- The commercial real estate sector is getting squeezed by tightening financing conditions, but prime assets have remained resilient. After attracting considerable investment in the era of low interest rates, the sector is now battling a storm of cyclical headwinds: besides the weak economic momentum and the resulting increased risk of tenants’ rent defaults, higher-for-longer interest rates will also hit debt servicing and the possibility of refinancing. Also, the sharp increase in construction costs is discouraging new developments and pushing up expenses for maintaining and upgrading buildings. However, limited supply due to subdued construction during the pandemic mitigates current price pressures, with greater differentiation between prime and non-prime assets and locations. Similarly, the inflation-hedge role of real estate will attract stabilizing long-term investment and counterbalance current headwinds.

- A banking doom loop does not seem to be on the cards in Europe. Banks have built up a solid capital position and CRE debt is mostly held by larger banks that are subject to strong oversight after the ECB identified some weaknesses in its 2021/22 review (e.g. banks lacking commonly defined basic CRE risk or even an overview of loans subject to refinancing risk). In contrast, in the US, a large portion of CRE debt is held in the public markets as Commercial Mortgage-Backed Securities (CMBS), which require refinancing, and much of the private debt is held by small banks experiencing considerable pressure from their deposit base.

- Strategic investment decisions will depend on being selective in terms of geography, segment and asset quality, with a focus on logistics, data centers and tourism. Based on our macro-financial model, we expect CRE prices to fall between 10-15% over 2023-2024 in the major Eurozone economies, although with wide heterogeneity across countries, segments and quality. Although remote working is becoming less popular, the office segment, especially in non-prime locations, will face price corrections. However, Europe will fare better than the US as remote work is less widespread, with lower vacancies in major cities. In fact, rents for prime-grade office assets have risen within the last quarter. In addition, declining supply in the wake of the pandemic and rising interest rates have limited construction, which has helped support rental growth. Aside from the resilient office sector, the bright spots are data centers and, to a lesser extent, logistics, while the strong recovery of tourism, especially in France and Spain, has made hotels more attractive. The retail segment will remain fragile as consumers have shifted to more online purchases

