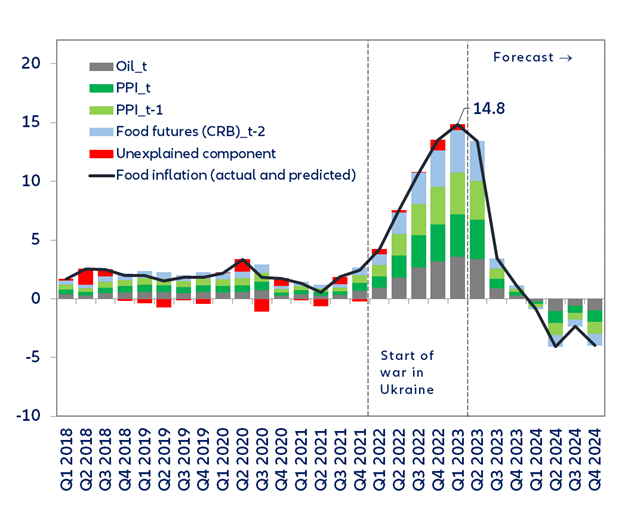

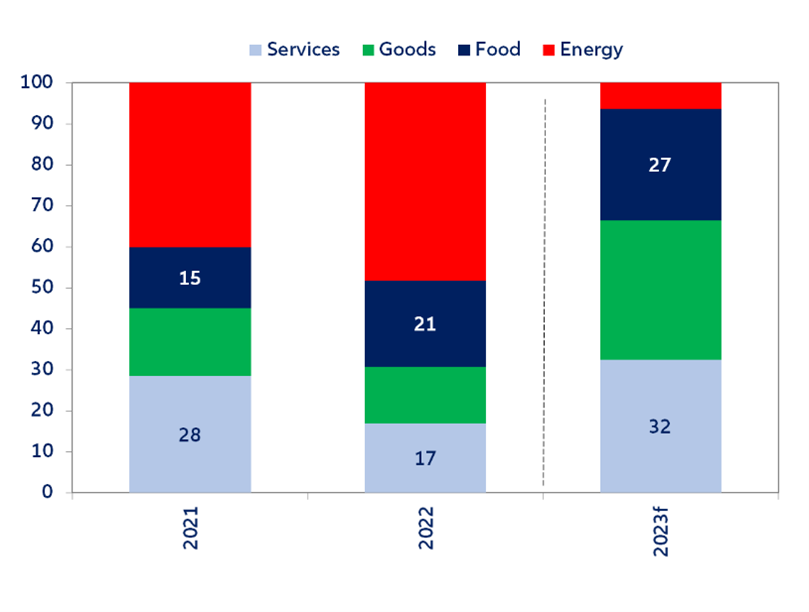

- Food prices in Europe remain high and will only decline later this year. In March, headline inflation in the Eurozone declined to 6.9% y/y (down from 8.5% y/y in February) due to a large drop in energy inflation to -0.9% (down from 13.7% y/y in February) as we mark the one-year anniversary of the jump in oil and gas prices after Russia invaded Ukraine. However, food, alcohol and tobacco inflation rose again to 15.4% and are likely to remain high until the end of the year.

