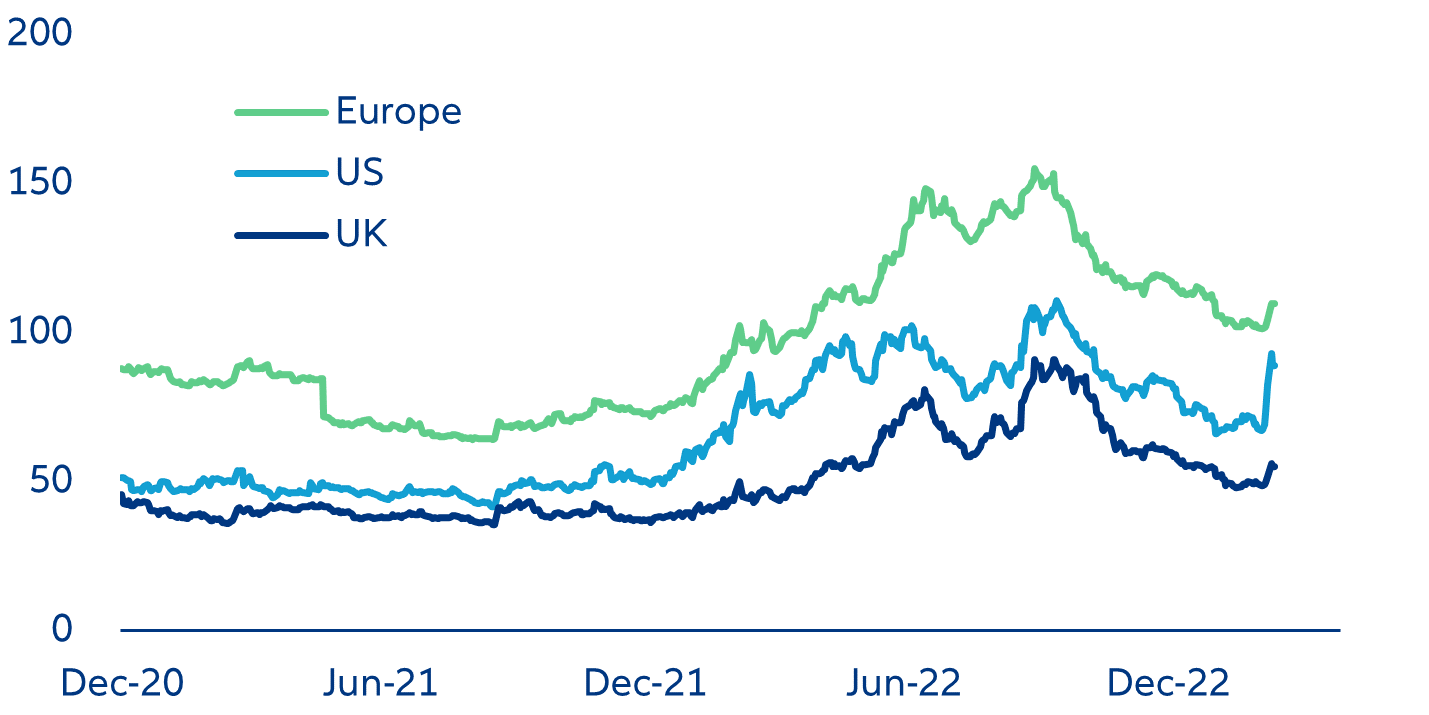

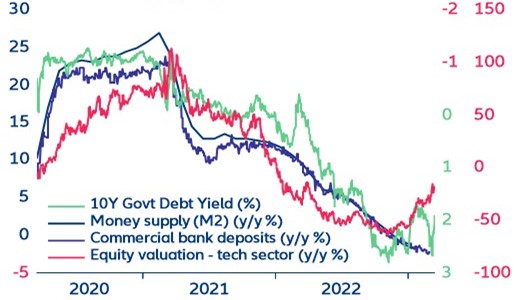

- The SVB failure was caused by poor risk management choices but also highlights banks’ general macro-financial challenges from restrictive monetary policy, which essentially removes diversification. Negative returns from bonds and equity put pressure on assets while quantitative tightening has led to a contraction of money supply, resulting in greater competition for deposits (as banks lend less).

- Essentially, SVB was the epitome of wrong-way risk – it accepted very lumpy deposits from start-ups (which parked their venture capital funding), used related-party equity in these start-ups to collateralize loans and invested excess funds in mostly long-dated mortgage-backed securities at a time when the yield curve was inverting even more, squeezing their net interest margin. As much as central banks’ fast rate hikes to tackle inflation hit the bank’s asset side (resulting in unrealized losses that exceeded their capital base) they also caused an economic pinch for their start-up depositors, who started withdrawing their funds long before the deposit run that brought SVB to its knees.

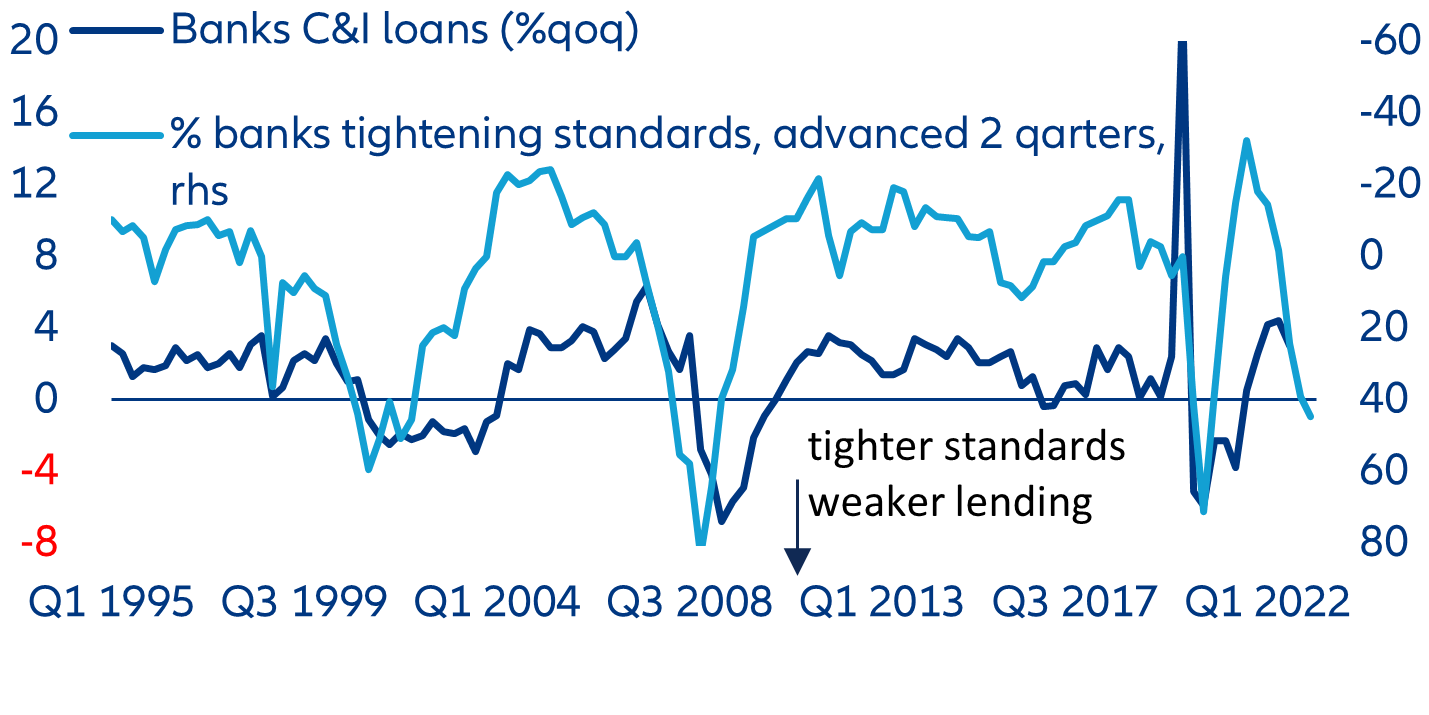

- In the wake of SVB’s failure, banks will become even more conservative in their lending. The planned resolution of the SVB imposes direct cost of other US banks, which will foot the bill for making all depositors whole (though higher FDIC fees) but, more critically; there is also an indirect effect of rising moral hazard in the banking sector as the Federal Reserve seems to be willing to still backstop failing banks. Over the near term, financing conditions are bound to tighten further in the US economy (and other countries) as banks raise lending standards and carefully safeguard their liquidity positions, further retrenching credit..

