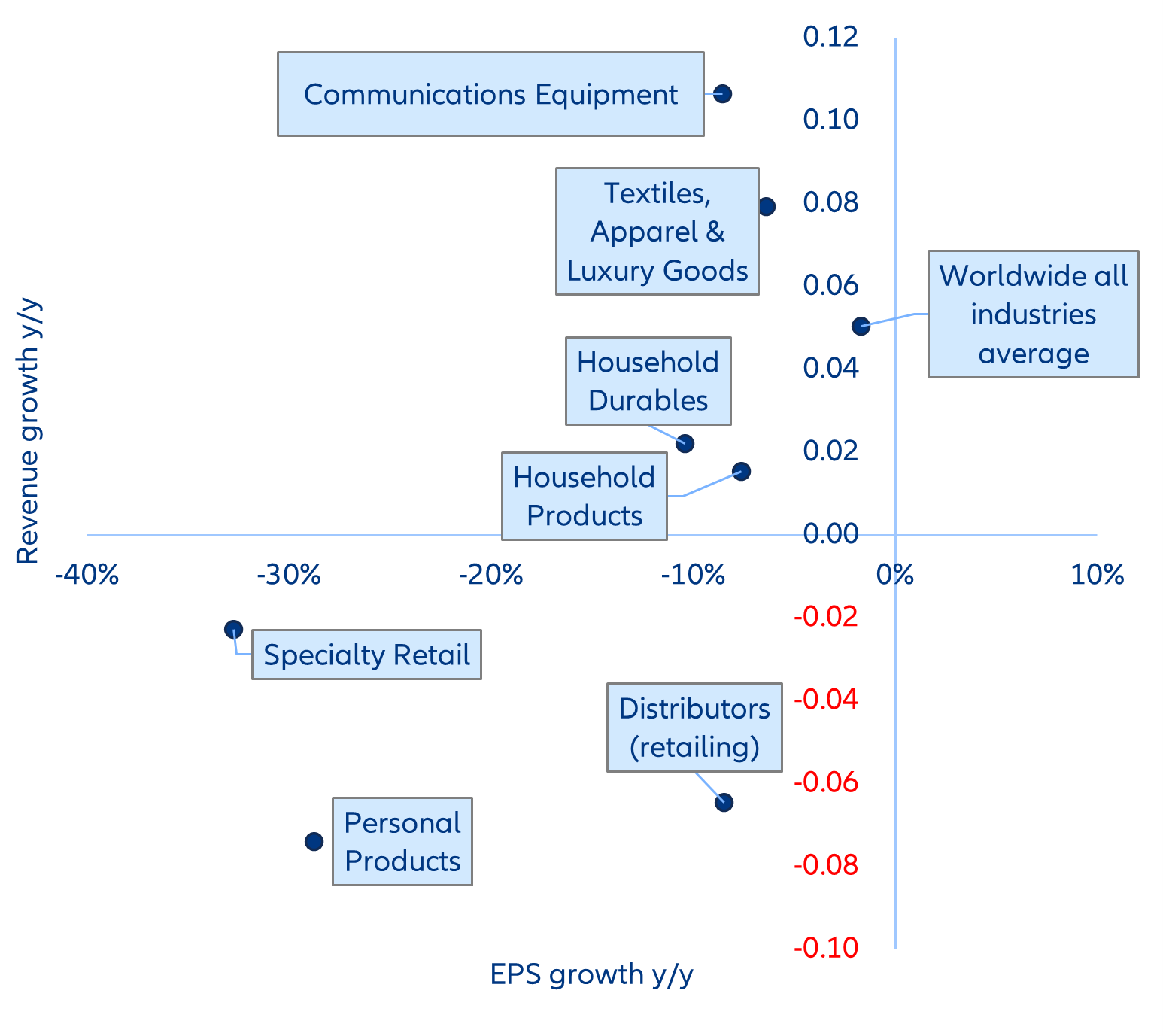

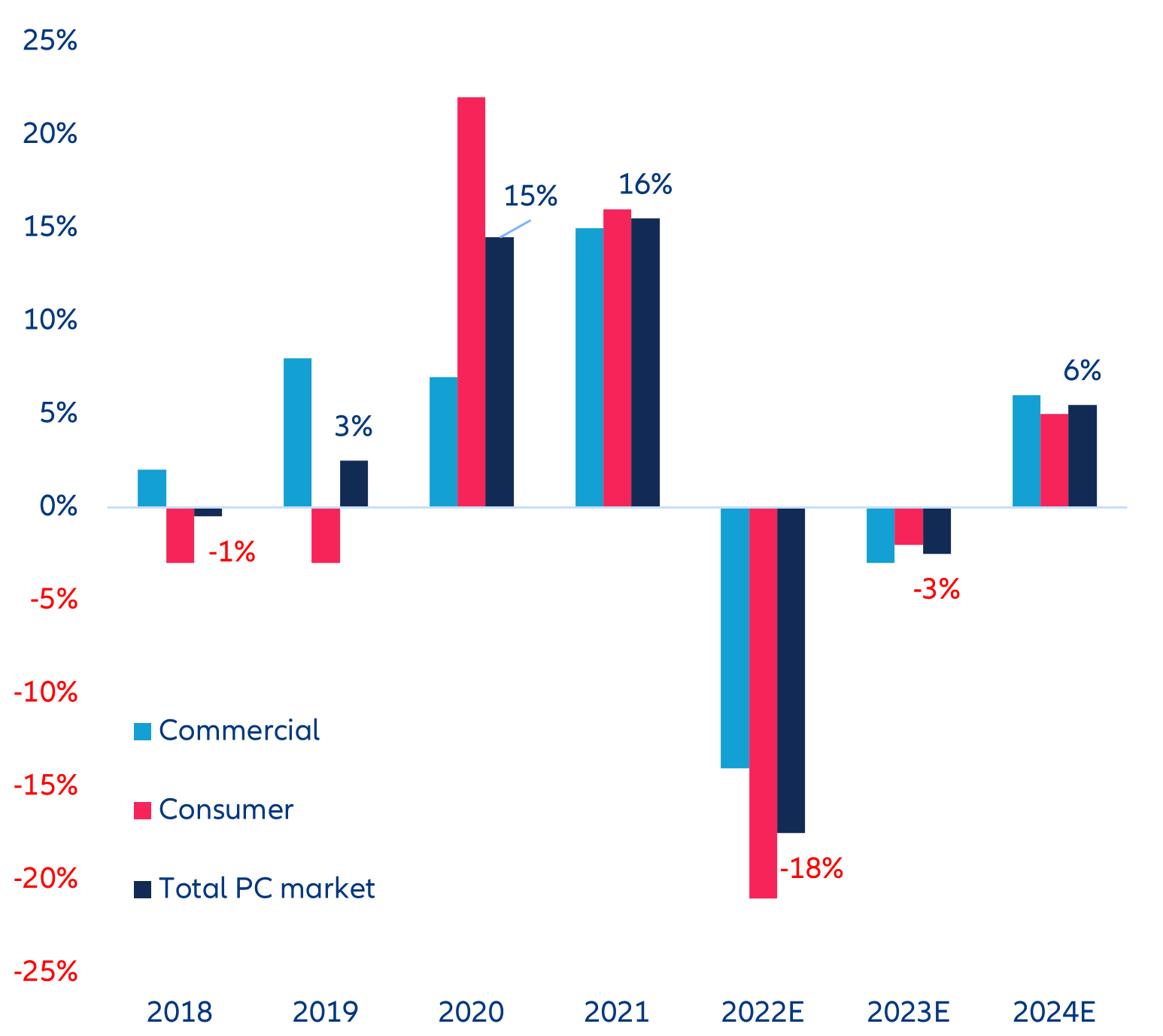

With a quarter of all listed companies having posted their Q4 2022 financial results, discretionary sectors appear to be the worst hit. Although it is still early to draw firm conclusions, it is fair to say that inflation has clearly hit household consumption over the past few months and therefore impacted the earnings of firms in the discretionary sector. Despite the discounts offered by distribution stores, aiming to reduce the inventories glut, retail sales fell by -1.1% in the US in December, and -2.7% in the Eurozone. Margin pressure has been particularly high for apparel retailers and department stores due to their higher bills for textiles, energy and transportation. While the overall industry EPS growth rate was -1.6% on average in Q4, the EPS of distributors and specialty retail companies fell by -8.5% and -32.7%, respectively. As per 2023 guidance, big players in the sector have cut their profit forecasts for the year, hoping for improving sentiments within a few quarters (Figure 10).

