ESG approach

Allianz Sustainability Integration Framework

We published the fifth version of the Framework in July 2023.

Integrating ESG in insurance and investments – tools and processes

Referral Process and Sensitive Business Guidelines

Insurance transactions and unlisted investments in 13 sensitive business areas are screened and assessed for ESG risks.

Scoring Approach

Listed assets’ ESG performance is systematically evaluated and companies with scores below a threshold require the asset manager’s explanation or divestment.

Engagement and Dialogue

For investments, we engage with the bottom 10% of listed assets in our portfolio to understand their business and help them improve their ESG performance. In insurance, we engage in risk dialogues with clients to discuss significant ESG risks.

Exclusion Policies

We strictly prohibit investing in certain sectors like banned weapons, coal-based business models, or sovereign bonds offered by countries with documented severe human right violations. We also restrict offering insurance covers to certain business areas such as controversial weapons and coal-based business models.

Asset Manager Mandating, Selection and Review

Over 99% of our assets under management are managed by asset managers that are PRI signatories and/or have ESG policies in place.

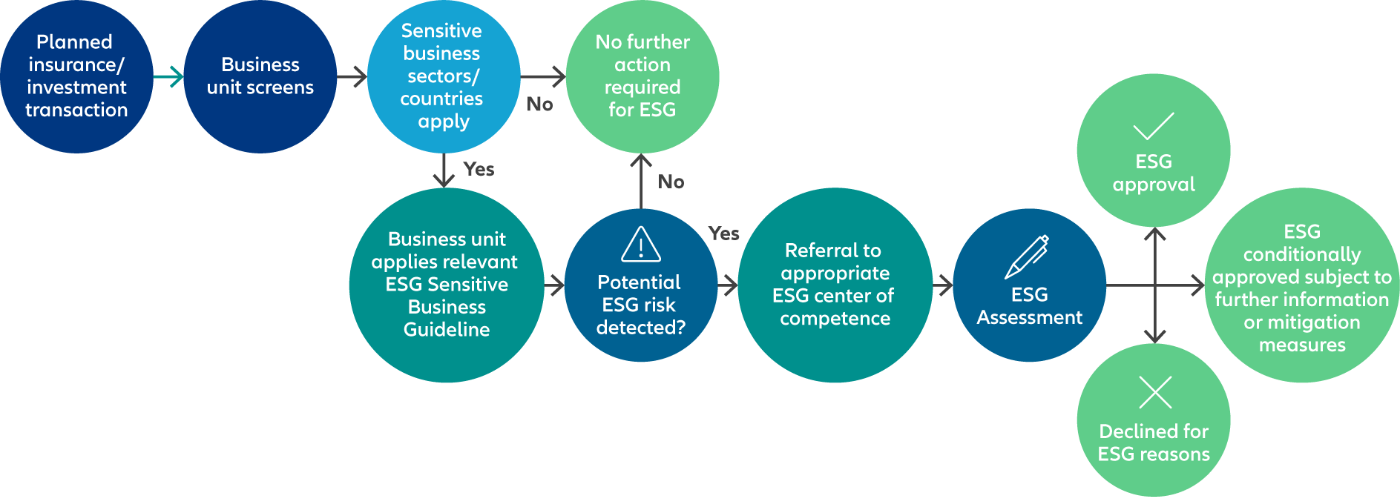

ESG referral process

We integrate ESG screening, referrals and assessments through the Allianz Standard for Reputational Risk Management and group-wide underwriting standards. We also apply the ESG referral and assessment process and guidelines to unlisted proprietary investments.

Active ownership

ESG engagement and dialogue

We aim to create a lasting positive legacy through our investments and engaging with the companies we invest in is one of the key ways we can address ESG concerns in our investment portfolios.

Active ownership also makes clear business sense. When the companies we invest in emphasize creating value for all stakeholders, they are better positioned to generate sustainable and long-term business success.

Increasingly, we see collaborative engagement as a key way to amplify our positive impact, especially on climate change issues as we work to decarbonize our portfolio without simply divesting from high emitting sectors. Our membership of Climate Action 100+ is a good example of how we’re doing this.

You can find specific examples of our engagements in section 02.2 of our 2021 Sustainability Report.

Excluding certain sectors, companies and sovereigns

We exclude certain sectors, companies and sovereigns from our businesses. These include companies producing or associated with controversial weapons and companies involved in coal-based business models.

We introduced an exclusion of coal-based business models in 2015. No new investments have been allowed, equity stakes have been divested and fixed income investments made before 2015 are in run-off.

Our exclusion approach covers multiple aspects with exclusion lists updated annually. A fill list of exclusions is included in the Allianz ESG Integration Framework.