In Focus

SVB failure: cause and impact

Implications for the European banking sector – What shock absorbers are in place?

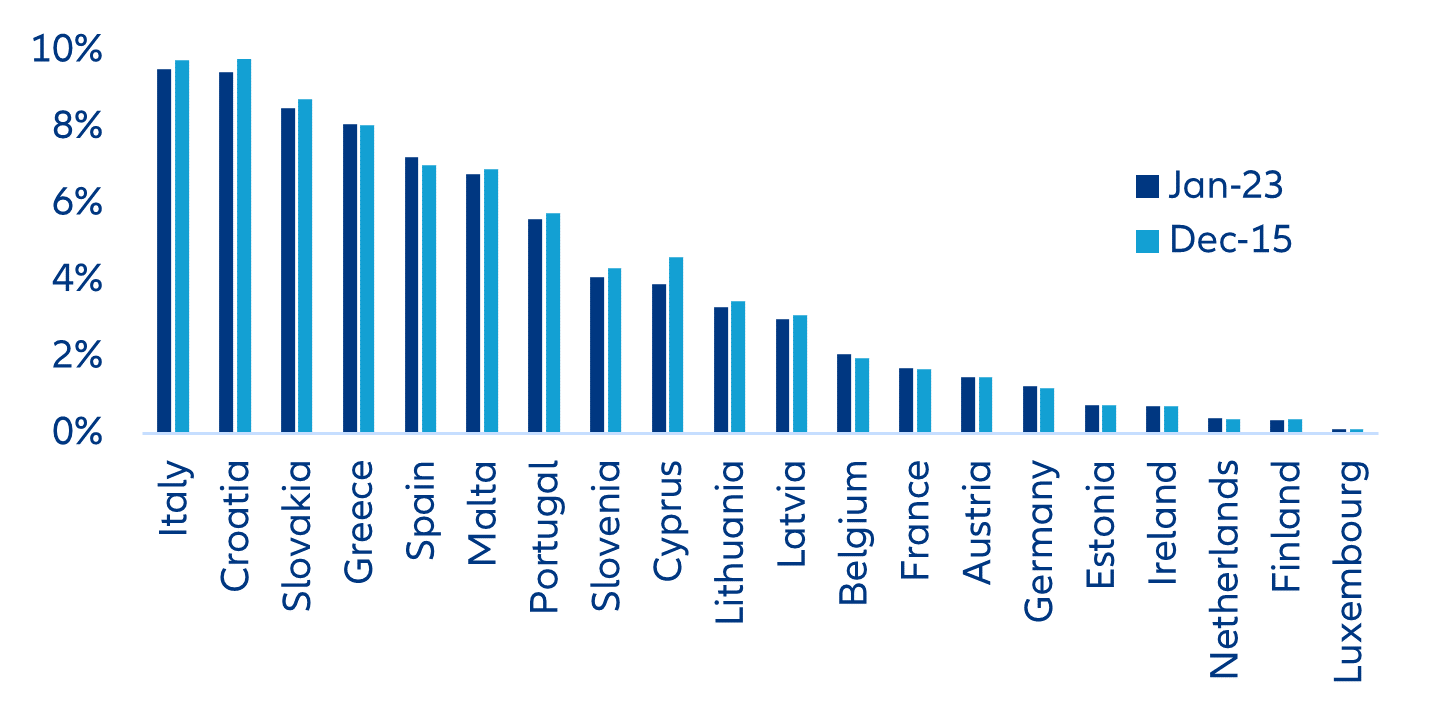

The Eurozone has significantly strengthened its banking supervision and resolution framework. The global financial crisis in 2008 and the subsequent sovereign debt crisis in Europe highlighted the need for a Banking Union (BU), with a consistent application of banking rules essential for financial stability and building resilience. Common decision-making procedures and tools create a more transparent, unified and safer market for banks, and help to prevent financial distress. The BU is currently based on two pillars: the Single Supervision Mechanism (SSM) and the Single Resolution Mechanism (SRM). The SSM consists of the ECB and national supervisory authorities. It is essentially a system of consistent banking supervision in Europe that aims for the safety and soundness of the EU banking system and increases financial integration and stability. The SRM comprises the Single Resolution Board (SRB), the central resolution authority within the BU, and the national resolution authorities. It promotes financial stability, provides the tools to resolve failing banks in an orderly manner (with as little impact as possible on the real economy and public finances) and protects taxpayers in the participating EU countries from the cost of bailouts. However, the third pillar of the BU, the European Deposit Insurance Scheme (EDIS), which would provide a stronger and more uniform degree of deposit insurance coverage than the existing national deposit-guarantee schemes, has yet to be completed. Indeed, one pre-condition is a material reduction of banks’ domestic sovereign exposure with a view to severing sovereign-bank linkages.

The Single Resolution Fund (SRF) is Europe’s first and foremost firefighting mechanism. The SRF is embedded in the SRM and is an emergency fund to be used after all other options have been exhausted (i.e. bail-in). Through the SRF, the financial industry itself ensures the stabilization of the financial system, not taxpayers. Banks are legally required to pay an annual contribution to the fund; by the end of 2022, the SRF held EUR66bn. The fund needs to reach at least 1% of the amount of covered deposits of credit institutions in the BU by the end of 2023. The reform of the European Stability Mechanism (ESM) created the Common Backstop, another instrument enhancing the firepower of the BU to manage bank failures. This additional emergency fund mirrors the size of the SRF using public money and will bring further confidence to the system. The backstop works as follows: in case the SRF is depleted, the ESM can lend necessary funds to the SRF to finance resolution. To this end, the ESM is a last resort and will provide a revolving credit line; the nominal cap for ESM loans is set at EUR68bn. The SRF must pay back the ESM loan with money from the contribution of banks within three years (possible extension of up to five years). Hence, over the medium term, the ESM loans are fiscally neutral. Together, the SRF and the Common Backstop provide Europe with firepower to address even a severe systemic crisis.

Monetary policy response: rates close to peak as retrenching credit and slowing growth will do the heavy lifting to bring down inflation

For both the US Federal Reserve and, to a lesser extent, the ECB, financial stability concerns might complicate the already difficult trade-off between inflation vs. growth in setting policy rates over the next few months. Should they keep hiking rates even though core inflation is becoming increasingly sticky or prioritize financial stability over price stability? In any event, the fight against inflation is likely to become more prolonged unless slowing demand is sufficiently disinflationary to allow central banks to tread more carefully.

Implications for the US

The Fed is in a seemingly difficult position, caught between its two core objectives of financial stability and price stability. Price pressures remain stubbornly high, with the recent February CPI report showing that the pace of monthly increases in core prices is not slowing (+0.5% m/m, in line with the average since mid-2021). On the other hand, lower bond yields and the potential injection of liquidity by the Fed (through its new bank term funding program and the existing reverse repo facility) could ease financial conditions. Easier financial conditions can complicate the Fed’s objective to bring inflation back to target, undermine its credibility and potentially lead to more volatile and higher inflation expectations.