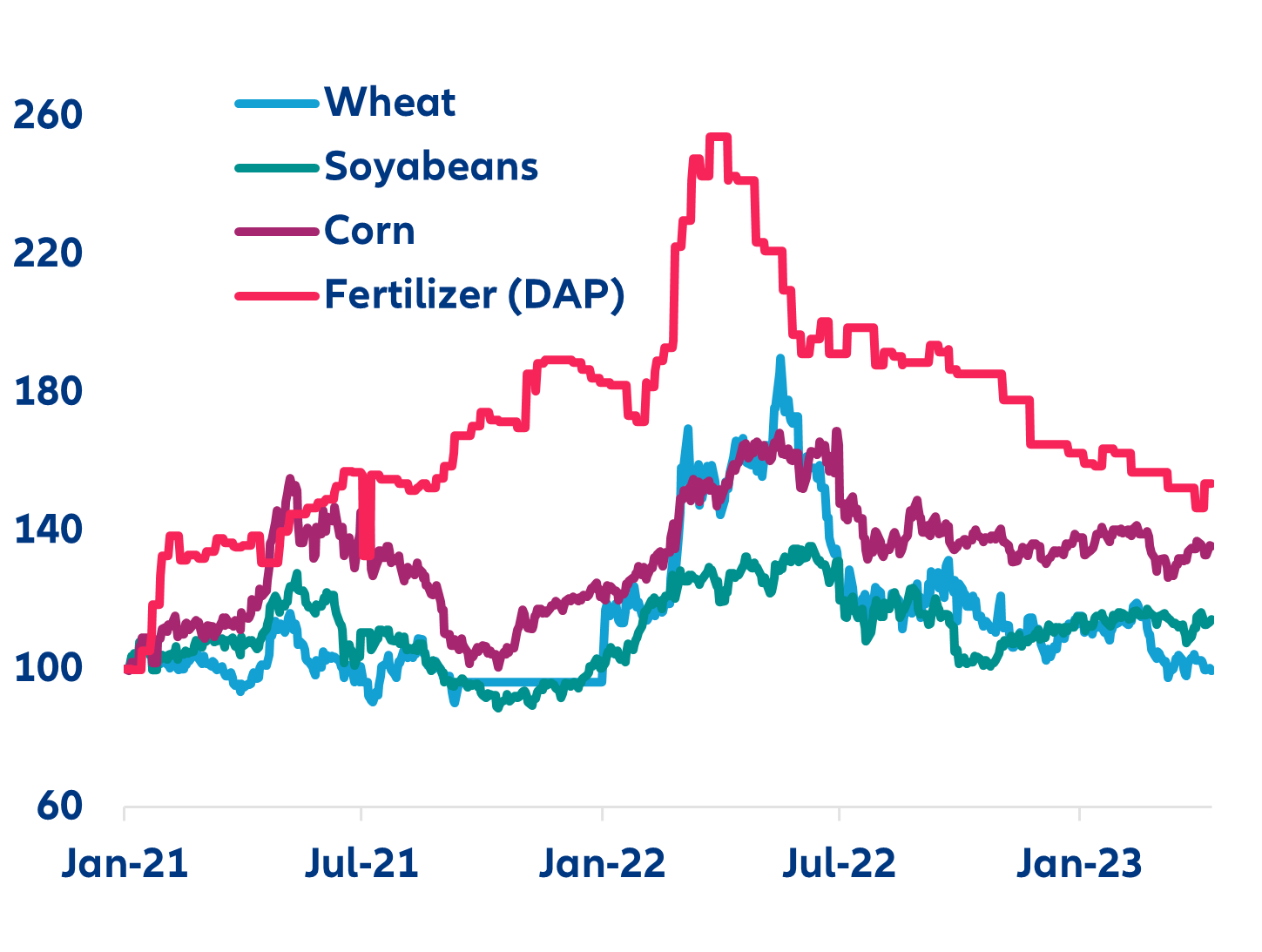

- Cooling commodity prices have not helped mitigate food price pressures in Europe. As of April 2023, most food commodities are trading at levels close to or slightly above those of 2021. Although some remain expensive, we saw similar prices in 2013-2014 without a large increase in food inflation. Packaged-food producers are behind most of the price pressures.