Tightening financing conditions to weigh on the commercial real estate sector

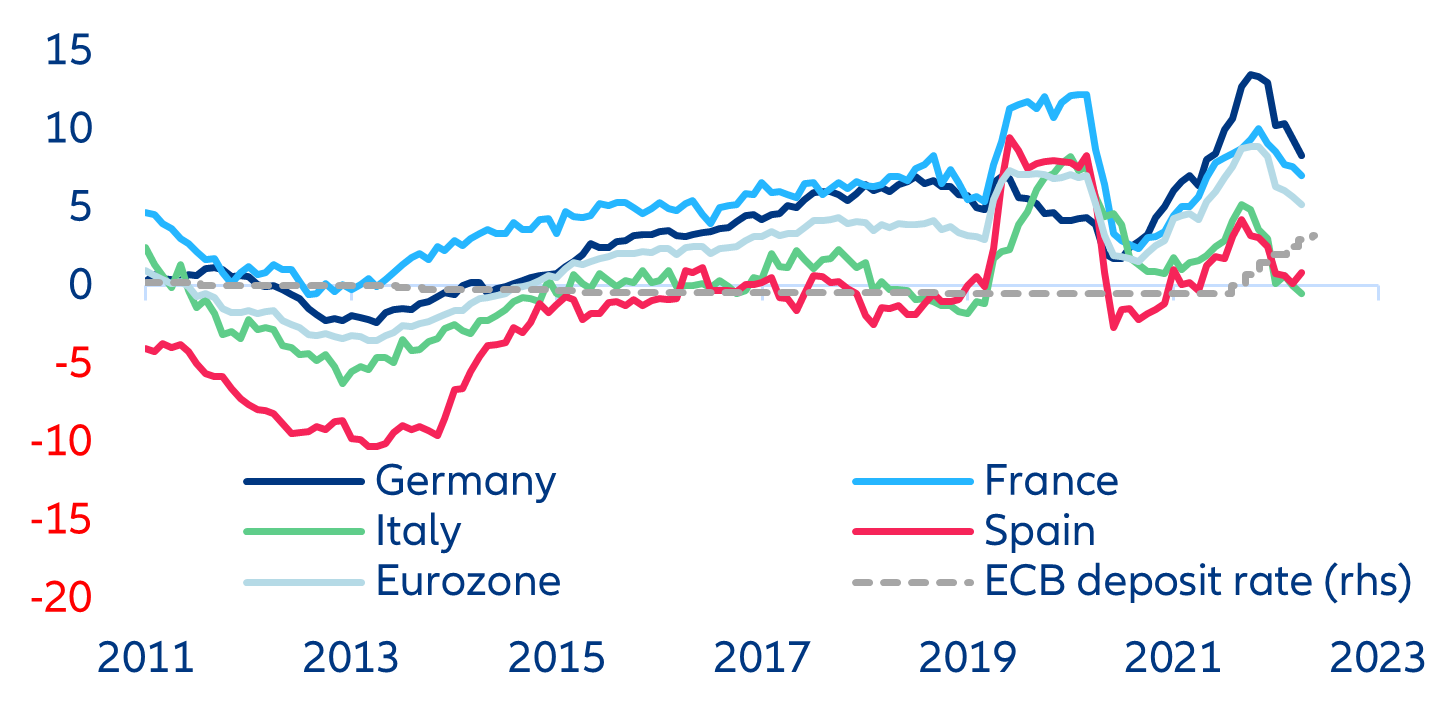

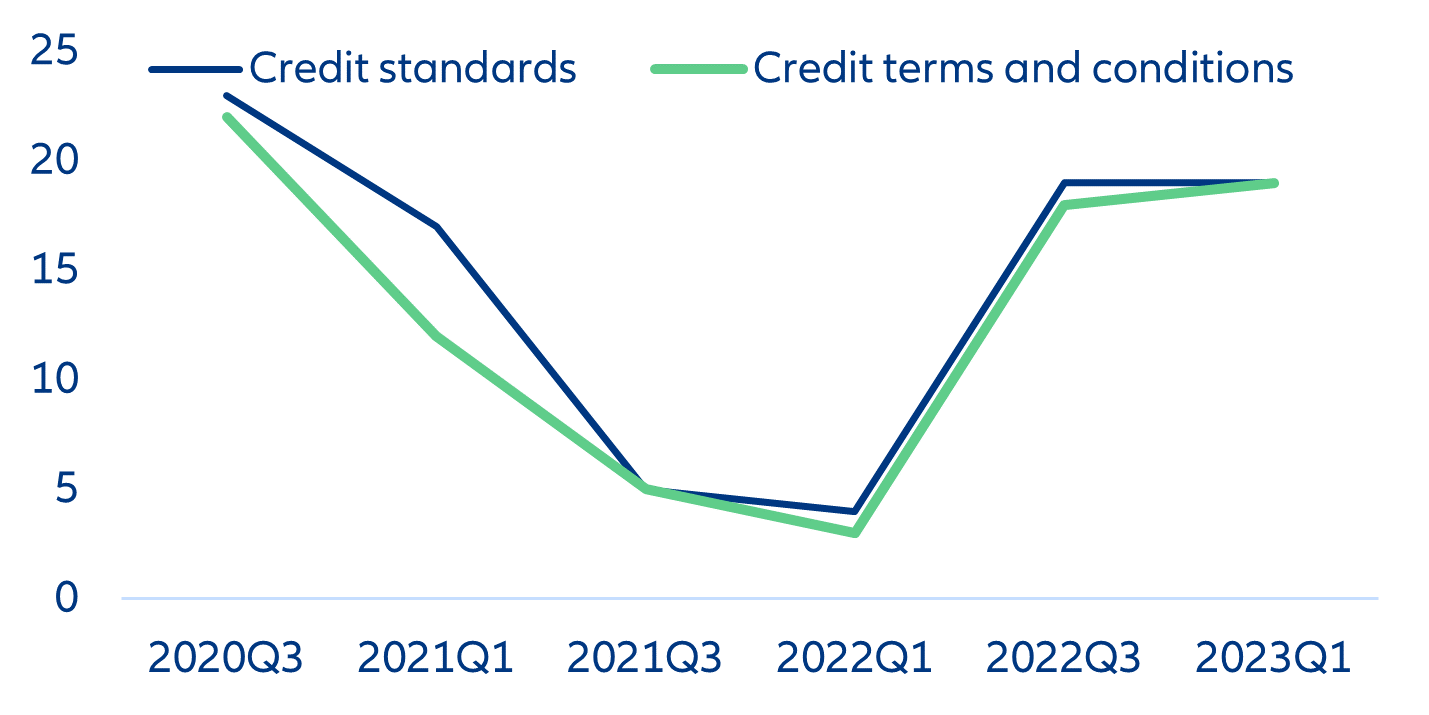

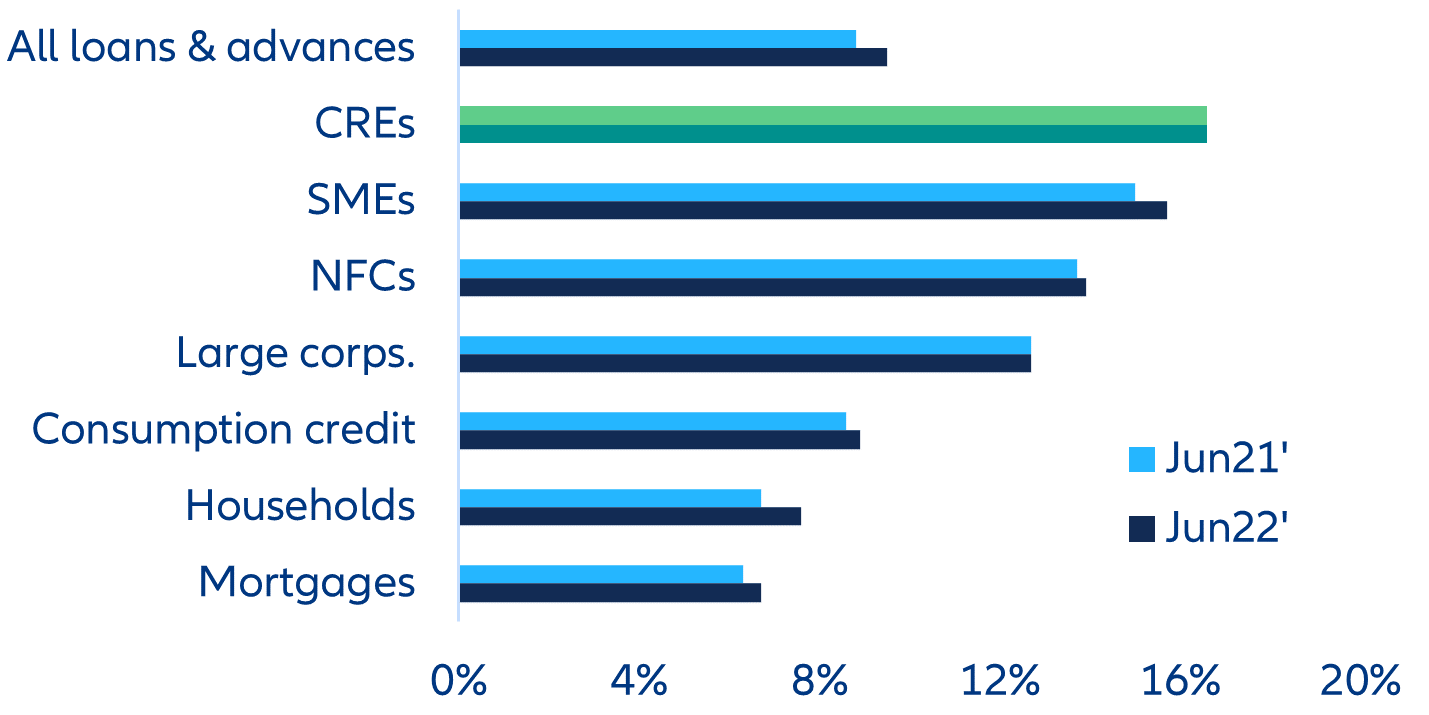

With Europe facing the prospect of stagnating growth in 2023, prolonged uncertainty and rising interest rates will weigh on the commercial real estate (CRE) sector. The sector is facing strong cyclical headwinds. Sharply rising interest rates (+375bps since July 2022) remain a major source of concern. The tightening of credit standards and banks’ overall terms and conditions – particularly pronounced in real estate – have reduced annual loan growth in recent months (Figure 1) and have amplified the negative impact on the CRE market. Also, the weak economic momentum is pushing up business insolvencies, which could lead to higher rental defaults. As we indicated in our recent Global Insolvency Report, sectors such as finance, B2B and real estate-related activities (ex-construction) – i.e., the primary users of office buildings – saw the largest rebounds in business insolvencies in 2022. And we expect insolvencies set to rise again in 2023, by +41% in France, +24% in Italy, + 22% in Germany and +18% in Spain. A sharp increase in construction costs has also discouraged investments and pushed up expenses for maintaining and upgrading buildings.

However, there are several sources of resilience. Higher demand by long-term investors for hard assets as an inflation hedge will provide some support to capital values. Limited supply should also support rents and prices of existing buildings, especially of those that are in good condition (and have high energy efficiency), attracting creditworthy tenants that can better navigate the economic downturn.