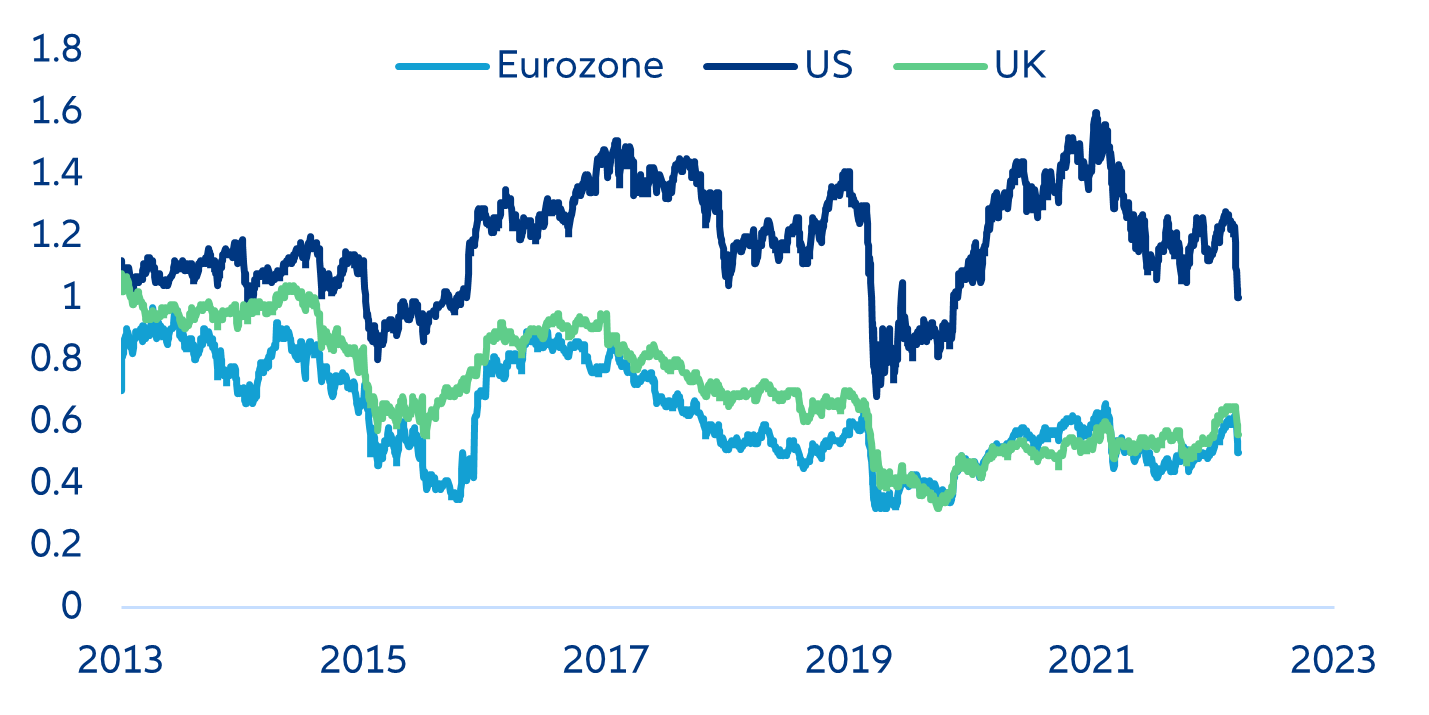

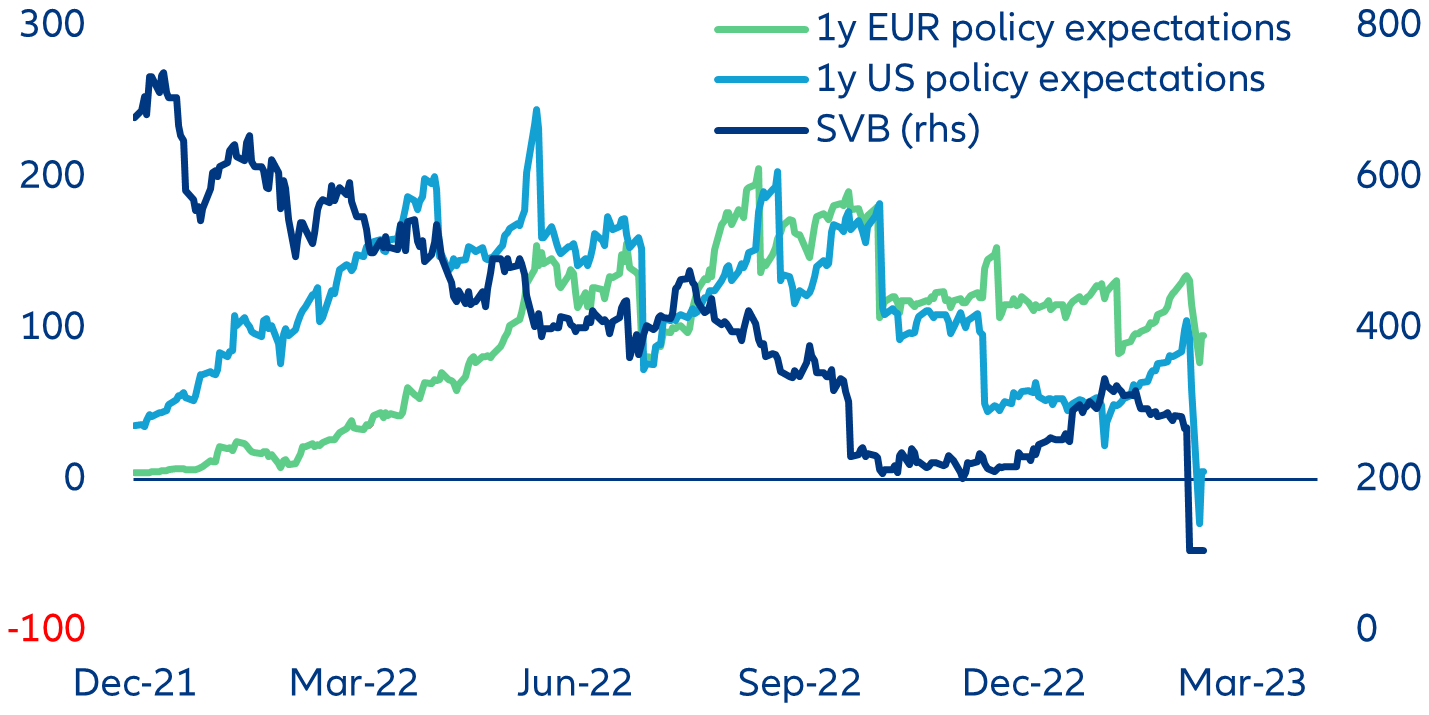

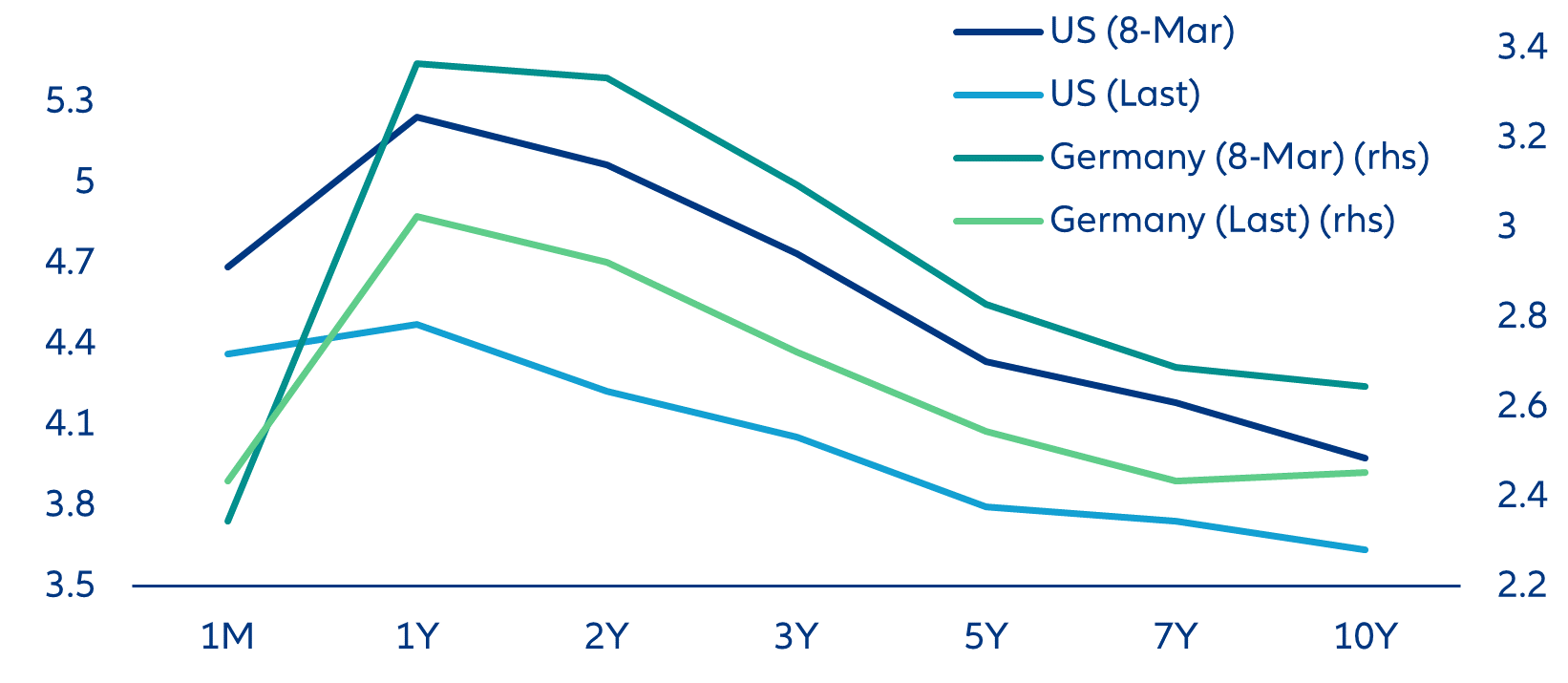

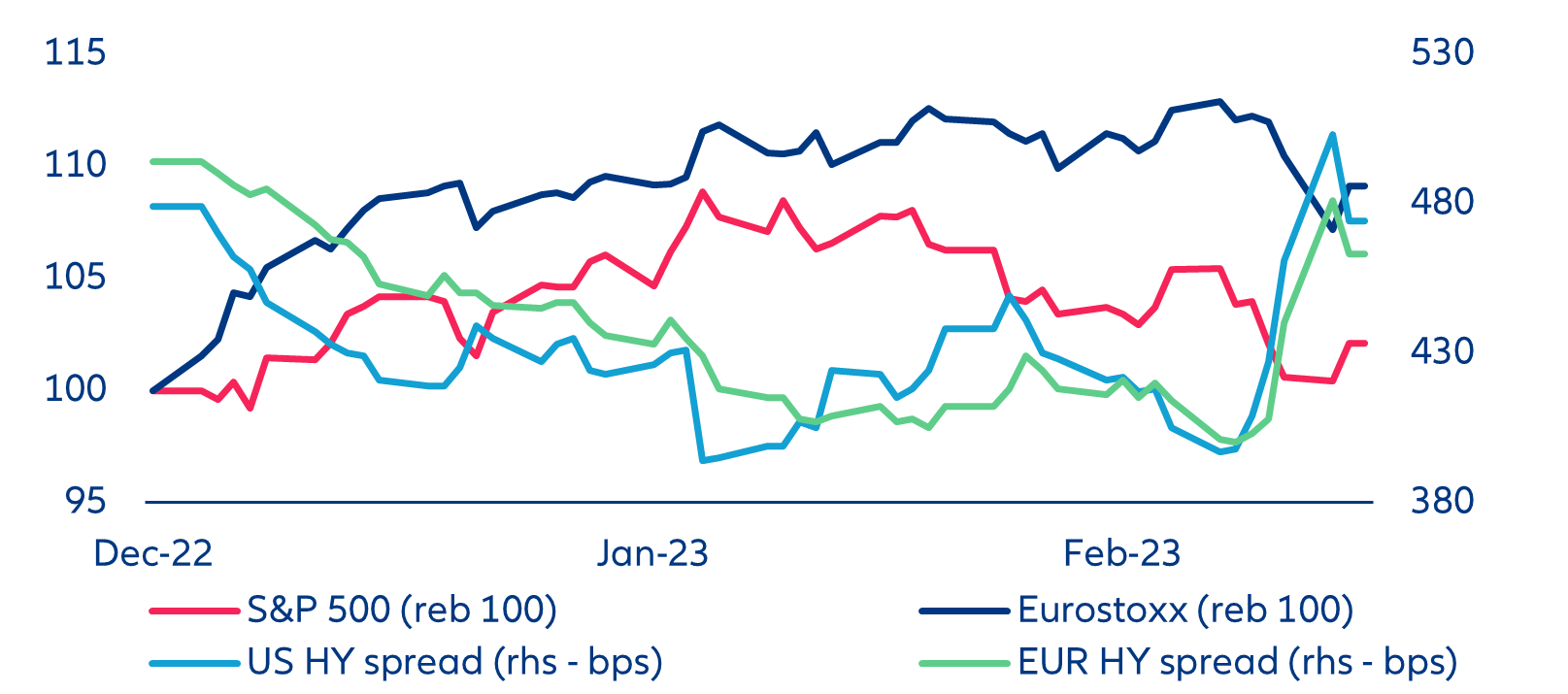

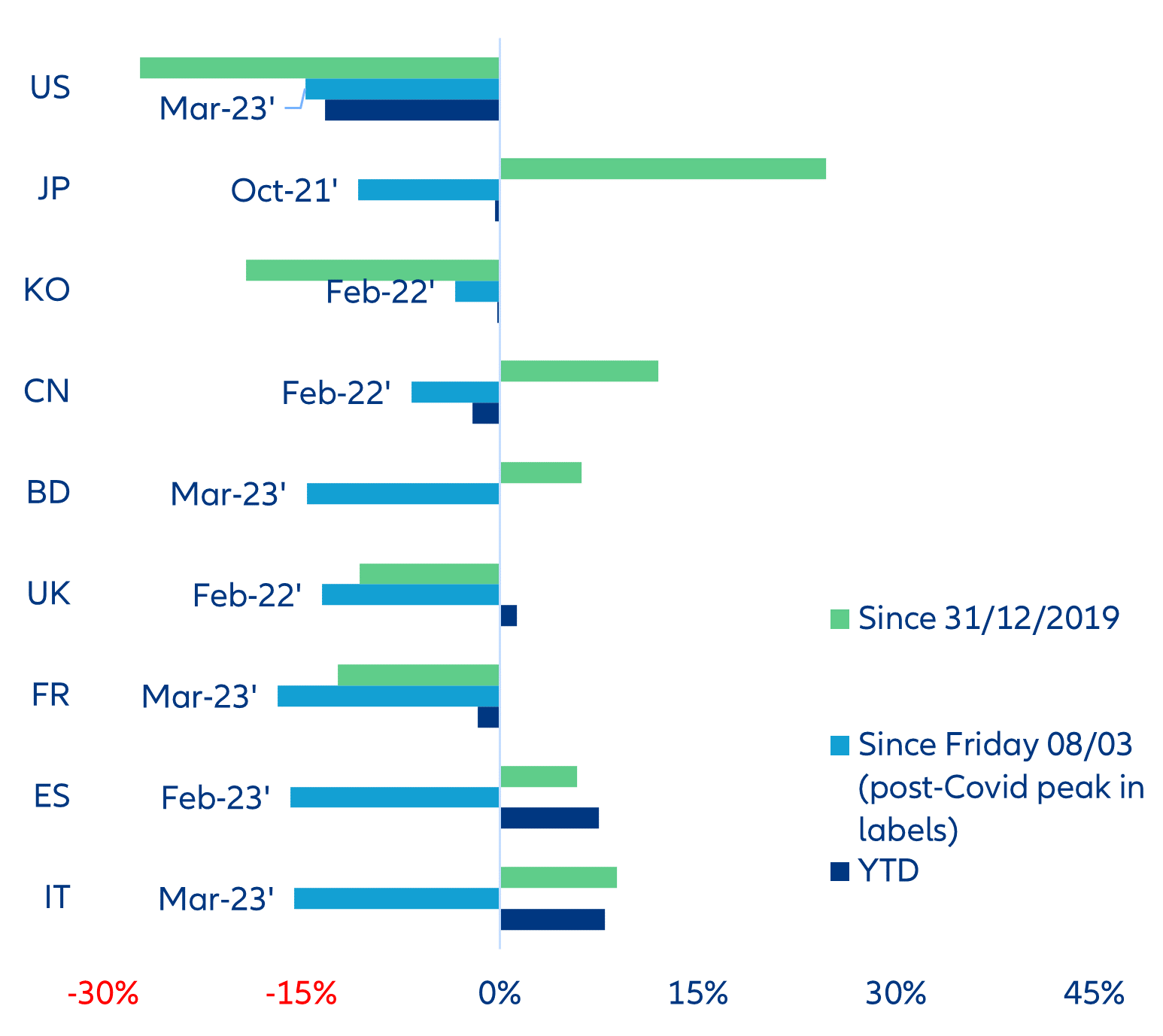

Financing conditions have not moved much overall while the Fed’s stance has eased because of lower short-term bond yield expectations (Figure 5). Since the SVB debacle, US financial conditions, as measured by various financial condition indices (FCIs), have not moved much: lower equity prices and tighter credit spreads have been broadly offset by declining bond yields. The Fed’ stance has, however, eased quite noticeably as markets have pared back Fed funds rate-hike expectations.

The SVB failure reinforces our view that the US economy is headed for a sizeable recession during the second half of this year. Elevated price pressures and a resilient economy prompted Fed officials to strengthen their hawkish rhetoric in the past few weeks, signalling that the FOMC could step up the pace of rate hikes. However, the SVB failure suggests a turning point in the monetary cycle: interest rates have reached a level sufficiently high to trigger a recession, which should alleviate inflationary pressures markedly by the end of the year.

However, we expect the Fed to hike by 25bps in next week’s meeting and to continue unwinding its asset holdings. We think the Fed will follow the BoE’s template during the fall 2022 Gilt crisis by raising rates in a measured manner while dealing with the banking crisis with its balance sheet through its new lending facility. We