Once upon a time…we were children who loved to read and listen to fairy tales because they entertained us, but more importantly, they helped us learn about life, its lighter and darker sides, and those happily-ever-after endings offered a sense of security and stability. As adults, we seek the same. We seek challenges as well as harmony. On this journey, a person’s sense of security plays an important role. If you recall those psychology classes from high school, you’ll surely remember a guy called Abraham Maslow and his concept of the hierarchy of needs. In Maslow’s famous pyramid of needs, a sense of safety and security ranks second, right after the fulfilment of physiological needs.

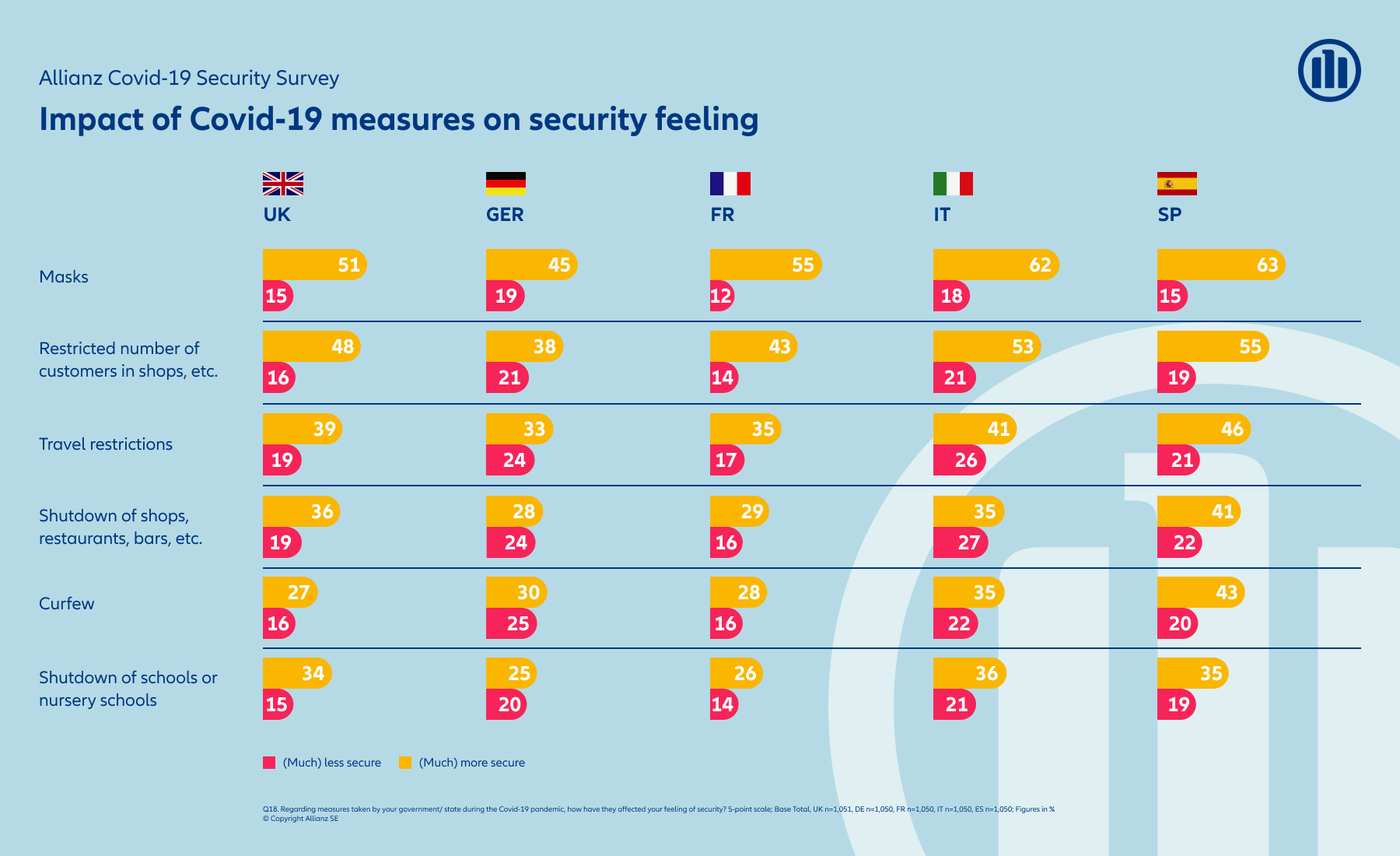