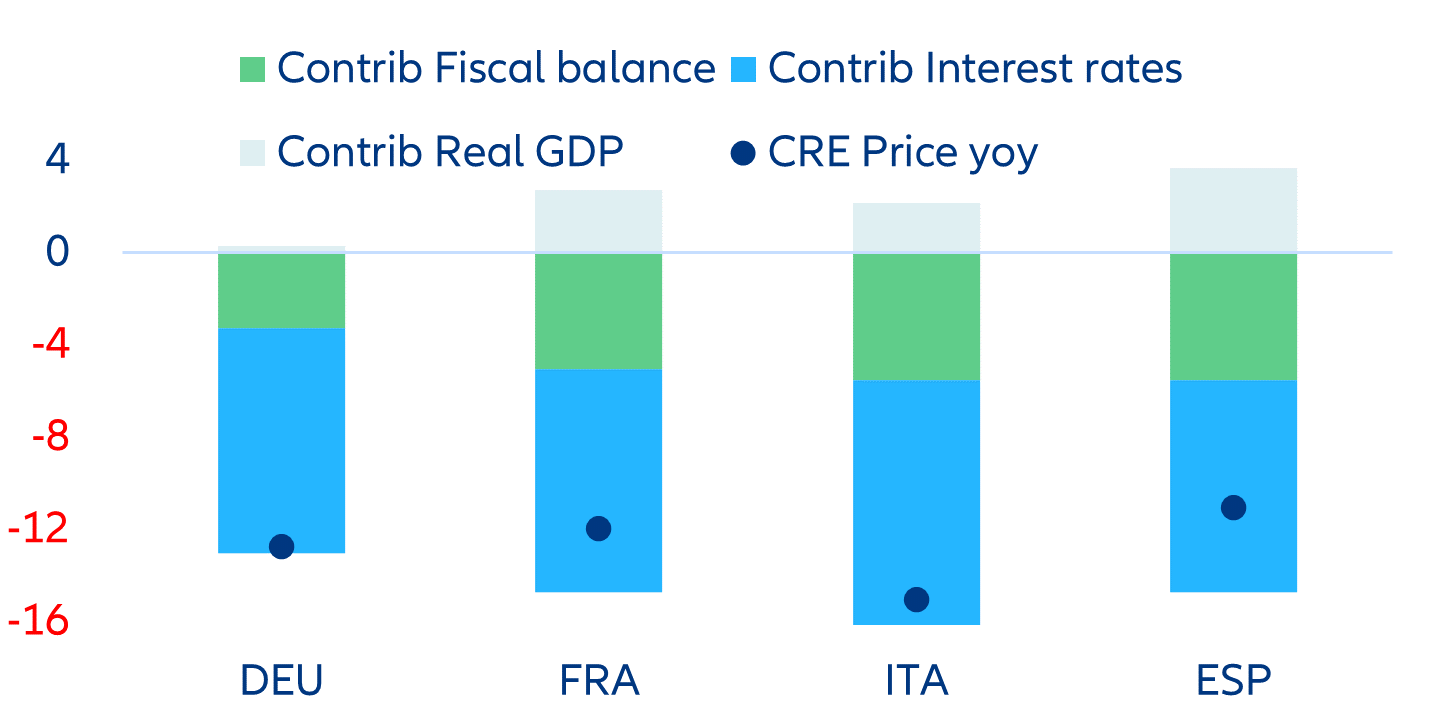

Against the backdrop of higher interest rates, we expect CRE prices to fall between 10-15% over 2023-2024 in the Eurozone. Weak economic growth will not help cushion the impact while the impending fiscal consolidation will inevitably come into play (Figure 3). Although we do not see any of the largest four Eurozone economies escaping the correction, there will be differences when it comes to specific locations. Cities with growing populations, good public transport, and GDP growth will see better outcomes for their commercial real estate than those without these benefits. However, two factors could trigger a larger-than-expected correction: (1) an inflation relapse that requires further monetary tightening that leads to a deeper recession; the severity of this scenario would depend on whether growing debt concerns lead to fiscal consolidation or whether there is still some room for fiscal policy to cushion the increase in insolvencies, or (2) a banking crisis in the Eurozone, which would tighten lending even more. The latter is proof of how interlinked both sectors are, although in this case, the transmission channel between CRE and banking would run in the opposite direction.