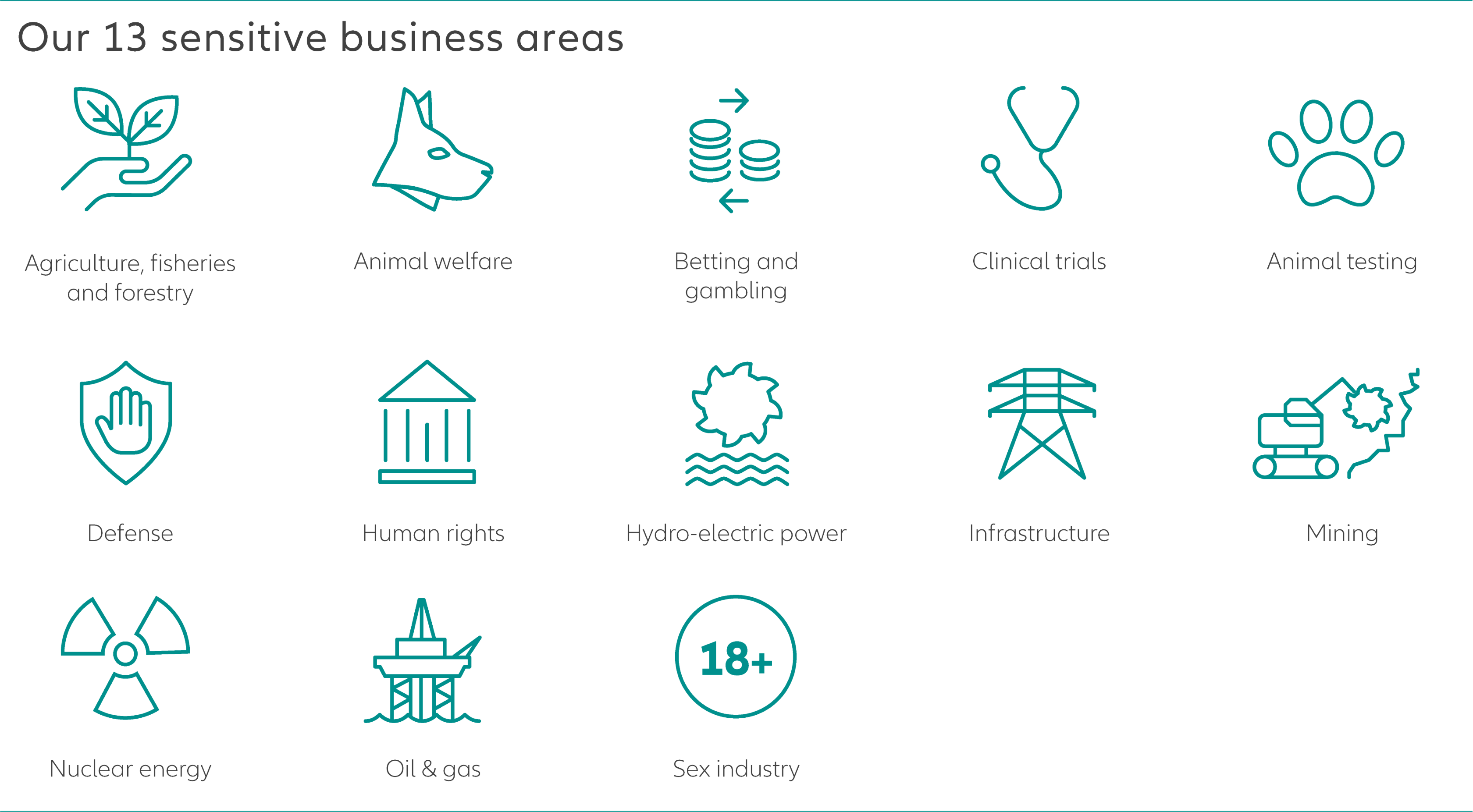

Our 13 sensitive business areas

We carefully consider a long list of sustainability issues through our ESG processes. We are especially careful about investing in the following 13 sensitive areas:

ESG processes across Allianz business lines

ESG integration in insurance is carried out by all Allianz operating entities and global lines. We also integrate ESG factors into the investment of proprietary assets and the management of third-party assets.

Swipe to view more

|

ESG Processes

|

Insurance

|

Investment (Listed)

|

Investment (Non-Listed)

|

|---|---|---|---|

| ESG Referral Process | ● | ● | |

| ESG Sensitive Business Guidelines | ● | ● | |

| Sensitive Countries List | ● | ● | |

| ESG Scoring Approach | ● | ||

|

Engagement and Dialogue1 |

● | ● | ● |

| ESG Exclusion Policies | ● | ● | ● |

| Asset Manager Mandating, Selection and Review | ● | ● |