The Allianz Group is one of the world's leading insurers and asset managers serving private and corporate customers in nearly 70 countries. Allianz customers benefit from a broad range of personal and corporate insurance services, ranging from property, life and health insurance to assistance services to credit insurance and global business insurance. Allianz is one of the world’s largest investors, managing around 761 billion euros* on behalf of its insurance customers. Furthermore, our asset managers PIMCO and Allianz Global Investors manage about 1.9 trillion euros* of third-party assets. Thanks to our systematic integration of ecological and social criteria in our business processes and investment decisions, we are among the leaders in the insurance industry in the Dow Jones Sustainability Index. In 2024, over 156,000 employees achieved total business volume of 179.8 billion euros and an operating profit of 16.0 billion euros for the Group.

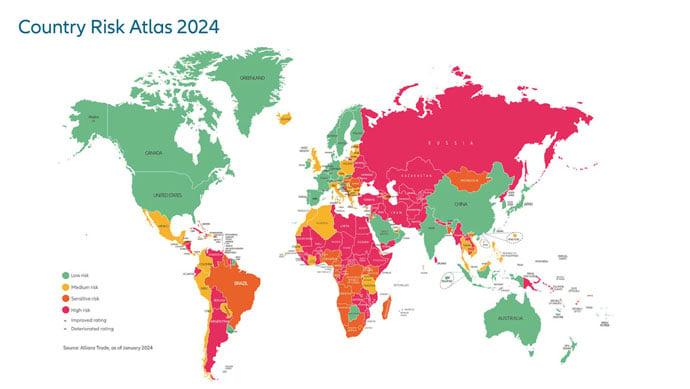

Allianz Country Risk Atlas 2024

A compass in times of global uncertainty

Downloads

Related links

2023: A year of resilience and change

The past year has been a testament to global resilience. The Atlas reports upgrades for 21 economies, encompassing 19% of the global GDP. Markets in China, South Africa, Qatar, Algeria, Morocco, Oman, Bulgaria, Tanzania and Uruguay showcased resilience to global shocks, while those of Croatia, Cyprus, Greece, Iceland, and Slovenia saw improvements. However, not all changes were positive; downgrades in countries like Egypt and Israel remind us of the persistent volatility in global markets.

In regional terms, Africa witnessed the most upgrades, with ten countries showing improvement, yet it continues to face significant challenges in terms of liquidity and access to international markets. Europe followed with six upgrades. In contrast, Asia and the Americas saw improvements only in China and Uruguay. This regional analysis indicates that while some areas are showing signs of progress, others like Africa and the Middle East may lag, especially given the increasing global liquidity risks and ongoing fiscal and monetary policy efforts.

2024 and beyond: Steering through global economic waters

Looking ahead, challenges are abound. From liquidity constraints to growing public and private debt, and from geopolitical tensions to increasing business insolvencies, the global economic landscape remains fraught with risks. These elements underscore the importance of the Atlas as a critical tool for risk assessment and strategic planning.

The Atlas' strength lies in its methodical approach. It provides a dual perspective: a medium-term Country Grade and a short-term Country Risk Level rating. These assessments are derived considering factors like macroeconomic stability, political risks, business environment, commercial and financing risks. This comprehensive methodology ensures a balanced view, capturing both imminent and long-term challenges.

As we step into 2024, the Country Risk Atlas is more than just a report: it's a compass for businesses and investors navigating through the complexities of international markets. It's not just about risk management; it's about uncovering opportunities in a dynamic global landscape.

You can access the in-depth analysis for each country here.

About Allianz

* As of September 30, 2025.