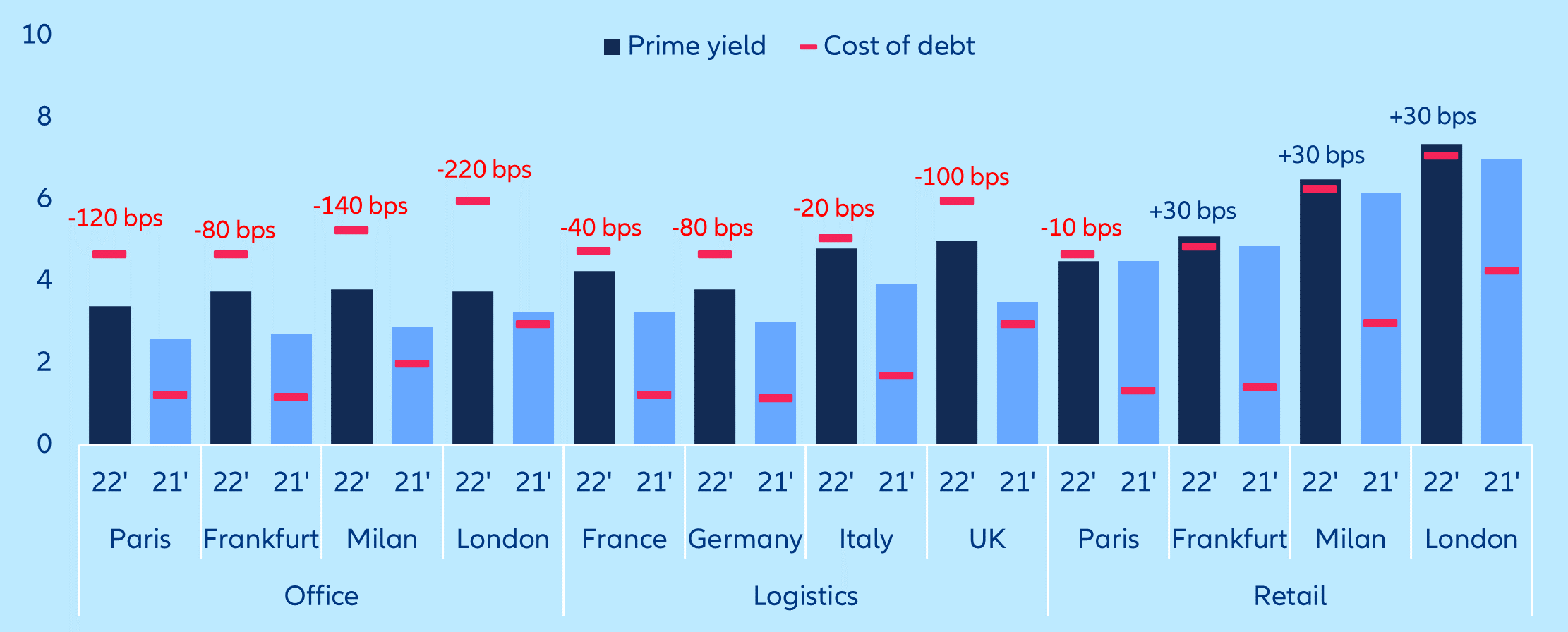

Box 1. Upward pressure on real estate companies from the increasing cost of debt

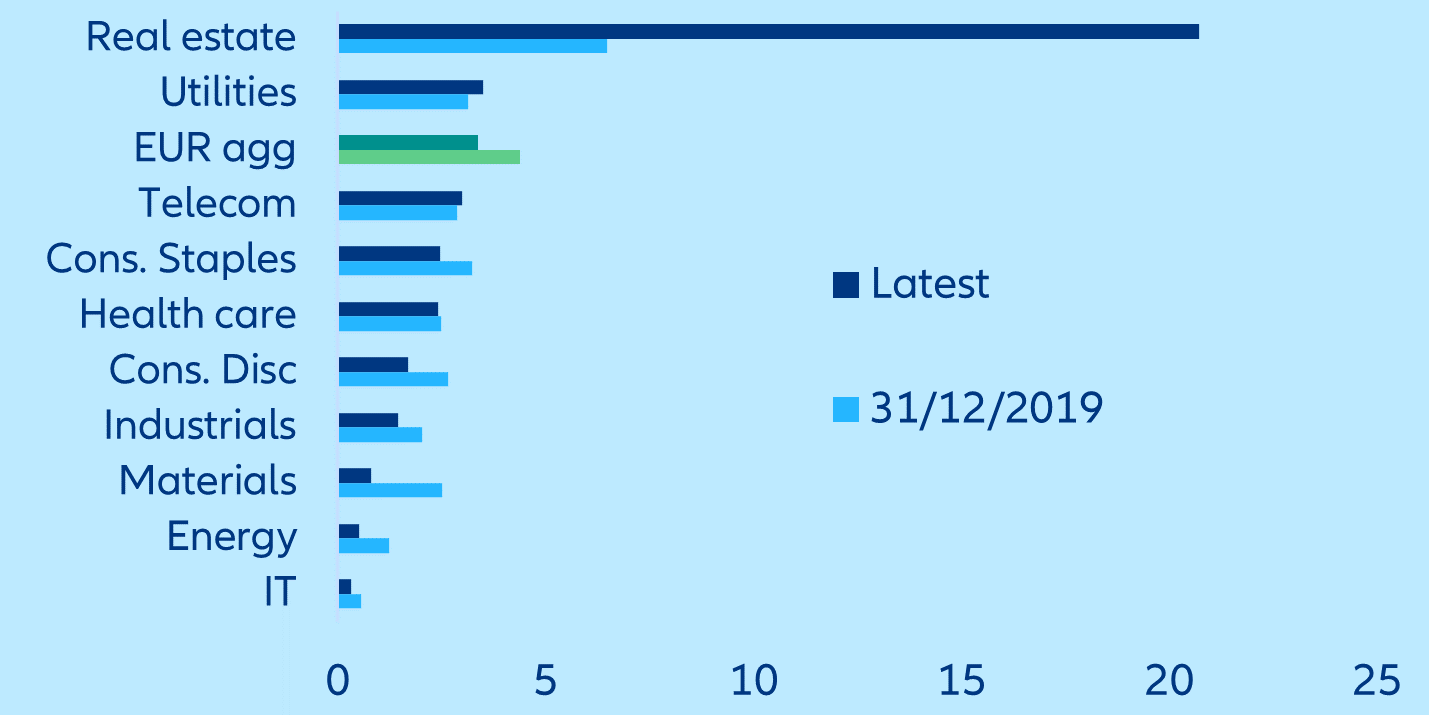

The reliance of real estate companies on borrowed funds makes them highly vulnerable to changes in the cost of capital. Be it for development, construction or property acquisition, real estate companies use debt financing from various sources (in Europe, mainly banks). As rates increase, variable-rate borrowers’ repayment capacity might deteriorate. In addition, a material volume of CRE loans have large instalments due at maturity (“bullet” or “balloon” loans). As the cost of lending increases, these borrowers may have problems refinancing their loans at maturity. In this context, real estate companies will need to focus on deleveraging and stabilizing their current portfolios. As a result, even in an optimistic scenario, a slow-down in construction activities is highly likely, with consequences for the wider economy.