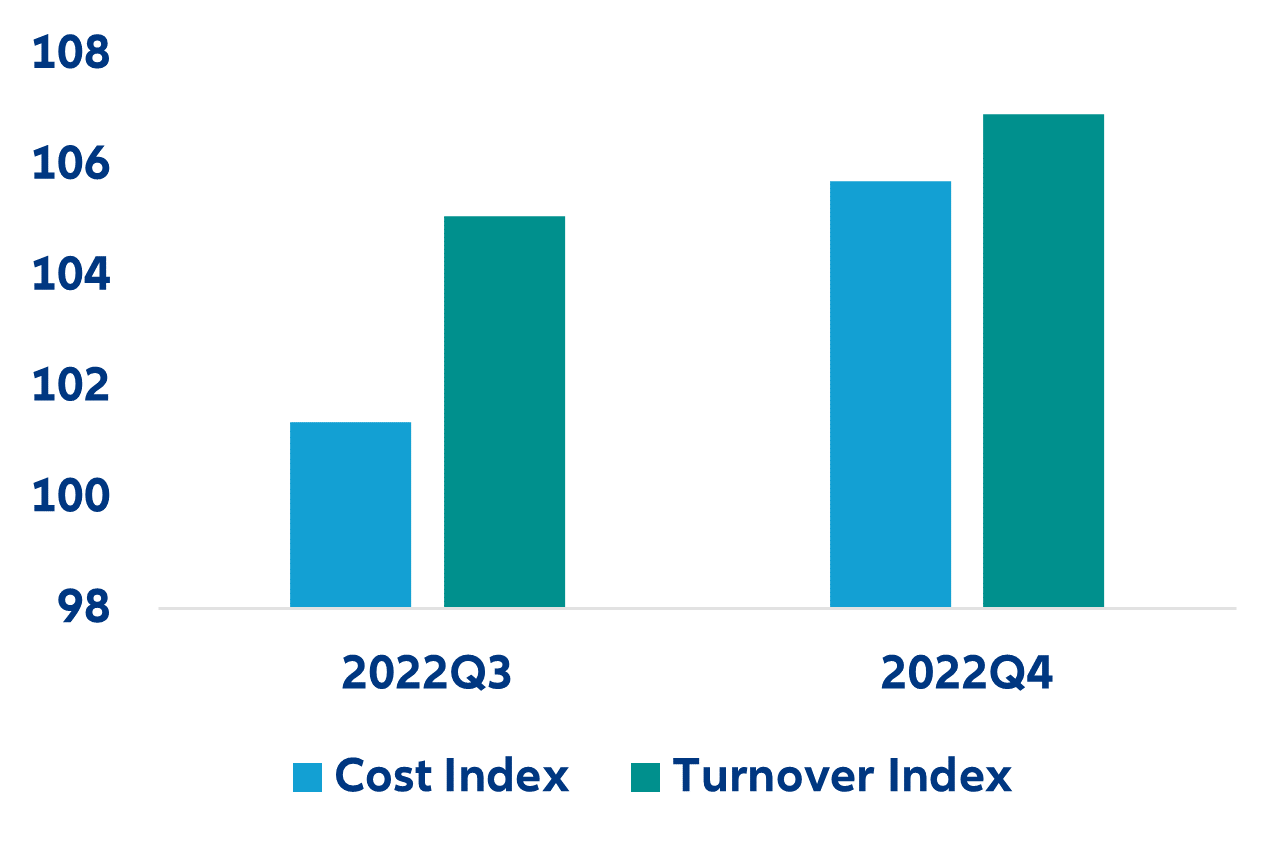

- Some food inflation remains “unexplained” due to catch-up profit-taking. This could stem from firms in the food sector making up for the difficult months between March and June 2022. We find that most firms have managed to increase turnover beyond costs since then.