In focus—monetary policy in Central and Eastern Europe ahead of the curve?

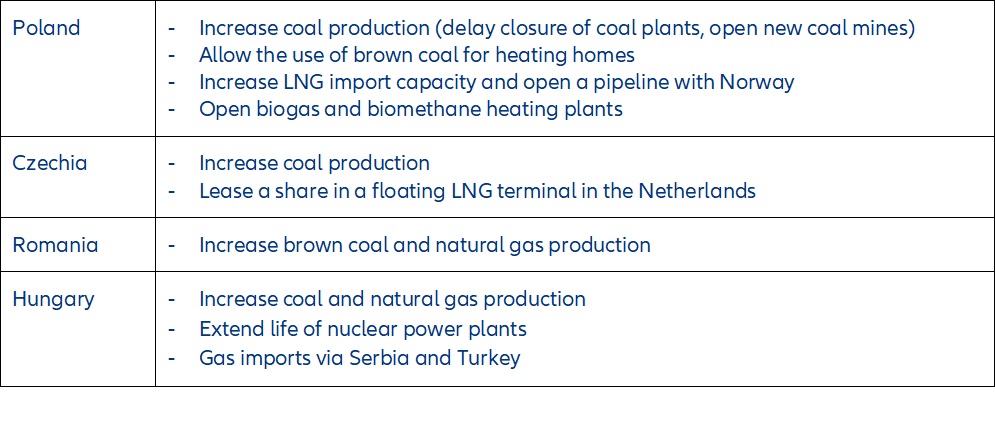

Central banks in the CEE-4 have been the first major ones to halt their interest rate hiking cycles and we expect some of them to also be ahead of the curve when it comes to the pivot. The Czech National Bank (CNB) was the first major emerging market central bank to end its tightening cycle (after a last hike in June 2022), followed by the National Bank of Poland (NBP) in September and Hungary’s central bank (MNB) in October. The National Bank of Romania (NBR) was initially a laggard in monetary tightening and thus has continued hiking until January 2023. That was perhaps the end of its hiking cycle though there is a chance it will opt for one more rate increase on 9 February. The central banks in the CEE-4 have recently been very cautious in their monetary policy communication, avoiding any talk about potential rate cuts later in 2023. But this may reflect the fact that policy communication mistakes by the MNB and the NBP about the ending of the tightening cycles caused some market turbulences (rapidly rising bond yields; see Figure 16) in September-October 2022; the MNB even had to tighten one more time then. Central banks will want to avoid a repeat of that turmoil.

Nonetheless, barring any new shocks, we expect that the central banks in the CEE-4 will begin monetary easing in 2023, given the somewhat improved disinflation outlook and ongoing headwinds to economic growth in the region. The CNB is likely to be one of the first EM central banks to cut interest rates this year, most likely in June when annual inflation in Czechia is forecast to have fallen back to single digits. The recent appreciation of the Czech koruna (Figure 17) may also support an early rate hike as the CNB wants to avoid the koruna being too strong and jeopardizing the economy’s competitiveness. Further rate cuts by the CNB are projected in H2, bringing the Czech policy rate to 6.00% at end-2023 (from currently 7.00%). In Poland, we expect a first lowering of the policy rate around September, when inflation should have declined to below 10% as well, followed by another cut at the end of this year, taking the NBP’s policy rate to 6.25% (from currently 6.75%). The central banks of Romania and Hungary are likely to wait until Q4 2023 for the pivot to monetary easing. Both countries are forecast to experience large double deficits on the fiscal and current accounts and government bond yields are higher than that of Czechia and Poland, requiring more caution by policymakers. We forecast end-2023 policy rates of 6.75% in Romania and 12.00% in Hungary (currently 7.00% and 13.00%, respectively). See Figure 18 for an overview of our policy rate forecasts for the CEE-4 in 2023. These forecasts also suggest that we expect all CEE-4 central banks to pivot ahead of the ECB, and the CNB and the NBP to pivot ahead of the Fed.