think that still uncomfortably elevated inflation and lower interest rate expectations will persuade the FOMC to reinforce its commitment to restore price stability at next week’s meeting. The Fed will insist that financial stability concerns can be addressed by its liquidity facilities without the need to ease its monetary stance. We call for another 25bps hike in the May meeting, which will cement the Fed’s anti-inflation credibility credentials. This will take the Fed funds rate target to a peak of 5-5.25% during this cycle. The recession-induced fall in core inflation the second half of 2023 will allow the Fed to pivot in November-December. We expect a 25bps cut in November followed by a 50bps cut in December.

The Fed is unlikely to alter the course of Quantitative Tightening (by keeping the monthly run-off of USD90bn per month). QT has been marketed as a policy aimed at reducing the degree of policy accommodation. Slowing down the pace of QT would thus, in our view, send conflicting messages as regards to the Fed’s priority to fight against inflation.

Implications for Europe

We think that the ECB will not blink at today’s Governing Council meeting and raise rates again while managing price and financial stability in tandem. We expect another 50bps hike (followed by smaller hikes in May and June for an effective terminal rate of 3.5%). However, the rate decisions in May and beyond will be highly data dependent. Our forecast is motivated by disappointing inflation data in February and the ECB’s determination to bring inflation back to the 2% target.