A banking doom loop is not on the cards in Europe

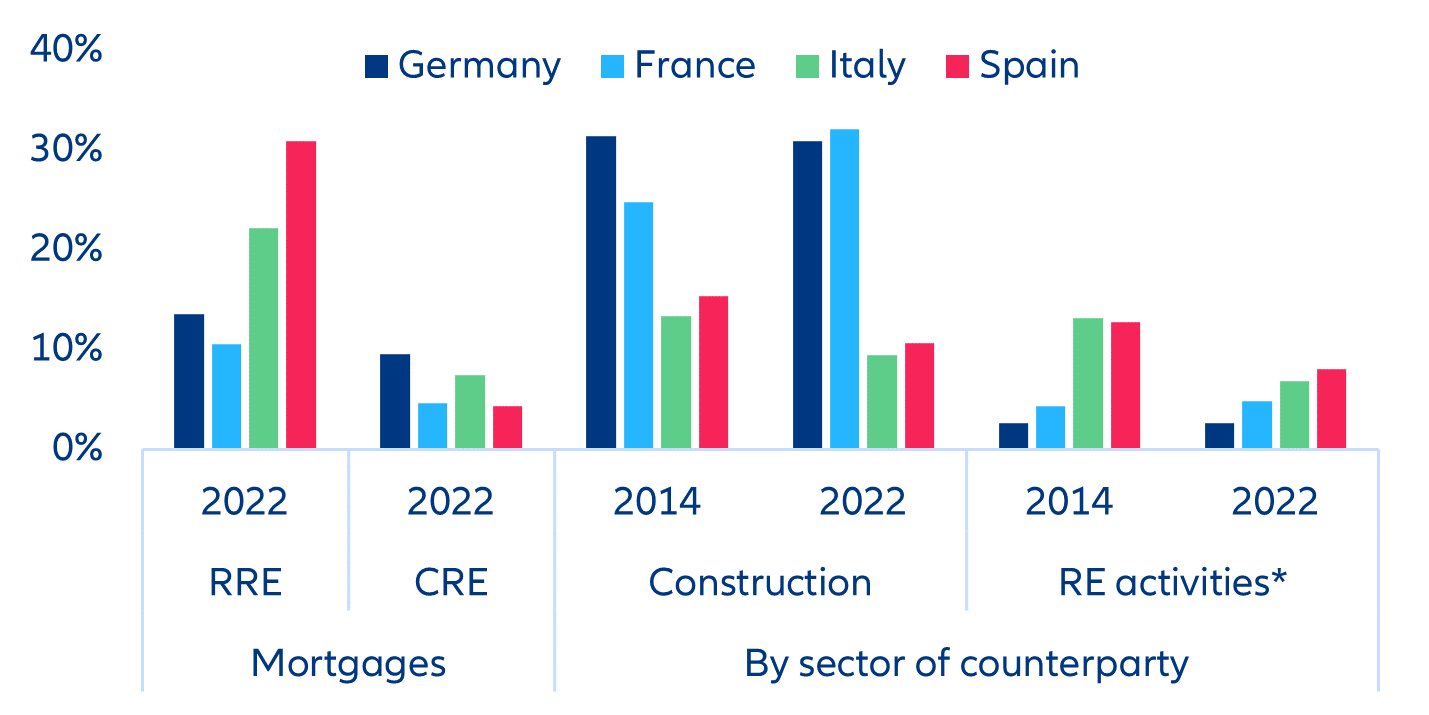

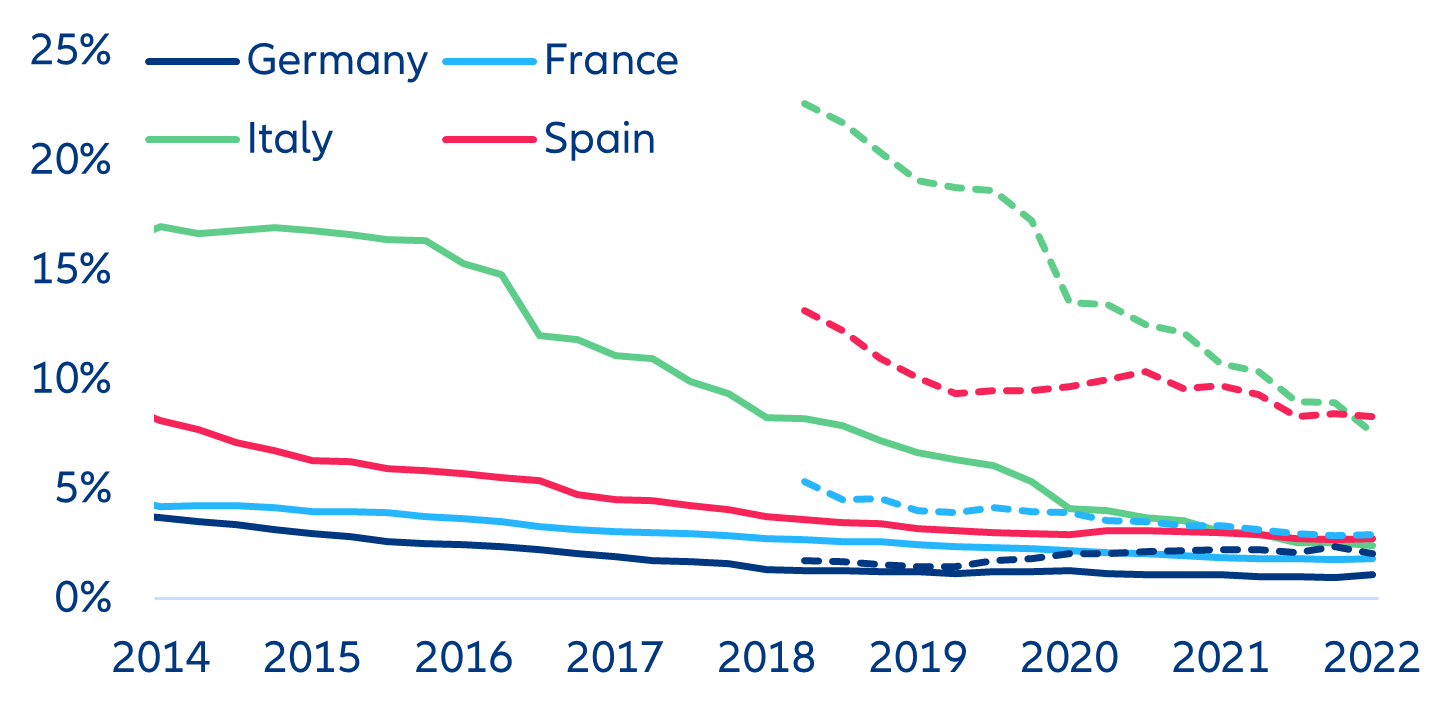

European banks are highly exposed to a potential rise in default risk in the CRE sector. In Europe, German banks are most exposed, with commercial mortgages accounting for 9.6% of total outstanding loans, roughly equally split between residential and commercial mortgages (Figure 4). Italy follows with 7.4%, while in France and Spain CRE exposure represents less than 5% of the loan book. When it comes to real estate-related activities, banks in Germany and France are most exposed (France is the only country where exposure has increased since 2014), thanks to a large exposure to the construction sector and growing exposure to companies involved in other areas of real estate (operating, buying-selling of properties).

And the picture in Europe is less alarming than in the US. While the ECB’s 2021/2022 review of CRE pointed to some weaknesses (e.g., banks lacking commonly defined basic CRE risk or even an overview of loans subject to refinancing risk), Europe is unlikely to be hit as hard as the US. There, a large portion of CRE debt is held in the public markets as Commercial Mortgage-Backed Securities (CMBS), which require refinancing, and much of the private debt is held by small banks. In Europe, the picture is more nuanced, with CRE debt held by fewer larger banks that are closely monitored on exposure and well-regulated.

Selectivity matters: the situation across CRE segments is very different and there are opportunities as well as challenges

Even before the current tightening cycle, shifting demand patterns impacted the CRE market. Covid-19-related restrictions and related policy measures increased demand for logistics and residential assets and decreased demand for office and retail assets, particularly outside of prime assets and prime locations. These types of CRE may well hold their capital values based on strong rent demand, despite cap rate compression from rising interest rates.

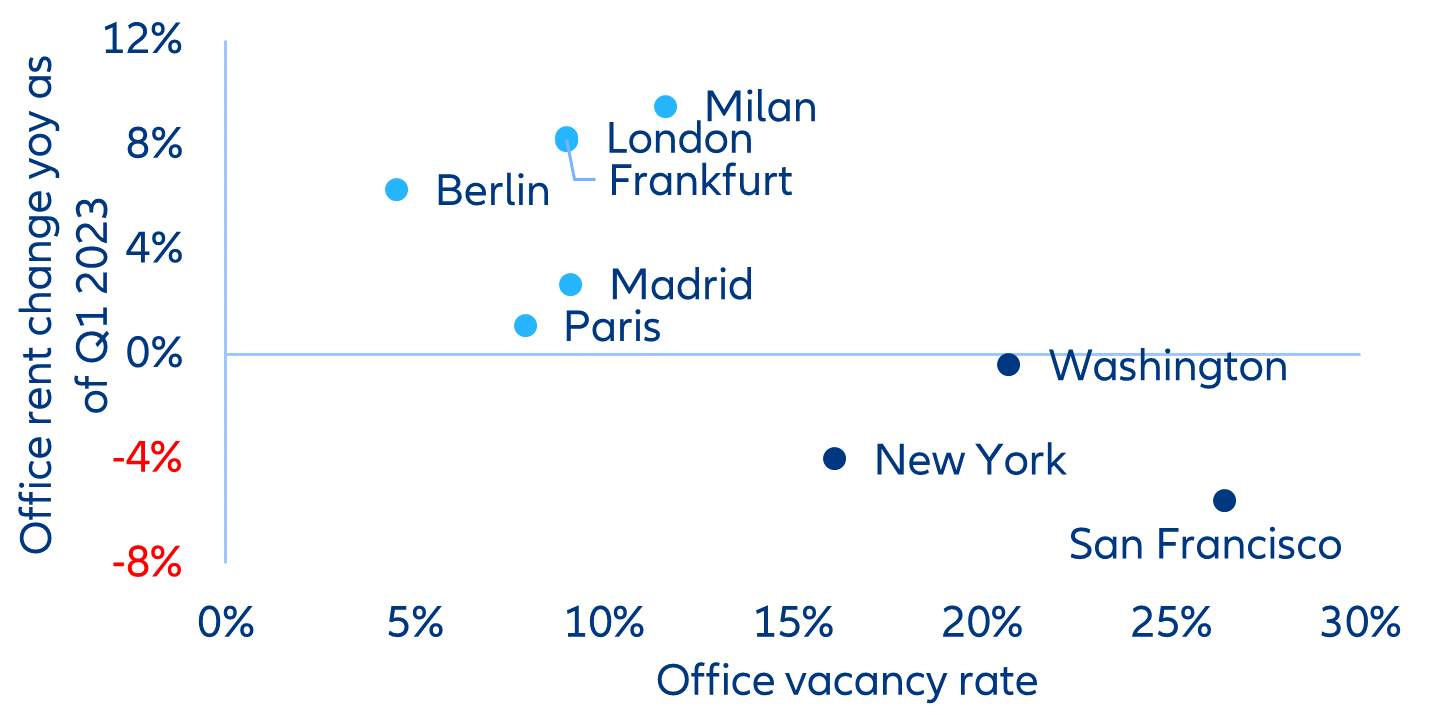

Post-Covid scarring effects on offices seem less severe in the Eurozone than in the US. Unlike in the US, in Europe, vacancy rates have been consistently improving since 2010 (Figure 7). Mobility in major European cities remained 10-20% below pre-pandemic levels in 2022 but in 2023, this differential seems to be narrowing: managers’ attitude towards remote working is less permissive and weak economic prospects have increased their bargaining power to induce a return to office. Furthermore, the relative scarcity of new supply has caused a shortage of well-constructed premium-grade ESG office assets that would help occupiers meet their net-zero carbon ambitions. In fact, rents for prime-grade office assets in Europe have risen within the last quarter despite the subdued economic outlook. In times of crisis, the difference between prime and non-prime locations is more apparent: Prime locations offer better accessibility and attract multiple prestigious and creditworthy tenants and amenities nearby (with lower crime rates in the surroundings). These factors act as safeguards, helping to mitigate rent delinquency and ensuring resilience in the face of economic downturns.