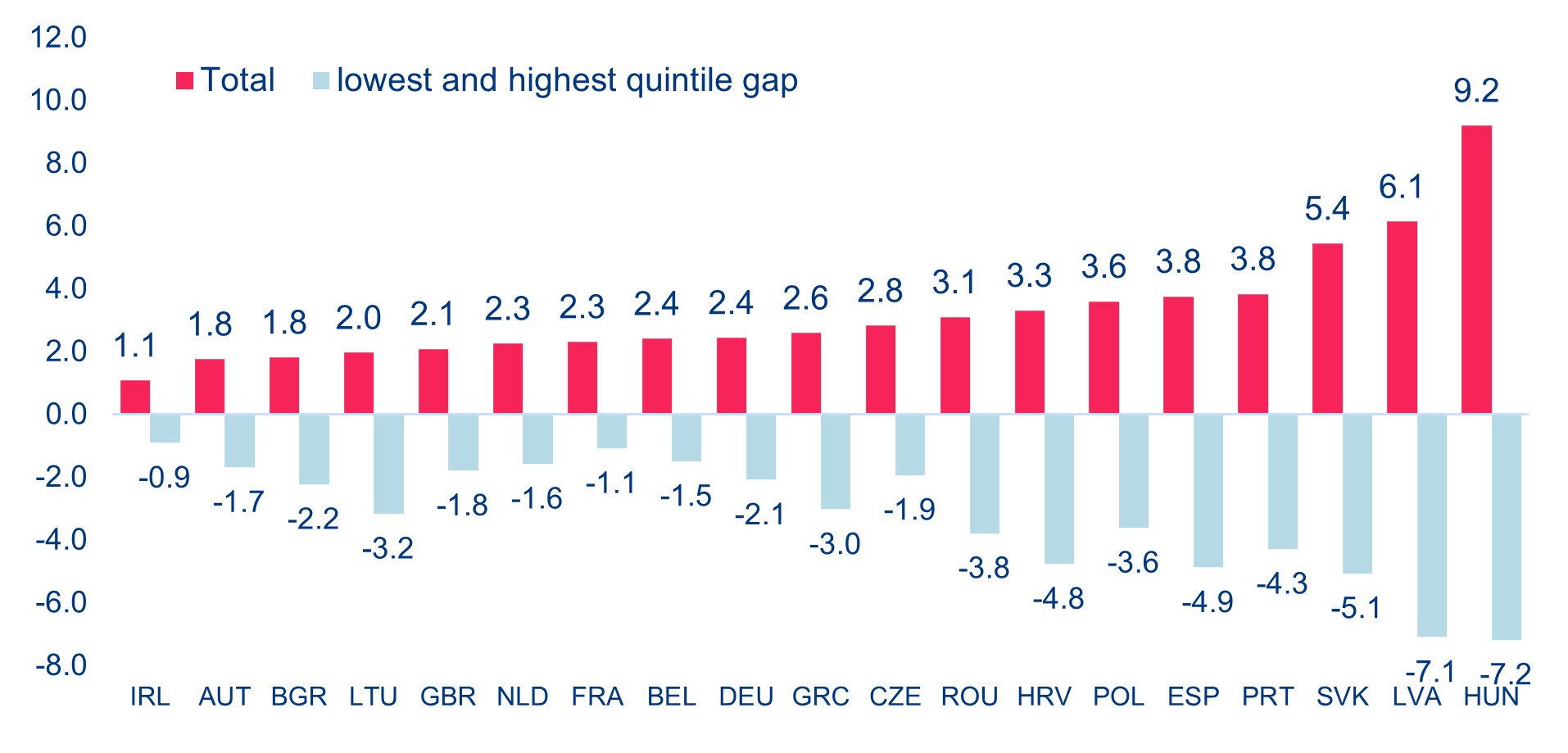

- Consumers will continue to pick up the tab. As PPI have just turned a corner, expect prices to continue increasing until the summer and remain at elevated levels. We estimate that households have lost between 1.1% and 9.2% of purchasing power over the past year, with Eastern European countries being hit the hardest. A further increase in food prices by +20% could lead to about 1-pp drop in consumption in the EU.

In Focus

European food inflation – hungry for profits?

An Arab Summer ahead?

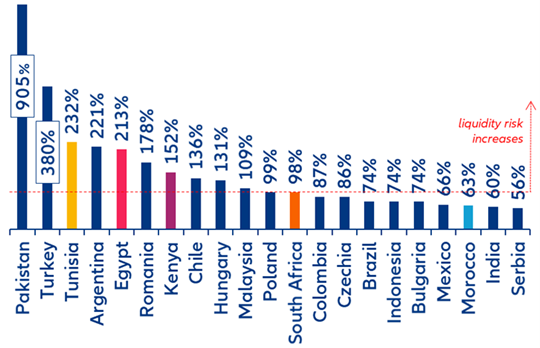

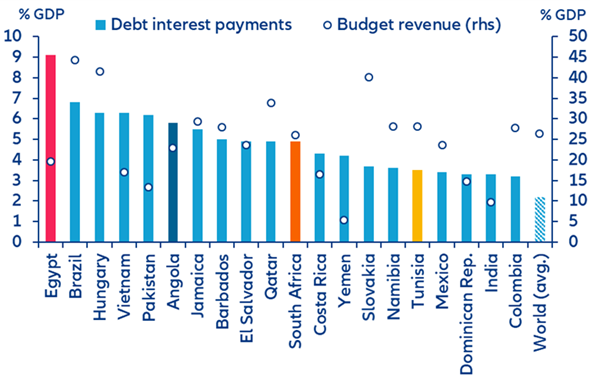

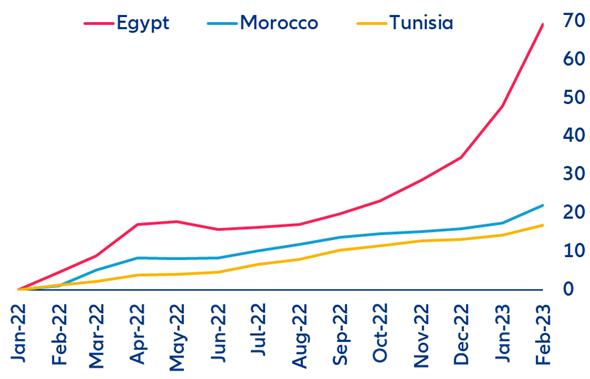

Tunisia and Egypt’s negotiations with the IMF for much-needed financial assistance are stalling at a time when political risks are mounting. While the IMF approved a two-year USD5bn Flexible Credit Line for Morocco in April, de-democratization in Tunis led the World Bank to suspend collaboration earlier this year, while the first review of the latest USD3.2bn program with Egypt was scheduled for mid-March and has not yet allowed for disbursements this year. International reserves in both countries are not enough to cover half-year maturities (see Figure 1), and Egypt’s interest payments are likely to absorb an amount equal to 9% of GDP in 2023 (see Figure 2).