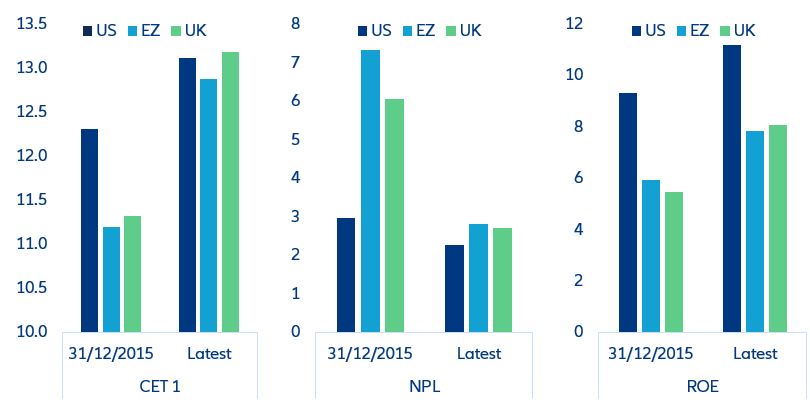

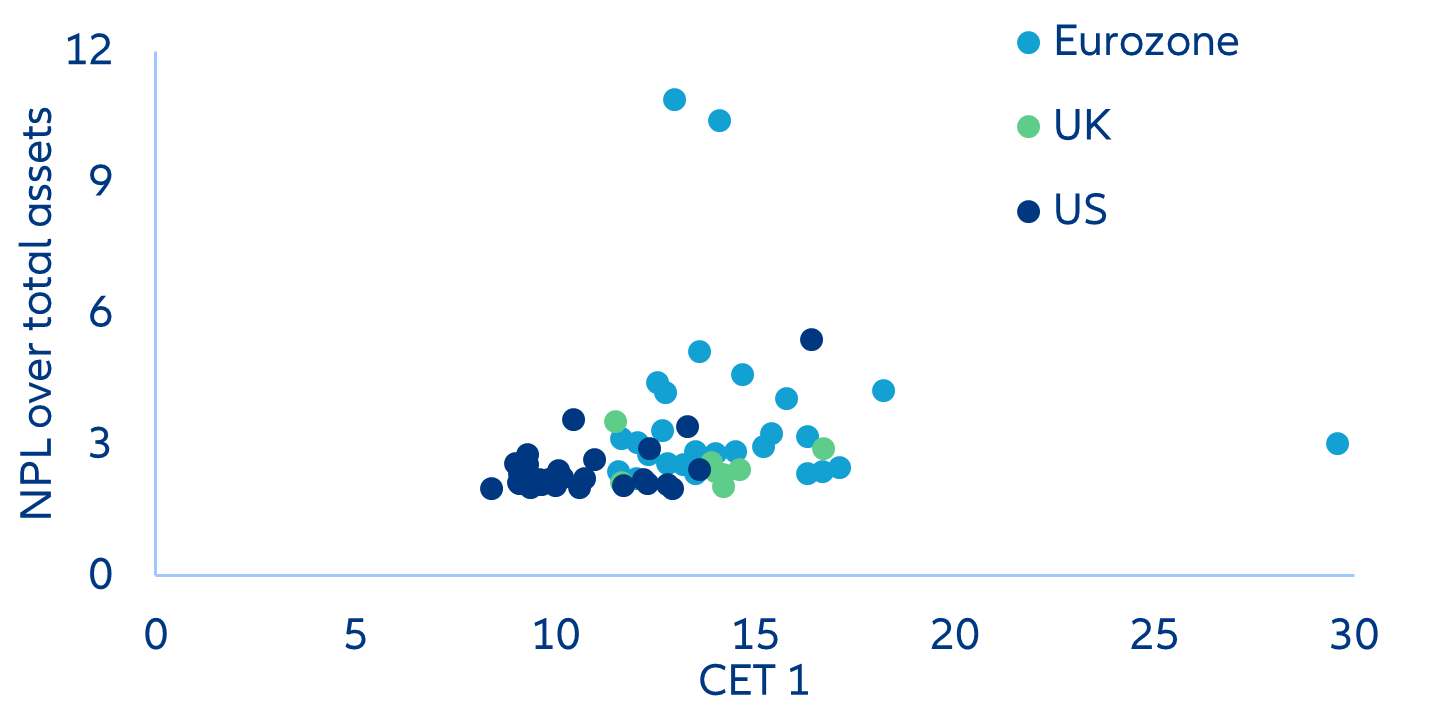

Financial stability considerations are less binding for the ECB’s policy rate decision. The ECB will remain conscious of potential market stresses but is less constrained than the Fed for its next policy rate moves. European banks are even more liquid than their US peers, have lower valuations but fewer asset-liability mismatches and hold more than EUR3trn in liquidity at the central bank (“excess liquidity”), with a still-high share of unencumbered assets that could be used for accessing central bank money if funding stresses arise. As a result, there are unlikely to be forced bond sellers in Europe. However, there could be some small/individual liquidity-constrained banks, and hold-to-maturity books are not marked to market (unrealized losses do not count towards capital).

However, compared to the US, the ECB would struggle to offer remedial actions if financial stability concerns arise, given concerns over risk-sharing within the monetary union and greater concern over moral hazard. For instance, it would be very difficult for the ECB to accept collateral at par value (as was done in the US) for banks to access central bank money. The risk mitigation within its collateral framework requires the collateral to be valued at market value, after which additional haircuts related to the risk of the asset are applied. However, the ECB could lower collateral haircuts and/or broaden the pool of eligible collateral, including more flexibility in accepting credit claims (which constituted 41% of the increase in collateral deployed at the ECB in 2020 and 2021). Such a measure would be more effective in combination with new, longer-rated refinancing operations (LTROs) with a duration of at least s months to provide a stickier funding source for banks. This could also include paring back some of the changes to the targeted longer-term refinancing operation (TLTRO) lending terms and reserve remuneration in November 2022 to delay early repayments and maturing TLTROs, which would slow the decline in money supply and excess liquidity. Our estimates suggest that mothballing the current (and expected) pace of the TLTRO run-off would mitigate the potential decline in credit growth by about a quarter.