Data centers and logistics are the bright spots. With increased reliance on cloud services, online communication, and data storage businesses require robust infrastructure to support operations. Consequently, the data center industry has seen a surge in demand for space, leading to the expansion and construction of new facilities to meet growing business needs.

The pandemic also accelerated the growth of e-commerce, resulting in a heightened demand for logistics and warehouses. With a shift in consumer behavior towards online shopping, retailers and logistics providers had to adapt their supply chains to meet increased demand for home delivery, which fueled the need for strategically located warehouses and distribution centers to efficiently handle inventory management, order fulfillment, and last-mile delivery. While this trend has since moderated, the shift away from “just-in-time” inventory management towards maintaining larger stocks as a buffer against future supply-chain disruptions will also benefit the logistics sector, although in very specific locations. The call could be made for the broader industrial real estate, but the elements available for evaluation are relatively limited. Europe has understood that it needs more factories as a strategy to tackle economic challenges while aligning with green goals. Strengthening industries will enhance competitiveness, generate jobs, and drive economic growth while also incorporating sustainable practices.

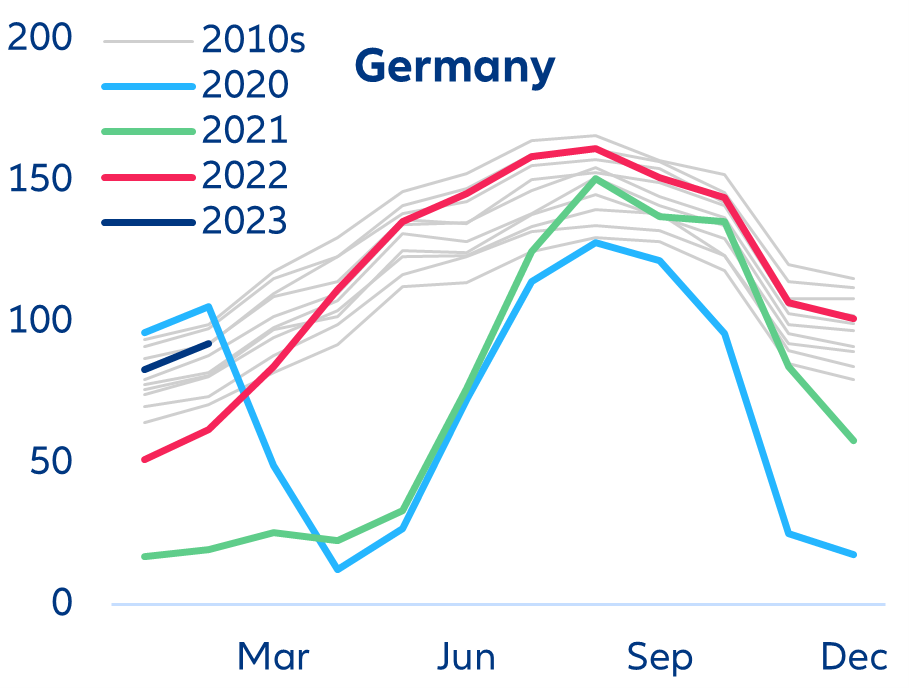

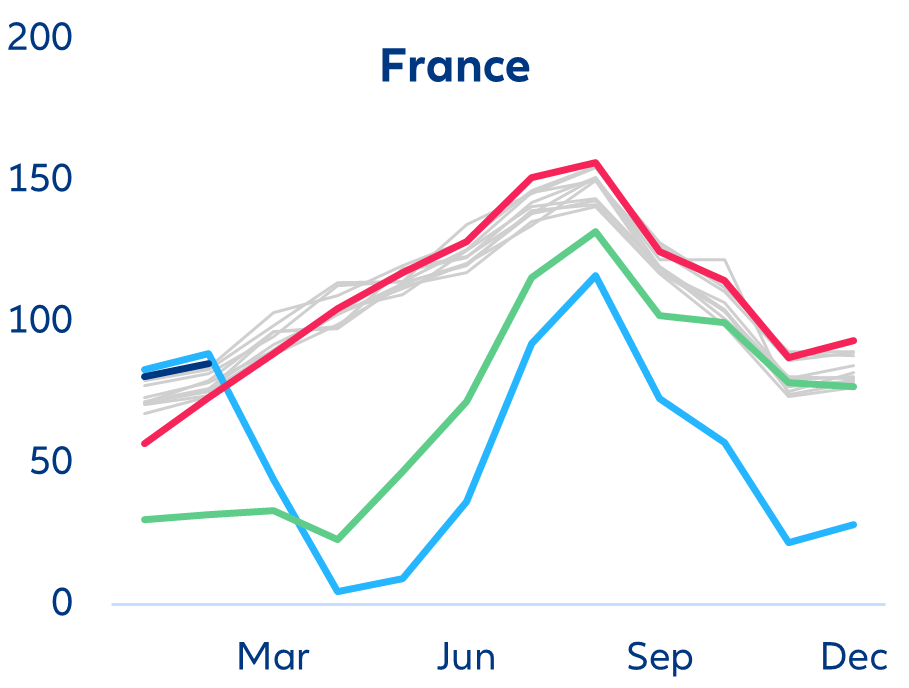

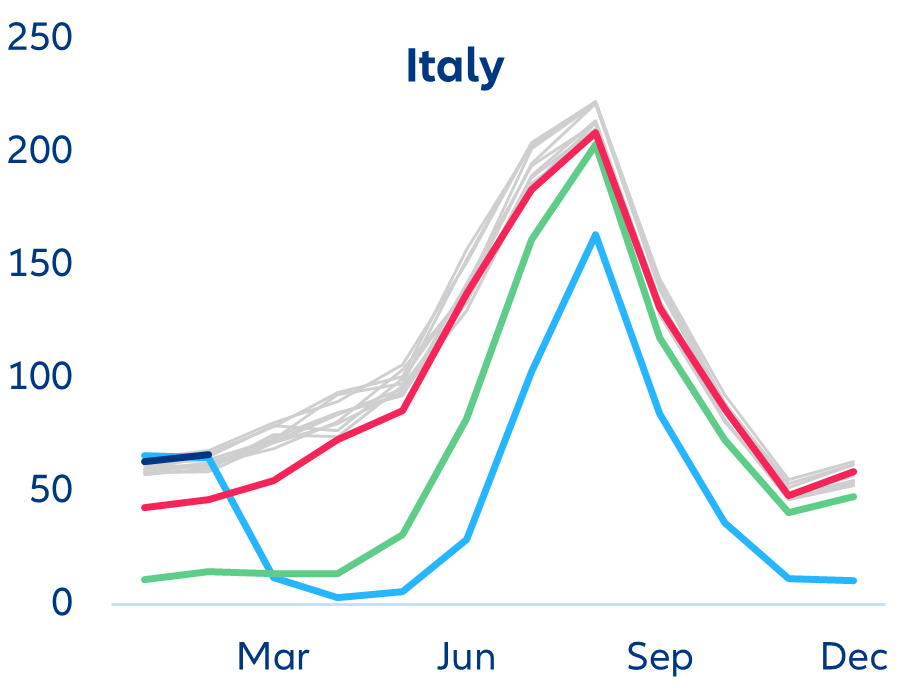

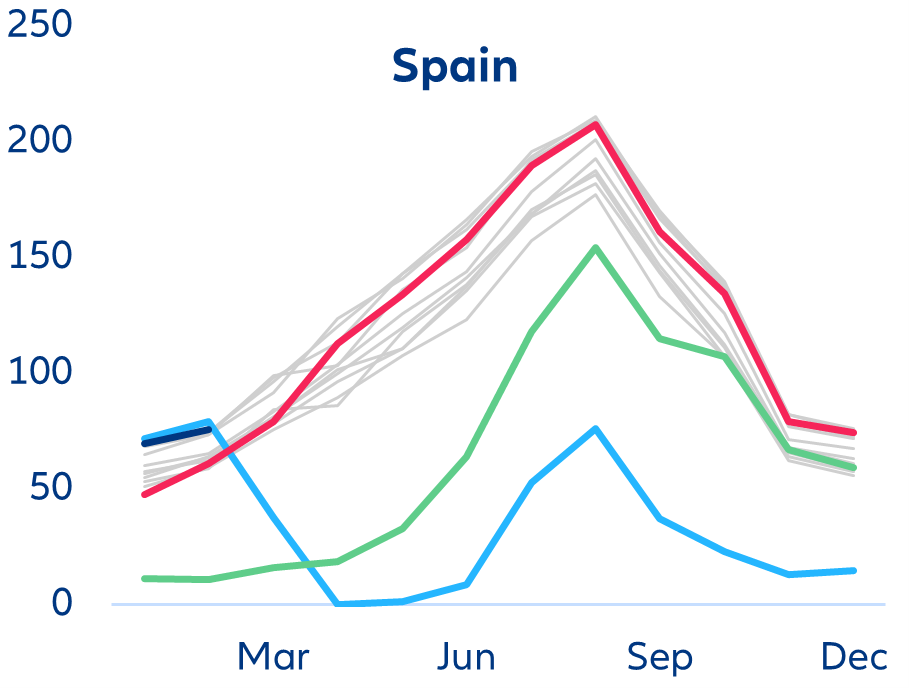

Hotels are recovering from the pandemic hit, and retail is set to remain the most fragile. Prior to the pandemic, hotels experienced a period of robust growth and prosperity: even major cities in the Eurozone witnessed a surge in hotel construction (or repurposing) and occupancy rates remained consistently high even with the surge of other competitors (e.g., Airbnb). Following the dramatic decline in tourism during the pandemic, occupancy has been gradually rebounding especially in Spain and France (Figure 8), and the outlook remains positive as the sector is adapting to technological change and evolving traveler preferences. In contrast, the retail sector may never recover from the rise of e-commerce, as particularly younger consumers have shifted spending patterns towards shopping online (Figure 9).

Box 2. From valuations in the more liquid assets to the impact on the physical assets portfolio