With USD18bn outstanding, Egypt is already the second-largest country in the world in terms of exposure to the IMF after Argentina. IMF repayments of around USD3.5bn are due in 2023 alone, meaning that even if the whole amount of the latest IMF loan were disbursed before year-end, it would not even cover debt repayments to the Fund itself.

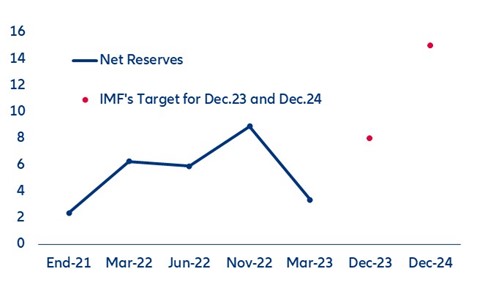

Argentina – IMF deal turns one, with little to celebrate

This month, Argentina received a fresh tranche of IMF funding (USD5.4bn) but almost unchanged targets and optimistic macroeconomic forecasts suggest that the Fund is being lenient, waiting for the new government to take power to design a more credible economic program. In total, Argentina has already accessed USD29.bn of the USD44bn provided under the 30-month arrangement via the Extended Fund Facility. The Fund noted that the country met quantitative targets through December 2022, supported by tighter macroeconomic policies to stabilize the economy. While it acknowledged that progress since end-2022 has been more mixed, owing to a severe drought and setbacks in energy, pensions and exchange rate policy, it did not make major revisions to macroeconomic projections for 2023. In fact, its forecast of +2% economic growth appears very optimistic at a time when markets are expecting a recession of around -1.5%. Moreover, targets for 2023 and 2024 also remain largely unchanged. Only the target for net international reserves (NIR) was revised downward by USD1.8bn to USD8bn for 2023 to partially reflect the impact of the drought and its effect on future exports.

