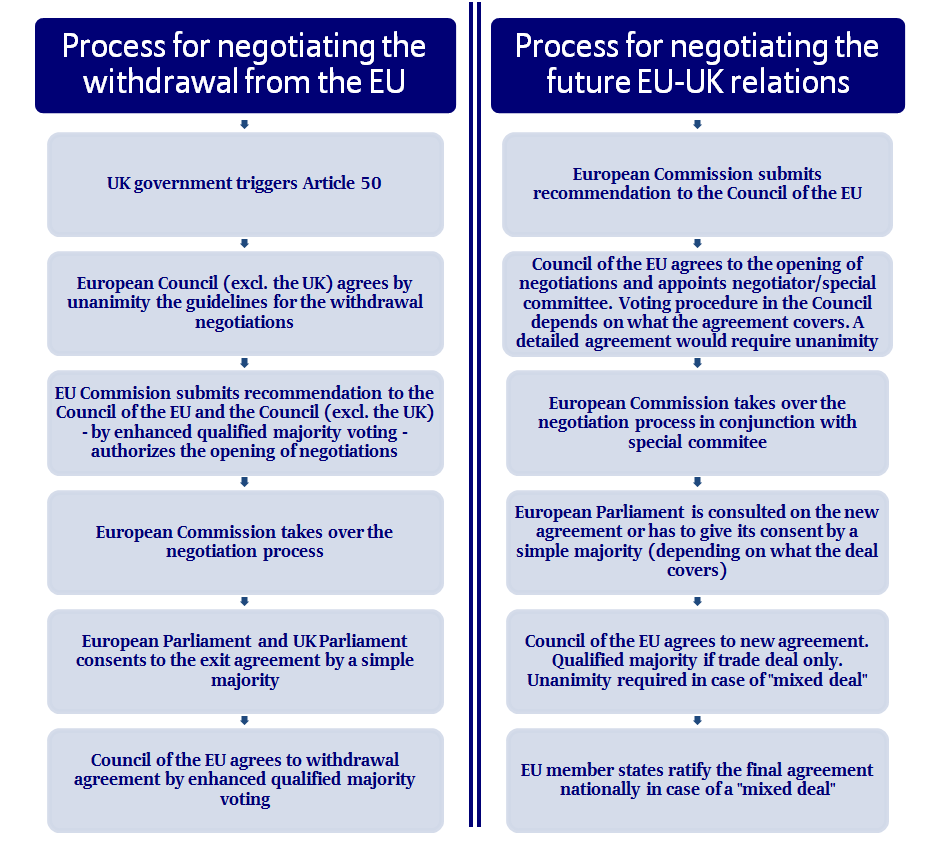

The withdrawal notification sent by the UK government to the European Council on March 29 triggered the two-year countdown specified by Article 50. Allianz economists believe that the actual time for negotiations is shorter and that the timeframe is not realistic to agree on both the exit deal and the trade deal.

Brexit and Beyond

Downloads

Related links

Breaking up is hard to do

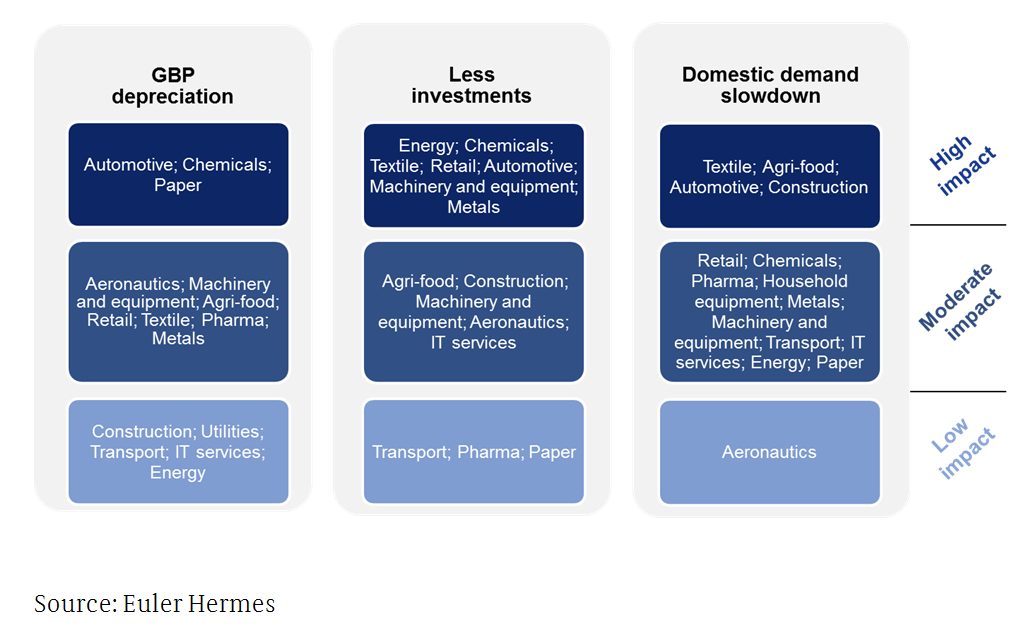

The resilience of the UK economy in the aftermath of the Brexit vote is expected to persist until mid-2017 when consumer spending, the main driver for growth until now, would take a hit from higher inflation and slowdown in wages.

Negotiation process: Who's in charge?

On the investment side, the wait-and-see mode will continue and flows are expected to be much lower. Overall, the UK’s gross domestic product growth is expected to slow to +1.4 percent in 2017 and to +1.0 percent in 2018 from +1.8 percent in 2016.

Impact of Brexit on various sectors

So, what are the timeline for Brexit negotiations, the UK government’s Brexit strategy and key issues in the exit talks? What are the key Brexit scenarios? What is the expected impact on the UK’s companies and financial markets? What is the expected impact outside the UK? And most important - What is the long-run impact of Brexit?

Find some answers to the ten most important questions around Brexit in our ‘The Taming of the Brexit’ report.

Further Information

Forward Looking Statement disclaimer

As with all content published on this site, these statements are subject to our Forward Looking Statement disclaimer: