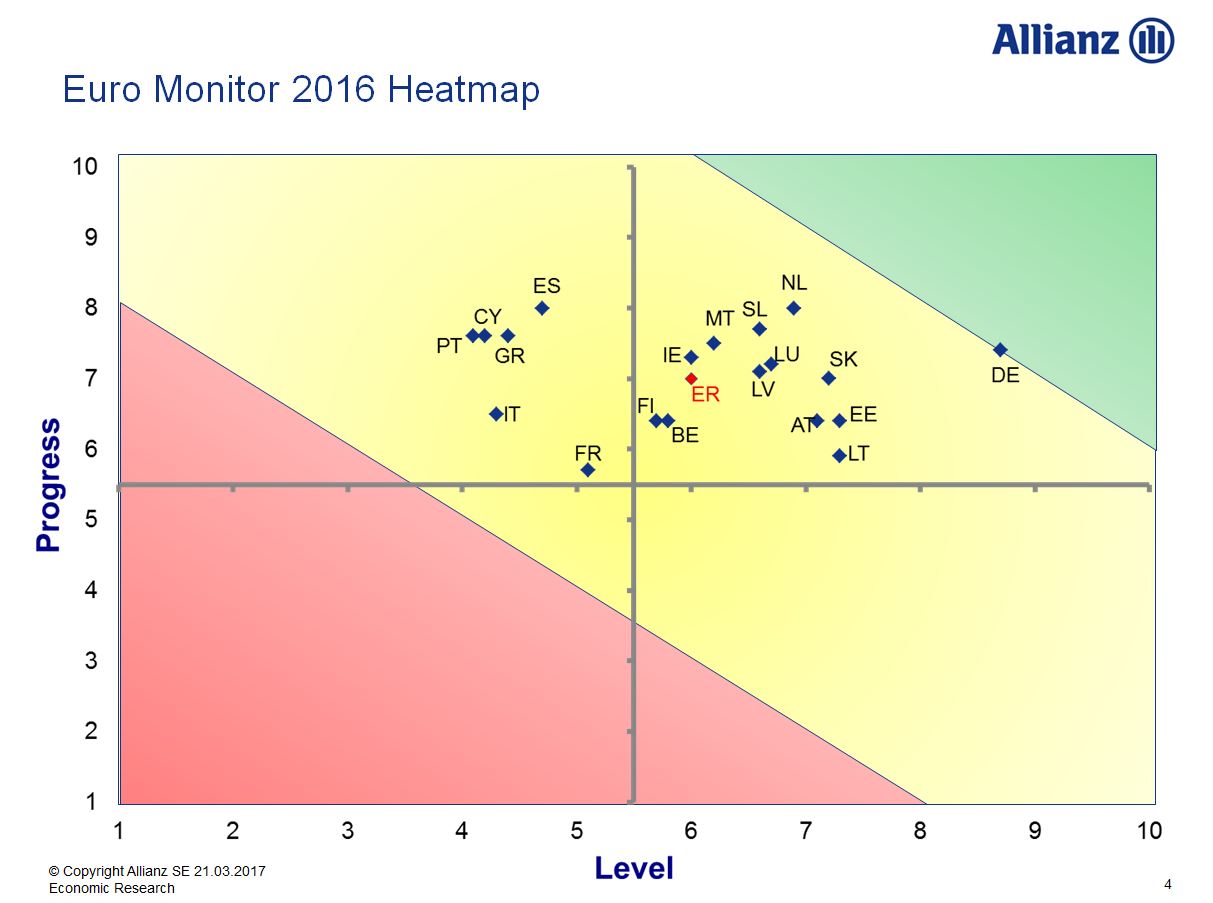

Despite the healthy economic performance in 2016, the eurozone failed to make further progress in reducing macroeconomic imbalances.

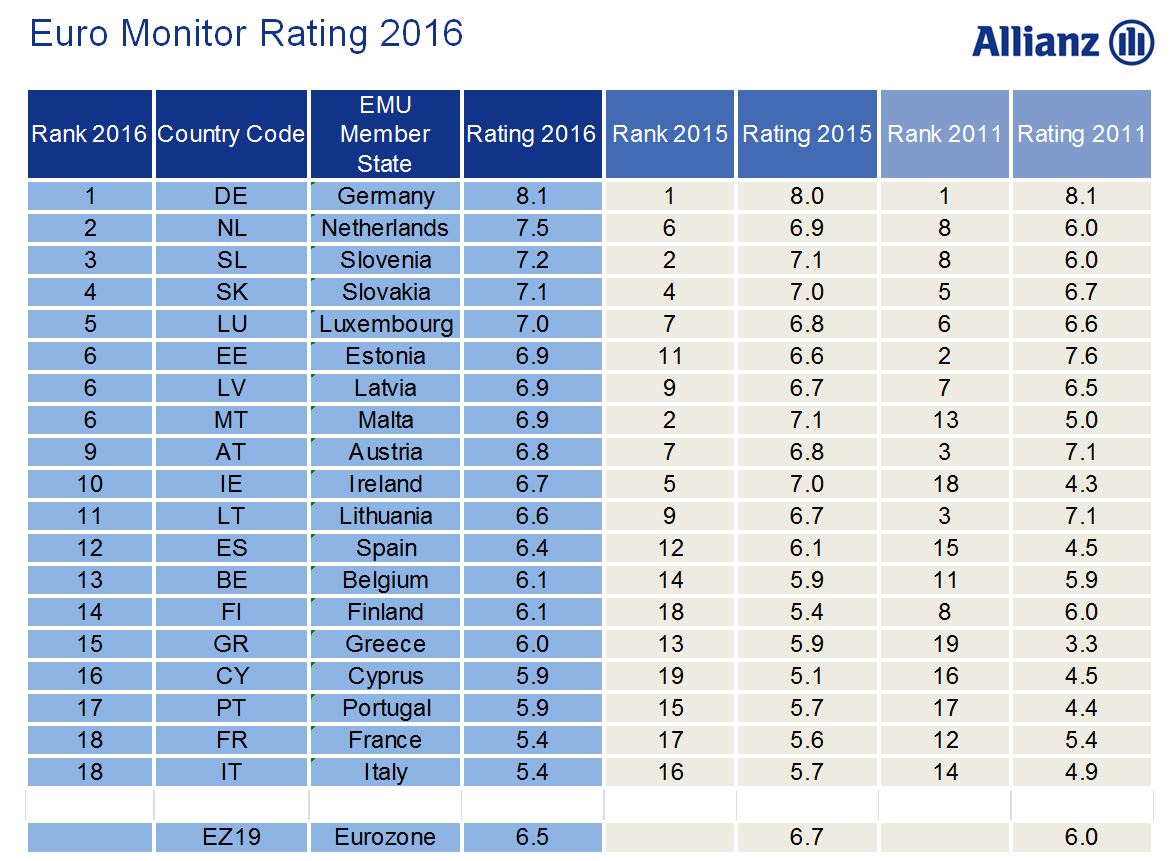

In the Allianz Euro Monitor we measure these imbalances using 20 indicators. After three years of steady improvement, the overall indicator, which captures the stability of growth, has now fallen.

In most countries public-sector deficits and employment improved somewhat, whereas structural budget deficits, export growth in relation to global trade dynamics and productivity growth all slipped, resulting on balance in a slight deterioration.