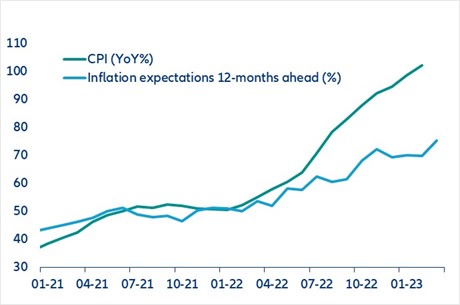

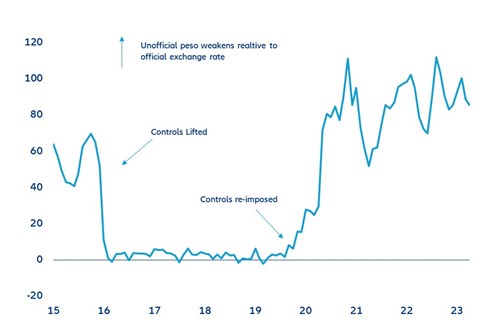

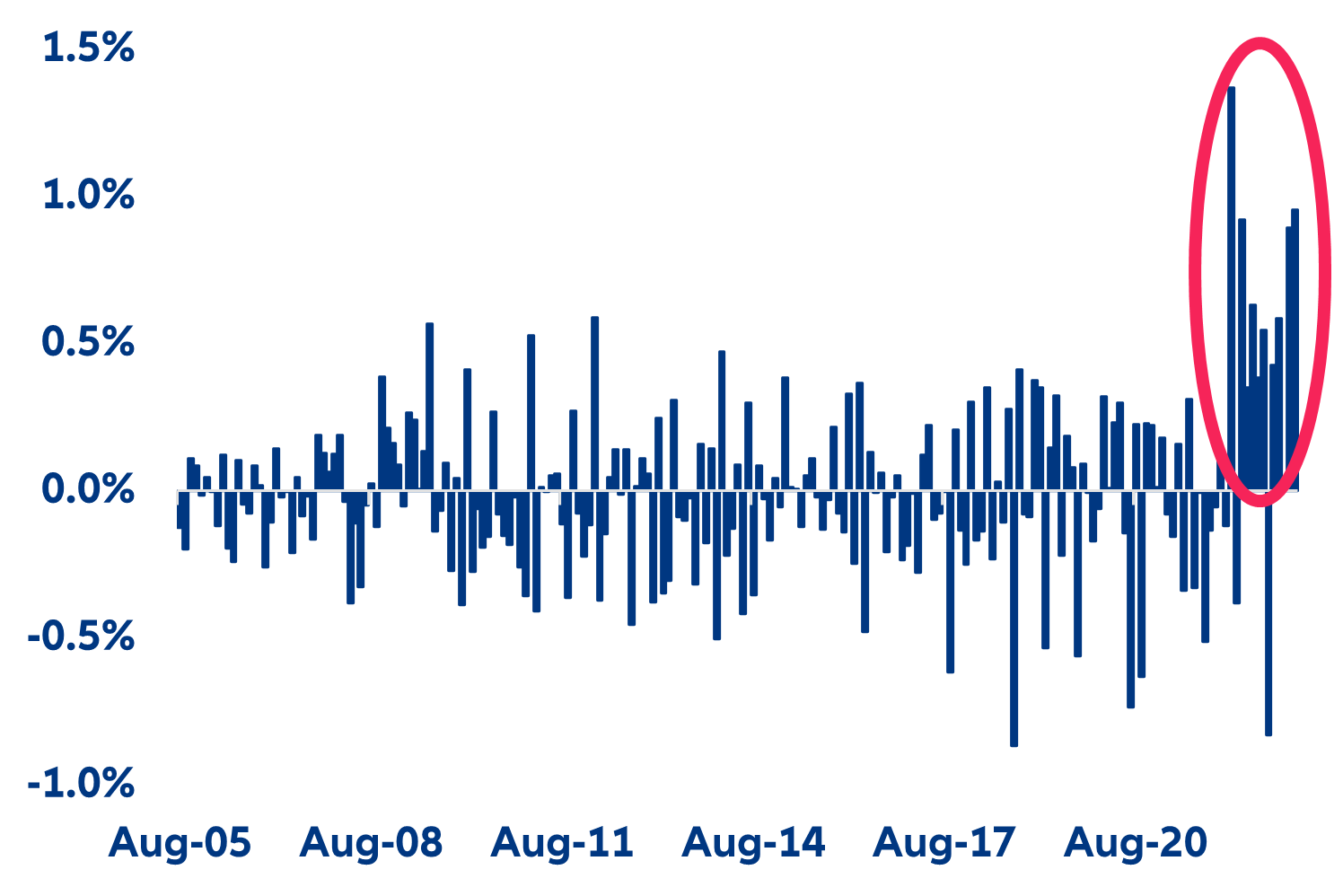

Argentina faces an extremely fragile situation. The economic and political situation has clearly become more challenging in the past months, with further deterioration of key macroeconomic variables. Inflation is above two digits, international reserves have fallen to extremely low levels and we observe a high spread between official and parallel exchange rates (the “Blue rate” being the most followed) (Figures 4-6). While this spread is lower than the peak observed in late June 2002, it still stands around 100.

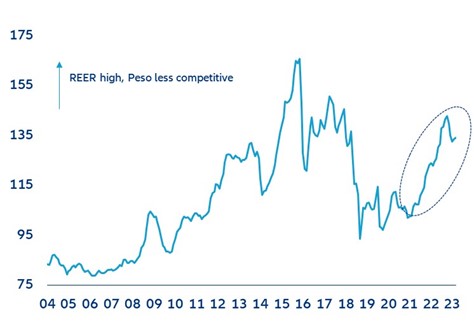

The drought might increase macroeconomic imbalances, weighing on economic activity, adding further pressures to inflation and challenging reserve accumulation. This suggests that the target imposed by the IMF might be very difficult to meet. Argentina has previously faced serious difficulties in accumulating international reserves, achieving the IMF target via temporary measures, including the introduction of multiple exchange rates, e.g. more favorable rates for exporters such as the soy exchange rate (introduced during September and December) and, more recently, the Malbec exchange rate to encourage exports of wine. While these measures provide temporary relief, they do not address the fundamental problem that the Argentine peso (ARS) is overvalued (Figure 7).

