- The large energy-price shock still lies ahead for European corporates. In 2022, increases in corporate utility bills were contained, thanks to government interventions and the long pass-through from wholesale energy prices to retail contracts, which are for the most part not fully indexed. But we expect utility prices to accelerate in 2023 as more contracts are rolled over, with power prices set to increase by less than +40% in Germany, compared to 2021, against +90% in Italy and Spain.

- However, this is not a game-changer for the price competitiveness of European industry relative to that of the US. Energy consumption generally makes up around 1-1.5% of production in the manufacturing sector. Price competitiveness is much more sensitive to changes in labor costs and the exchange rate. We find that the power-price gap that has opened up between the US and Europe would lead to generally modest losses in manufacturing employment and output, though Spain appears weaker.

- Yet, there are signs that Europe has started to lose market share against other partners. Exporters visibly losing market share in EU15 imports are almost exclusively found in Europe (in agrifood, machinery and electrical equipment, metals and transportation) – but not to the benefit of the US. Rather, the countries benefitting are found in Asia, the Middle East and Africa (and a few in Europe).

- The main direct channel of the energy crisis is through its impact on corporate profitability and investment. We find that the current energy shock would dampen corporate profitability by around -1pp to -1.5pp, and the investment rate by -1pp to -2pp. This would represent EUR40bn in investment losses in France and GBP25bn in the UK.

The huge energy-price shock is coming for European corporates in 2023

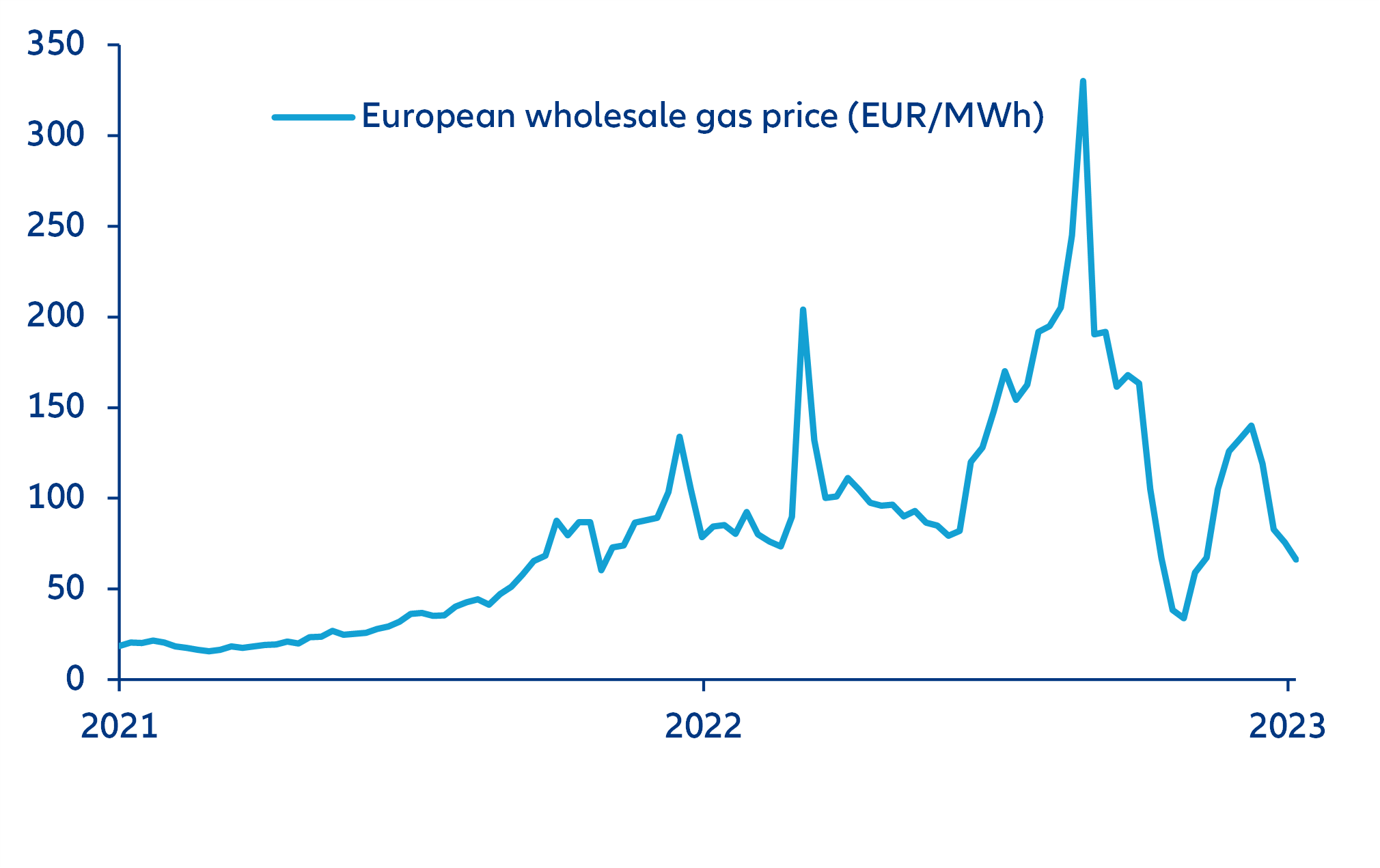

- Recent drops in wholesale gas prices have raised hopes that the worst of the energy crisis in Europe is now behind us. But these hopes are misplaced. Unlike an oil shock, a gas (and electricity) shock does not feed through rapidly to the real economy because household and corporate utility bills are, for the most part, based on fixed-price and/or government-controlled contracts, rather than being partially indexed to wholesale gas and electricity prices. What’s more, gas prices have trended lower in recent weeks due to an unusually mild winter, but we expect prices to rise ahead of winter 2023 as Europe faces mounting competition for energy supplies from China.

European wholesale gas price (EUR/MWh), Dutch TTF first future day

Sources: Refinitiv, Allianz Research

Contact

Maxime Darmet

Allianz Trade

Allianz Trade

Francoise Huang

Allianz Trade

Allianz Trade

Ano Kuhanathan

Allianz Trade

Allianz Trade