Allianz Group and Liverpool Victoria Friendly Society (LV=) have agreed to launch a joint venture and a longer-term strategic partnership in the UK, creating a general insurance business with over 6 million customers and gross premiums written in excess of 1.7 billion pounds.

The transaction allows Allianz and LV= to take a leading role in the growing UK retail sector by creating a strong and customer-centric insurer in the personal home and motor insurance markets. While the joint venture offers Allianz the opportunity to partner with a trusted brand offering excellent customer service, it provides LV=, the UK’s most trusted and most recommended insurer, the financial strength and expertise to further grow in general insurance through this partnership and enables it to continue to develop in its core Life and Pensions market.

The transaction also strengthens Allianz’s position in the commercial market where it has over 1 billion pounds in annual income and complements its broader UK presence including the market leading Petplan brand, and strong positions in legal expense and musical insurance.

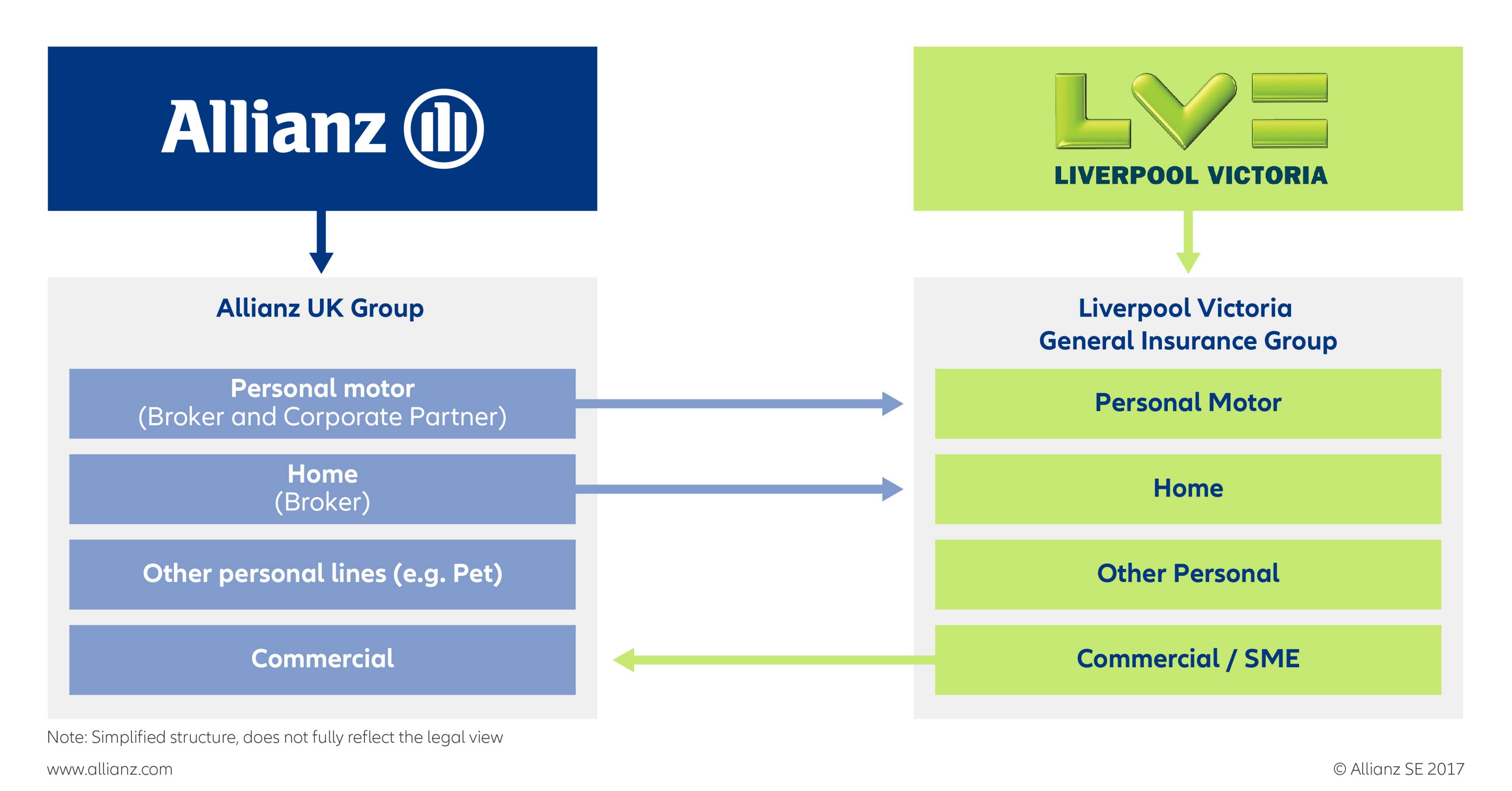

LV= will receive 500 million pounds from Allianz in exchange for a 49 percent stake in LV=’s General Insurance businesses. The new, long-term joint venture will acquire Allianz’s personal home and motor insurer’s renewal rights while AIlianz will obtain LV= GI’s commercial insurer’s renewal rights. The first stage of the transaction is expected to close during the second half of 2017. The second stage of the transaction will take place in 2019 and will see Allianz pay 213 million pounds for a further 20.9 percent stake in LV= GI through an agreed, forward purchase based on a total valuation of 1.020 billion pounds for 100 percent of LV= GI. LV= has a put option under which it can sell all or part of its remaining shares to Allianz 1. The transaction is subject to regulatory approvals.

The key benefits of this new partnership include:

• The combination of two successful, customer-focused businesses.

• Technical excellence as a result of combining Allianz’s and LV= GI’s expertise in pricing, underwriting and claims.

• Accelerated innovation and growth through the combination of digital capabilities.

• Potential opportunities to develop broader joint propositions in the UK market.

“I am thrilled to join forces with LV=, one of UK’s most respected and loved brands. This partnership will first and foremost benefit our customers who will have access to an expanded range of products backed by the financial strength of Allianz. We value LV=’s strong brand and market positioning,” said Oliver Bäte, Chief Executive Officer of Allianz Group.

Richard Rowney, Chief Executive of LV=, said: “I am delighted to announce this joint venture with Allianz, which will see us create the third largest personal insurance business in the UK. With this deal, LV= has a positive future in both General Insurance and Life and Pensions. The strategic partnership with Allianz will allow us to continue to benefit from a growing personal insurance business while also enabling us to strengthen our capital position, leaving us well placed to continue to expand our Life and Pensions business and pursue new digital opportunities.”

“I am delighted that two organizations with excellent reputations in both personal and commercial lines have forged a landmark partnership with the twin aims of benefiting customers and generating profitable growth,” said Jon Dye, Chief Executive Officer of Allianz Insurance plc.

Steve Treloar, Managing Director of General Insurance of LV=, added: “Our joint venture will be a leading personal insurer with a diversified distribution base across direct, broker and corporate partner channels. The combination of LV=’s strong brand, longstanding reputation in personal insurance and excellent customer service with the financial strength, digital expertise and data analytics of Allianz, the world’s largest P&C insurer, will allow us to further develop and expand the products and services that our customers demand.”

The joint venture will be run by Steve Treloar, reporting to a Board of Directors drawn from LV= and Allianz.