Exchange rate and capital controls are unlikely to be eliminated any time soon. Argentina is caught between a rock and a hard place: Although there is growing pressure for a devaluation of the currency, given international reserve dynamics, doing so would increase production costs, aggravating an already complicated inflationary scenario. Moreover, a large part of the country's local debt is inflation-FX linked; as a result, depreciation would significantly increase fiscal costs, with detrimental effects on public debt dynamics. With two-thirds of debt denominated in foreign currency, a depreciation would also cause a significant deterioration in Argentina’s debt-to-GDP ratio. With risks of currency depreciation rising, there could be some risk of debt restructuring, so its rollover in the market will remain uncertain in the medium term.

The general election planned for later this year implies fiscal targets could also be compromised. Given a further acceleration of inflation and deteriorating social conditions (real wages are falling fast), risks of social unrest are increasing, which would compromise fiscal consolidation through expenditure controls – notably the targeting of energy subsidies and social assistance. It is very likely that the government will keep the subsidies. Moreover, the approval by Congress of a new pension moratorium bill in February is likely to create additional pension liabilities of around 0.4% of GDP over the medium-term. Additional policy measures will be required to mitigate the impact and maintain the fiscal-adjustment path.

All in all, it is unlikely that the IMF program will improve short-term macroeconomic performance. Policy credibility remains weak, inflation is expected to remain in the triple digits, financial repression is increasing and a significant slowdown in real activity is already under way. The fresh tranche of funding will simply allow Argentina to buy some time.

European food inflation – hungry for profits?

Sources: Refinitiv, Allianz Research

Sources: Refinitiv, Allianz Research

Sources: Refinitiv, Allianz Research

Cooling commodity prices suggest that other factors might explain continued prices pressures on food. Global commodity prices have retreated sharply from their 2022 peaks: wheat and soybeans are now trading at 2021 levels, while corn is about 30% more expensive than in early 2021 and fertilizers remain about 50% more expensive than a couple of years ago; yet food inflation keeps rising. Operating costs of food producers and retailers seem to explain the growing disconnect between upstream (commodity) and downstream food prices: energy (oil: +43% (2022 vs. 2021), wholesale electricity (+145%), packaging (+24% for paper, +18% for glass, +23% for metal, +16% for plastic), and labor (unit labor cost in the retail sector +5%) (Figure 10).

It seems that packaged food companies rather than retailers have increased their prices the most. Capturing over 70% of all spending on food in Europe, food retailers have historically driven most of the price increases over the recent past. Food price increases rose in the second half of 2021 following the surge in agricultural benchmark prices before accelerating in the wake of Russia’s invasion of Ukraine. Retailers have passed most (but not all) of their costs onto customers: In 2022 alone, food producers increased their prices by +17% y/y (compared to “only” +12% for food retailers). Financials from listed food retailers confirm that costs rose faster than sales, with 2022 gross margins shrinking and falling below their pre-pandemic levels. Looking closer, we also find that the European food sector was hit by higher costs in Q2 2022: At the time, our total cost index for the sector increased by +6.7% while turnover grew by a meagre +0.8%. Since then, turnover growth has been outpacing the cost index, suggesting that firms in the food sector have been increasing prices to make up for lost margins (Figure 11).

However, food inflation varies significantly across countries due to structural factors. France (+7.3%), Italy (+9.3%) and Spain (+11.6%) recorded food inflation below the 2022 European average (+11.9%). On the other hand, Germany (+12.6%), Poland (+14.5%) and Slovakia (+18.6%) recorded above-average food inflation. This cross-country dispersion depends on:

- Retail market structure: Countries with above-average penetration of discounters report generally above-average inflation. Discount-brand packaged food incorporates a comparatively higher share of input costs as a percentage of total costs vs. branded packaged foods, i.e. their prices are likely to increase at a faster pace compared to those of brands where other costs are more flexible (advertising, promotional expenses). Discounters generally have much higher market shares in Germany (47%) as well as Central and Eastern Europe compared to Southern Europe (e.g. 8% in Italy).

- Consumption habits: Processed food typically incorporates a greater share of energy and packaging costs. As a result, countries with above-average consumption generally report above-average inflation. In Europe, processed-food consumption is comparatively lower in France, Italy or Spain compared to the UK, Germany and Nordic countries.

- Dependence on food imports from Ukraine: Eastern European countries have been hurt the most.

Contact

Allianz SE

Allianz Trade

Allianz Trade