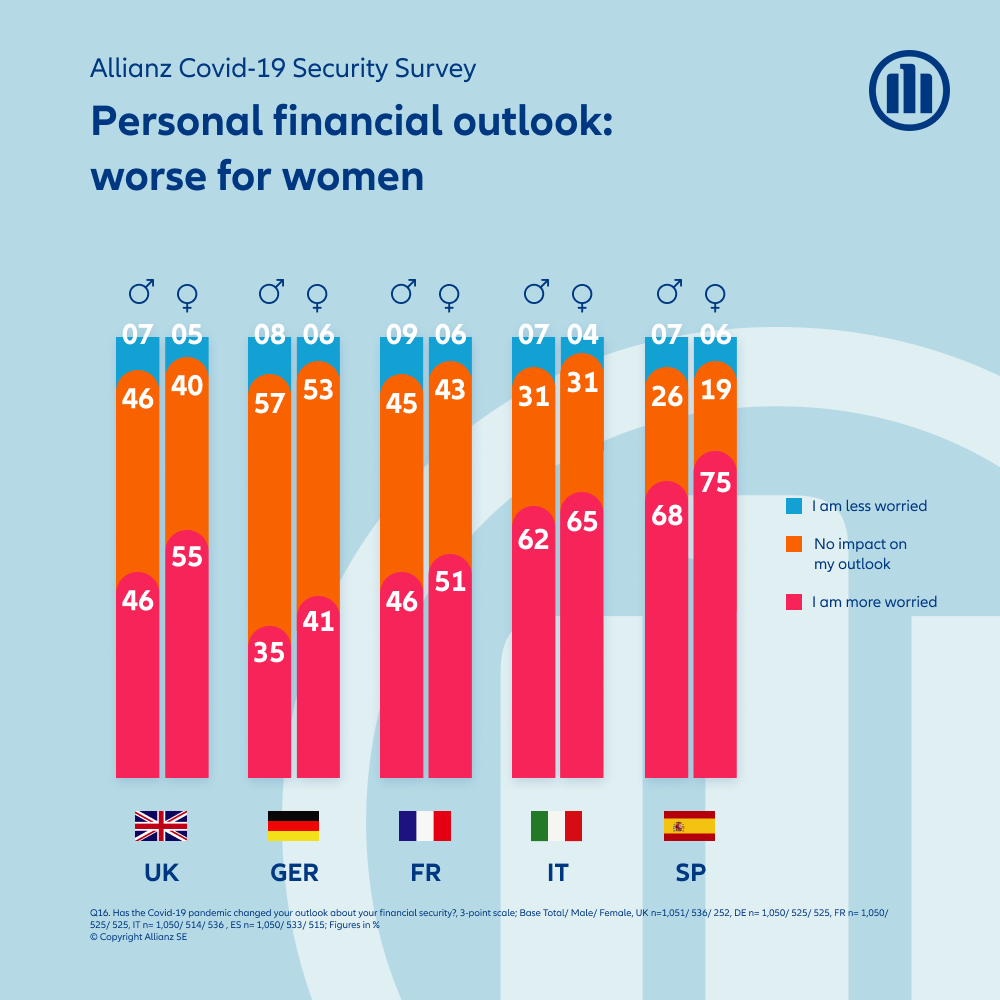

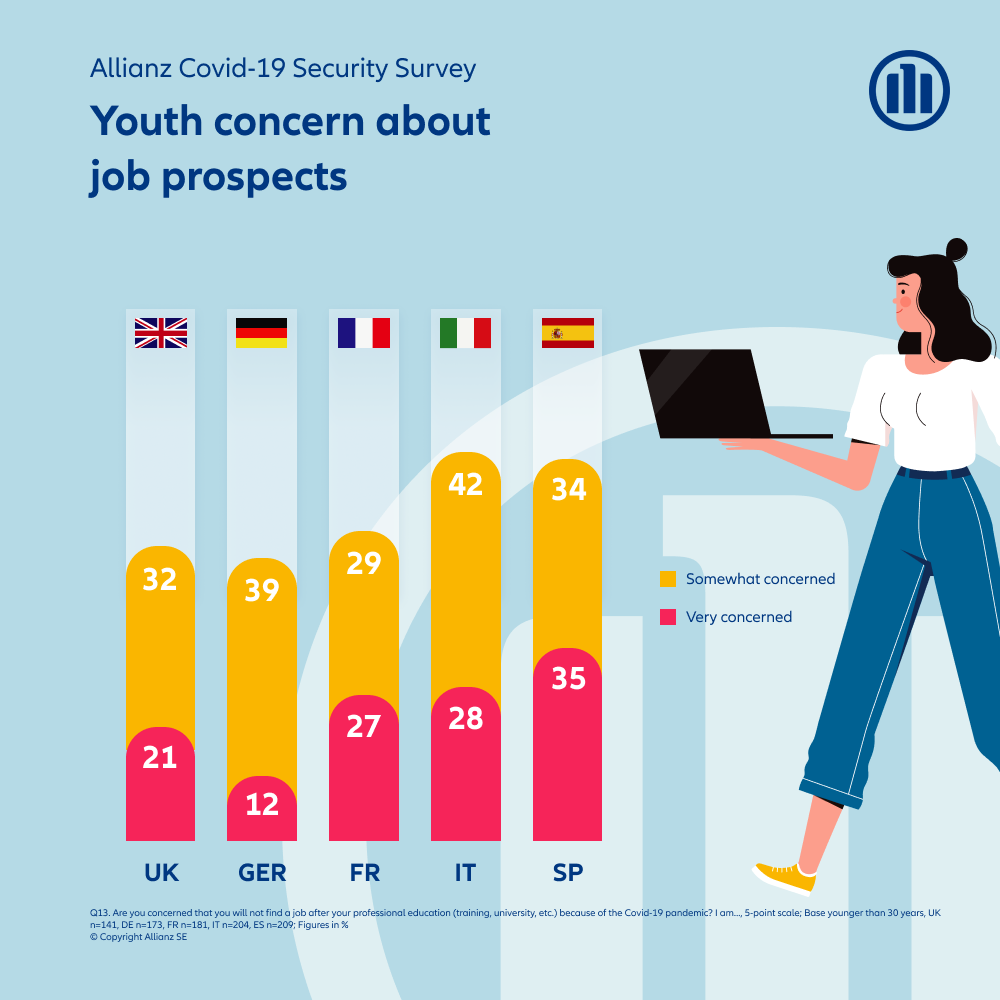

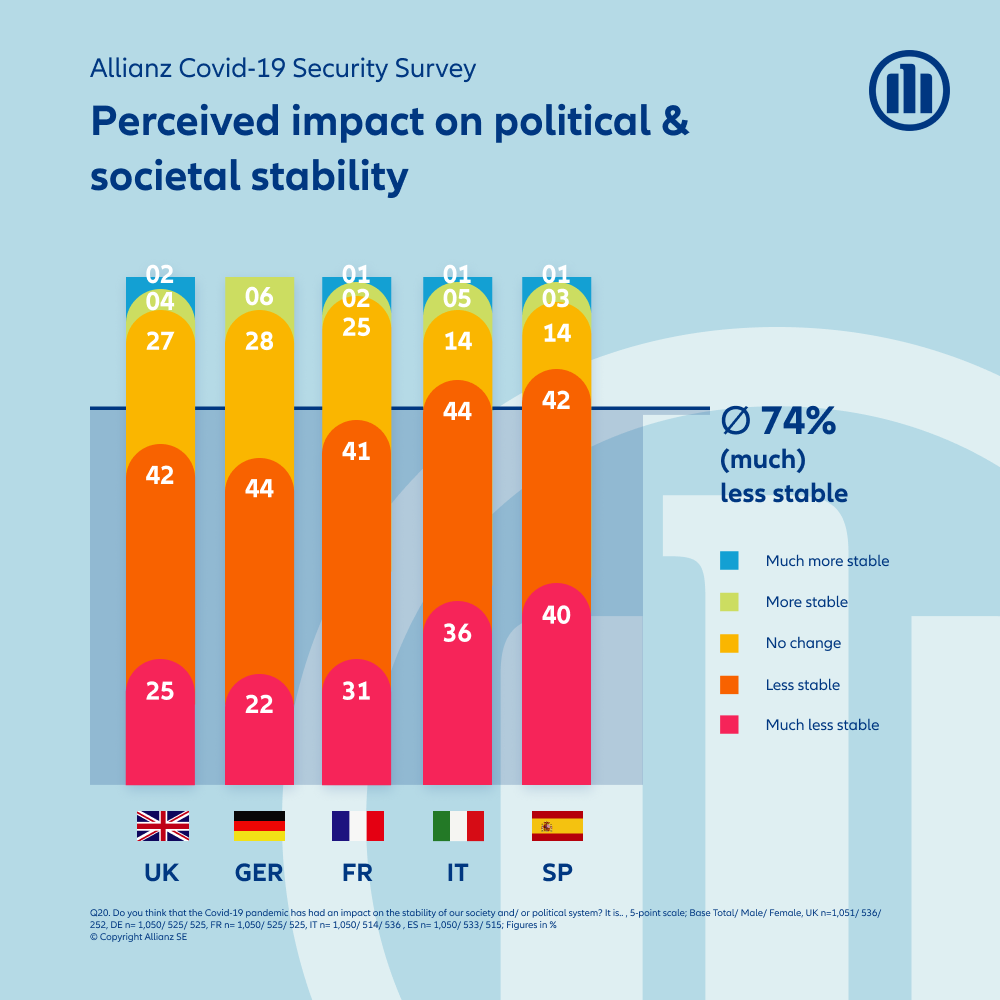

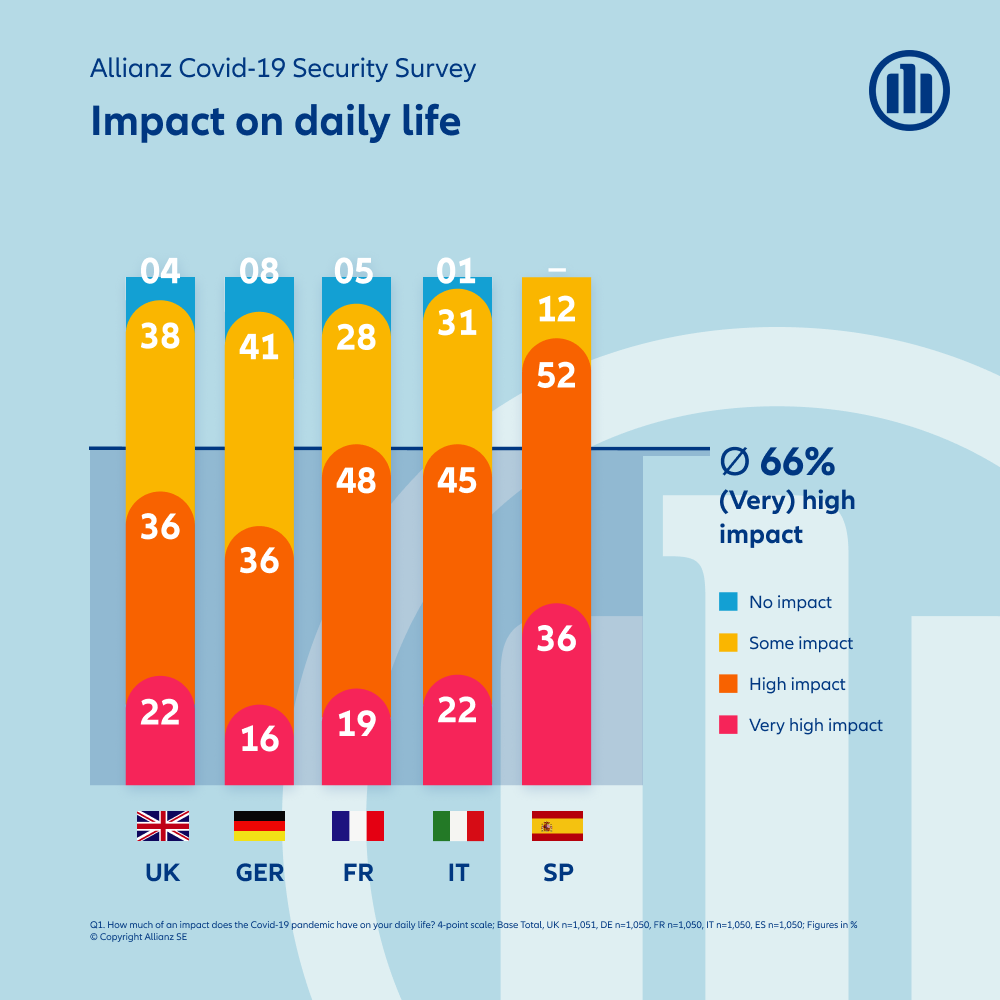

With the onset of the pandemic, our sense of safety and security has come into question. For some, the pandemic managed to destabilize even the fundamental, basic needs. A recent survey commissioned by Allianz, which covered more than 5,000 respondents split equally across genders and ages between 18 and 65 years in Germany, France, the UK, Italy, and Spain, explored people’s perceptions around Covid-19 and the way it affected their sense of safety related to work, education, health, house and home, financials and relationships.