11th Allianz Motor Day 2023

Allianz survey: High level of approval for data use in accident investigation

Better accident clarification, faster claims processing

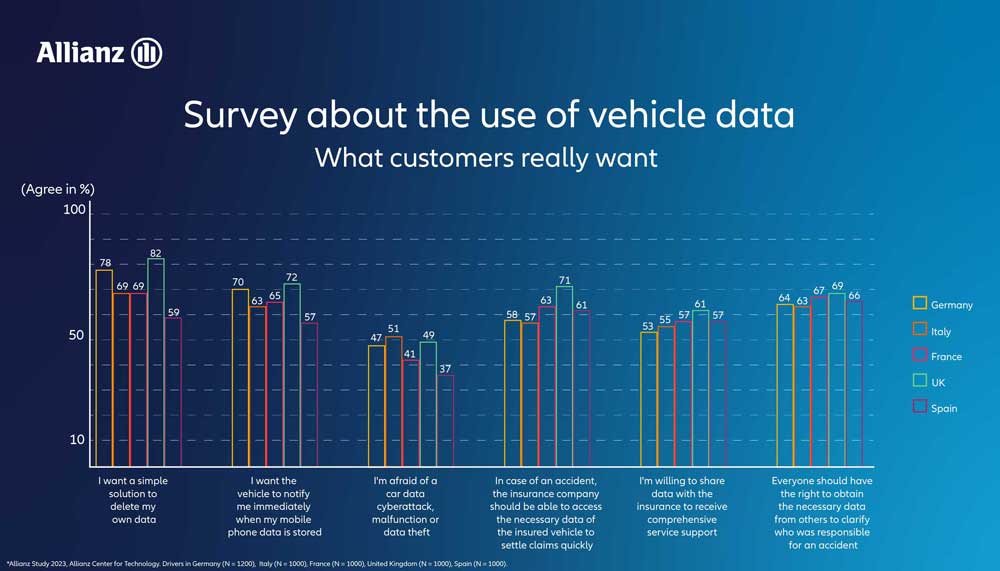

With two-thirds of all respondents agreeing, approval is highest of data use for clarifying accident blame. For example, 69 percent (UK), 67 percent (France), 66 percent (Spain), 64 percent (Germany), and 63 percent (Italy) agree with the statement that every party involved should have the right to receive the data necessary for this purpose. “Our survey shows that there is a very positive view of the benefits of data recording for accident investigation,” says Jörg Kubitzki, safety researcher at the Allianz Center for Technology (AZT) and co-author of the study.

The use of data for quick accident processing by the insurance company also found high approval ratings (UK: 71 percent, France: 63 percent, Spain: 61 percent, Germany: 58 percent, Italy: 57 percent). The interest in making data available to the insurance company for improved services (e.g., automatic accident detection, roadside assistance, adapted insurance products) is 61 percent (UK), 57 percent (France, Spain), 55 percent (Italy), and 53 percent (Germany). Clarification of vehicle condition at the time of purchase and sale was agreed to by 58 to 69 percent of respondents, and improvement of road safety by 48 to 58 percent.

Protecting privacy is important

Three-quarters of respondents demand clear deletion procedures

Further information

Media contacts

About Allianz

The Allianz Group is one of the world's leading insurers and asset managers serving private and corporate customers in nearly 70 countries. Allianz customers benefit from a broad range of personal and corporate insurance services, ranging from property, life and health insurance to assistance services to credit insurance and global business insurance. Allianz is one of the world’s largest investors, managing around 761 billion euros* on behalf of its insurance customers. Furthermore, our asset managers PIMCO and Allianz Global Investors manage about 1.9 trillion euros* of third-party assets. Thanks to our systematic integration of ecological and social criteria in our business processes and investment decisions, we are among the leaders in the insurance industry in the Dow Jones Sustainability Index. In 2024, over 156,000 employees achieved total business volume of 179.8 billion euros and an operating profit of 16.0 billion euros for the Group.

* As of September 30, 2025.