First-pillar pension reforms introduced over the last two decades have brought about drastic changes in the global retirement landscape driven by unfavorable demographics and unsustainable, outdated or fragmented systems. The reform process differs considerably from country to country though. The Allianz Pension Sustainability Index (PSI) analyses countries according to a range of parameters in order to arrive at a country ranking that reflects the long-term sustainability of the pension system in aging societies. This years’ updated version includes some surprising changes.

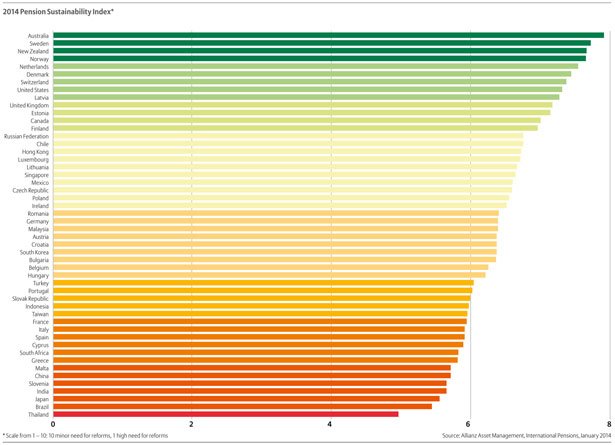

Pension Sustainability Index: Australia ranks first, Thailand at the low end

In the current study, the pension systems of Thailand, Brazil and Japan were found to be the least sustainable whereas Australia, Sweden and New Zealand lie at the other end of the spectrum. They are closely followed by Norway, the Netherlands and Denmark.

Dr. Renate Finke, author of the study, points out: “A good ranking in the index does not equal to generous pension payments in a country, but it shows that a country’s pension system will be able to cope with its underlying demographics. In contrast to that you have to take into account that the countries at the low end of the ranking are there for different reasons.”

Thailand for example has an extremely low retirement age, only sporadic coverage, and is aging rapidly. It probably postponed tackling the consequences of its aging problem after disastrous flooding and political turmoil brought other issues to the political agenda. Brazil is also aging quickly, and its pension system has a high replacement rate which, combined with early retirement options, will be unsustainable in the long run. Japan comes in at the low end of the ranking because of its very old population and very high sovereign debt level. In consideration of these factors, the pension system is still too expensive, making the need for reform an ongoing concern.

Australia lies at the other end of the spectrum. The amount of burden a country’s pension expenditures place on public finances is a core sub-indicator in this study. Therefore, Australia’s two-tier system combining a lean public with highly developed funded pensions is under the least pressure to reform. Australia’s success is followed in order by Sweden, New Zealand, Norway and the Netherlands. The western European countries benefit from their comprehensive pension systems based on strong, funded pillars. Sweden and Norway benefited from their comparatively solid public finance situation. Norway even succeeded in surpassing the Netherlands due to its better fiscal position. Norway’s high legal retirement age and moderate aging demographic also assisted in awarding the country its high index ranking.