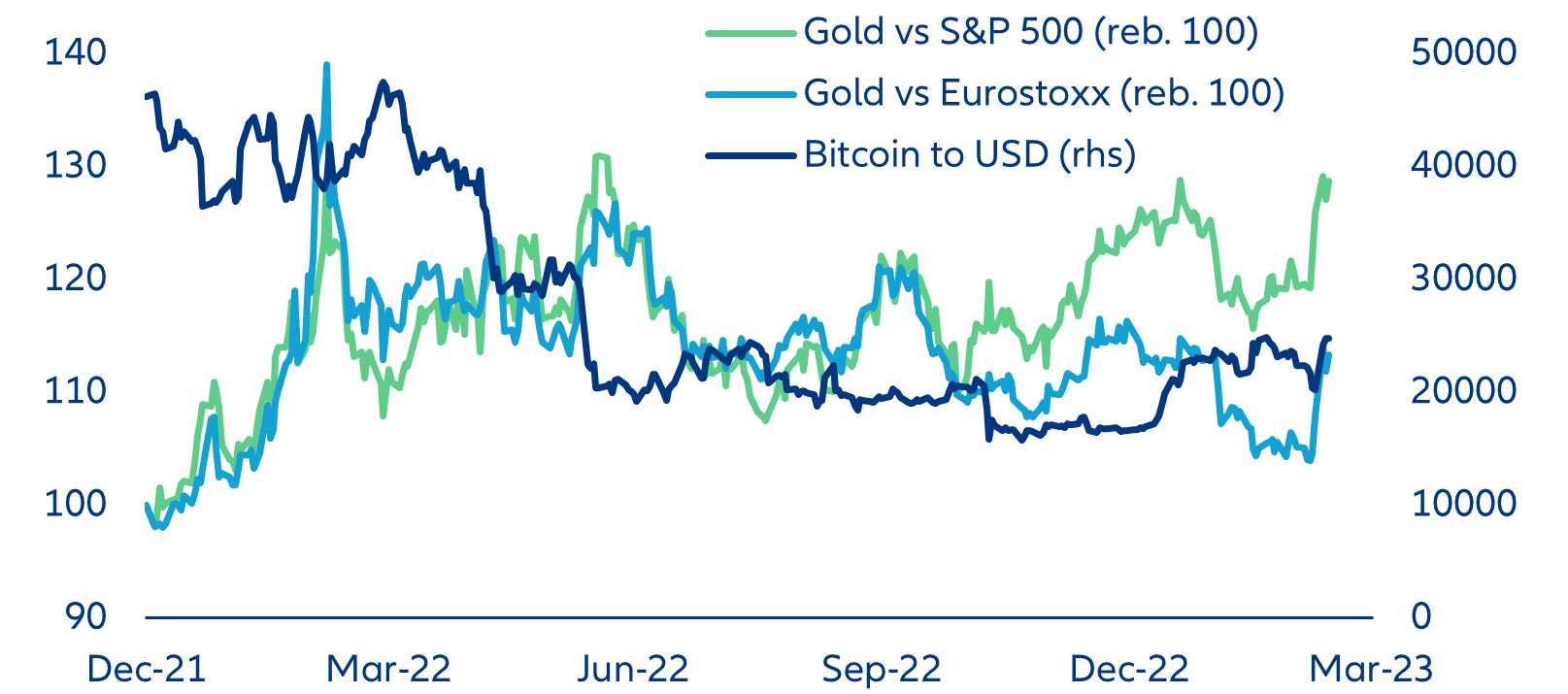

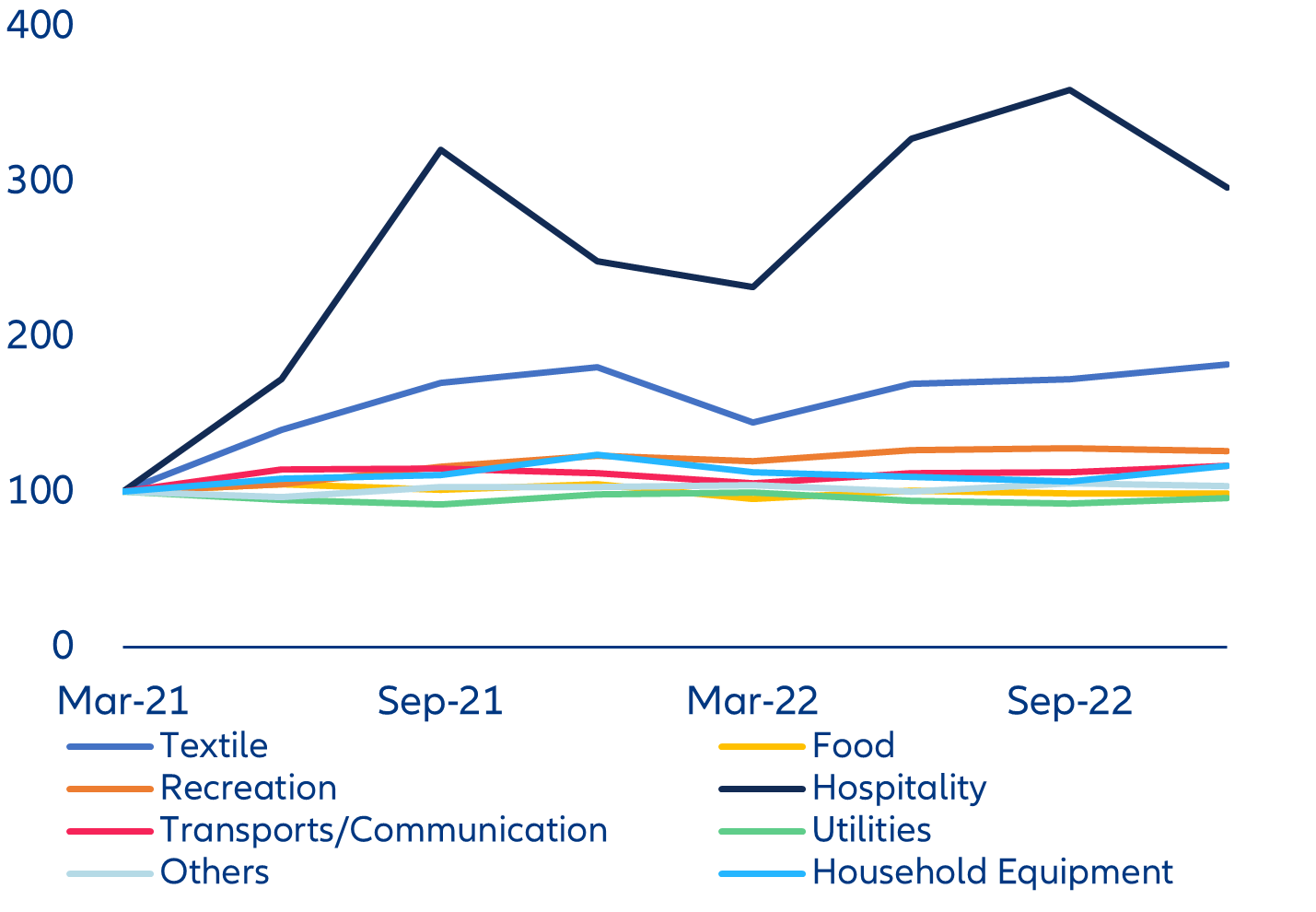

Implications for markets: headed for hard landing in the blink of an eye!

Sources: Refinitiv Datastream, Allianz Research.

Note: curves limited to 10-year maturity

In focus – US bank failures: what’s next?

Sources: US Federal Reserve, FDIC, Silicon Valley Bank, Allianz Research.

Note: 1/ "Other lending assets"=commercial and industrial (C&I), sponsor lead buyout, private bank, premium wine as well as CRE/PPP/other; 2/ US Treasuries (incl. US government agency debt, sub-national debt) mortgage-backed securities and other debt securities; 3/ checking/savings, money market and time deposits; 4/ shareholder equity minus goodwill and other intangibles.

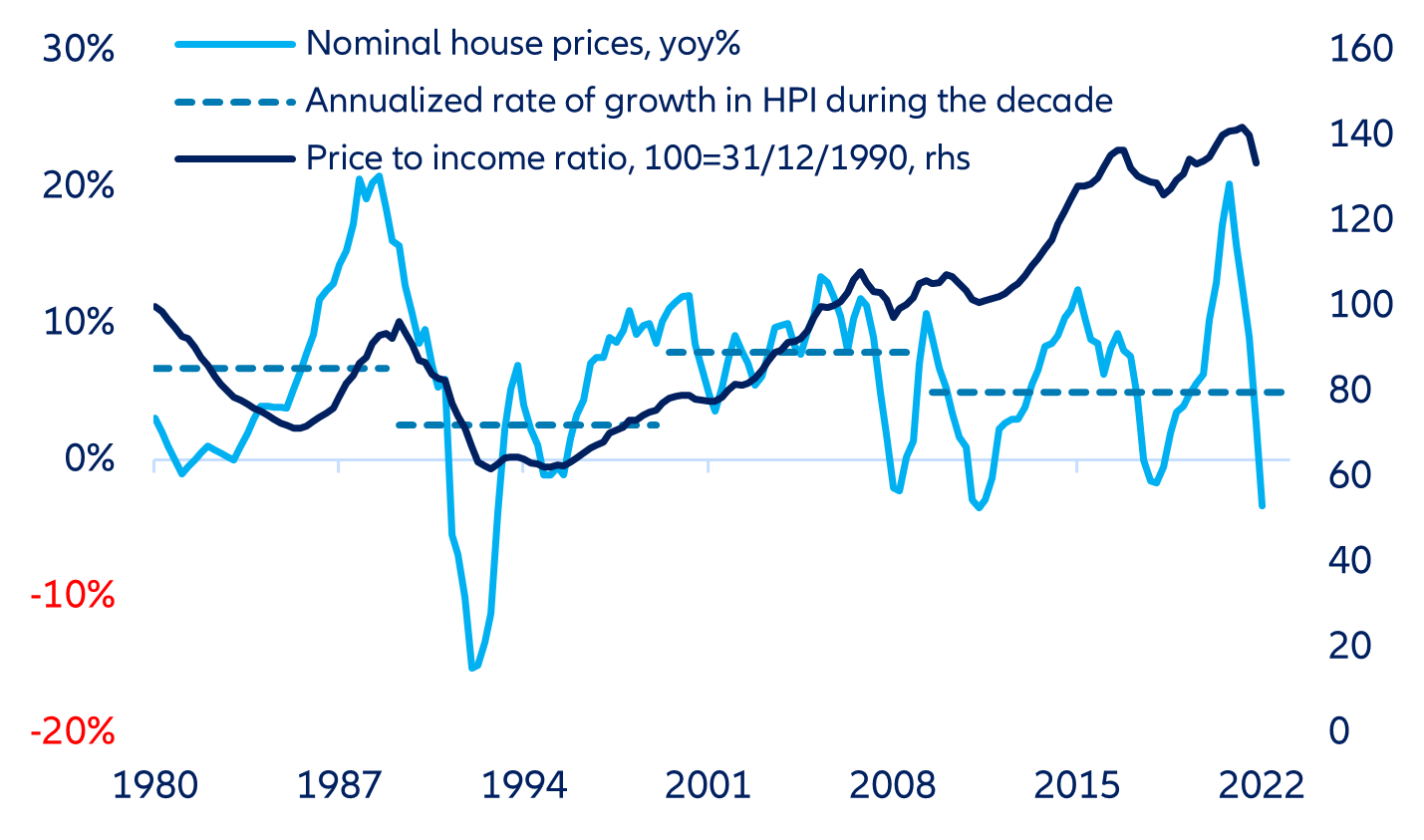

SVB’s widening duration gap has built up over time against the background of aggressive balance sheet growth. With total assets of USD209bn at the end of 2022, SVB was the 16th largest bank in the US. Even though it accounted for slightly more than 0.9% of the total banking sector assets, it catered to more than half of US venture capital (VC) funds and offered a vast array of tech and health start-ups a broad range of services. Over the last three years, SVB’s balance sheet tripled (against a 39% increase for the whole US banking system). During this period, SVB received massive deposit inflows from these start-ups, which parked the excess capital they raised as deposits. At the end of 2022, 96% of its USD173bn deposits were not insured by the FDIC, because they exceeded the USD250,000 threshold. In parallel, SVB built up a sizeable portfolio of long-dated Treasury securities and mortgage-backed securities (USD120bn), which was valued with unrealized losses of USD17 bn (or 14.8%) and would have absorbed the bank’s entire capital. After December 2022, the portfolio was left unhedged against the risk of further rising interest rates.