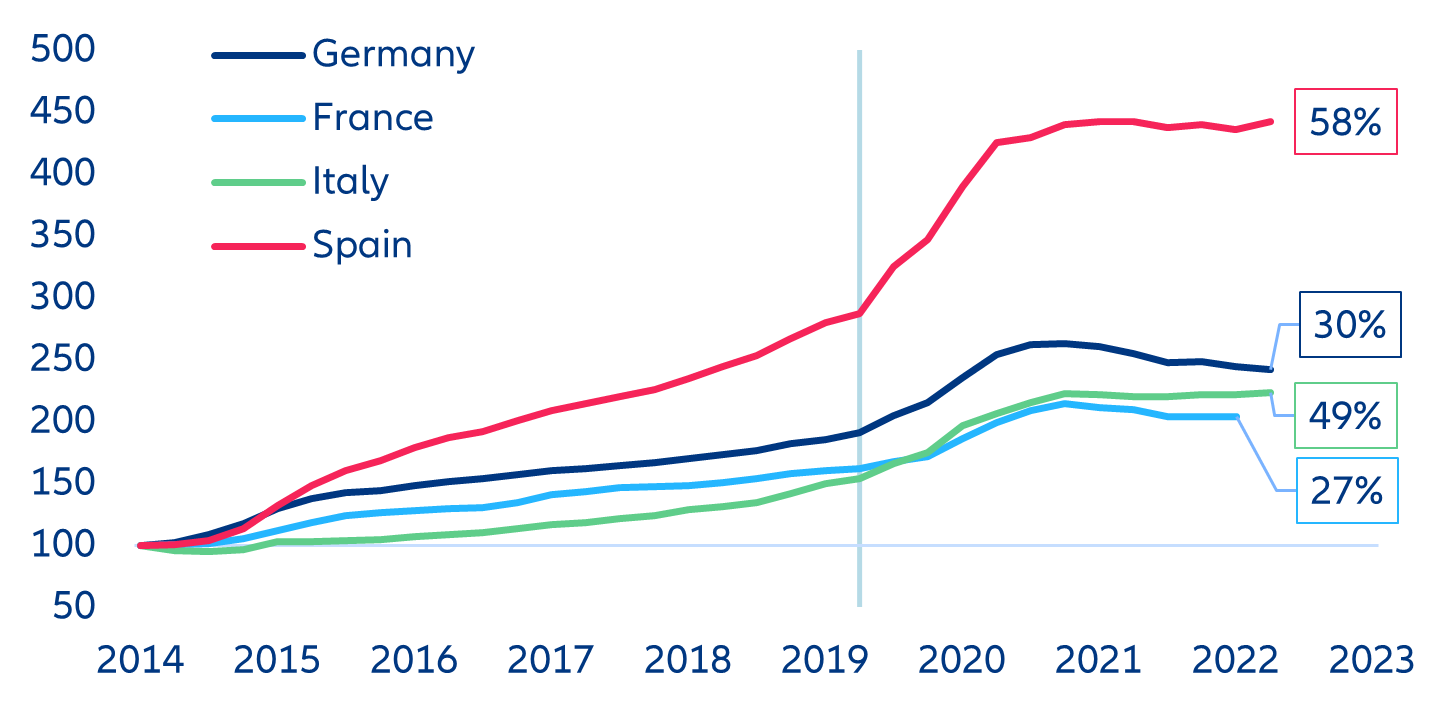

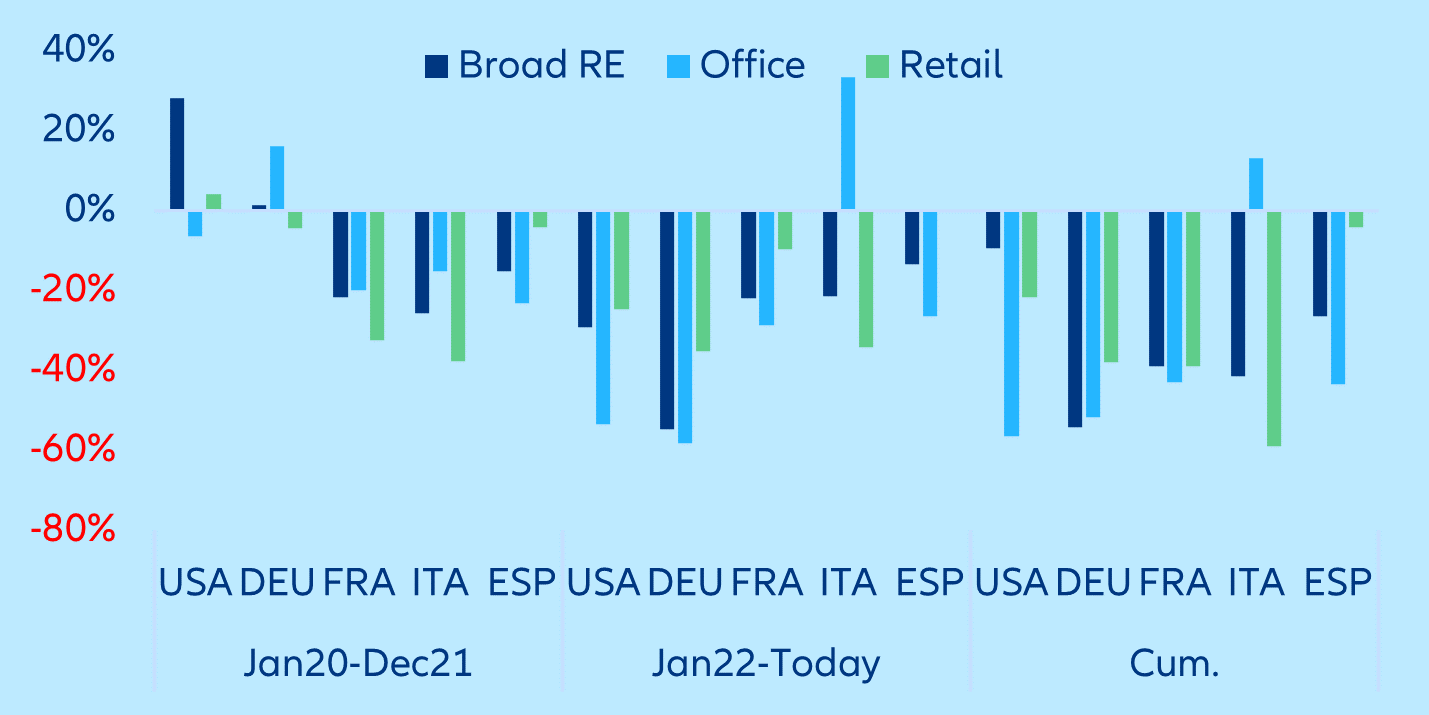

As funding conditions deteriorate, the more liquid8 public segments of the CRE market. As usually the case, liquid real estate-related securities have been the first to correct. REITs markets in both Europe and the US have sold off and many REITs now trade below Gross Asset Value (GAV). They have been hit twice in a relatively short horizon without any time for recovery, first by the Covid-19 shock hit in 2020 and then by the interest-rates blow in 2022. Looking at Refinitiv Datastream REITs indexes for European countries, we find that the share price losses ranged between -20% and -50% compared to end-2019 (and they went beyond -60% at the worst moments before slight recoveries in some segments). This contrasts with the performance of the broad equity markets in the same period (2019-end to date): the main indexes in Germany, France and Italy accumulated share price gains of between +15-20% while the losses in Spain were of less than -5%.

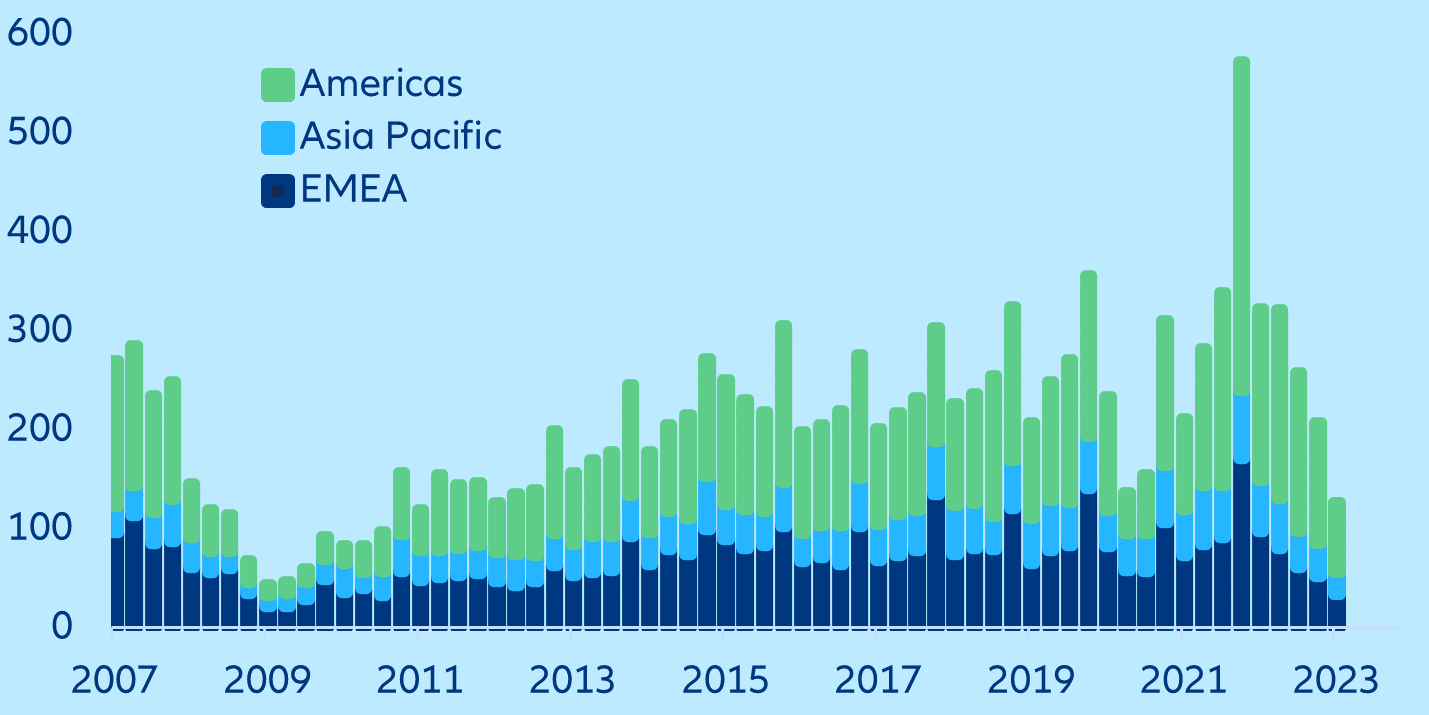

Nonetheless, unlike in the US, drawing conclusions from REITs performance for the European private real estate is not straightforward. In Europe, listed assets can be a poor reflection of physical assets on the ground. For example, the c. 20 largest listed European office landlords control less than 10% of investment office space. In the private real estate direct investment markets, global transaction volumes have decreased by -60% so far in 2023 compared to the same period of 2022, continuing the decline seen in the second half of 2022 following the sharp rise in interest rates. In Europe, the picture does not differ: Q4 2022 was the third lowest quarter since 2013 in terms of (nominal) investment volumes, although the 2020-2021 investment spree was more modest.

Still, the hit to physical assets will not be of the same magnitude. In a low liquidity market with private transactions, it takes longer for price discovery between buyers and sellers of direct physical assets. Lengthy lease terms also tend to delay the impact of macroeconomic factors on vacancy rates. In the past, the macroeconomic environment has even changed before the price adjustment took place: For example, during the pandemic, the rapid policy response and the evolution of the situation translated in price increases in many physical assets as yield compression continued.

The portfolio implications are even harder to gauge. The gradual realization of valuation losses already mentioned is a critical factor to consider. However, equally important are the quality and location of assets within the portfolio. With regard to quality within the same geographical area, prime locations and the capacity to attract creditworthy tenants usually go hand in hand. In the end, the capacity to withstand the downturn phase of the cycle depends on very particular investment decisions during the expansion phase.