The collapse was triggered by a deposit run of a concentrated investor base. Once SVB started experiencing some deposit withdrawals, the forced liquidation became a likely scenario: selling USD21bn of bonds was contemplated at the risk of realizing a USD1.8bn loss. To recapitalize itself, SVB tried to raise USD2.25bn of fresh capital but failed to do so, perhaps because – among other things – SVB’s top managers had sold their shares two weeks earlier. Last Friday, news of SVB’s financial stress fostered an online bank run, which was compounded by the poor diversification of funding sources. Several firms failed to diversify their banking partners, with some having reportedly kept all their excess liquidity with SVB as deposits. During that single day, SVB lost 25% of its deposits (USD42bn). Some VC backers encouraged their start-ups to jump ship. Eventually, US regulators decided to withdraw SVB’s license and shut down the bank. Yet, with very few exceptions, they wasted no time arguing that the US leadership in tech was at stake, should SVB’s uninsured depositors lose money. It is also true that, under California law, company founders are personally liable for unpaid wages.

US regulators seems to prefer firefighting over preventing fires. After another large bank failed (Signature Bank, USD110bn), the Fed, Treasury and FDIC acted swiftly to prevent contagion risk and preserve financial stability. Under the systemic risk exception, Treasury Secretary Janet Yellen instructed the FDIC to make whole all depositors with both banks out of its Deposit Insurance Fund (DIF), i.e. not just those with deposits under the USD250k threshold. In addition, under a new Federal Reserve facility, the Bank Term Funding Program (BTFP), banks can access liquidity without selling securities at a loss: to get funding up to one year, they just need to pledge securities valued at par (i.e. above market prices) as collateral. In a replay of previous stress episodes, policymakers asserted that the US banking system remains healthy; the trouble is that this could have also been claimed before the demise of SVB put the spotlight on some significant regulatory shortcomings.

These significant regulatory shortcomings amounted to benign neglect of SVB’s poor risk management. SVB was a state-chartered bank, with the Federal Reserve as primary supervisor. But the bank was also supervised by the state of California. The division of labor between these two institutions may not have been optimal. For instance, SVB’s increasing reliance on funding from the Federal Home Loan Bank of San Francisco (from 0 at the end of 2021 to USD15bn one year later) seemingly went unnoticed. Yet, it is well-known that this lender to US regional banks is a lender of second-last resort (incidentally, the FHLB system has just sold USD88.7bn of short-term notes to increase its firepower).

In 2018, in a rollback of the Dodd-Frank Act, banks with assets under USD250bn were exempted from the Fed’s stress tests and capital and liquidity requirements. In 2019, considering that large regional banks (or medium-sized banks) were not systemic, the Fed approved lighter regulations for all but the largest banks. More generally, supervisors seemed to have paid insufficient attention to interest-rate risk despite a large amount of unrealized losses in the banking sector (USD620bn). Much has already been said about the wrong incentives given by the extended deposits guarantee and the BTFP. Such policies are likely to increase moral hazard.[1]

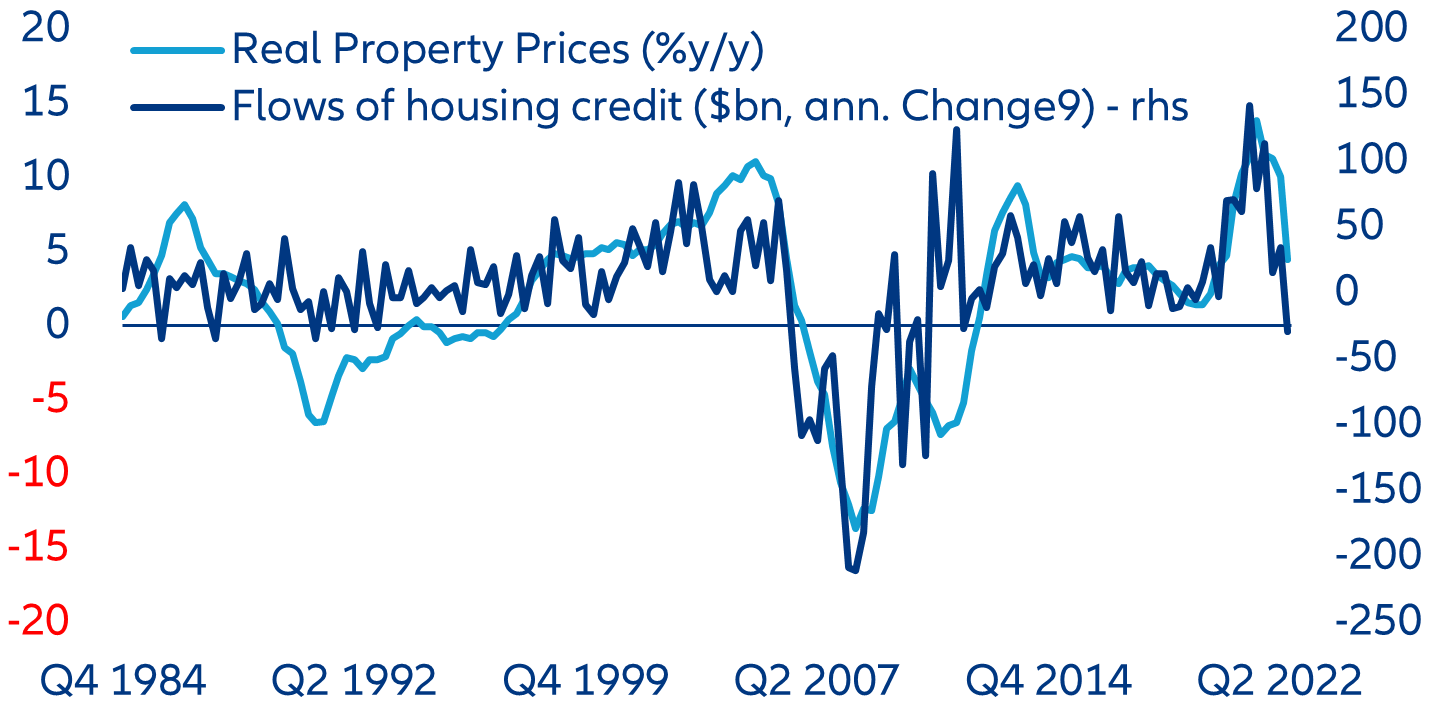

In the wake of SVB’s failure, banks will become even more conservative in their lending. The planned resolution of the SVB imposes direct costs on other US banks, which will foot the bill for making all depositors whole (though higher FDIC fees). But more critically, the indirect effect will be rising moral hazard in the banking sector as the Federal Reserve seems to be still willing to backstop failing banks. Over the near term, financing conditions are bound to tighten further in the US economy (and other countries) as banks raise lending standards and carefully safeguard their liquidity positions, further retrenching credit.

Declines in bank asset values significantly increase the fragility of the US banking system to uninsured depositor run. According to simulations by a SSRN study, SVB was far from being the worst capitalized and having the largest unrecognized losses amongst US banks. SVD stood out in having a disproportional share of uninsured funding. However, if only half of uninsured depositors decided to withdraw their funds, almost 190 banks would be a potential risk of impairment to insured depositors.